Freed at $13M ARR

Jan-Erik Asplund

Jan-Erik Asplund

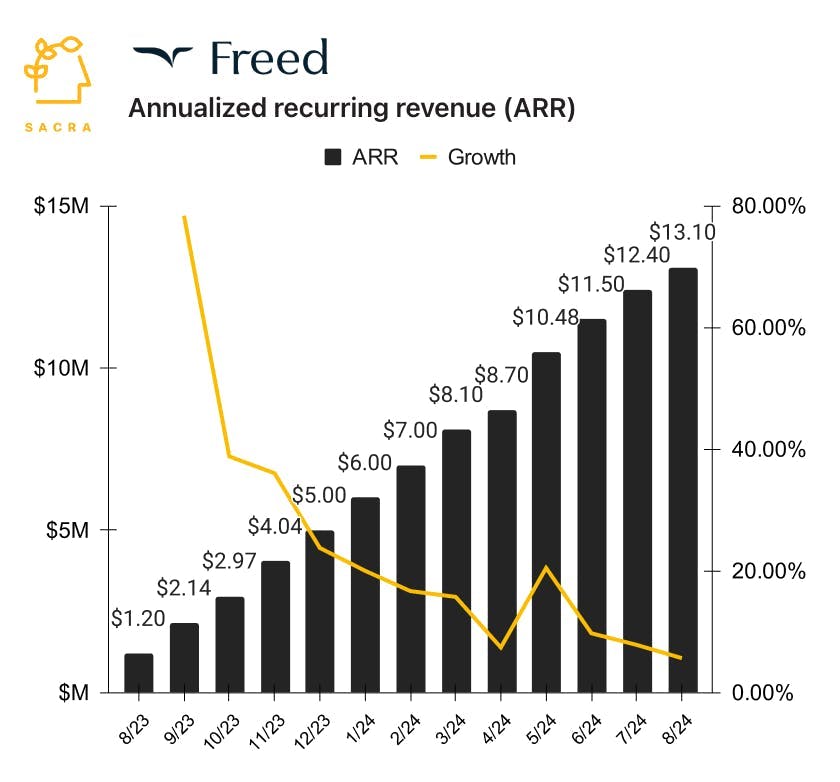

TL;DR: Sacra estimates that AI medical scribe Freed hit $13M in annualized recurring revenue (ARR) in August 2024, growing 992% YoY by using speech-to-text and LLMs to save doctors 3 hours per day on data entry into EHRs. Unlike AI scribe incumbents Abridge and Nuance, the capital efficient Freed is using bottom-up PLG to get traction with individual doctors. For more, check out our full report and dataset on Freed.

Key points via Sacra AI:

- Founded in 2023, Freed ($13M ARR, Sequoia) uses speech-to-text and large language models (LLMs) to transcribe patient conversations, saving doctors 3 hours per day on data entry into electronic health records (EHRs) at a $99/month price point (vs. the $300-600/month of Ambience, Suki and Nuance) that’s affordable for solo and small practices. AI has shown strong product-market fit on text-to-speech (saving money on transcription) and structured data entry (saving time), fitting perfectly with outpatient healthcare—the average doctor sees 15 patients per day for 20 minutes each, creating roughly 5 hours of conversation and 3 hours of associated data entry as a byproduct.

- Sacra estimates that Freed hit $13M in annualized recurring revenue at the end of August 2024, growing 992% YoY from $1M while going from 1,000 to 12,000 clinicians over the same period with roughly $1K ACV. Compare to the early AI-enabled scribe company Augmedix (2013, NASDAQ: AUGX) at $45M of revenue in 2023, up 45% YoY, recently acquired by healthcare automation platform Commure at a $139M valuation for a 3x revenue multiple.

- Attacking the problem bottom-up, alongside Heidi Health (Blackbird, $15M raised), Freed crossed $10M ARR in fewer than 12 months with only 4 salespeople using a product-led growth (PLG), self-serve centric motion into small practices made up of less than 10 doctors (representing 47% of U.S clinicians) where the end-user is also the buyer and decision-maker. While healthcare regulations like HIPAA force even mid-sized practices to route software purchases through IT and compliance teams—turning even $10K software deals into enterprise sales—Freed's and Heidi Health's PLG motions enable them to build distribution without depending on EHRs like Epic (38% market share) which can extract an onerous tribute from top-down AI scribes like Abridge (Lightspeed, $212.5M) and Nuance (Microsoft, $19.7B).

For more, check out this other research from our platform:

- Freed (dataset)

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Ro and the telehealth capital cycle

- Johannes Schildt & Claes Ruth, CEO and CFO of Kry, on the AI future of telehealth

- Marc Atiyeh, CEO of Pawp, on building telehealth for pets

- Liana Guzmán, CEO of Folx, on the $400B market for LGBTQIA healthcare

- Noom (dataset)

- Hone Health (dataset)

- Kry (dataset)

- Lifen (dataset)

- Ro (dataset)

- Quartet Health