eToro vs Robinhood

Jan-Erik Asplund

Jan-Erik Asplund

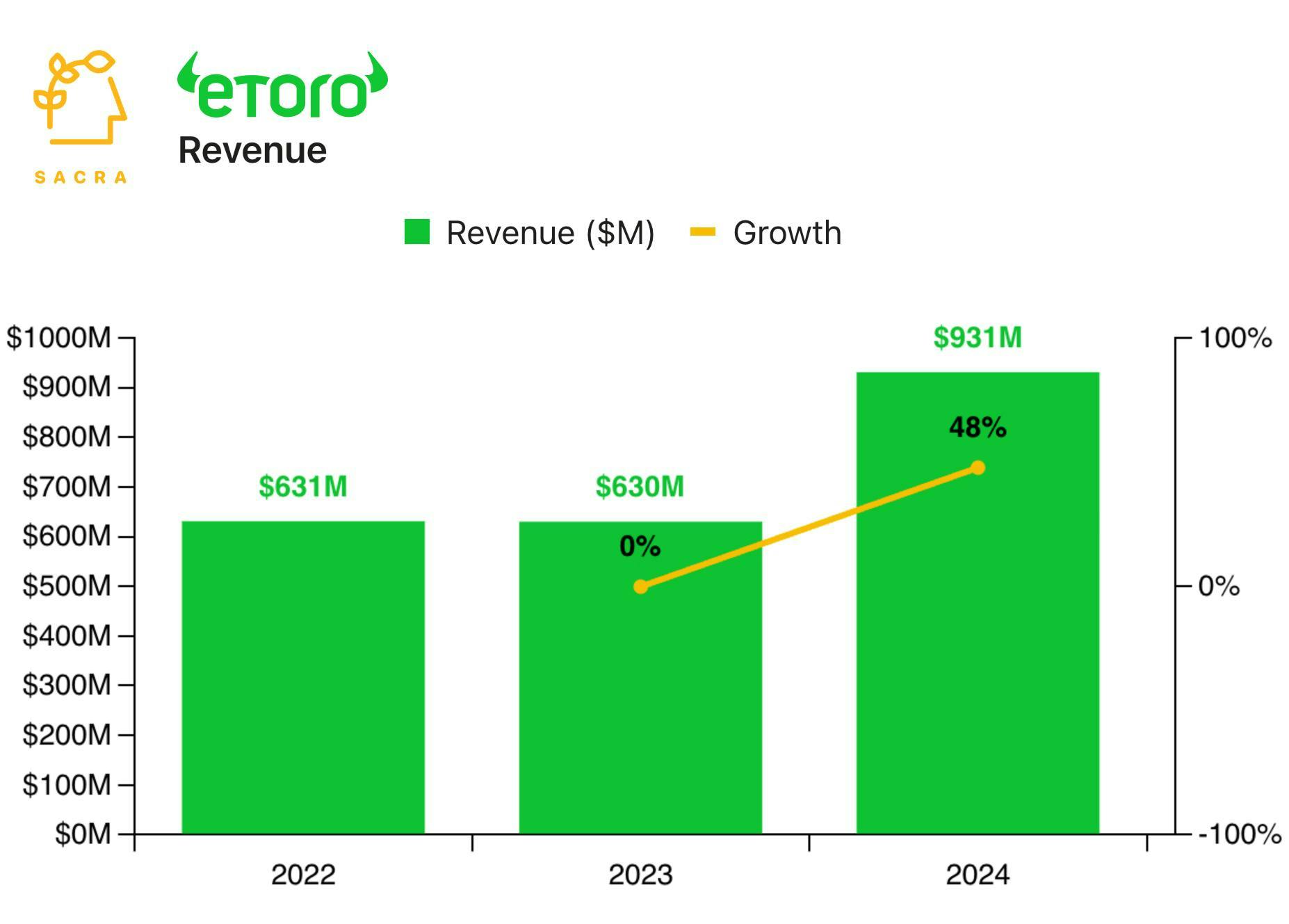

TL;DR: Founded in Tel Aviv in 2007, eToro pioneered the social investing model with a Twitter-like feed for investing ideas and the ability to copy others traders’ trades. As the company aims for a Q2 IPO, eToro reached $931M revenue in 2024, up 46% YoY, after a flat year in 2023. For more, check out our full report and dataset on eToro.

Founded in 2007 in Tel Aviv, eToro pioneered the social investing model later taken up by Stocktwits (2009) and Public (2019). Earlier this year, eToro filed its F-1, targeting a Q2 2025 IPO at a $5B valuation.

Key points via Sacra AI:

- Launched as a visual forex trading platform making it easier to trade currency pairs, eToro broke through in 2010 with its CopyTrader feature—allowing users to see other traders’ moves across multiple asset classes in a Twitter-like feed and automatically copy their trades. With payment for order flow (PFOF) banned in much of the EU, eToro primarily monetizes through spread fees (87% of transaction revenue)—charging up to 1% on transactions—supplemented by currency conversion charges (0.25-3%), and growing interest income on deposits ($50M in Q4 2024, 20% of total revenue).

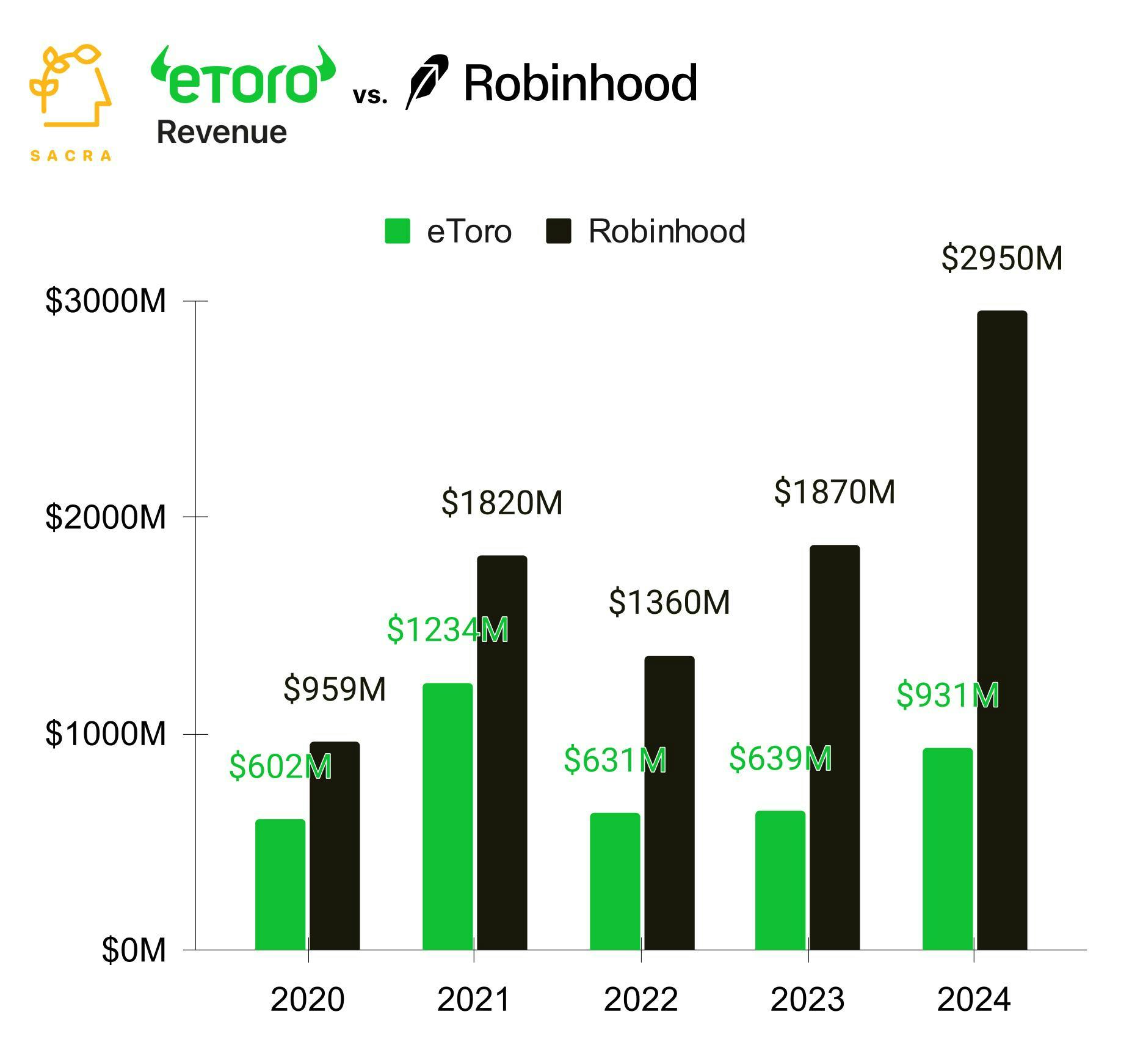

- After a flat 2023, eToro rode the crypto bull run to 46% YoY growth to $931M in revenue for 2024, with their F-1 showing a revenue mix led by traditional equities trading (35%), followed by crypto trading (21%, up from 9% in 2023), and interest income (20%), driving net income to $192M (up 1,161% YoY) and adjusted EBITDA to $304M (up 159%), with its sights set on IPO’ing at $5B for a 5.4x revenue multiple. Compare to Robinhood (NASDAQ: HOOD), which generated $2.95B in revenue in 2024 (up 58% YoY), valued at $30.6B for a 10.4x revenue multiple and with stronger profitability at $1.41B net income and $1.43B adjusted EBITDA, led by interest income (35% of revenue) and followed by PFOF-fueled options trading (26% of revenue) and crypto trading (21% of revenue).

- While Robinhood is building a Cash App-like US-centric consumer super app for investing, eToro is building a WhatsApp-like global social investing brokerage for the rest of the world—with 70% of its funded accounts in Europe/UK, 16% in Asia Pacific, 10% in Americas, and 4% in Middle East/Africa—and plans to launch options trading for non-US users in 2025, targeting a product segment that drives ~$900M per year for Robinhood. In Europe, where only 11% of households own stocks (vs. 58% in the United States), eToro's long-term upside hinges on being the dominant international platform positioned to capture a disproportionate share of a forecasted 22 million new European brokerage accounts by 2028 as retail investing slowly becomes mainstream—as it is becoming in France (retail investors 2x'ed from 2019 to 2021) and Belgium (50% growth from 2019 to 2021).

For more, check out this other research from our platform:

- eToro (dataset)

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- Kraken at $1.5B up 128% YoY

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Stablecoin diplomacy

- Trevor John, co-founder of Underdog Fantasy, on the business model of fantasy sports

- Fernando Sandoval, co-founder of Kapital, on tropicalizing Brex for LatAm