Freed at $19M ARR

Jan-Erik Asplund

Jan-Erik Asplund

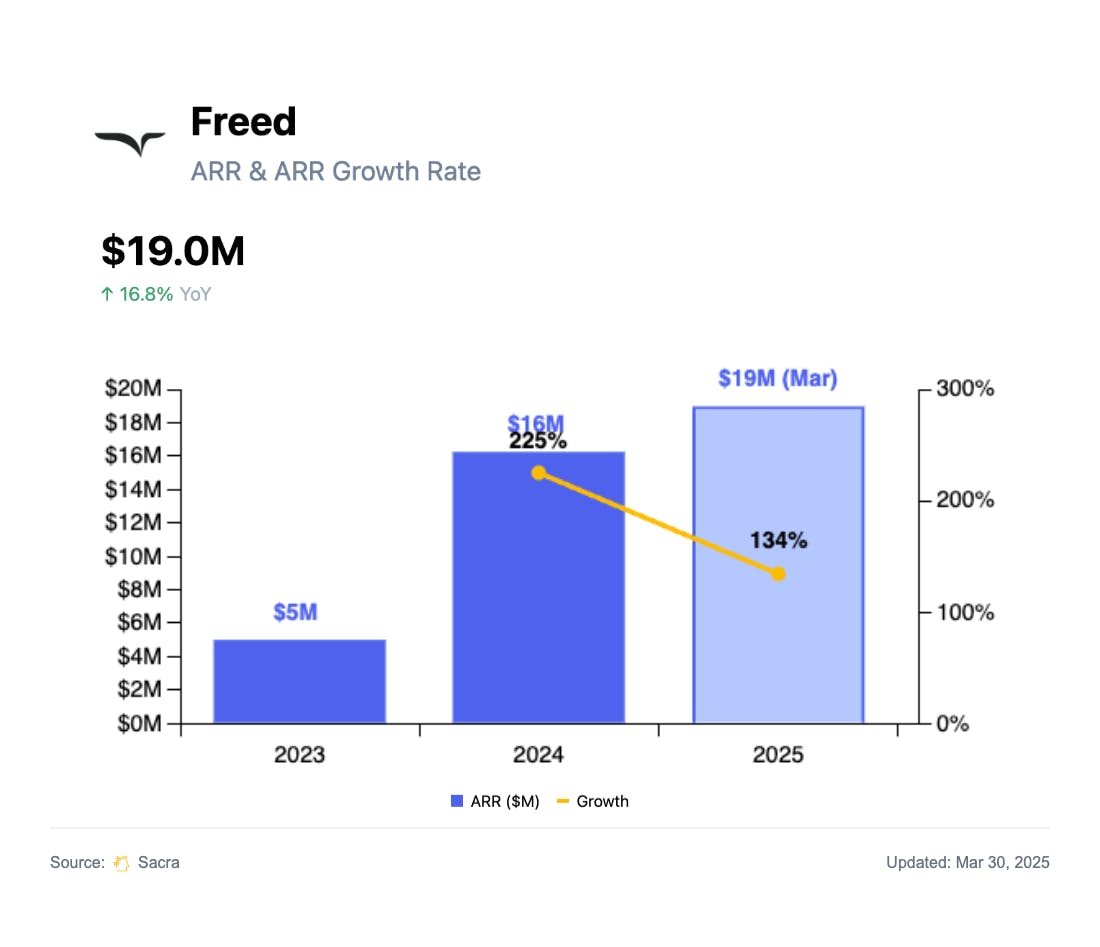

TL;DR: AI medical scribes are rapidly eating up adjacent workflows—moving from ambient note-capture into pre-charting, coding, and ultimately payments. Sacra estimates Freed hit $19M in ARR in March 2025, up 134% YoY from $8M ARR in March 2024. For more, check out our full report and dataset on Freed.

Freed is an AI ambient voice scribe that records clinician-patient encounters, converts them into structured, EHR-ready notes, and sells into individual providers through a $99/month self-serve subscription.

We first covered Freed at $13M ARR in August 2024, growing 992% year-over-year from $1.2M in August 2023, and serving 12,000 clinicians. In October 2024, we interviewed Brendan Keeler, interoperability lead at HTD Health, on different go-to-market strategies for AI medical scribes like Freed.

Here’s our Freed update with key points via Sacra AI:

- After getting from $1M to $10M in ARR in 9 months from August 2023 to May 2024, Sacra estimates Freed has gone from $10M to $19M in another 10 months, adding 5,000 clinicians since last August to reach 17,000 total clinicians and announcing a $30M Series A in March led by Sequoia to bring their total funding to $34M.

- Unlike AI medical scribes Abridge ($458M raised, Lightspeed), Ambience ($100M raised, Kleiner Perkins), Suki ($168M raised, Venrock) and Augmedix ($118M raised, acquired by Commure)—which have raised a combined $700M+ to chase enterprise adoption via hospitals and large healthcare groups—Freed has taken a bottom-up approach focused on individual clinicians and small practices, combining a $99/month self-serve entry point with optional sales-assisted upgrades and EHR integrations to capture the 47% of U.S. small practices with less than 10 doctors.

- With its note-taking wedge, Freed is betting that by starting with the lightest-weight, least embedded workflow and building a product clinicians love, it can drive attach into more integrated, higher-value workflows like pre-charting (launched 2025), coding (launched 2025), payments—and the $250B+ U.S. revenue-cycle market.

For more, check out this other research from our platform:

- Freed (dataset)

- Freed at $13M ARR

- Gongification of SaaS

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Virta Health at $175M revenue

- Commure at $105M ARR

- Noom at $1B ARR

- BillionToOne at $153M/yr

- Maven Clinic at $268M ARR

- Virta Health (dataset)

- Noom (dataset)

- Ro and the telehealth capital cycle

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Andy Hoang, CEO of Aviron, on the unit economics of connected fitness

- Strava: the $265M/year Whole Foods of social networks

- Aviron and the Xbox of connected fitness

- Oura (dataset)