Otter at $100M ARR

Jan-Erik Asplund

Jan-Erik Asplund

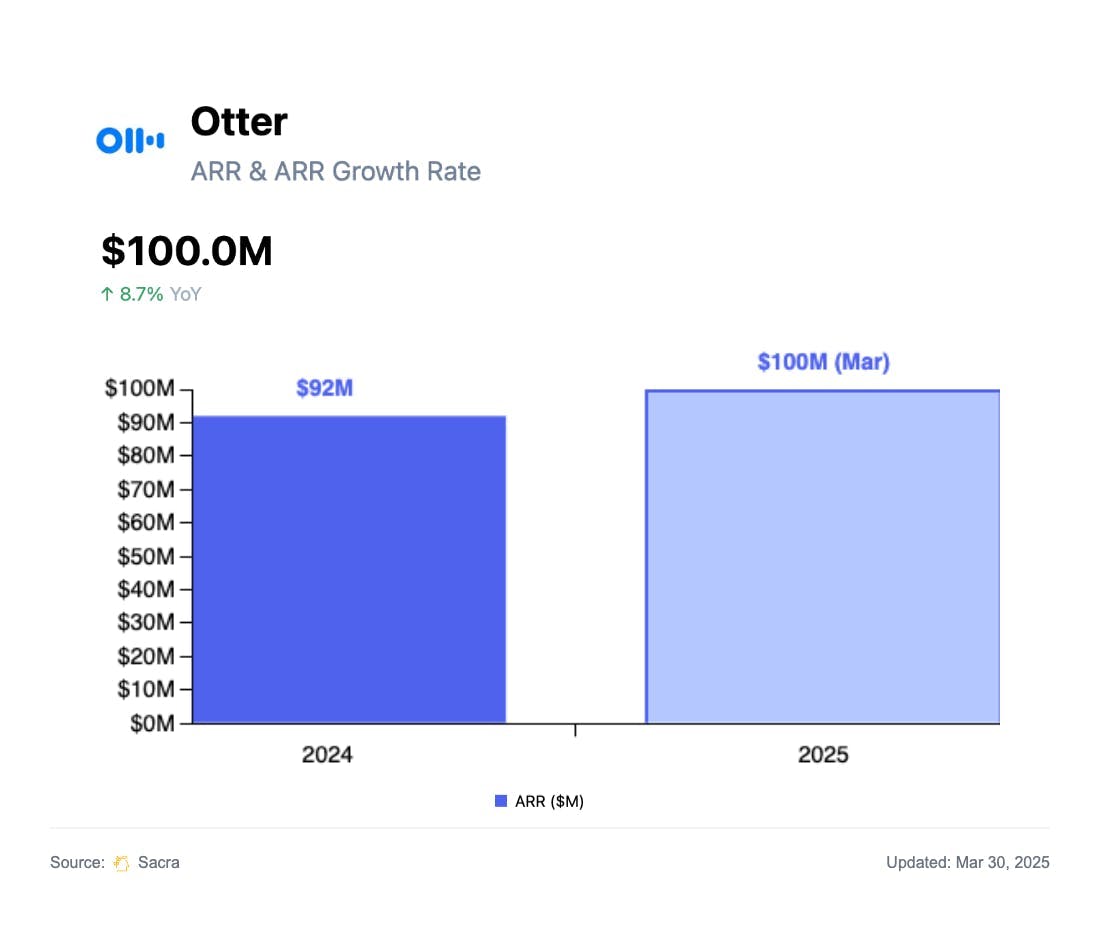

TL;DR: As COVID turned every meeting into a Zoom call, Otter’s automatic transcription meeting bots became ever-present, driving a viral growth loop. Sacra estimates Otter crossed $100M ARR in March 2025, up from $81M at the end of 2024. For more, check out our full report and dataset on Otter.

We first covered the meeting bot space in November 2023 when we looked at the commoditization of sales call recording—the Gongification of SaaS. In April 2025, we followed up with looks at Recall.ai's $10M/year "Plaid for meeting bots" and Granola's attempt to undercut Zoom, Meet and Teams by getting closer to the operating system.

Key points on Otter via Sacra AI:

- Founded as a real-time mobile transcription app, Otter (2016) found explosive product-market fit during COVID when it launched Otter Assistant—a meeting bot that automatically joins Zoom, Google Meet, and Teams meetings, generates a timestamped transcription, and emails it after the meeting. The viral bot-in-meeting effect drove Otter's core growth loop to now-25M+ users with each Zoom call featuring an Otter bot generating an average of ~7.5 new social interactions—about 3% of users are converted into paid tiers, each enforcing strict minute caps (Pro: 1,200 min/mo, Business: 6,000 min/mo) that create natural upgrade pressure.

- With AI enabling Otter customers to do more with transcripts like create and assign todos, chat with them, and get call coaching and sales insights, Sacra estimates that Otter crossed $100M in annual recurring revenue (ARR) at the end of March 2025, up from $81M ARR at the end of 2024. Compare to direct competitor Fireflies.ai at ~$15M ARR and 16+ million users, call recording SaaS leader Gong at $298M ARR at the end of 2024, up 28% YoY from $232M in 2023, and “Plaid for meeting bots” Recall at $8M ARR in 2024, up 300% YoY from $2M in 2023.

- As transcription has been commoditized, meeting recording has become highly competitive between other horizontal bots like Fireflies ($19M raised, Lightspeed), sales/success-focused notetakers like Grain ($51M raised, Tiger Global), AI-native agents like Granola ($24M raised, Spark Capital), and vertical SaaS tools like HubSpot (NYSE: HUBS) and Apollo ($134M ARR) embedding call recording as a monetization lever. As infrastructure products like Recall (meeting bots) and Deepgram (transcription) have made it easy to build meeting capture and transcription directly into products, the battleground is shifting to who can transform that unstructured call data into downstream artifacts like CRM entries, follow-ups, tickets, and knowledge graphs.

For more, check out this other research from our platform:

- Granola vs Zoom

- $10M/yr Plaid for meeting bots

- Gong (dataset)

- Gongification of SaaS

- Nico Ferreyra, CEO of Default, on building an end-to-end inbound sales platform

- Austin Hughes, CEO and co-founder of Unify, on the death of the SDR

- How Clearbit sold to HubSpot

- Apollo at $100M ARR

- Matt Sornson, co-founder & ex-CEO at Clearbit, on vertically integrated data and workflow tools in sales and marketing

- Apollo (dataset)

- Pinecone

- Adam Brown, co-founder of Mux, on the future of video infrastructure

- Matt Redler, ex-CEO of Panther, on the competitive positioning of Deel vs. Remote vs. Rippling

- Lenny Bogdonoff, co-founder and CTO of Milk Video, on the video infrastructure value chain

- Len Markidan, CMO at Podia, on the future of business video

- Ben Ruedlinger, CINO at Wistia, on the video hosting infrastructure stack