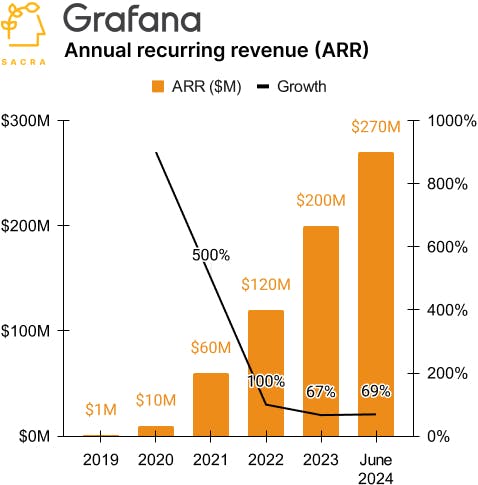

Grafana at $270M/year growing 69%

TL;DR: Sacra estimates that Grafana hit $270M annual recurring revenue (ARR) in June 2024, up 69% year-over-year, monetizing just 1% of its 20M users. As the leading open-source alternative to Datadog (NASDAQ: DDOG), Grafana is going after an observability TAM that is now $50B+ and growing.

Torkel Ödegaard launched Grafana in 2013 as a delightfully-designed, simple dashboard for time-series data, designed to make it easier for devops teams to visualize the performance of their web applications.

The original v1 of Grafana took the form of a pull request to add support for the Graphite time-series database to the popular visualization tool Kibana. When that PR was rejected, Ödegaard decided to build it as his own open-source product, Grafana.

Today, Grafana is one of the fastest-growing devops companies by revenue, one of the biggest open source projects in the world by contributions and users—and yet it only monetizes 1% of its total user base.

Key points from our update:

- Sacra estimates that Grafana is at $270M of annual recurring revenue (ARR), up 69% year-over-year, currently raising at a $5.5B valuation for a 20x forward revenue multiple. Compare to Datadog (NASDAQ: DDOG) at $2.45B fo annual recurring revenue, up 27% year-over-year, currently valued at $39B for a 16x forward revenue multiple, and to Elastic (NYSE: ESTC) at $1.3B ARR, up 16%, for a 8x multiple on their $11B market cap.

- Early on, Ödegaard focused on making Grafana the default visualization for Prometheus databases, recognizing that their growth would be tightly coupled—at the first Prometheus conference 5 months after their first release, 30% of the audience was using Grafana. Over time, Grafana differentiated through its "big tent" approach of prioritizing interoperability with a wide ecosystem of over 100 different databases, unlike competitors like Kibana which were tied to specific tools like Elasticsearch.

- Grafana's open source model and "big tent" interoperability have enabled it to efficiently acquire customers and expand their $50B+ observability TAM as data volumes and sources proliferate. Grafana acquires users for free via the open source community at near-zero marginal cost—Grafana currently has 20M users, 61K Github stars, and the third-most contributors of any OSS project, just behind Next.js—and monetizes them over time through enterprise support and managed services, resulting in 80-90% gross margins.

For more, check out this other research from our platform:

- Cribl (dataset)

- Fivetran (dataset)

- Databricks (dataset)

- Fivetran: the $200M/yr Zapier of ETL

- Salesforce, Amplitude, and the fat data layer in B2B SaaS

- Colin Nederkoorn, founder & CEO at Customer.io, on the CDP layer in messaging

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel

- Conor McCarter, co-founder of Prequel, on Fivetran's existential risk

- Julia Schottenstein, Product Manager at dbt Labs, on the business model of open source

- Sean Lynch, co-founder of Census, on reverse ETL's role in the modern data stack