Marshmallow at $370M/year growing 62% YoY

Jan-Erik Asplund

Jan-Erik Asplund

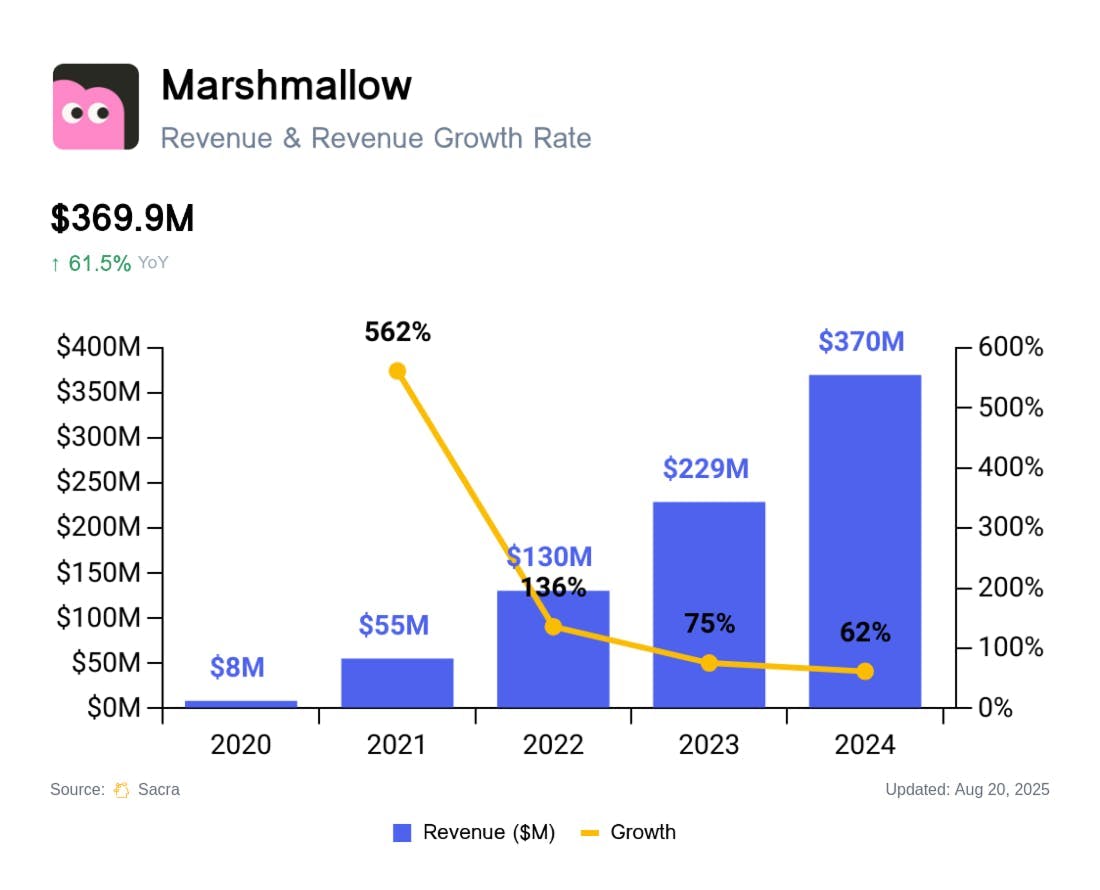

TL;DR: Immigrants in the UK have historically paid ~51% above market rates for car insurance due to lack of local driving history, inspiring Marshmallow to build a full-stack insurtech that underwrites with international driving records & telematics. Sacra estimates Marshmallow hit $370M revenue in 2024, up 62% YoY, with $26M net profit. For more, check out our full report and dataset on Marshmallow.

Key points via Sacra AI:

- Historically, immigrants to the UK have been overpriced by legacy car insurers (~51% above market average) because of their lack of UK driving history, inspiring Marshmallow (2016) to use international driving records & telematics to underwrite immigrants’ car insurance, delivering ~£220 average savings vs incumbents. As a “full-stack” insurtech with their own Gibraltar-based carrier entity and UK-based broker, Marshmallow can monetize via both interest income from investing premium float (60% of revenue) and via brokerage fees from policy sales (40% of revenue) without sharing revenue or coordinating with carrier partners to launch new policies.

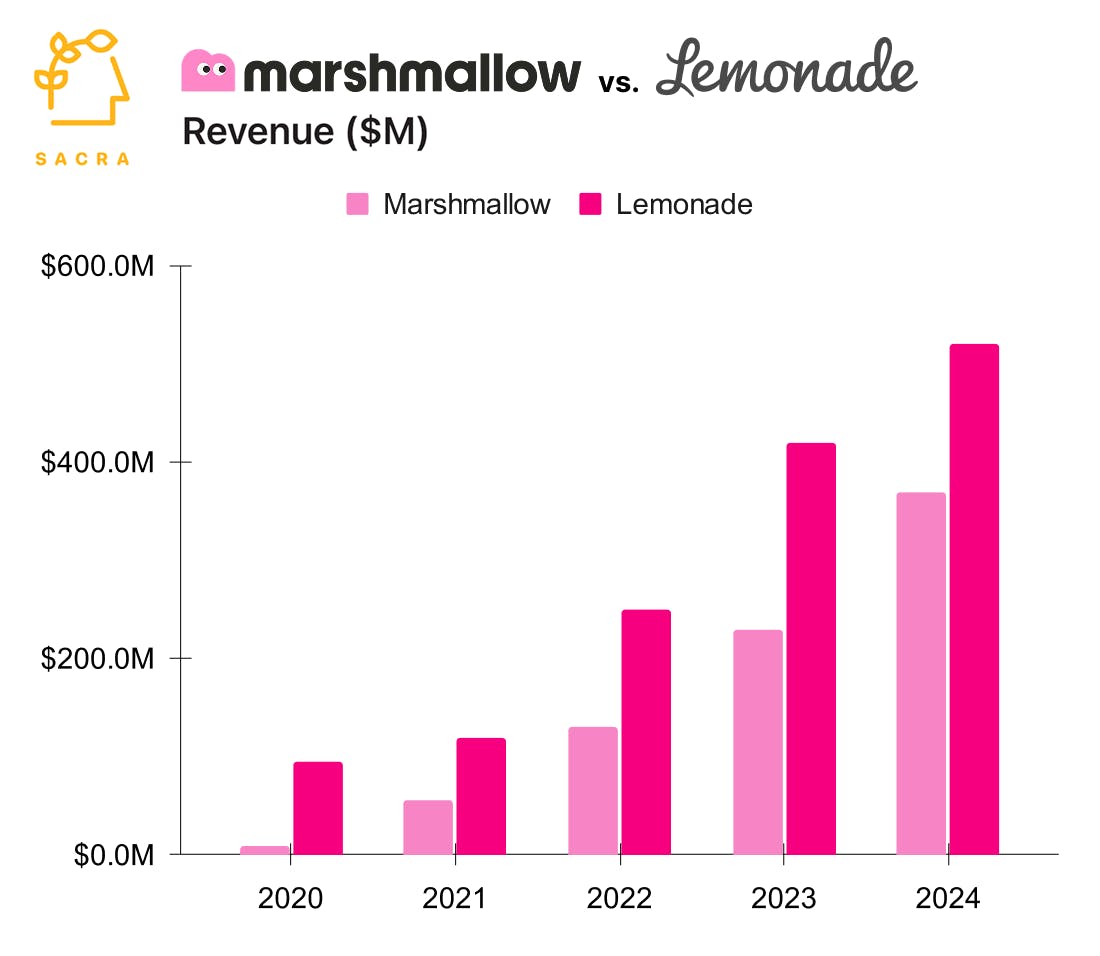

- Riding a historic surge of immigration to the UK with 1.3M arrivals in 2023 (the most ever in one year) and 948K in 2024—both double from pre-2020 levels of ~550K annually—Sacra estimates Marshmallow hit $370M revenue in 2024, up 62% YoY from $229M, generating $25.9M net profit (7% margin) valued at $2B+ (5.4x revenue) after a $90M Series C in April 2025 (Portage Capital). Compare to UK incumbent Admiral (LON: ADM) at £4.78B in 2024 revenue growing 37% YoY trading at 2.3x revenue, neobank-turned-insurer Revolut at $4B in 2024 revenue growing 75% YoY raising at a $65B valuation for a 16x multiple, and American insurtech Lemonade (NYSE: LMND) at $520M in 2024 revenue growing 22.5% YoY valued at $4.12B for a 7.9x multiple.

- After using car insurance as a wedge into the wallet of 1M+ UK immigrants, Marshmallow is now getting into competition with neobanks Monzo & Revolut, building a one-stop financial shop for “thin file” immigrants across personal lending (£300-500M TAM), credit cards (£900M-1.4B), and home insurance (£100-150M), cross-selling into their existing base for cheaper CAC. Geographic expansion gives Marshmallow the opportunity to expand its TAM from the UK to other countries with 1) mass migration where 2) new immigrants’ lack of driving history limits their insurability—with Germany/France/Spain/Italy ($3.3-5.3B TAM), Canada ($1.2-2B), and the United States ($15-25B) next on the roadmap.

For more, check out this other research from our platform:

- Marshmallow (dataset)

- Monzo (dataset)

- Revolut (dataset)

- Carl Ziadé, co-founder of Gaya on the auto financing and insurtech opportunity

- The neobank capital cycle

- European neobanks are back

- Revolut at $4B/year growing 75% YoY

- Turo at $958M revenue

- Turo at $880M revenue

- The state of European venture

- Ex-Chime employee on Chime's multi-product future