Lead Bank vs Column

Jan-Erik Asplund

Jan-Erik Asplund

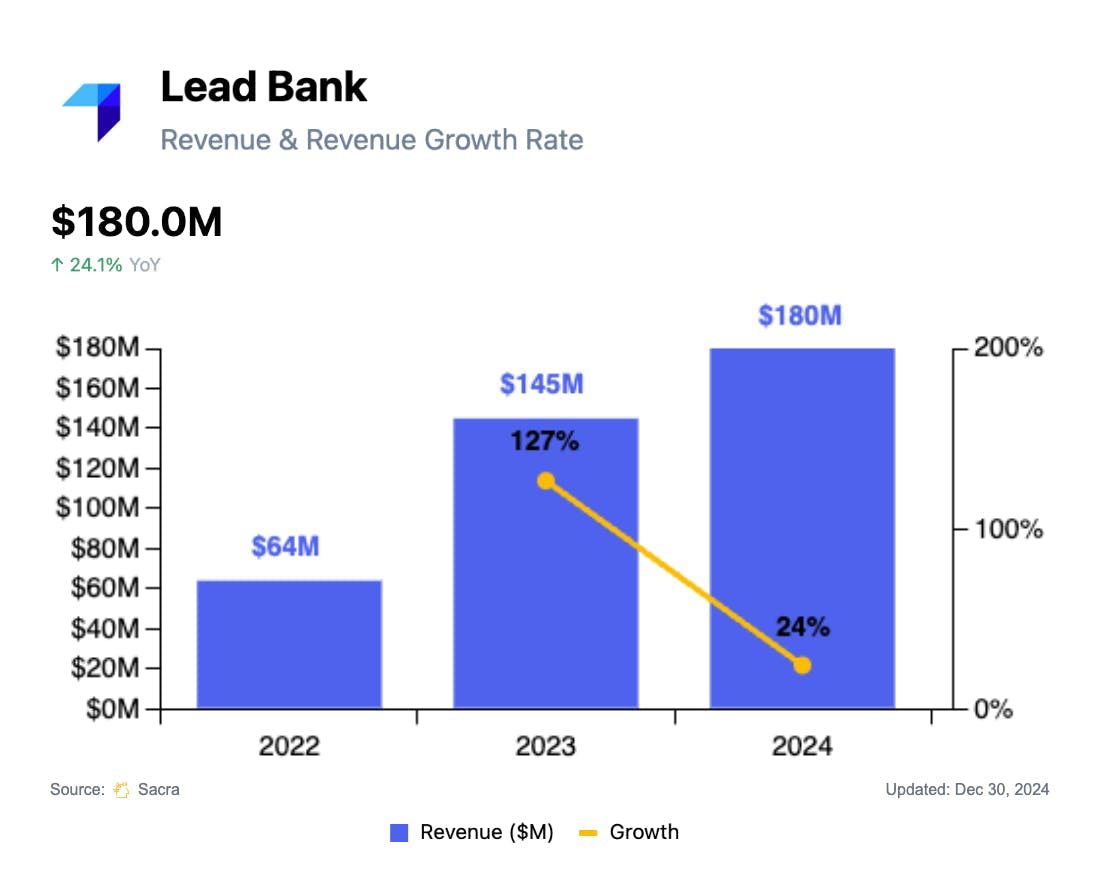

TL;DR: While Brex and Mercury migrated to Column, Lead Bank has emerged as the lending-centric alternative to middleware BaaS—now powering Affirm’s BNPL and Revolut’s U.S. banking. Sacra estimates Lead Bank generated $180M in 2024 revenue, up 24% YoY, with 68% of revenue from interest. For more, check out our full report and dataset on Lead Bank.

With Column now hosting both Mercury and Brex—America’s marquee neobanks—we turned next to Lead Bank, the other big vertically-integrated community bank in fintech.

Key points via Sacra AI:

- After turning Square into a bank—securing an FDIC industrial-loan charter in 2020 and scaling Square Capital to $8B in loans—executive chairman of Square Financial Services Jackie Reses and a group of former Square executives bought Kansas City-based Lead Bank in 2022 with $100M in funding (A16Z, Coatue, Khosla Ventures) to turn it into a vertically integrated community bank with an API core. Unlike middleware BaaS platforms such as Unit or Treasury Prime that broker fintechs to third-party banks, Lead Bank exposes its own API so partners can open FDIC-insured accounts, originate loans, push real-time payments (ACH, RTP, Fedwire), and issue debit or virtual cards directly through Lead Bank as their banking partner—monetizing through usage fees ($0.25–$0.75 per ACH, $3–$10 per wire) and 20–30% of interchange, while also earning interest on the short-duration loans it funds.

- In 2024, after Affirm shifted a growing share of its core BNPL originations to Lead Bank (alongside Cross River Bank and Celtic Bank) and Revolut tapped it for all of its U.S. banking products, Sacra estimates Lead Bank brought in roughly $180M of revenue in 2024, up 24% year-over-year—about 68% ($123M) from interest on fintech deposits and loans and 32% ($57M) from non-interest fees. Compare with vertically integrated community banks like Column at $55M in revenue in 2024, up 130% YoY, Cross River Bank at $675M revenue in 2024, down 15% YoY, Celtic Bank at $345M revenue in 2024, down 21% YoY, and Choice Financial Group at $315M revenue in 2024, down 22% YoY.

- While Lead Bank derives 68% of revenue from interest on BNPL and working-capital programs with partners like Affirm, making it more rate-sensitive versus Column’s neobank-centric, Mercury- and Brex-anchored model, where higher interchange fees yield a roughly 50/50 mix of interest on deposits and non-interest revenue such as interchange and API/transaction fees. Lead Bank’s growth trajectory is indexed on its marquee fintech customers Affirm at $2.8B in revenue in 2024, up 46% year-over-year, and Revolut at $4B in revenue in 2024, up 72% year-over-year—but with marquee logo Ramp shutting down its lending product Flex in April 2025.

For more, check out this other research from our platform:

- Lead Bank (dataset)

- Column (dataset)

- Cross River Bank (dataset)

- Celtic Bank (dataset)

- Choice Financial Group (dataset)

- Mercury (dataset)

- Brex (dataset)

- Ramp (dataset)

- Anthony Peculic, Head of Cards at Cross River Bank, on building a fintech one-stop shop

- Bo Jiang, CEO of Lithic, on the power of the cards as a digital payment rail

- Art Levy, Chief Business Officer at Brex, on the strategy of Brex Embedded

- Immad Akhund, CEO of Mercury, on the business models of fintechs vs. banks

- Mercury: the unbundling of Silicon Valley Bank

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Karim Atiyeh, co-founder and CTO of Ramp, on the future of the card issuing market