Earnest Capital: The Bootstrapped SaaS VC Firm with 1.46x TVPI after 2 Years

Jan-Erik Asplund

Jan-Erik Asplund

A bet on bootstrappers

Join our list for access to more of our exclusive private markets research and company coverage.

Success!

Something went wrong...

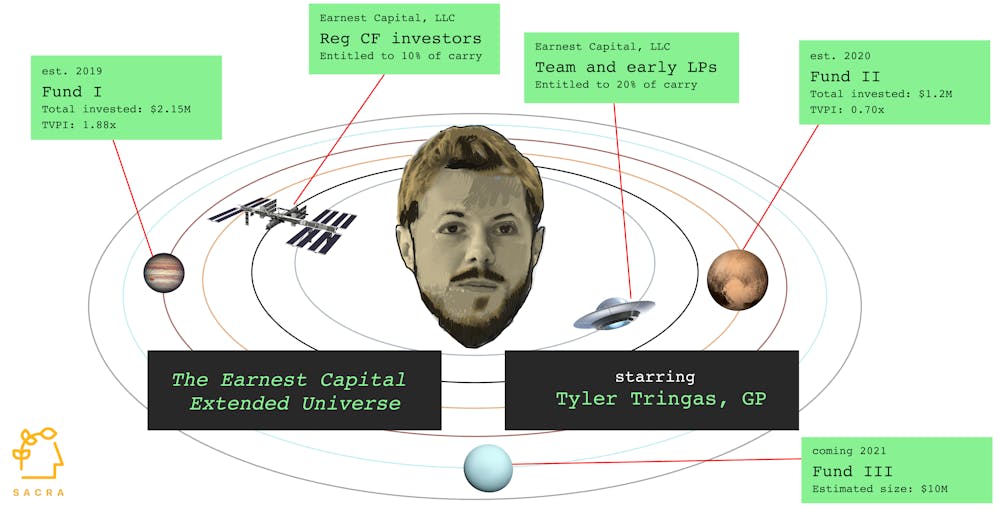

Earnest Capital is a fund that invests not in high-growth startups but in bootstrapped SaaS companies. Founder Tyler Tringas’s vision, after Carlota Perez, is that software’s coming “deployment age” will bring about in explosion in the number of small, niche, profitable SaaS businesses—and that a new kind of funding, not VC, will be required to underwrite this transition.

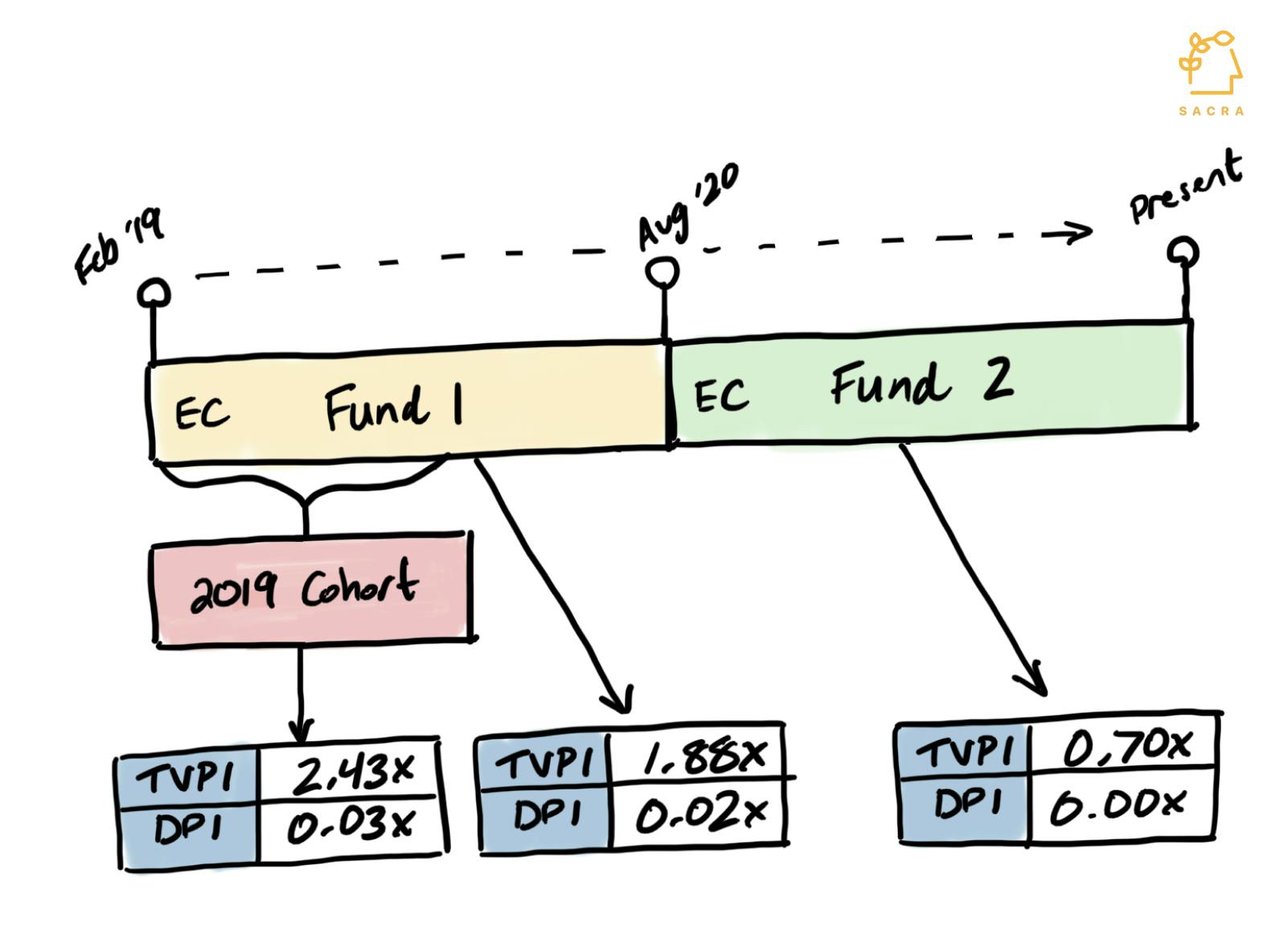

So far, Earnest has hit 2.43x total value to paid-in capital, or TVPI on their 2019 cohort and an overall 1.88x TVPI on Fund 1. That means Earnest's 2019 investments have appreciated and/or paid out enough that they're now worth more than double the principal. While that doesn't reflect actual cash returns (DPI), it's still a sign that Earnest's strategy can work—though questions remain about whether it can work at scale.

Now, with their upcoming Reg CF campaign on Wefunder, Earnest is giving unaccredited, retail investors—more operators, angels and founders than pension funds and endowments—a way to invest directly into Tyler and his vision of the future.

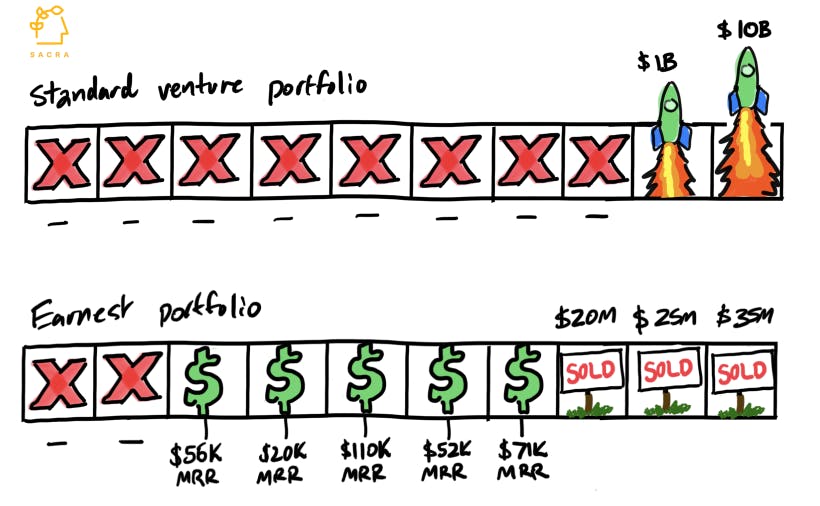

Earnest Capital’s strategy hinges less on picking a few big 100x companies and more on identifying profitable SaaS businesses with the potential for long-term returns.

Crowdfunding GP equity, as done by Earnest and previously by Backstage Capital on Republic, unlocks a completely new set of behaviors and strategies for emerging fund GPs.

While GPs cannot invest money raised via crowdfunding into companies, they can use it to pay salaries and manage their operations, making it a powerful tool for emerging managers and those with smaller funds. GP crowdfunding also gives managers the chance to build a different-looking, potentially more aligned base of LPs—more angels and founders than pension funds and endowments.

Perhaps most importantly, GP crowdfunding allows GPs to bring in investors that want to bet on the GP and their vision. Traditional LPs invest from fund-to-fund, while investors who put money into Earnest Capital on Wefunder are betting on Tyler

The trade-off is that the equity stake that investors on Wefunder and similar platforms own in a GP's carry is limited. In the case of Earnest Capital, getting a reliably S&P beating return on investment requires believing that Earnest will go on to raise not more $3-$10M funds but $50M-$100M funds.

While it's nothing like traditional fund investing, it is a compelling opportunity for bootstrappers, creators, founders, and investors who feel aligned with Tyler and his vision for the future—and who want to support it.

Valuation: Funds raised and DPI are the two crucial levers for Earnest’s Reg CF investors

Earnest Capital IRR Calculator, LP Sensitivity Analysis, and Fund Benchmarks

Members

Unlock NowUnlock this report and others for just $50/month

Earnest Capital IRR Calculator, LP Sensitivity Analysis, and Fund Benchmarks

Members

Unlock NowUnlock this report and others for just $50/month

At the moment, Earnest Capital has set a goal to raise $2M through Wefunder at a “post-money valuation” of $20M. To understand what exactly that means in the context of a firm like Earnest, it’s useful to first go through where the money goes.

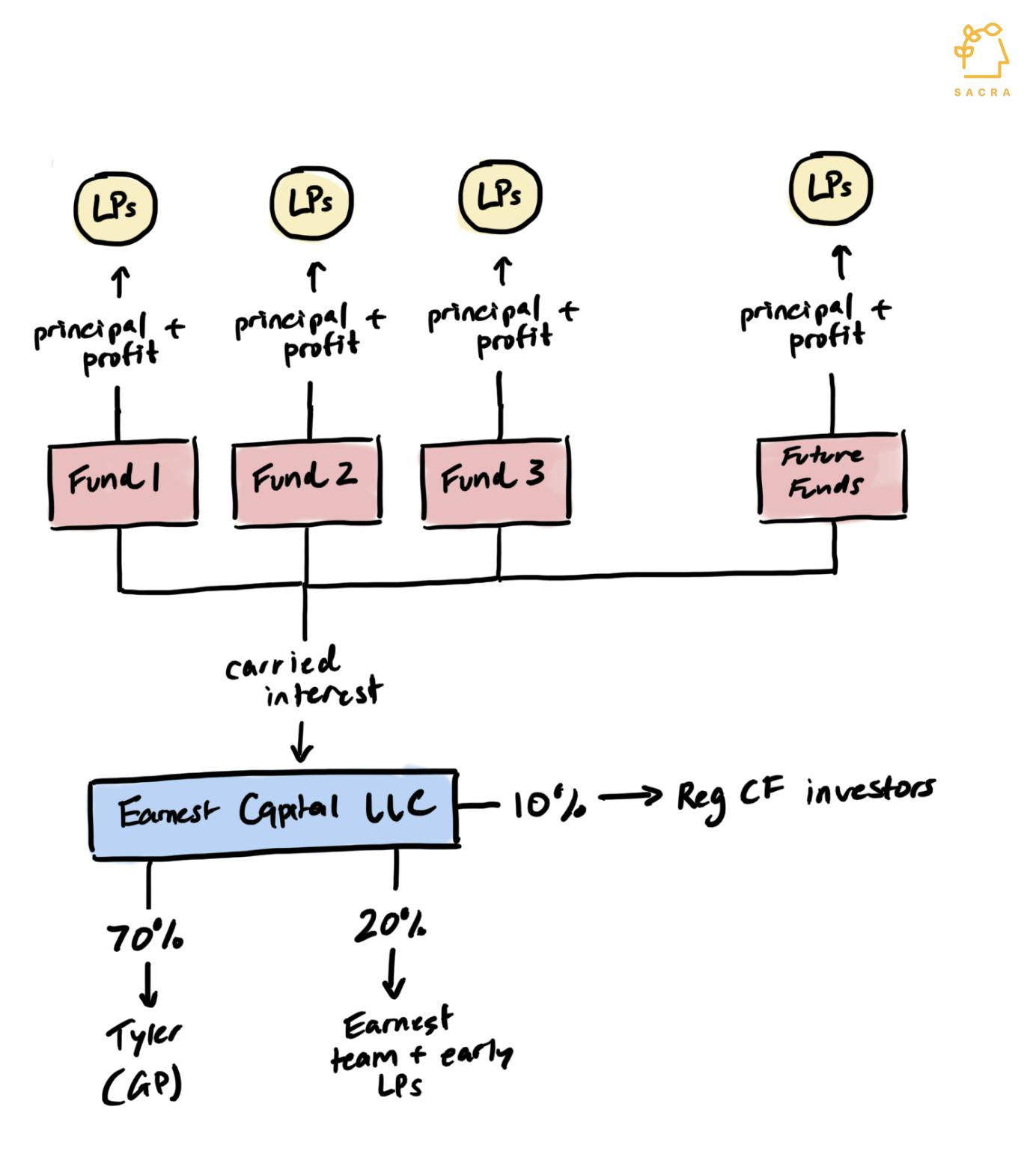

Unlike traditional fund investing, in GP crowdfunding you’re buying a stake in the GP’s carry—not in the profits from an individual fund or funds.

When you invest in a fund through Reg CF, the GP can't (legally) put that money into their portfolio companies via one of their regular funds. Instead, the money goes to things like team salaries and fund operations, and in return, you get an ownership stake in the managing company: in this case, Earnest Capital LLC.

The simple way to think about it is that you're investing in the person, not their fund.

As a result, you’re not going to be getting returns from the companies themselves, like a regular LP in a fund would. What your equity stake in the management company entitles you to is a certain percentage share of the carry—the GP's cut of the profits left over after paying the LPs 1x their investment back.

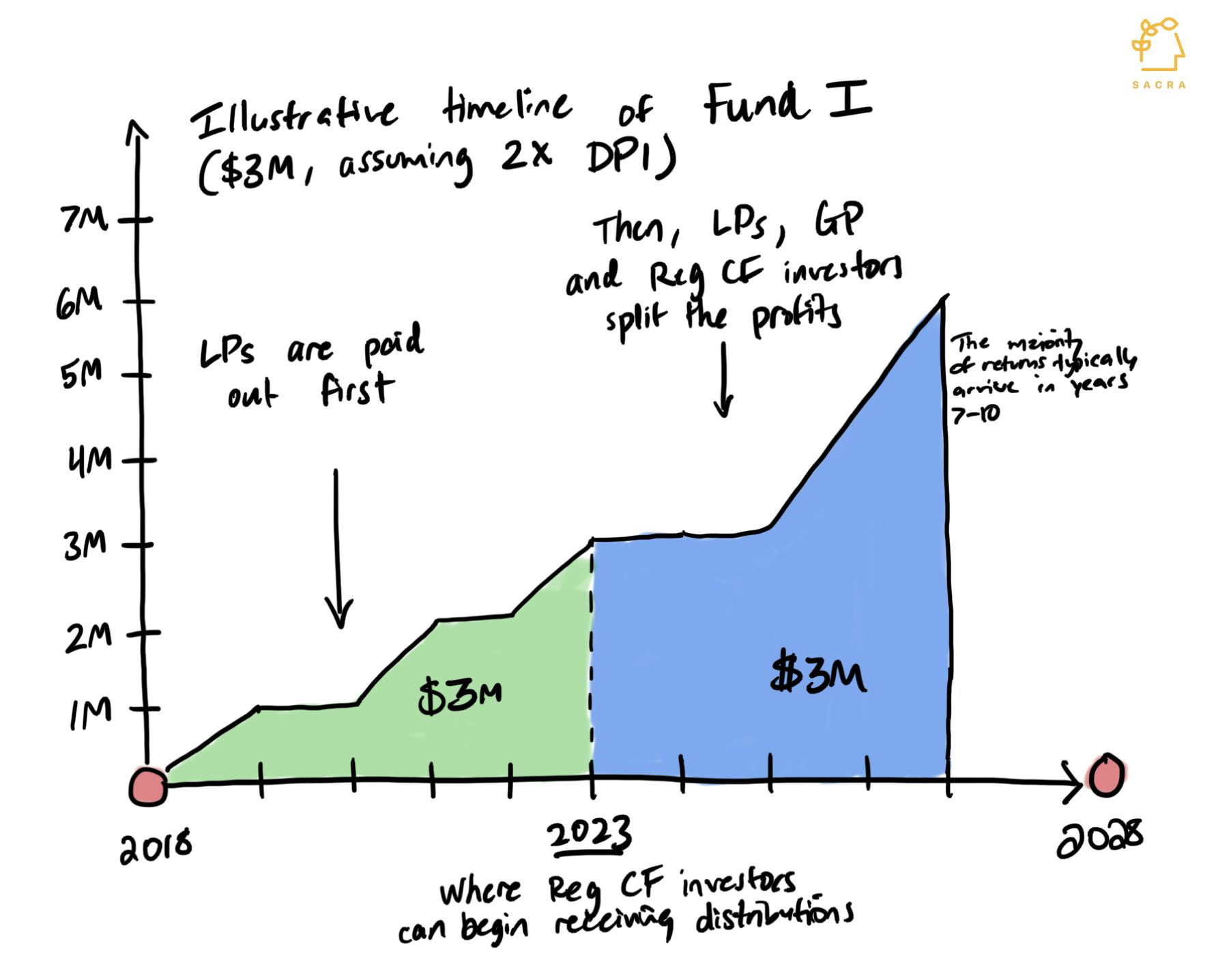

Typically, Earnest LPs receive all initial returns from portfolio companies until 1x capital is returned—then, they split the profits with the GP (and now Reg CF investors).

Once Earnest's LPs are paid back 1x, they will take 80% of the profits and the GP will take a 20% slice. Earnest raising $2M at a $20M valuation means Wefunder investors will collectively be entitled to 10% of that slice ($2M is 10% of $20M—this is assuming all $2M is raised). And as an individual investor, you are buying a portion of that 10%.

While this structure means you don't have the same protections and preferences as traditional fund LPs—since if a fund doesn't return at least 1x, you don't get anything—there is an upside. Since you're investing in the GP's managing company, you get exposure to all their carried interest across current and future funds.

Normally, when you invest in a fund as an LP, you only see the upside from that specific fund. Here, because you’re investing in the person, you're getting exposure to the upside of all of the companies that GP invests in across current and future funds, and you’re less vulnerable to volatility between individual companies and even within individual funds.

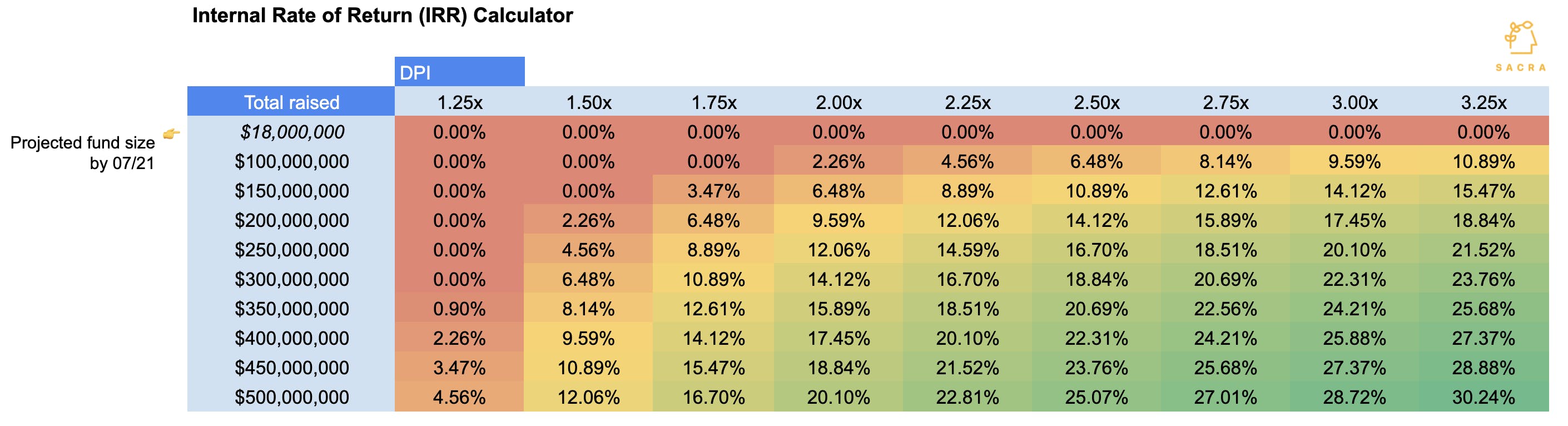

The 2 levers for (pre-tax) IRR growth are cumulative funds raised and total DPI, or return multiple. Calculations assume Earnest’s management fees cover operating expense every year. (download our Earnest Capital IRR calculator here).

The upshot is that there are two primary ways your investment into Earnest Capital can appreciate:

- Earnest raises more and bigger funds: Earnest raising a Fund IV, V, and beyond means they’ll be able to deploy more capital, hopefully generating more carry

- Earnest earns a higher DPI (return multiple): Earnest companies succeeding (exiting and generating higher shared earnings) increases overall returns and generates more carry

If Earnest Capital’s funds return just 1x the capital they raised from LPs or below, then investors on Wefunder will receive nothing (see calculator above)—their investment goes to zero.

According to Tyler, his goal is for Earnest Capital in the future to be raising $50M or larger funds every year.

The economics are tough for Wefunder investors if Earnest Capital fails to do that. With just $100M raised, even a 3x DPI doesn't generate enough IRR to beat the S&P 500, which averages about 10% growth year-over-year. It's not until Earnest has $350M raised that a 2x+ DPI and above can net investors a 15% return—10% to match the S&P 500 with a 5% illiquidity premium on top.

Earnest's stated goal of 3x returns—returning three times the invested cash to LPs—are considered the gold standard of top-tier venture investing, but they are rare: 2020 Cambridge benchmarks pegged the median ten-year fund DPI at 1.03x, the arithmetic mean at 1.62x, and the top quartile of funds at 2.01x.

Ultimately, the math backs up the basic premise of the campaign as explained by Tyler himself. Investing in Earnest as a Reg CF investor is not like investing in the stock market or even investing in a traditional venture fund: it is “like investing in a startup where you're betting that [our thesis] will be BIG.” Specifically, you're betting that Earnest will grow its AUM by 10x or more—if you don't believe it will, then it's unlikely the math on the investment will work out.

Model: The unconventional investing approach that’s gotten Earnest to 2.43x TVPI

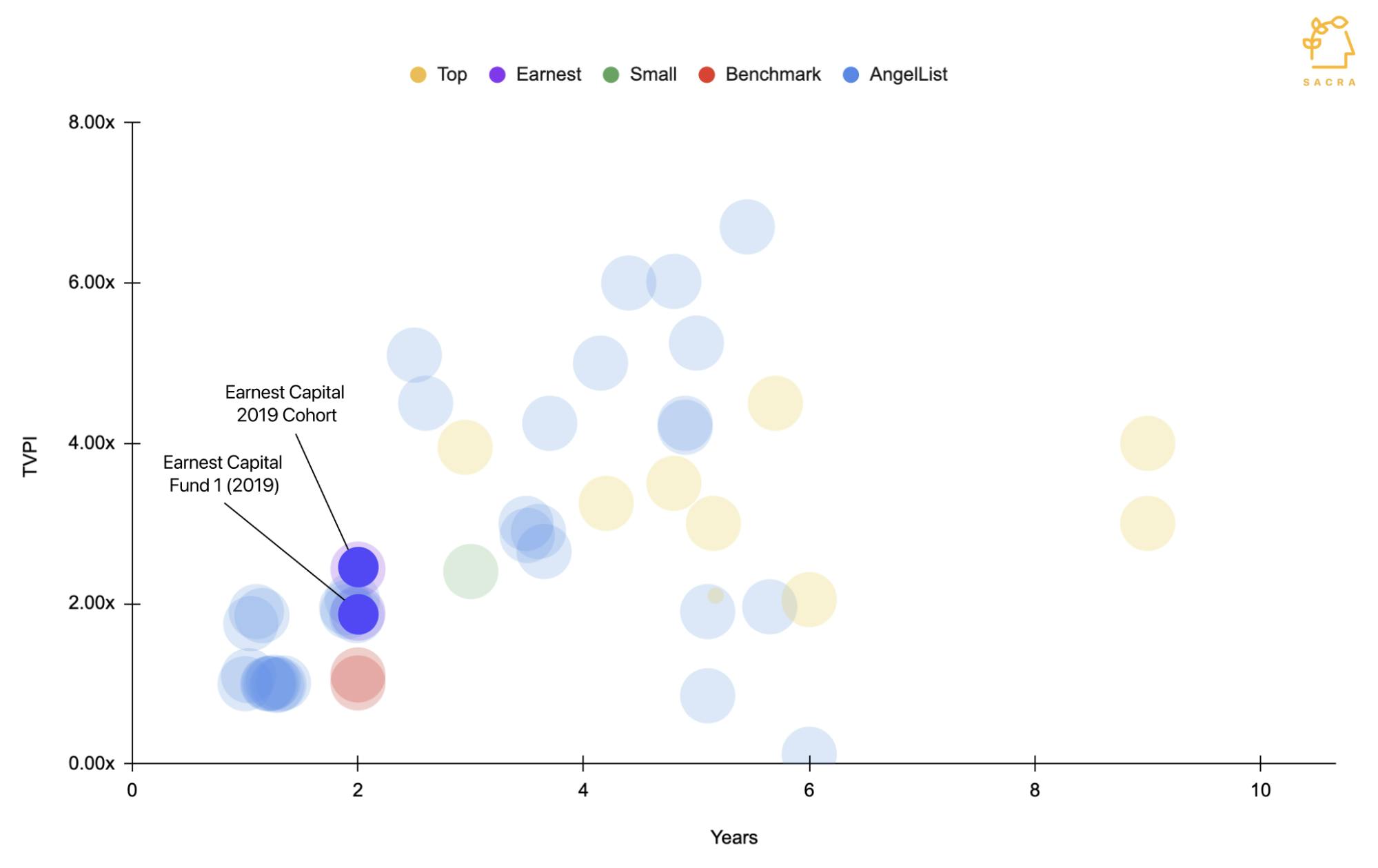

As of December 2020, Earnest’s Fund 1 and 2019 cohorts have outperformed the pooled and median benchmarks for 2-year old venture funds, with all investments made in 2019 up 250% since time of investment in terms of total value growth.

Fund 1 and Earnest’s 2019 cohort compared to a VC fund benchmark, a collection of AngelList funds, and others.

TVPI on that 2019 cohort, which reflects Earnest’s 12.5% upfront fee, is at 2.43x. Fund 1 sits at 1.88x—both are well above the industry median of 1.01 for two-year old funds (as of 2020.)

Earnest Capital’s approach is different from that of a traditional venture fund. Instead of investing in startups with the potential to create a 10x/100x outcome, Earnest invests in largely-bootstrapped founders building profitable SaaS businesses.

While Earnest can make money from an acquisition or secondary sale of their shares—like a regular VC—they also make money through profit sharing agreements. Founders trade Earnest a portion of their cash flows (until the total is paid back between 2x to 5x, depending) in exchange for some liquidity up-front.

Earnest Capital’s summary metrics by portfolio cohort. (download our Earnest Capital IRR calculator here).

This is similar to the strategy employed by Indie VC and a few other funds over the last several years. The difference is that Earnest Capital is more narrowly focused on supporting profitable, bootstrapped founders with steady businesses than on finding both capital efficient and high-growth businesses like Zapier, Qualtrics, or Atlassian.

And, with Indie VC’s announcement earlier this year that it would no longer be making investments, Earnest Capital has now become one of the biggest names in the bootstrap fund space alongside TinySeed, the bootstrapped accelerator that just raised $25M for its second fund. Tyler’s personal brand is a big driver of deal flow and a big factor in convincing both entrepreneurs to work with Earnest and investors to invest, and with Indie VC out of the picture, Earnest Capital becomes even bigger.

Still, there are questions around how well this model can ultimately scale. The Earnest position is that the universe of profitable SaaS companies that aren’t a fit for venture capital is much larger than that of the universe of venture-backable startups. But two main risk factors remain:

- Potential lack of investor interest: Indie VC shut down because LPs were unimpressed with its returns. It remains to be seen whether Earnest can deliver sufficient returns at scale to get investors interested in the bootstrap fund model at significant scale.

- “Base hit” companies are capital light and high touch: Softbank can deploy $1B into an on-demand startup without blinking. Small, profitable, SaaS businesses are never going to be able to take that much capital, which means you need to invest in more of them to deploy a large amount of capital—plus, those relationships are high-touch and follow-ons are inherently limited.

In a sense, the end of Indie VC is both advantageous for Earnest and potentially a cautionary tale: advantageous because it raises Earnest’s profile in the space even more, and cautionary because it folded because it was unable to scale.

Long-term, the thesis behind Earnest Capital is that the market of profitable SaaS companies with a need for non-traditional funding that they’ve tapped with Funds 1 and 2 is a big one: capable of supporting multiple more funds that are multiple times as large.

Portfolio

In the two years since inception, Earnest Capital has invested about $8M in over 30 companies, mostly bootstrapped, profitable SaaS companies.

Fund 1

Earnest Capital's first fund features several companies that have gone on raise large rounds from traditional VCs, go through Y Combinator, or scale revenue to $100K+ ARR, including:

- Yac: raised a $7.5M Series A from GGV in 2021

- Mailbrew: reached $107K ARR as of March 2021

- Every: hit $250K ARR in June 2020

Fund 2

Earnest Capital started writing checks for its second fund in August 2020 and features companies like:

- NativShark: $155K ARR as of March 2021

- Conversion Crimes: $10K revenue in first month

- EnjoyHQ: raised $2M from Point Nine Capital and Social Capital

Top performers

Among the standout companies in Earnest Capital's portfolio are companies that have gone on to raise from well-regarded Silicon Valley and European VCs, those generating large amounts of recurring revenue and one exit.

Appendix

Disclaimers

- Sacra has not received compensation from the company that is the subject of the research report.

- Sacra generally does not take steps to independently verify the accuracy or completeness of this information, other than by speaking with representatives of the company when possible.

- This report contains forward-looking statements regarding the companies reviewed as part of this report that are based on beliefs and assumptions and on information currently available to us during the preparation of this report. In some cases, you can identify forward-looking statements by the following words: “will,” “expect,” “would,” “intend,” “believe,” or other comparable terminology. Forward-looking statements in this document include, but are not limited to, statements about future financial performance, business plans, market opportunities and beliefs and company objectives for future operations. These statements involve risks, uncertainties, assumptions and other factors that may cause actual results or performance to be materially different. We cannot assure you that any forward-looking statements contained in this report will prove to be accurate. These forward-looking statements speak only as of the date hereof. We disclaim any obligation to update these forward-looking statements.

- This report contains revenue and valuation models regarding the companies reviewed as part of this report that are based on beliefs and assumptions on information currently available to us during the preparation of this report. These models may take into account a number of factors including, but not limited to, any one or more of the following: (i) general interest rate and market conditions; (ii) macroeconomic and/or deal-specific credit fundamentals; (iii) valuations of other financial instruments which may be comparable in terms of rating, structure, maturity and/or covenant protection; (iv) investor opinions about the respective deal parties; (v) size of the transaction; (vi) cash flow projections, which in turn are based on assumptions about certain parameters that include, but are not limited to, default, recovery, prepayment and reinvestment rates; (vii) administrator reports, asset manager estimates, broker quotations and/or trustee reports, and (viii) comparable trades, where observable. Sacra’s view of these factors and assumptions may differ from other parties, and part of the valuation process may include the use of proprietary models. To the extent permitted by law, Sacra expressly disclaims any responsibility for or liability (including, without limitation liability for any direct, punitive, incidental or consequential loss or damage, any act of negligence or breach of any warranty) relating to (i) the accuracy of any models, market data input into such models or estimates used in deriving the report, (ii) any errors or omissions in computing or disseminating the report, (iii) any changes in market factors or conditions or any circumstances beyond Sacra’s control and (iv) any uses to which the report is put.

- This research report is not investment advice, and is not a recommendation or suggestion that any person or entity should buy the securities of the company that is the subject of the research report. Sacra does not provide investment, legal, tax or accounting advice, Sacra is not acting as your investment adviser, and does not express any opinion or recommendation whatsoever as to whether you should buy the securities that are the subject of the report. This research report reflects the views of Sacra, and the report is not tailored to the investment situation or needs of any particular investor or group of investors. Each investor considering an investment in the company that is the subject of this research report must make its own investment decision. Sacra is not an investment adviser, and has no fiduciary or other duty to any recipient of the report. Sacra’s sole business is to prepare and sell its research reports.

- Sacra is not registered as an investment adviser, as a broker-dealer, or in any similar capacity with any federal or state regulator.