Jenni AI: the $5M/year Chegg of generative AI

Jan-Erik Asplund

Jan-Erik Asplund

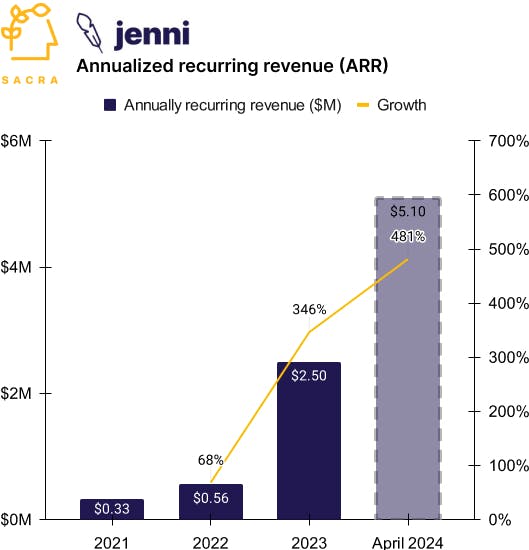

TL;DR: Jenni AI has grown their annual recurring revenue (ARR) by 925% since the ChatGPT-pocalypse that decimated horizontal, prosumer businesses built on GPT-3. For more, check out our full dataset on Jenni and our interview with David Park, Jenni’s CEO and co-founder.

Key points from our research:

- Jenni AI (2019) started as an SEO copywriting app built on fine-tuned GPT-2, used as an internal tool by the human writers at founder David Park’s marketing agency—when GPT-3 launched in June 2020, they pivoted to SaaS, selling it into other agencies and into marketing teams directly. While marketing teams preferred Jasper ($72M ARR by 2022) and Copy.ai ($10M ARR by 2022), Jenni AI discovered an emergent use case with students who wanted to write essays faster with AI suggestions and auto-generated, in-text citations using their own sources.

- Jenni AI niched down into the academic essay-writing use case in 2022, getting to ~$560K ARR by the end of the year after verticalizing their “ChatGPT for college students” with features like automatic fetching of citations, the ability to chat with your research library, bulk source importing, and LaTeX/Word exports. By September 2023, Jenni AI was doing $150K monthly recurring revenue with an average OpenAI bill of $20K to $30K, re-selling the output of GPT-3 with ~83% margins (compared to the ~60% gross margins of Jasper and Copy.ai).

- Sacra estimates that Jenni AI is at $5.1M annual recurring revenue (ARR) as of April 2024, growing 481% year-over-year—after taking 4 years to go from 0 to $1M ARR, they took 4 months to get to $2M and another 6 months to get to $5M. Jenni AI’s 16% monthly churn rate is due both to intrinsic promiscuity with which users jump from app-to-app in generative AI and the seasonality of edtech products (big drop-offs in summer and winter).

- While ChatGPT (2022) decimated the horizontal, prosumer businesses of Jasper and Copy.ai, forcing their move into the enterprise, for verticalized generative AI companies built on GPT-3, it was actually a rising tide moment that proved the capabilities of the underlying LLM tech. The main customer question that Jenni AI got from students early on was about whether the output could be detected as plagiarism—ChatGPT’s proliferation made it common knowledge that LLM text output synthesizes existing text but doesn’t directly reproduce it in traceable ways.

- There’s a growing trend of small teams—on zero or minimal outside capital—combining generative AI with self-serve SaaS to create highly profitable and fast growing businesses, from Midjourney ($200M ARR on $0 raised) to Photoroom (~$15M ARR on $125K raised) to Jenni ($5M ARR on $850K raised). Midjourney hit $200M ARR with 11 employees ($18M per full-time employee) and an app built on Discord, leveraging its network of 600M+ users for distribution and engagement—today, Midjourney represents 13% of all traffic to Discord.

For more, check out this other research from our platform:

- David Park, CEO and co-founder of Jenni AI, on prosumer generative AI apps post-ChatGPT

- Jenni AI (dataset)

- AI writing goes enterprise

- Chris Lu, co-founder of Copy.ai, on generative AI in the enterprise

- Chris Lu, co-founder of Copy.ai, on the future of generative AI

- Copy.ai (dataset)

- Jasper (dataset)

- Hugging Face (dataset)

- OpenAI (dataset)

- Anthropic (dataset)

- CoreWeave (dataset)

- Lambda Labs (dataset)

- Scale (dataset)

- Cristóbal Valenzuela, CEO of Runway, on the state of generative AI in video

- Thilo Huellmann, CTO of Levity, on using no-code AI for workflow automation

- Dave Rogenmoser, CEO and co-founder of Jasper, on the generative AI opportunity

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future