Noom at $1B ARR

Jan-Erik Asplund

Jan-Erik Asplund

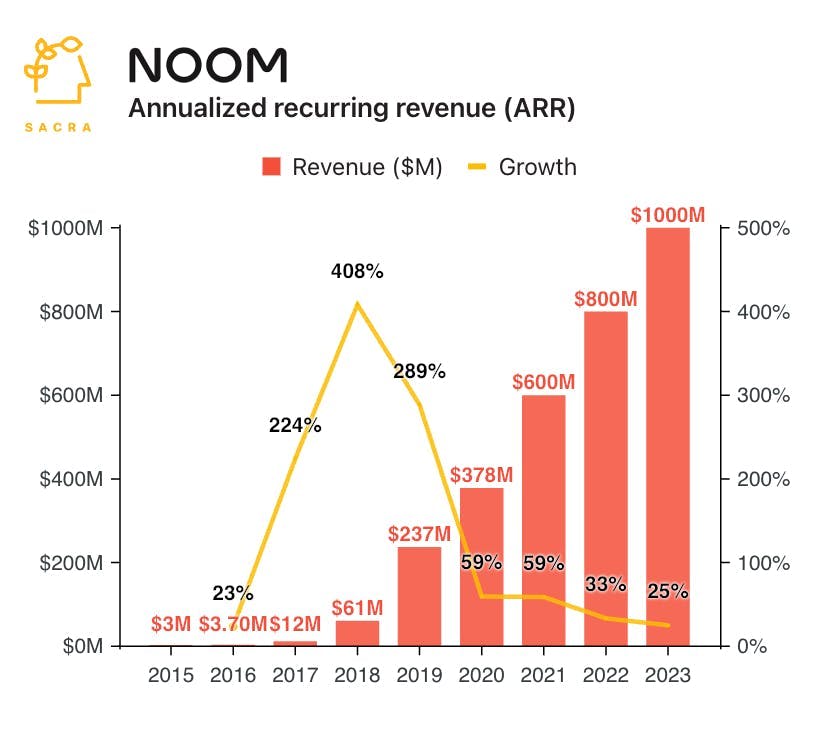

TL;DR: Noom grew from $12M ARR in 2017 to an estimated $1B ARR in 2023, finding product-market fit by combining WeightWatchers' coaching model with the mobile-native food and activity tracking of MyFitnessPal. Now, Noom is selling generic Ozempic and going up against multi-vertical telehealth companies like Ro and Hims & Hers. For more, check out our full report and dataset on Noom.

Key points via Sacra AI:

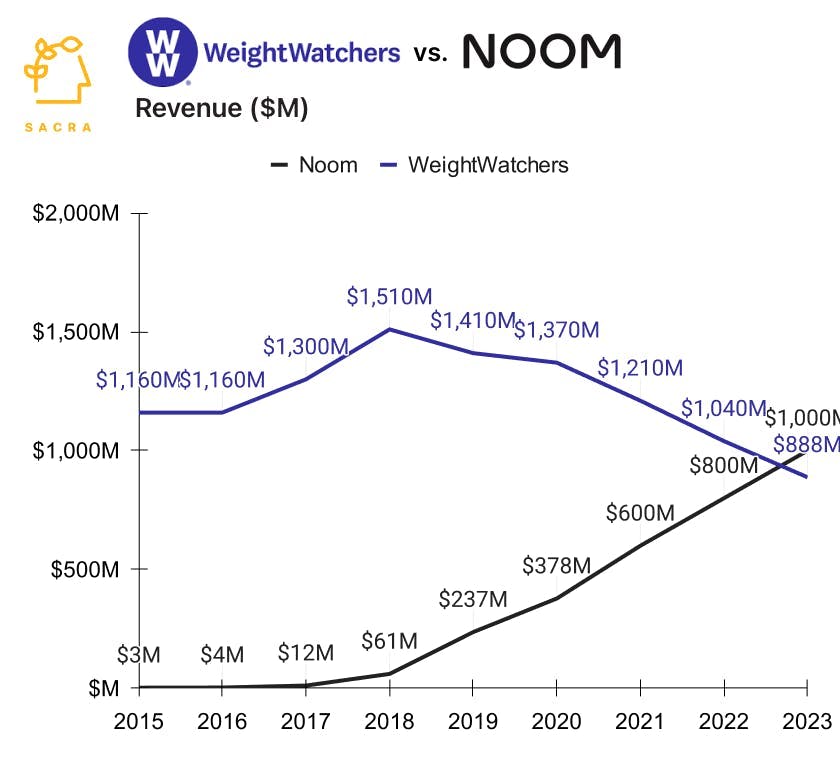

- Noom (2008) found product-market fit by combining WeightWatchers' model of 1:1 and group coaching with the digital calorie and activity tracking of MyFitnessPal, counter-positioning against WeightWatchers' emphasis on in-person as a mobile-native, science-backed app with fully-virtual text-based coaching. Noom’s B2C model today employs an LLM-powered chatbot that handles initial user interactions and questions, creating leverage for their team of human coaches (paid at $19-24/hr) who can manage 300-400 users each (vs. the 7-15 each of a traditional dietician).

- After Noom pivoted from their early B2B model to a D2C weight loss app in 2017, their growth exploded, going from $12M ARR in 2017 to an estimated $1B ARR by the end of 2023, growing 25% YoY, driven by aggressive ad spend that scaled from $5M in 2017 to $330M in 2023. Compare Noom's $3.7B valuation at its May 2021 Series F round to the legacy incumbent WeightWatchers (NASDAQ: WW) at $890M revenue in 2023 (down 15% YoY) with a $140M market cap (0.2x multiple), GLP-1 competitor Hims & Hers (NYSE: HIMS) at $872M revenue in 2023 (up 65% YoY) with a $3.95B market cap (4.5x multiple), and telehealth therapy company Talkspace (NASDAQ: TALK) at $150M revenue in 2023 (up 26% YoY) with a $431M market cap (2.8x multiple).

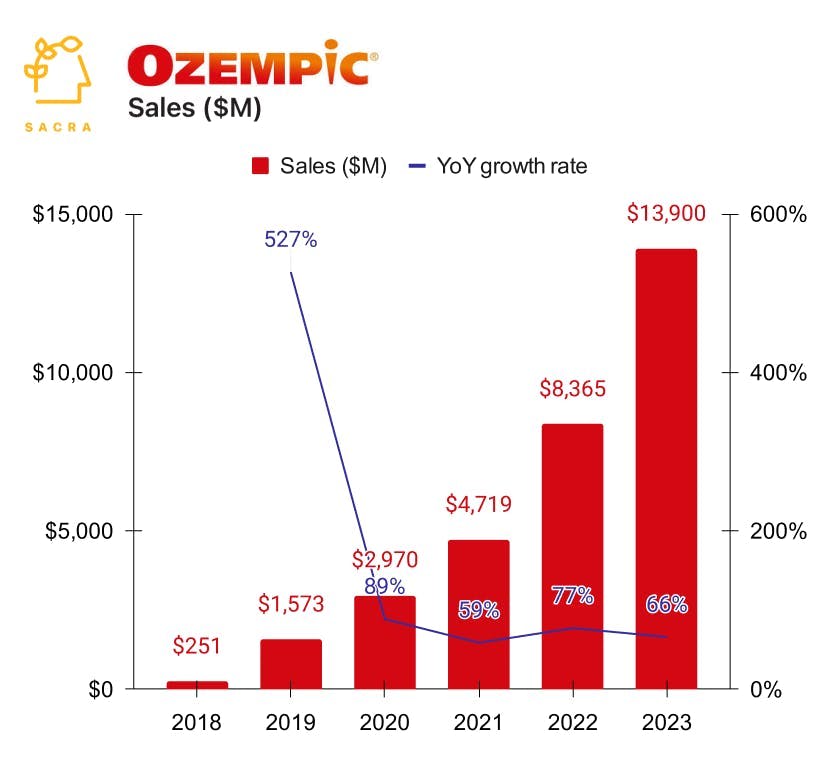

- Ozempic’s disruptive potential in weight loss—with $14B of sales in 2023, up 66% YoY—has forced Noom to start selling GLP-1s, which, fortunately for Noom, have structurally high customer lifetime value (CLTV) driven by their “for life” design and the ongoing need to tweak dosage. Noom’s competitive set now includes multi-vertical telehealth companies like Hims & Hers (NYSE: HIMS) and Ro (General Catalyst, $1B raised), which also offer meds for ED, hair loss, anxiety, and more—Noom’s strategy hinges on being the best solution for weight loss in particular with their combination of drugs, food and activity tracking, and 1:1 coaching.

For more, check out this other research from our platform:

- Noom (dataset)

- Hone Health: the $55M/year D2C testosterone startup

- Ro and the telehealth capital cycle

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Andy Hoang, CEO of Aviron, on the unit economics of connected fitness

- Strava: the $265M/year Whole Foods of social networks

- Aviron and the Xbox of connected fitness

- Oura (dataset)