Manus at $90M/year

Jan-Erik Asplund

Jan-Erik Asplund

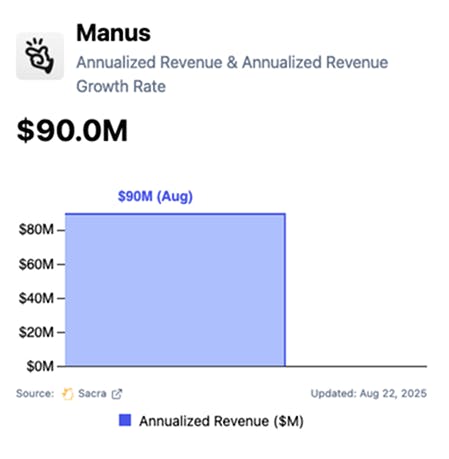

TL;DR: Founded in 2022, Manus launched in March 2025 as the first consumer-facing agent that combined agentic browser control, deep research, and third-party integrations into a single product. Sacra estimates Manus hit $90M in annualized revenue by August 2025, just five months post-launch, with Japan, the Middle East, and the U.S. as its biggest markets. For more, check out our full report and dataset on Manus.

Key points via Sacra AI:

- Where Anthropic's Computer Use for AI browser control (Oct 2024) and OpenAI's Deep Research (Feb 2025) introduced the idea of long-running AI agents with access to the web, Chinese AI startup Manus (founded 2022) was the first to combine browser use, deep research and 29 3rd-party integrations & tools into an all-in-one consumer agent product, launching in March 2025 as an agent that can scrape data, fill out forms, run & debug code, and generate decks. Manus monetizes through a credit-based subscription model with monthly tiers from free (300 daily credits) to Pro ($199 for 19,900 credits), where tasks consume 200-900 credits depending on complexity—directly mapping to infrastructure costs including LLM tokens for planning, VM compute time for execution, and third-party API calls.

- After growing their waitlist to 2 million people a week after their demo video went viral with 1M+ views, Sacra estimates that Manus hit $90M in annualized revenue in August 2025, just five months after launch, with Japan, the Middle East, and the U.S. as its biggest geographic segments by revenue. Compare to U.S.-based agentic all-in-one competitor Genspark at $36M in annualized revenue as of May 2025, up from $10M as of mid-April, agentic coding company Cognition at $73M in annual recurring revenue (ARR) in June 2025 pre-Windsurf acquisition, and Cursor at $500M in annual recurring revenue (ARR) in May, up from $100M at the end of 2024.

- As foundation model labs like Anthropic and OpenAI fold agentic capabilities into unified systems—OpenAI unifying Operator, deep research, and code execution into ChatGPT Agent, Anthropic expanding Claude Code with parallel sub-agents and web search—while Model Context Protocol (MCP) becomes the industry standard for agent-to-tool connections, Manus risks seeing commoditized its core experience of long-running agents that can read + write + execute code across different systems. Like TikTok (founded at Bytedance's headquarters in Beijing) and HeyGen, Manus has tried to “de-China” its identity—closing its Beijing and Wuhan offices, laying off local staff, moving its founders and HQ to Singapore, and incorporating a U.S. entity—as U.S. regulations crack down on Chinese tech and Anthropic has restricted access to its models for China-headquartered companies.

For more, check out this other research from our platform:

- Manus (dataset)

- Perplexity (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- Perplexity at $100M ARR

- How Perplexity hits $656M ARR

- Anthropic's ChatGPT

- Fal.ai at $95M/year growing 4,650% YoY

- Replit at $106M ARR

- OpenEvidence at $50M/year growing 30% MoM

- Lovable at $84M ARR growing 36% MoM

- $100M/year Plaid of AI

- Harvey at $75M ARR

- Danny Wheller, VP of Business & Strategy at Hebbia, on vertical vs horizontal enterprise AI

- Wade Foster, co-founder & CEO of Zapier, on AI agent orchestration

- Sam Hall, CEO of Wafer, on AI agent form factors

- Why OpenAI wants Windsurf

- Claude Code vs. Cursor

- Vibe coding index