Harvey at $50M ARR

Jan-Erik Asplund

Jan-Erik Asplund

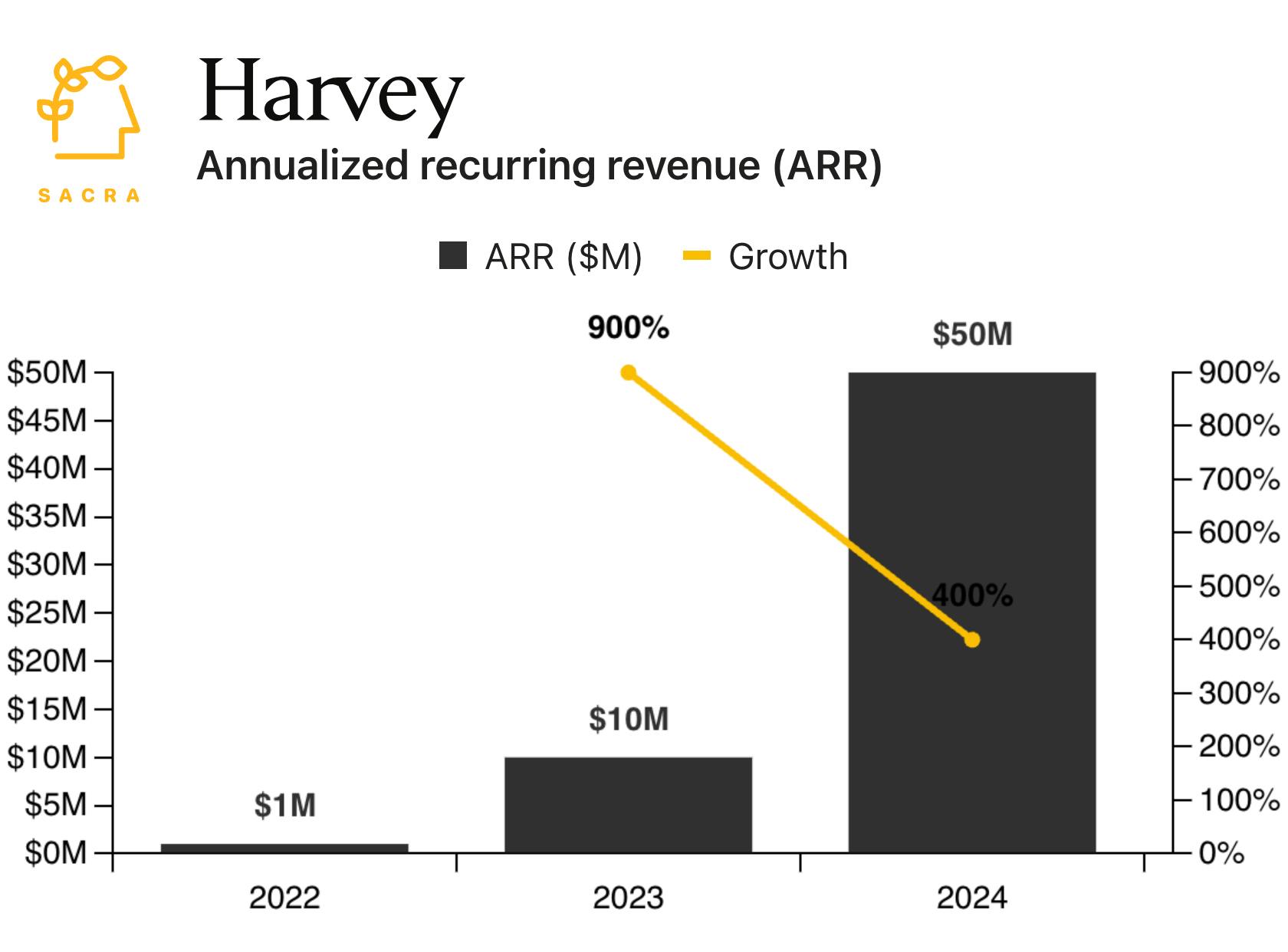

TL;DR: Westlaw and LexisNexis's $5B/yr legal tech duopoly is under threat from Harvey, which is leveraging LLMs to end-around their massive library of hand-created content and annotations. Sacra estimates that Harvey passed $50M annual recurring revenue (ARR) at the end of 2024, up 400% YoY, and is now in talks to raise $300M at a $3B valuation for a 60x forward revenue multiple. For more, check out our full report and dataset on Harvey.

Key points via Sacra AI:

- Thomson Reuters’s Westlaw (NYSE: TRI) and Reed Elsevier’s LexisNexis (NYSE: RELX) dominate legal research tech with a $8B/yr, 50 year long duopoly—offering a daunting challenge and plum prize to would-be disruptors like Casetext (acquired by Thomson Reuters for $650M, started with crowdsourcing annotations) and Harvey (large language models) leveraging new technology to end-around the massive library of content, annotations and structured data those companies have created by hand over the last 6 decades. Founded in 2022 by Winston Weinberg (1 year at O'Melveny & Myers, a top 25 law firm) and Gabriel Pereyra (research scientist at DeepMind), Harvey launched as the first GPT-4 powered legal research AI assistant, with backing and funding from OpenAI.

- Harvey stands out as one of the fastest growing vertical AI companies, with Sacra estimating that Harvey passed $50M annual recurring revenue (ARR) at the end of 2024 (up 400% YoY) backed by Sequoia from its $21M Series A through its $100M Series C in July, now in talks to raise $300M at a $3B valuation for a 60x forward revenue multiple. Compare to other vertical AI companies like medical AI scribe Abridge at $50M ARR in October 2024, valued at $2.5B for a 50x revenue multiple, and finance-focused Hebbia at $13M ARR as of June 2024, up 160% YoY, valued at $700M for a 54x revenue multiple, along with legal research incumbents Thomson Reuters at $7.2B, growing 5% and valued at $73B and RELX at $12B, growing 13% and valued at $90B.

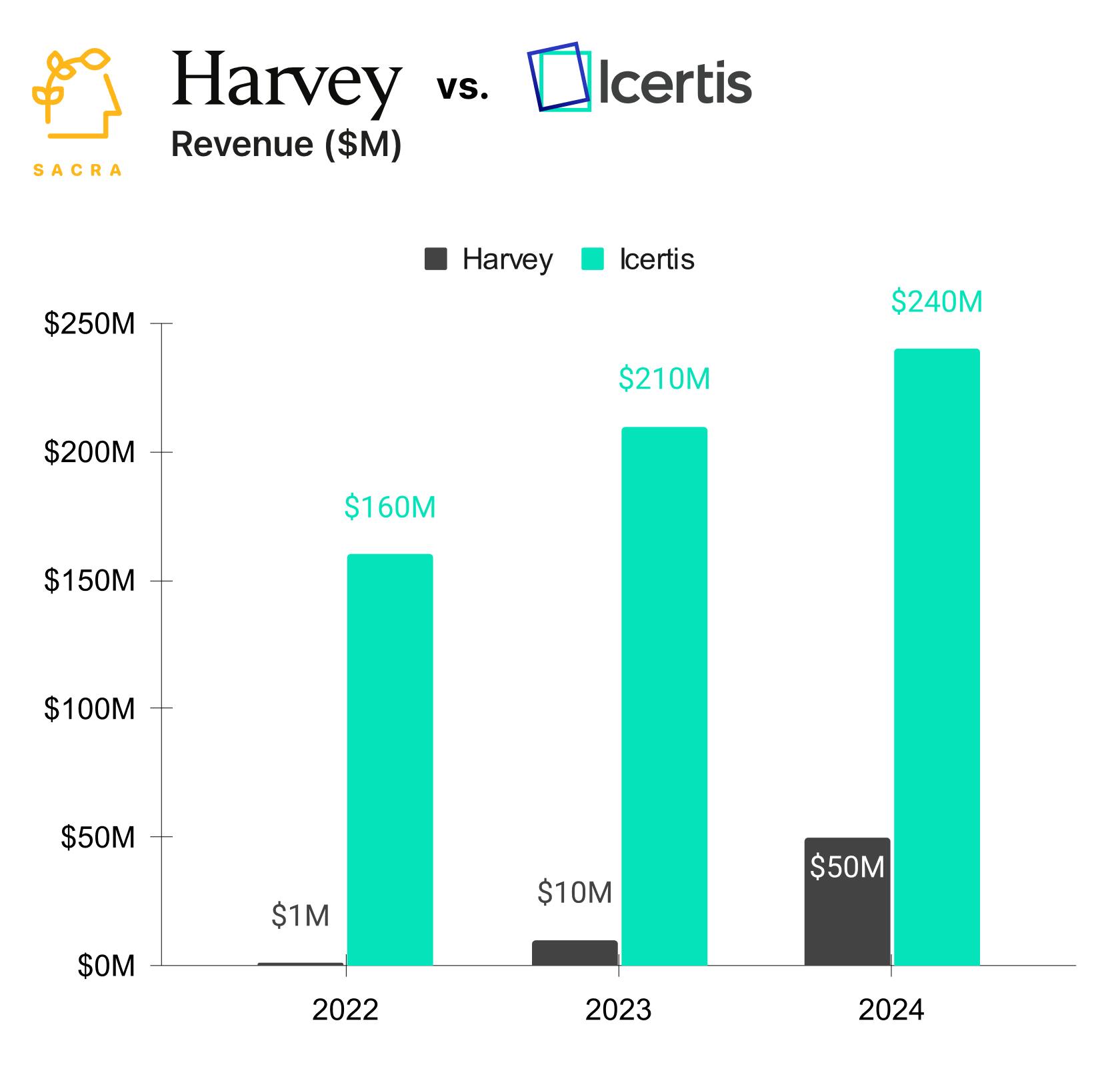

- While Harvey initially positioned itself as an AI copilot for biglaw firms with the highest paid lawyers that do the most sophisticated legal work, its logos have shifted towards corporate in-house counsel and legal services firms like PricewaterhouseCoopers (PWC) (tax compliance) and Adecco Group (outsourced legal support). With $200M raised in 2 years, Harvey’s full-stack approach has it competing across a number of categories, including custom legal LLMs against increasingly capable, frontier reasoning models like o1 from OpenAI ($5B ARR in 2024, up 248% YoY), AI research copilot against legal research incumbents Wexis (~$8B in revenue in 2024) and AI-powered document management & automation against contract lifecycle management companies like Icertis ($250M ARR in February, up 9% YoY).

For more, check out this other research from our platform:

- Harvey (dataset)

- Hebbia (dataset)

- Glean (dataset)

- Writer (dataset)

- Zapier (dataset)

- Airtable (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Will Bryk, CEO of Exa, on building search for AI agents

- Retool: the $82M ARR internal app builder

- Anthropic vs. OpenAI

- Zapier: The $7B Netflix of Productivity [2021]

- Former Zapier partner on Zapier's commoditization of SaaS [2021]

- Airtable: The $7.7B Roblox of the Enterprise [2021]