Ironclad at $150M ARR

Jan-Erik Asplund

Jan-Erik Asplund

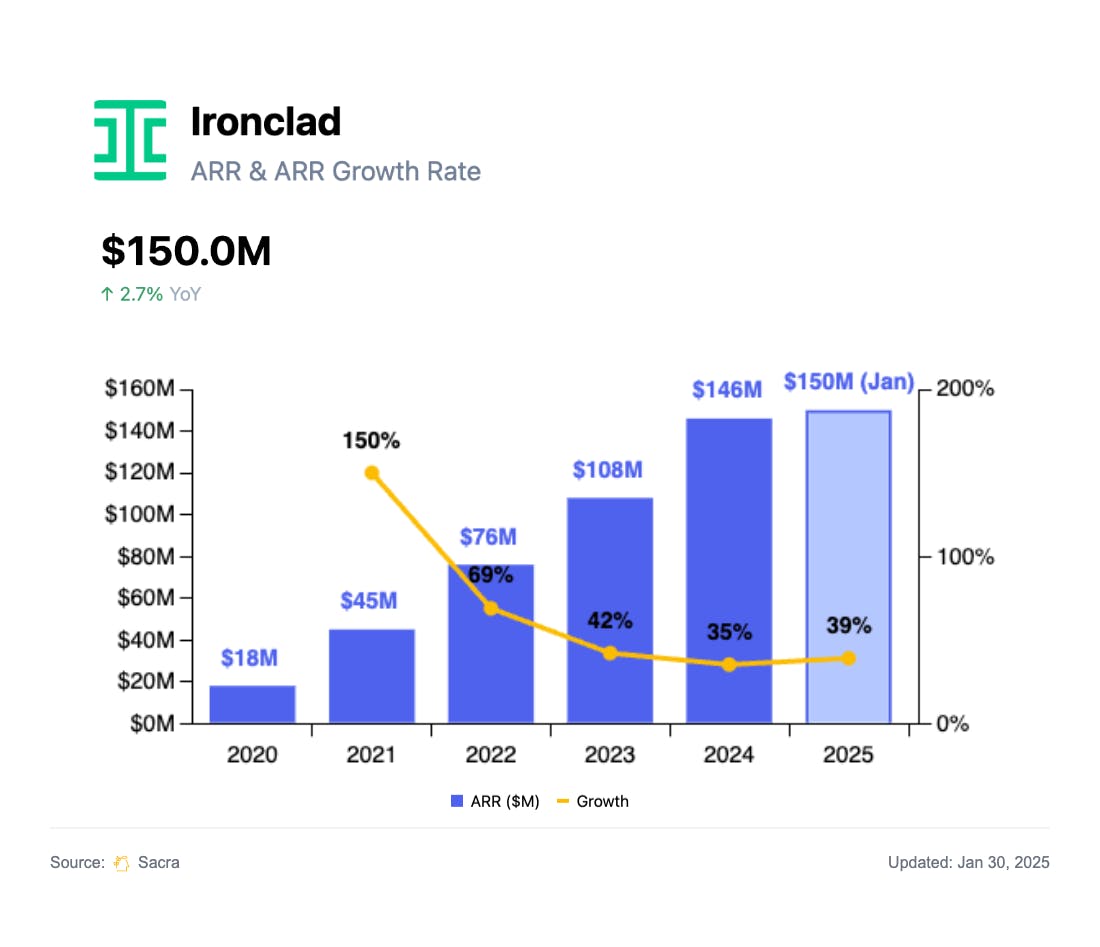

TL;DR: Founded in 2014, Ironclad began as a product-centric company building products for the rising category of legal ops that people would want to use, vs. stodgy incumbents like Apttus and SpringCM. In January 2025, Sacra estimates Ironclad hit $150M in annual recurring revenue (ARR), up 39% year-over-year. For more, read our full report and dataset on Ironclad.

Legal, like coding (e.g., Cursor at $300M ARR), holds great promise for AI-powered software because both deal in highly structured textual data with large available data troves for training—exemplified by legal research & drafting copilot Harvey ($50M ARR, growing 400% YoY). Flipping from the law firm side to the in-house corporate side, we decided to look into contract lifecycle management (CLM) company Ironclad ($333M raised, Accel), founded in 2014 by former Fenwick & West attorney Jason Boehmig and ex-Palantir engineer Cai Wangwilt.

Key points via Sacra AI:

- Versus “digital filing cabinet” incumbent CLMs like Apttus ($474M raised, acquired by Thoma Bravo) and SpringCM ($98M raised, acquired by DocuSign for $220M), Ironclad (founded in 2014) launched as a legal ops-centric GitHub for contracts integrating (1) a version controlled repository of contracts with (2) workflows around updates and approvals to contracts to get to signature. Like most system of record cum workflow B2B SaaS of its era, Ironclad largely prices per seat, focused on core usage & monetization of the legal ops role, with additional seats added over time across sales, procurement, HR and finance as Ironclad colonizes contract workflow use cases.

- Extremely sticky once configured to a customer’s workflows, Ironclad first built those workflows for customers by hand, then launched a rich self-serve workflow builder, scaling to a Sacra-estimated $150M in ARR as of January 2025, up 39% year-over-year. Compare to competing CLM platform Icertis at $250M ARR as of February 2024, up from roughly $240M at the end of 2023, AI legal platform Harvey at $50M ARR at the end of 2024, up 400% YoY from $10M at the end of 2023, and Clio at $250M ARR in February 2025, up from $235M at the end of 2024.

- Ironclad’s strength in pre-signature structured workflows has made it durable to disruption from LLMs—buying Ironclad time to structure contract data with LLMs to go end-to-end, particularly in executed contracts for sales & procurement, and action expirations & renewals, automate reporting and vector-ize search. Cementing partner relationships with systems integrators like PwC, Deloitte and KPMG has become key in legal tech and CLM, with these kingmaker firms increasingly controlling vendor selection, running RFPs, and leading implementation.

For more, check out this other research from our platform: