Owner at $34M ARR

Jan-Erik Asplund

Jan-Erik Asplund

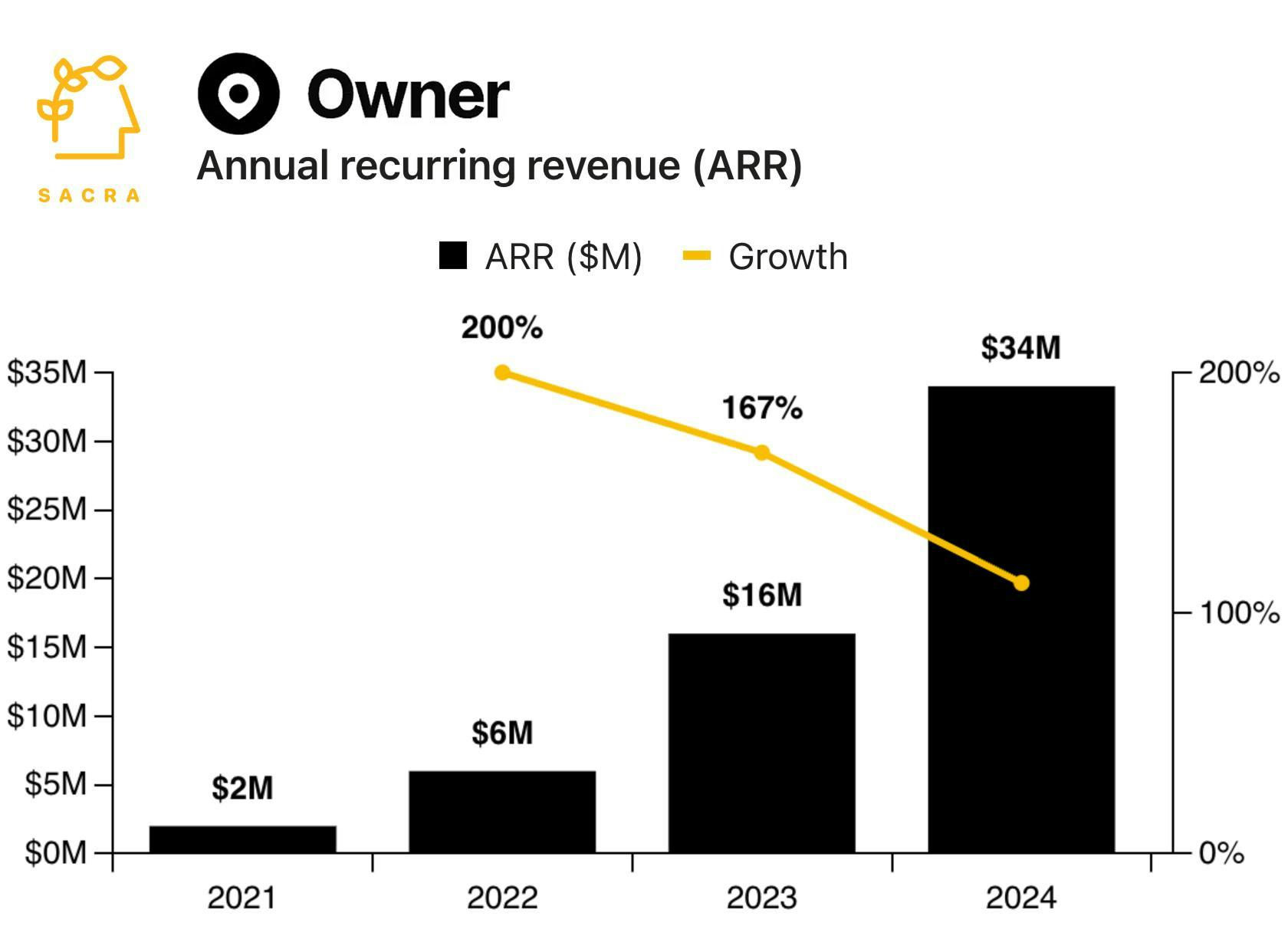

TL;DR: During COVID, restaurant margins fell to 1-2% as discovery, ordering and delivery shifted to online aggregators like DoorDash and Uber Eats, a wave of B2B SaaS companies like Owner launched online ordering platforms to give restaurants control over the customer experience. After hitting $2M ARR in 2021, Sacra estimates Owner hit $34M ARR in 2024, up 113% YoY, as it continues to scale post-COVID at 100%+ YoY. For more, check out our full Owner report and dataset, as well as our interviews with ChowNow CEO Chris Webb and Lunchbox CEO Hadi Rashid.

Key points via Sacra AI:

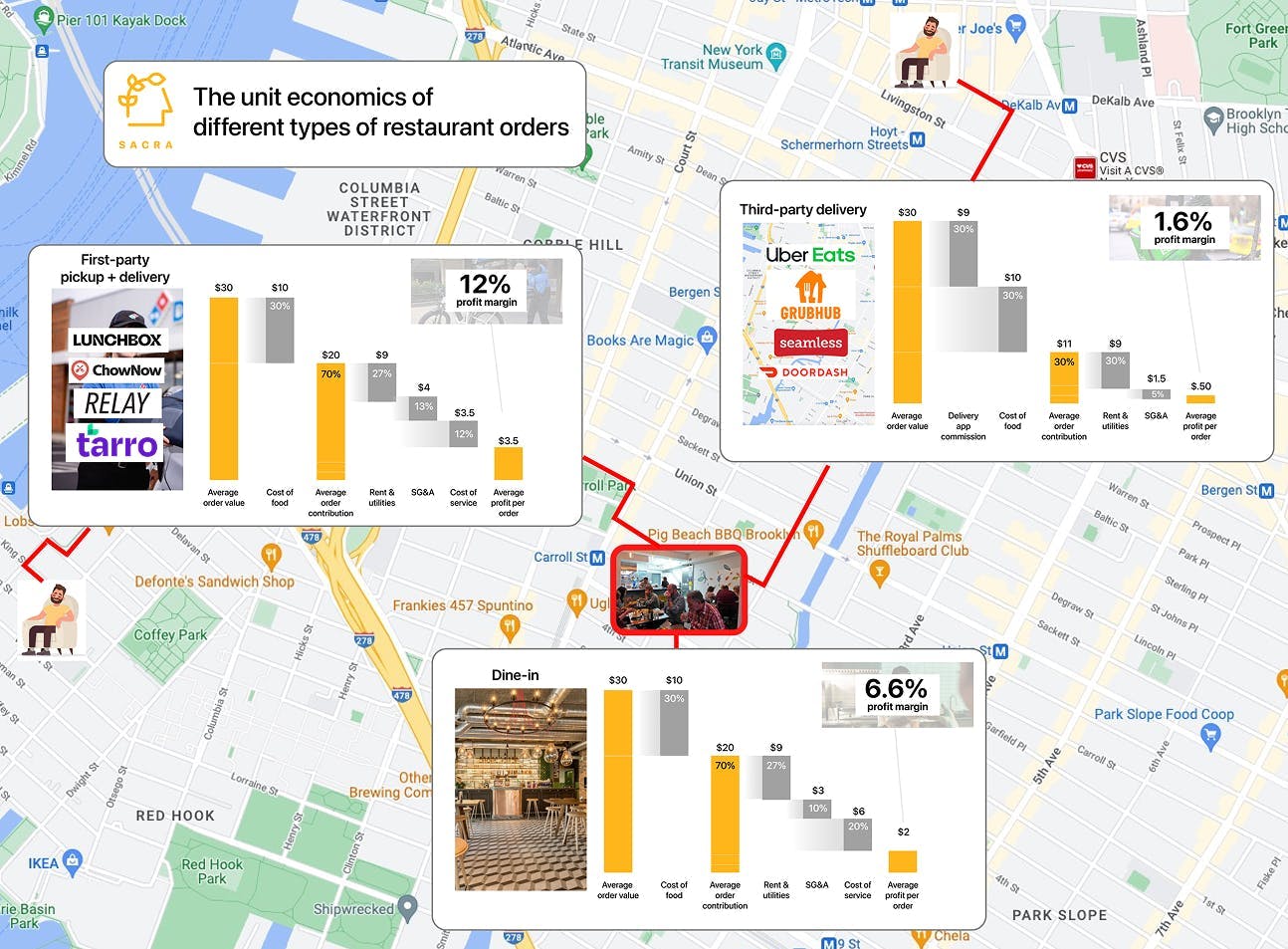

- In 2020, as COVID lockdowns shut down in-person dining, demand shifted online and DoorDash’s (NASDAQ: DASH) GMV grew 227% to $8.2B, but with a 30% take rate that drove restaurant margins down to 1-2%—inspiring a wave of B2B SaaS like Owner (online ordering), ChowNow (online ordering), Lunchbox (online ordering), Relay (delivery), Wix (website), and FiveStars (loyalty) that enabled the restaurant to own the customer relationship and experience end to end with a blended take rate of ~11%. Owner aims to replace everything but the point of sale (POS)—website builder, delivery (via DoorDash/Uber Eats), online ordering, email, SMS, mobile app, and loyalty—monetizing restaurant owners through a flat $499 monthly subscription with no commission (versus the 20-30% per-order commission model of UberEats and DoorDash) while charging customers 5% of their order (versus the 10-15% of Grubhub).

- Finding initial traction during COVID hitting $2M ARR by year end 2021, Sacra estimates that Owner hit $34 million ARR in 2024, up 113% YoY, as it continues to scale post-COVID at 100%+ YoY headed into the mid-8 figures of revenue. Compare to restaurant tech competitors like Toast (NYSE: TOST) which grew ~200% YoY at similar revenue scale (albeit with ~20% payment gross margins) en route to $3.9 billion in 2023 revenue (up 40% YoY) with a $9.8 billion market cap for a 2.5x revenue multiple, BentoBox (acquired by Fiserv in 2021) which was generating approximately $20 million ARR at acquisition, and AI voice ordering platform Tarro at $85M ARR at the end of 2024, up 118% YoY from 2023.

- After starting with restaurants due to their high organic local demand, low transaction size, and constant need to drive new customers, Owner’s next act hinges on expanding beyond the $23B restaurant marketing industry into the $100B+ market for adjacent local services—dog groomers, hardware stores, salons, and more. While Square (NYSE: BLOCK) and Toast used payments and POS as its wedge to get into restaurants, Owner complements the POS, landing with its commission-free online ordering while bundling in all the products that Square and Toast monetize as add-ons—making it easier to scale across verticals without the friction of hardware replacement.

For more, check out this other research from our platform:

- Owner (dataset)

- Tarro (dataset)

- ChowNow, Lunchbox, and the $12B product-market fit of pizza that launched food delivery

- Lunchbox

- ChowNow

- Chris Webb, CEO of ChowNow, on the new restaurant stack

- Hadi Rashid, co-founder of Lunchbox, on vertical SaaS for restaurants

- Scale AI for Chinese restaurants

- Weee! vs. Instacart

- Online Grocery Unit Economics, Sensitivity Analysis and TAM

- The Key Profitability Levers in Online Grocery

- Instacart vs Amazon vs Uber

- Mike Bell, CEO of Miso Robotics, on automating across the value chain of fast casual food

- Former corp dev at a European on-demand unicorn on dark store unit economics

- Weee! (dataset)