OpenRouter at $100M GMV

Jan-Erik Asplund

Jan-Erik Asplund

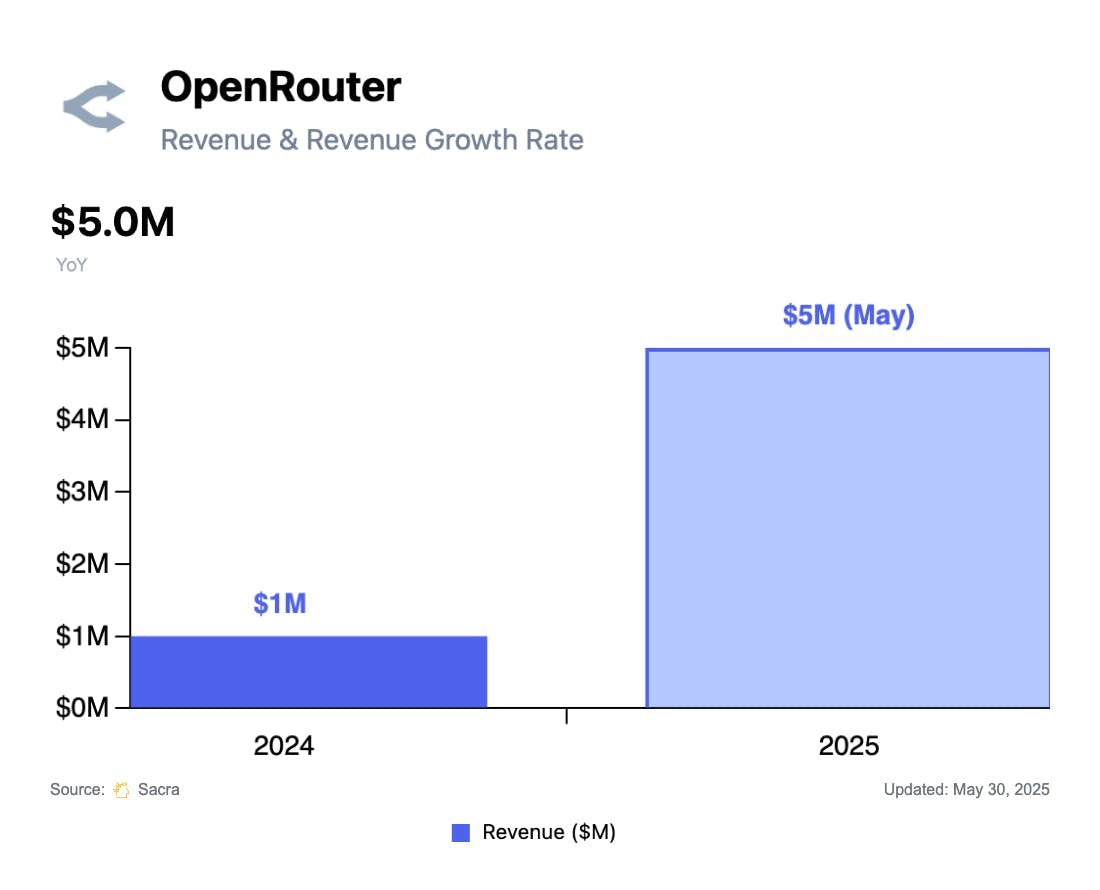

TL;DR: As developers move from wrapping single LLMs to stitching together multiple models, OpenRouter has emerged as the universal LLM adapter—routing requests across OpenAI, Anthropic, Google and 60+ other providers with automatic failover, model selection, and centralized analytics. Sacra estimates that OpenRouter hit $5M in annualized revenue in May 2025, on $100M in GMV, up from $1M in annualized revenue at the end of 2024. For more, check out our full report and dataset on OpenRouter.

Key points via Sacra AI:

- Launched in 2023, OpenRouter built a universal API endpoint for LLMs, hooking up to 400+ different models through a single integration so (1) developers can instantly hook up open-source models that would otherwise require spinning up cloud GPUs via Together AI or Hugging Face, (2) developers externally can easily expose “model switching” to the end user in the client or internally swap between smarter, cheaper, or faster models on the backend without dropping in 3–5+ individual SDKs, and (3) power users of AI models can “bring their own key” to AI cloud IDEs like Cline & Aider or image generators like Fal.ai where they swap in their own OpenRouter key and pay for the inference themselves on their own key. OpenRouter customers buy tokens for inference that get spent across various providers like OpenAI and Anthropic, with tokens marked up roughly 5%—with the value prop for developers being faster setup, a simpler integration experience, and the ability to abstract away the complexity of model selection, with one API, one dashboard for usage & billing, and cost savings from automatically down-shifting to cheaper models when possible.

- Indexed on the rise of AI in your IDE like Cursor ($500M ARR) and Codeium ($40M ARR), Sacra estimates OpenRouter hit $5M annualized revenue in May 2025 off $100M in annualized inference spend (aka GMV), up from $1M annualized revenue at the end of 2024 off ~$19M of spend. Compare to universal API for fintech Plaid at $390M in ARR in 2024, up 27% YoY from 2023, universal meeting-bot API Recall.ai at $8M ARR at the end of 2024, up 300% YoY from $2M ARR in 2023, and AI evaluation startup Weights & Biases (acquired by CoreWeave in May 2025) at $50M ARR at the end of 2024.

- Just as the boom in location-based apps like Uber created demand for Twilio, the rise of fintechs like Venmo led to Plaid, and Segment / SaaS, the explosion of AI models across 60+ providers and 400+ model variants is making OpenRouter core infrastructure for connecting AI apps to models. OpenRouter's upside is in becoming the orchestration layer for LLMs—helping developers optimize COGS by auto-routing to the most cost-efficient endpoints, drive speed & performance through real-time latency and throughput scoring, and conduct evals to continuously fine-tune which models to use and when.

For more, check out this other research from our platform:

- OpenRouter (dataset)

- Danny Wheller, VP of Business & Strategy at Hebbia, on vertical vs horizontal enterprise AI

- Wade Foster, co-founder & CEO of Zapier, on AI agent orchestration

- Cursor at $200M ARR

- Cerebras at $250M

- "Plaid for X" startups

- $10M/yr Plaid for meeting bots

- Ayan Barua, CEO of Ampersand, on going upmarket with deep native product integrations

- The future of Plaid's $250M screen scraping business