Guideline: the $80M/year 401(k)

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Where platforms like Gusto, Rippling and Deel are leveraging their strategic ownership of the payroll spigot to come after neobanks, 401(k) providers like Guideline are positioned to do the same for retirement savings. For more, check out our interview with Kevin Busque and Steven Wu, CEO and CFO of Guideline, as well as our company reports on Guideline (dataset) and Human Interest (dataset).

- In 2012, Gusto ($260M revenue in 2021) launched, taking the paper-based payroll process of incumbents ADP and Paychex, and re-inventing it with an online portal through which both employers and employees could login to manage payroll and paychecks. Gusto defined what became the insurgent B2B strategy of its time—disrupting enterprise software with terrible UX—by building consumer-grade experiences that “surprise and delight” SMB buyers-cum-end-users. (link)

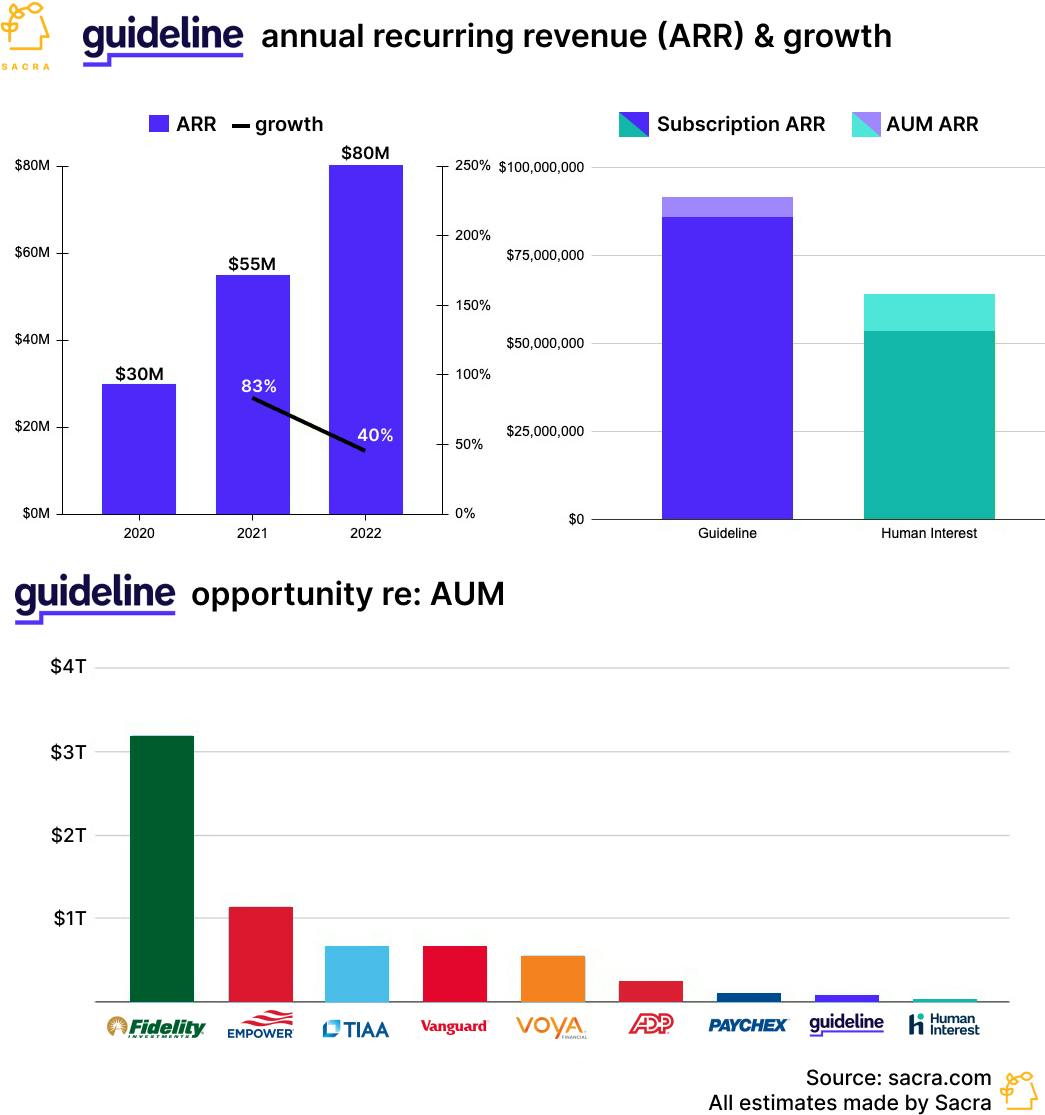

- In opposition to incumbent 401(k) providers like Fidelity/Vanguard charged savers 1%-2% of assets under management (AUM), TaskRabbit co-founder Kevin Busque founded Guideline ($80M ARR) in 2015—as an employee-centric 401(k) benefits companies could use to attract talent. Guideline’s initial product-market fit came from selling into tech companies like Plaid ($250M revenue in 2021), businesses that fight to hire and retain high earners aware of the disproportionately large fee structure incumbent 401(k) providers charged under the AUM model. (link)

- Guideline’s business model shifted the burden of paying for benefits from the individual to the company—with a flat monthly SaaS fee, a $8 per/mo charge per employee, and a nominal 0.08% take rate on AUM. Like payroll, switching costs are high in 401k, making those products extremely sticky as SaaS businesses with strong expansion dynamics via seat expansion rather than growth in AUM, see, e.g., Justworks’ 117% net revenue retention (NRR). (link)

- Payroll products—leveraging “delightful UX” into becoming systems of record and workflow tools with weekly active usage—have platform-ized as app stores for HR, benefits & finance, becoming the primary distribution channel for products like Guideline and taking a cut of sales akin to Apple’s 30% tax on transactions. In 401k and many payroll adjacent services which deal in employee funds, first-party integration and a direct relationship with the payroll provider ensures clean data for both read and write to payroll—which makes the difference in the end-user experience. (link)

- To grow ARPU and attach rate, payroll platforms are building native apps to compete against apps in their own ecosystems, focusing first on high-margin software use cases in close proximity to payroll data and existing employee engagement—for Gusto, see Performance (Lattice), Expense Management (Bill.com), and Recruiting (Greenhouse). While multi-product has become key to driving SaaS growth at scale (see Box, where 64% of revenue comes from multi-product customers), a pattern exemplified by Rippling and its notion of building a “compound startup,” it has software companies eating up adjacent use cases and making frenemies out of partners. (link)

- As Gusto, Justworks ($982M revenue in 2021), Rippling ($135M revenue) and Deel compete over SMB payroll, they’re also expanding into consumer financial services with wallet products, becoming neobanks by virtue of their strategic ownership over payroll as the spigot from which bank accounts get funded. Similarly, Guideline gets in front of Wealthfront and Betterment’s ($100M revenue in 2021) IRA products by owning 401(k)s and the point at which they roll over into IRAs—and that gives it green field into expanding into retirement-adjacent consumer finance products like HSAs and SEPs.

- Zooming out, Guideline’s opportunity from here is large—all U.S. 401(k) plans held $7.3 trillion in assets, and Guideline has roughly $8.5B on the platform, or about 0.1% of that 401(k) total. As the SMB payroll wave goes upmarket and becomes enterprise grade as an ecosystem, it threatens to unbundle ADP and its $17B in revenue and $90B in market cap. (link)

For more, check out our interview with Kevin Busque and Steven Wu, CEO and CFO of Guideline, and this other research from our platform:

- Human Interest (dataset)

- Guideline (dataset)

- Gusto (dataset)

- Justworks (dataset)

- Rippling (dataset)

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- Jeremy Zhang, CEO of Finch, on building a universal API for employment systems

- Kurtis Lin, CEO of Pinwheel, on the rebundling of payroll into every app

- Dan Westgarth, COO of Deel, on the global payroll opportunity