dbt Labs vs Databricks vs Snowflake

Jan-Erik Asplund

Jan-Erik Asplund

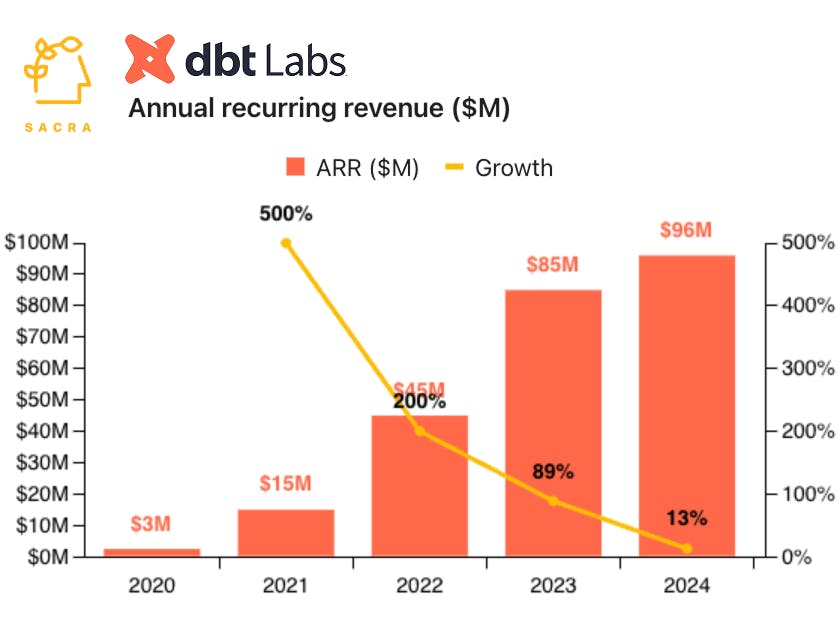

TL;DR: After building the de-facto standard for the T in ETL—transformations—dbt Labs is now under pressure from partners (Snowflake, Databricks) and startups alike as every player in the modern data stack looks to own their customer's key workflows. Sacra estimates dbt Labs hit $96M in annual recurring revenue (ARR) at the end of 2024, up 14% YoY, as they expand into cataloging, orchestration, and observability. For more, check out our full report and dataset on dbt Labs.

Key points via Sacra AI:

- With the rise of Amazon Redshift (2013), teams started sending all their data from their apps and SaaS tools into the cloud data warehouse, with the downside that differing schemas and data formats made it hard to analyze data consistently across all sources—creating the opportunity for dbt Labs (2016) to build a vendor-neutral tool where teams could define the structure of their data once and set it up for ingestion into any BI tool. dbt Labs’s core open-source product lands with individual analytics engineers and small teams, with a top-down sales motion built around the GUI-based dbt Cloud which monetizes its collaboration and governance features with per-seat subscriptions ($100/user) and usage fees ($0.01 per successful data transformation), similar to how GitLab offers Git for free and monetizes with their workflow tools for CI, roadmapping, and security.

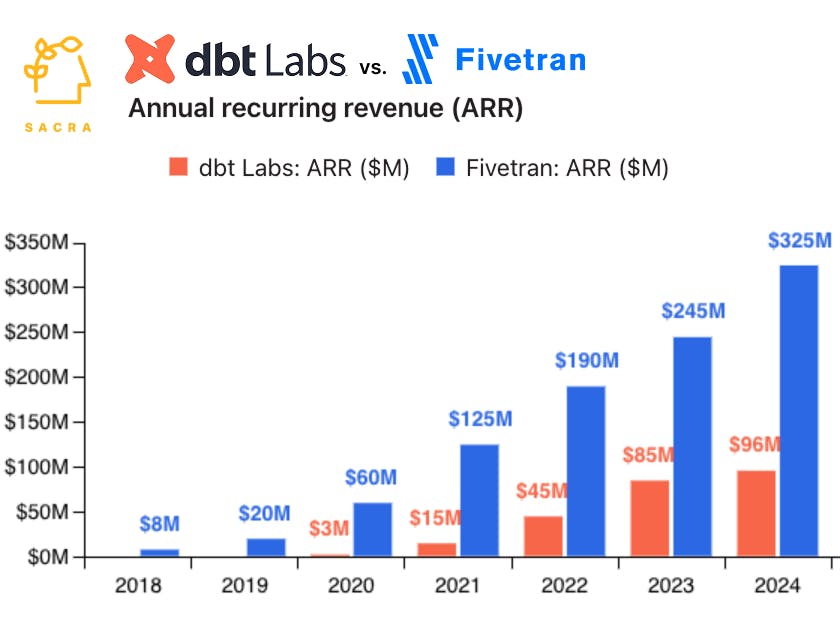

- Sacra estimates that dbt Labs hit $96M in annual recurring revenue (ARR) at the end of 2024, growing about 14% year-over-year, with over 5,000 paying customers and 50,000 teams using dbt weekly, valued at $4.2B as of their February 2022 Series D (Altimeter) for a 221x multiple off $19M in estimated ARR. Compare to data integration competitor Fivetran (private) at about $325M ARR at the end of 2024 (up about 33% YoY) valued at $5.6B as of their 2021 Series D—implying a 45x multiple on $125M in 2021 ARR—and to analytics software provider Alteryx (formerly NYSE: AYX) at $970M in revenue (up 13% YoY) with a market cap of $3.52B when taken private for a 3.6x multiple.

- Under pressure from Snowflake and Databricks (building native transformations) and from startups “re-bundling” dbt with better orchestration and scheduling (Dagster, Meltano), dbt is now expanding into cataloging (Collibra), orchestration (Airflow), and observability (Metaplane) to defend their position as the key interface where data engineering teams define their business metrics. dbt’s vision for 2025 is that data engineers will use this expanded platform and its new AI copilot to create interfaces for business users to do their own transformations and query their data, picking up more seats within the organization and driving increased usage.

For more, check out this other research from our platform:

- dbt Labs (dataset)

- Julia Schottenstein, Product Manager at dbt Labs, on the business model of open source

- Conor McCarter, co-founder of Prequel, on Fivetran's existential risk

- Sean Lynch, co-founder of Census, on reverse ETL's role in the modern data stack

- Cribl (dataset)

- Fivetran (dataset)

- Databricks(dataset)

- Fivetran: the $200M/yr Zapier of ETL

- Salesforce, Amplitude, and the fat data layer in B2B SaaS

- Colin Nederkoorn, founder & CEO at Customer.io, on the CDP layer in messaging

- Geoff Charles, VP of Product at Ramp, on Ramp's AI flywheel