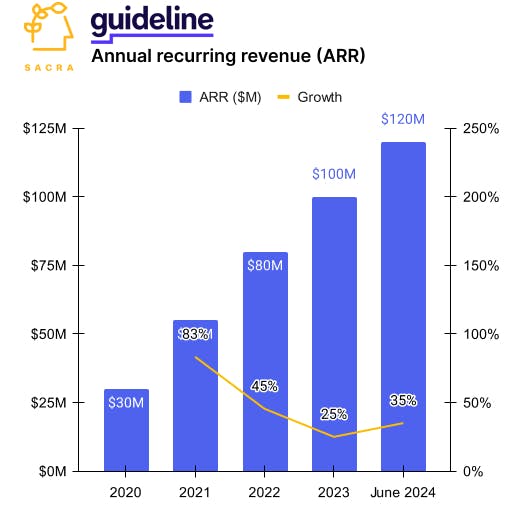

Guideline at $120M ARR growing 35%

Jan-Erik Asplund

Jan-Erik Asplund

TL;DR: Guideline hit $120M of annual recurring revenue (ARR) in June, up 35% year-over-year, re-accelerating and hitting cash flow break-even amid the rise of new legislation and state mandates designed to get more Americans into retirement savings programs. For more, check out our interview with Kevin Busque and Steven Wu, the CEO and CFO of Guideline.

Founded in 2015 by TaskRabbit co-founder Kevin Busque, Guideline found product-market fit with a digital 401(k) paid for by employers, not employees.

They targeted tech startups like Plaid that were fighting to hire and retain high earners who were aware of the high, AUM-based fees that legacy 401(k) providers were charging.

Recently, we caught up with Kevin Busque and Steven Wu, the CEO and CFO of Guideline, to talk about how the digital 401(k) space is evolving.

Our key takeaways:

- Guideline is at $120M annual recurring revenue (ARR), up 35% year-over-year, with AUM growing 55% over the same period from $9B to roughly $14B. Compare to Human Interest at roughly $85M ARR at the end of 2023, up 80% from $47M ARR a year prior, and Fidelity (NYSE: FNF) at $28.2B of revenue in 2023, up 12% year-over-year, with $12.6T of AUM, up 23% year-over-year, and serving 24,000 employers and 43.2M individual participants.

- Where most digital 401(k) providers are marketing wrappers on top of legacy 401(k) record-keeper Ascensus, Guideline’s custom ledger allowed them to launch a mobile web app experience—which most 401(k) plans don’t have—that now sees 40% of all new sign-ups to their product. While relying on Ascensus (founded 1980) for recordkeeping enables digital 401(k) companies to get started faster, it limits their ability to control money movement and differentiate on the product experience because of the lack of modern APIs.

- SECURE 2.0 came into effect in 2024, lessening the administrative burden on new 401(k) programs for smaller companies—Guideline’s new “Starter K” product rides the tailwind of this as well as new state mandates requiring employers to have retirement programs. Because new 401(k) programs under this legislation have less required administrative overhead, Guideline can lower its fees to make Starter K more attractive to SMBs while keeping the same gross margin due to lower customer success costs.

- Payroll products—leveraging “delightful UX” into becoming systems of record and workflow tools with weekly active usage—have platform-ized as app stores for HR, benefits & finance, becoming the primary distribution channel for products like Guideline and taking a cut of sales akin to Apple’s 30% tax on transactions. In 401(k) and many payroll adjacent services which deal in employee funds, first-party integration and a direct relationship with the payroll provider ensures clean data for both read and write to payroll—which makes the difference in the end-user experience.

- Guideline is now becoming a non-bank trustee, giving it green field to expand into new products like HSAs and opening the door to building a “Mint for retirement savings”—a single view and management dashboard across all of an individual’s long-term savings products. Zooming out, Guideline’s opportunity from here is large—all U.S. 401(k) plans hold $7.4 trillion in assets as of the end of 2023, and Guideline has roughly $13B on the platform, or about 0.1% of that 401(k) total.

For more, check out this other research from our platform:

- Kevin Busque and Steven Wu, CEO and CFO of Guideline, on hitting $120M ARR

- Guideline (dataset)

- Human Interest (dataset)

- Gusto (dataset)

- Justworks (dataset)

- Rippling (dataset)

- Contractor Payroll: The $1.4T Market to Build the Cash App for the Global Labor Market

- Jeremy Zhang, CEO of Finch, on building a universal API for employment systems

- Kurtis Lin, CEO of Pinwheel, on the rebundling of payroll into every app

- Dan Westgarth, COO of Deel, on the global payroll opportunity