Figure vs Apptronik vs Agility Robotics

Jan-Erik Asplund

Jan-Erik Asplund

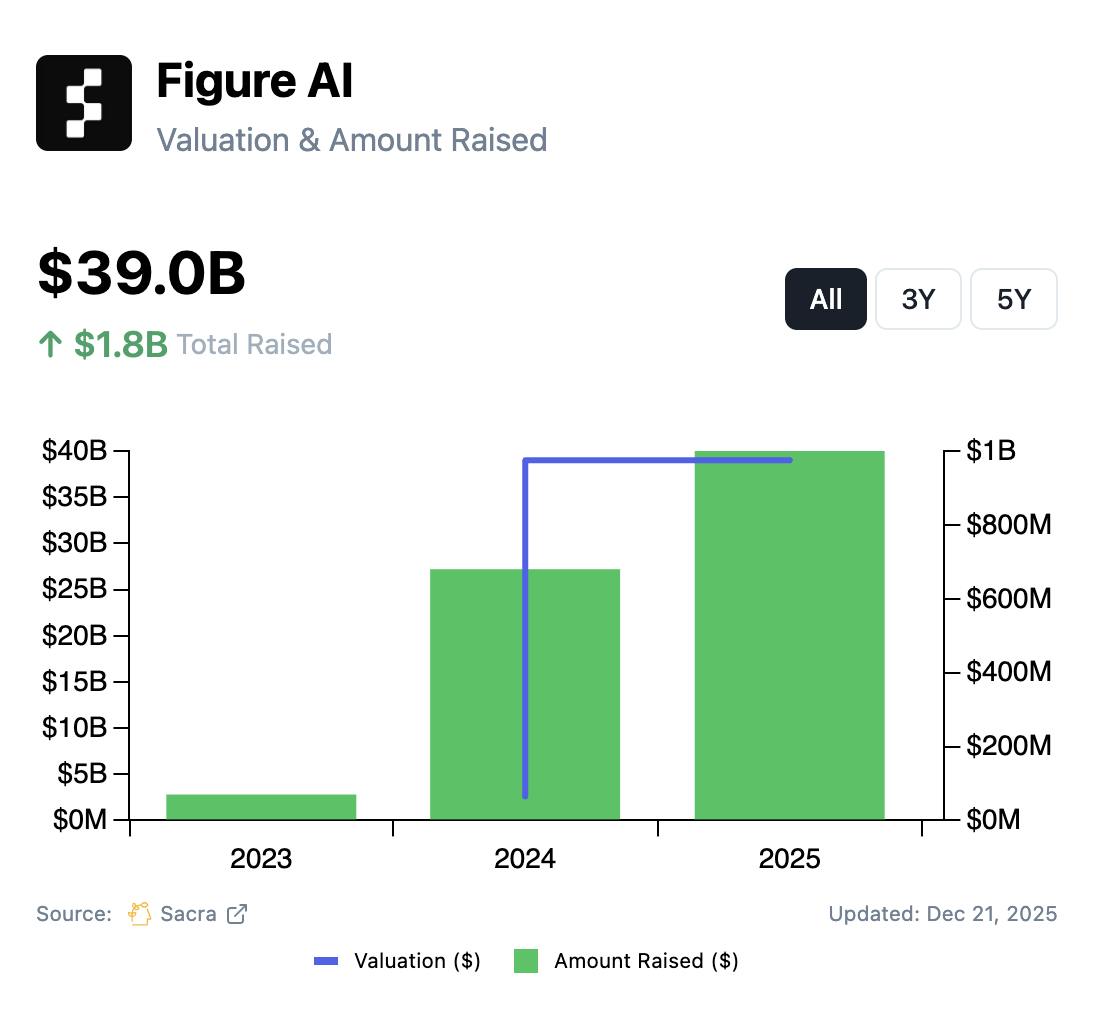

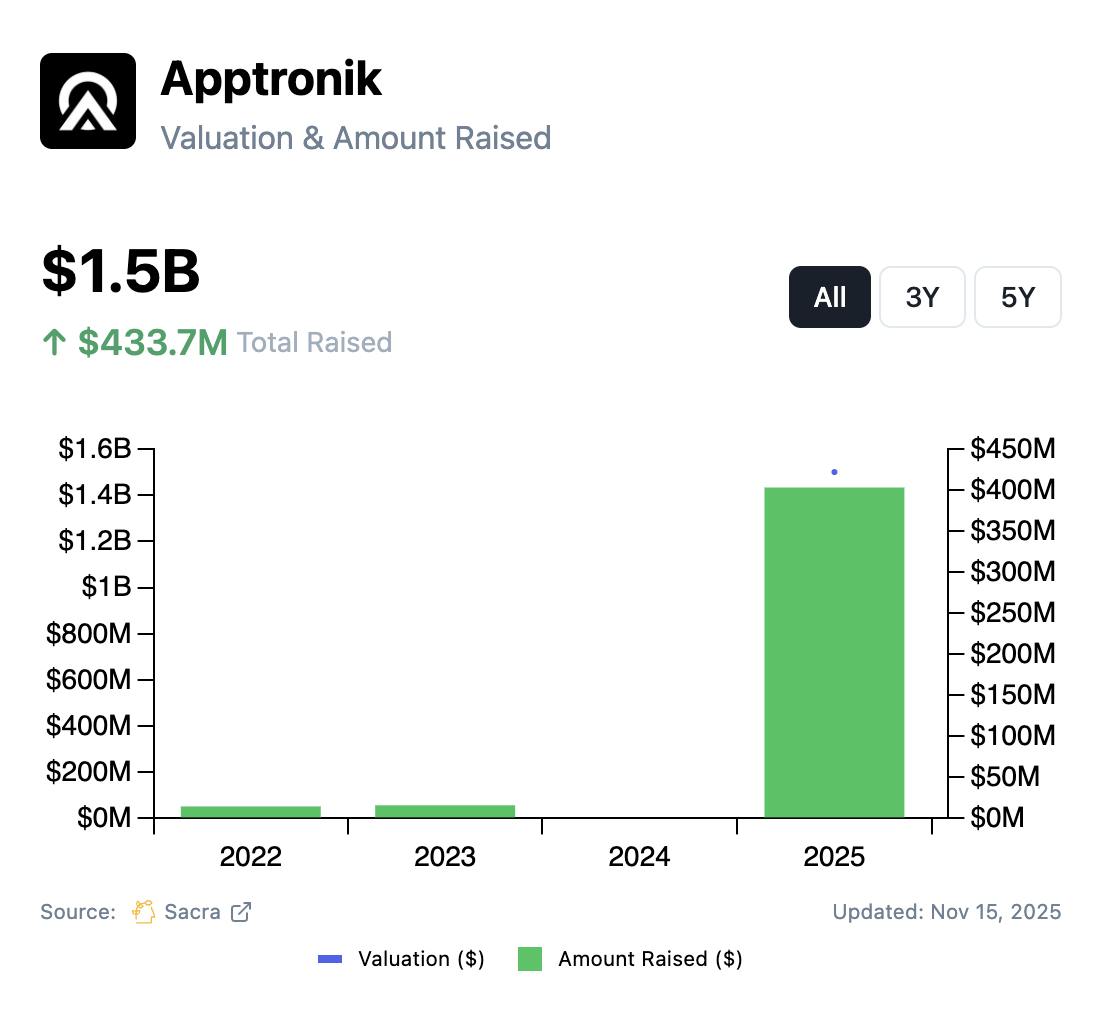

TL;DR: As step-function improvements in hardware (motors, sensors, microprocessors) converge with transformer-based AI and a projected 2.1M U.S. manufacturing worker shortfall by 2030, humanoid robotics startups like Figure AI ($1.75B raised, $39B valuation), Apptronik ($767M raised, $5B valuation), and Agility Robotics ($641M raised, $2.12B valuation) are racing to deploy robots that slot into existing factory infrastructure without costly retrofits. For more, check out our full reports on Figure AI, Apptronik and Agility Robotics, as well as our interview with Sankaet Pathak, CEO of Foundation.

Key points via Sacra AI:

- Circa 2022-2023, step-function increases in the quality and reliability of hardware—sensors, actuators, microprocessors, cameras—driven by automotive and consumer electronics at scale, and the emergence of transformer-based AI, enabled end-to-end policies for robots operating in unstructured environments, creating the inflection point for humanoid robots with a bipedal, two-armed form factor uniquely able to slot into existing factories & warehouses. Only companies with Amazon-scale resources (750K+ robots across its fulfillment network) can afford to spend 12-18 months re-architecting facilities for specialized robots vs. humanoids which can be dropped in alongside humans to replace workers performing the most dangerous, high-attrition tasks (~100% annual turnover in some warehouse roles) to help address the projected 2.1M U.S. manufacturing worker shortfall by 2030.

- The primary emerging business model of robotics-as-a-service (RaaS) allows customers treat humanoid robots as operational expense—budgeted alongside labor rather than as multi-hundred-thousand-dollar capital purchases—with unit pricing targets of sub-$20K designed to compete with fully-loaded annual labor costs (~$50-60K/year for warehouse workers), with the added advantage that robots can run 24/7 versus 8-hour human shifts. Human teleoperation has emerged as a critical bridge strategy where operators intervene when robots encounter novel situations, serving a dual purpose: (1) ensuring robots provide immediate value rather than disrupting operations when models mispredict, and (2) collecting labeled intervention data that identifies failure cases for retraining, driving the data flywheel.

- B2B-focused startups like Figure AI, Agility Robotics and Google-partnered Apptronik are taking a utilitarian approach to specific industrial tasks like line assembly & material handling, while B2C-focused 1X Technologies ($125M+ raised) is betting on design-centric, household robots with a focus on form factor and human interaction, and component suppliers like Anvil Robotics are selling robotic arms, legs, and actuators into the ecosystem. Tesla, with 50-100K Optimus robots targeted for 2026 at sub-$20K, represents the largest incumbent threat with massive manufacturing scale, AI talent from across Elon's empire, and a ready-made customer base it can turn on across Tesla factories, SpaceX facilities, and Boring Company operations.

- Despite high valuations, revenue across the humanoid robotics space remains minimal, with companies primarily promoting LOIs (letters of intent) and pilot deployments rather than recurring revenue, all still at the starting gates of what has become the key competition: building the data flywheel from real-world training environments. Skild AI ($1.8B raised, $14B valuation) is attempting to shortcut the data problem by building an omni-bodied "robot brain" trained on trillions of synthetic data points and billions of internet videos of human manipulation, while AI video companies like Runway ($90M ARR in June 2025) and Luma AI are betting that video can be used to scale robotic AI without extensive training time.

- Most humanoid robotics companies are entering through narrow B2B use cases like picking parts and lifting & carrying bumpers on automotive assembly lines, but the long-term thesis is dual-use expansion, with B2B-first players eventually moving into consumer markets & B2C-first players expanding into commercial applications, including retail, hospitality, healthcare, and defense (Foundation). China represents both a competitive threat (75% of humanoid companies based in Asia, control of 63% of key components enabling robots built 65% cheaper than non-Chinese supply chains, 1,000+ robots shipped by some Chinese companies as of 2024) and a limited near-term concern for U.S. companies given likely protectionist regulations against importing Chinese-made humanoids into sensitive domestic industries and defense applications.

For more, check out this other research from our platform:

- Sankaet Pathak, CEO of Foundation, on why humanoids win in robotics

- Scott Sanders, chief growth officer at Forterra, on the defense tech startup playbook

- Anduril, SpaceX, and the American dynamism GTM playbook

- Anduril: the $342M/year Nintendo of American dynamism

- Shield AI (dataset)

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Anduril at $1B/yr

- Anduril (dataset)

- The biggest mistake defense startups make