Hone Health: the $55M/year D2C testosterone startup

Jan-Erik Asplund

Jan-Erik Asplund

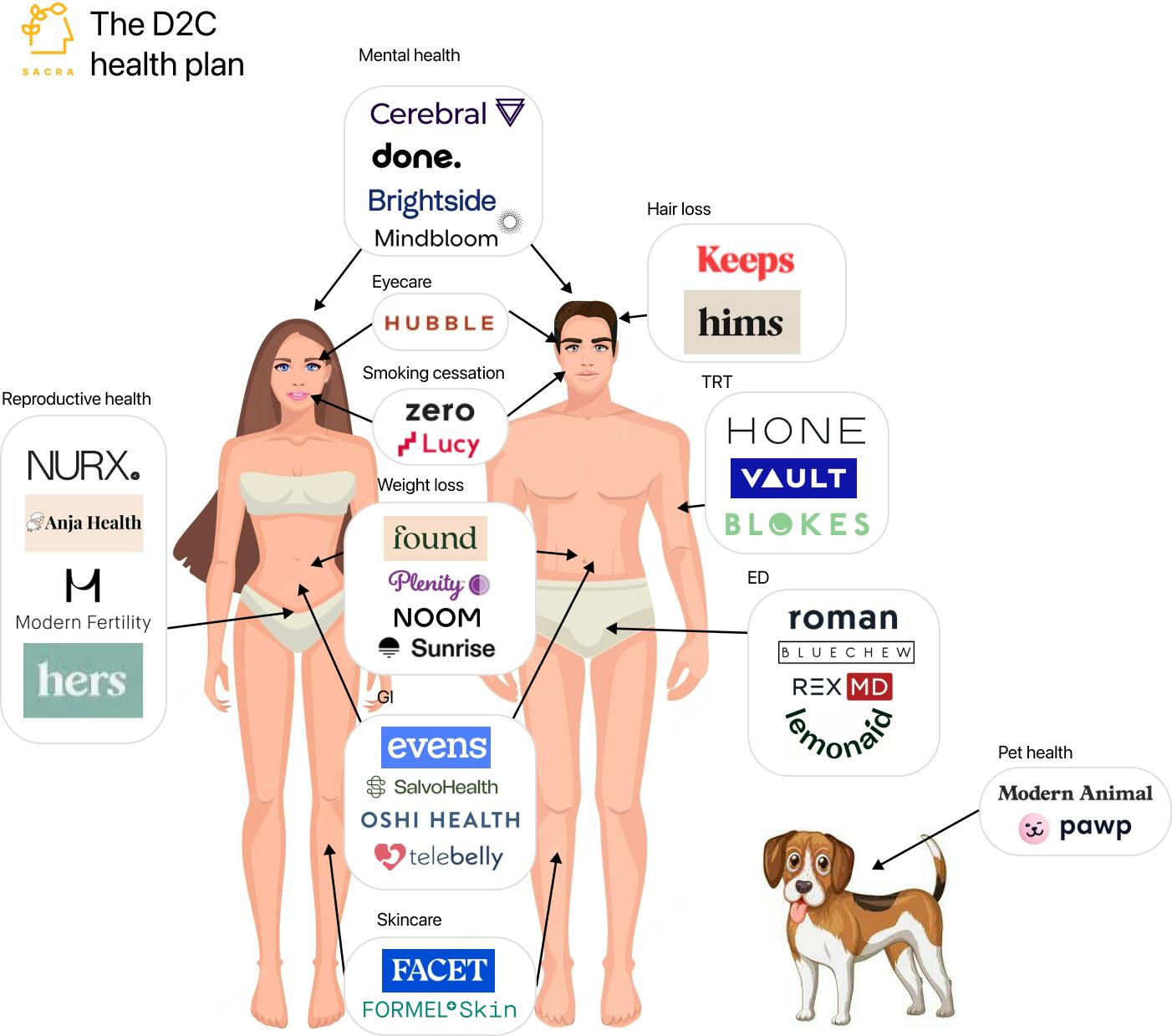

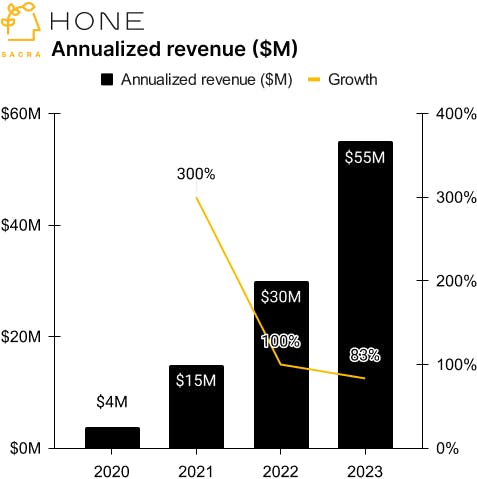

TL;DR: In 2023, Hone Health hit $55M in annualized revenue selling direct-to-consumer testosterone, capitalizing on the government’s loosening of the rules around online prescription for controlled substances. Now, they're using their superior economics around LTV to cross-sell into more products. For more, check out our report and dataset on Hone Health.

Key points from our research:

- From 2006 to 2024, interest in testosterone replacement therapy (TRT) among 18-45 year old men grew 1,000% against the backdrop of concerns spreading virally on Facebook and TikTok about population-level T declines, birth control in the water, and endocrine disruptors in plastic. When COVID hit, the government opened the D2C TRT floodgates by allowing doctors to prescribe testosterone—and other controlled substances like Adderall and ketamine—without an in-person visit. undefined

- Similar to Ro with erectile dysfunction telehealth, Hone Health (founded in 2020 as Peak) found product-market fit replacing embarrassing in-person visits to “low T” clinics with a mail-order telehealth experience around TRT wrapped in the brand of a sleek, scientific, longevity supplement. Unlike Ro with ED, delivery of a controlled substance like testosterone requires an ops platform to manage each patient's ongoing consultations, blood work, and changes to their medication.

- Sacra estimates that Hone hit $55M in annualized revenue at the end of 2023, growing 83% year-over-year on $5M raised with the majority of revenue coming from their $129/month subscription consult product and its add-ons, like testosterone injections ($28/month) and anastrozole for estrogen reduction ($22/month). Compare to Hims & Hers (NYSE: HIMS) at $906M of annualized revenue on their $1.99B market cap, up 56% year-over-year off $99 average monthly order value, Thirty Madison at $300M of revenue in 2022 and a valuation of $1B after merging with the female-focused Nurx, and Ro at $300M of revenue in 2021 with a $7B valuation, up 30% from $230M in 2020.

- Hone enjoys structurally high customer lifetime value (CLTV) due to their high AOV of $150+ and strong retention, driven by the ongoing need to tweak and monitor dosage, and similar to Ozempic, the for-life tendency of treatment. Compare to the 50% yearly churn of companies like Ro and Hims whose treatments tend towards more transactional patient relationships and where substitutes exist through the broad availability of generics like Viagra and Cialis.

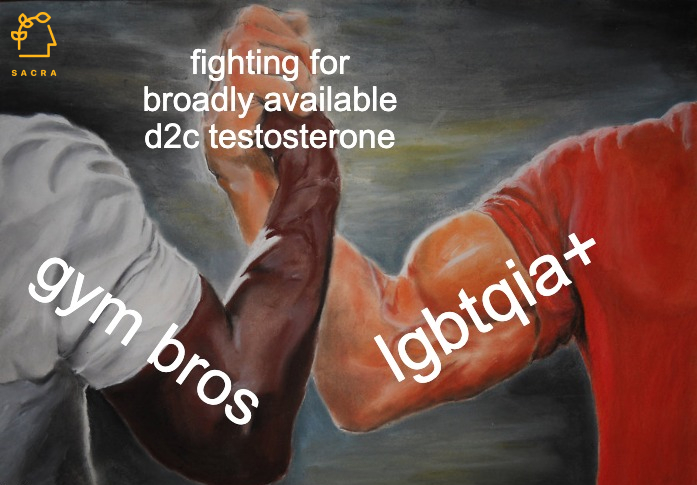

- Hone is now launching more products into their platform of recurring consultations and blood work—from metformin for weight loss to glutathione for anti-aging and vitamin B12 injections—to drive CLTV and expand their TAM beyond TRT to men's health and longevity generally. Ironically, what mitigates the existential risk of COVID-era rules getting rolled back is the bipartisan gym bros-trans coalition that’s emerged to fight for easily-accessible testosterone, led by Massachusetts senators Elizabeth Warren (D) and Ed Markey (D).

For more, check out our other research here:

- Hone Health (dataset)

- Ro and the telehealth capital cycle

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Marc Atiyeh, CEO of Pawp, on building telehealth for pets

- Liana Guzmán, CEO of Folx, on the $400B market for LGBTQIA healthcare

- Brendan Keeler, Senior PM at Zus Health, on building infrastructure for digital health

- Kry (dataset)

- Lifen (dataset)

- Ro (dataset)

- Quartet Health