Commure at $105M ARR

Jan-Erik Asplund

Jan-Erik Asplund

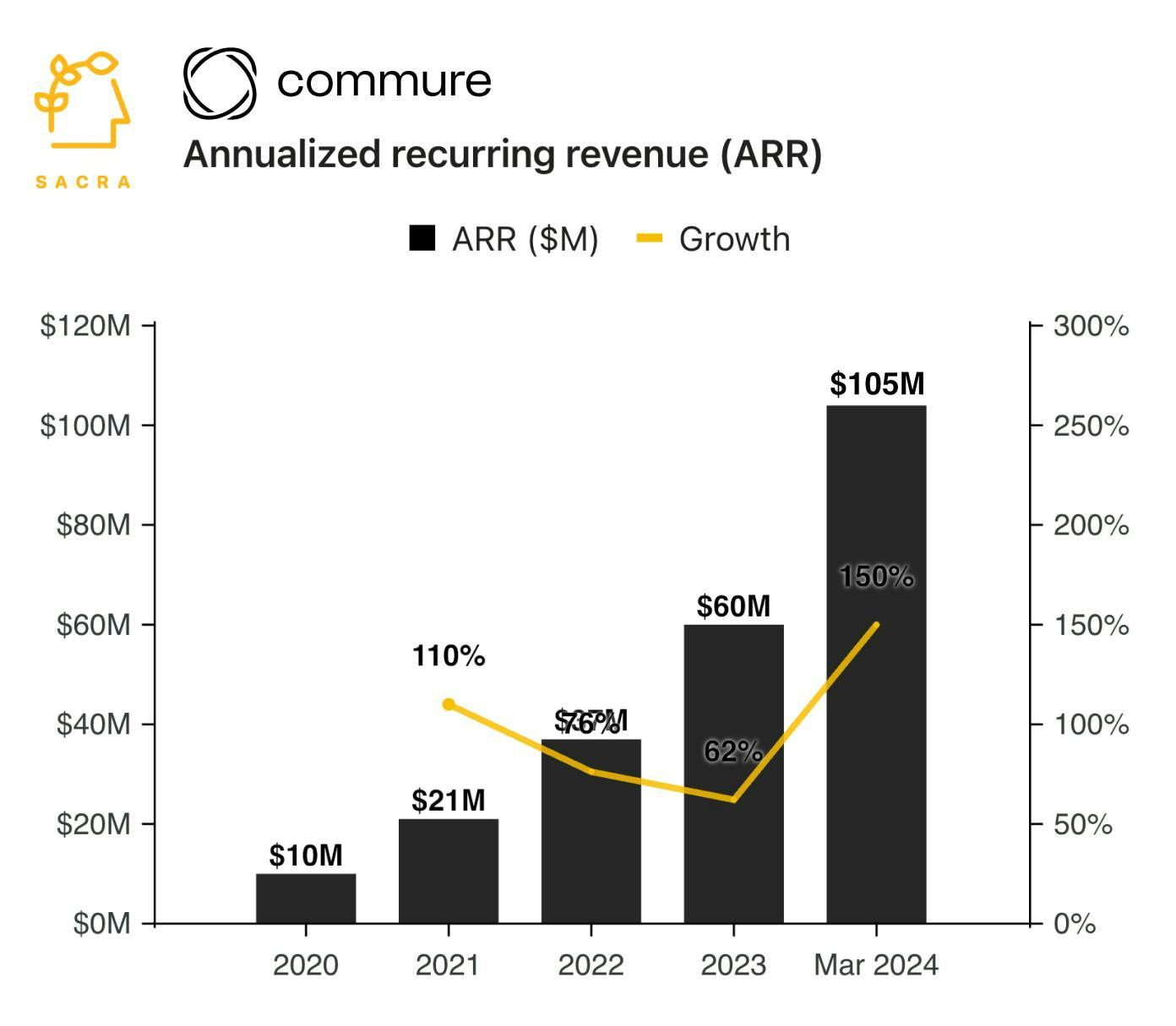

TL;DR: Sacra estimates that Commure has accelerated to $105M in annual recurring revenue (ARR) as of March 2024, growing 150% YoY, after their 2023 merger with Athelas. Through aggressive M&A, they’ve now built the only digital health platform with the product surface area to credibly compete with entrenched EHRs like Epic and Cerner as an all-in-one for hospitals. For more, check out our full report and dataset on Commure.

Key points via Sacra AI:

- Hatched inside General Catalyst in 2017 by ex-Livongo founder Hemant Taneja (General Catalyst, acquired by Teladoc for $13.9B in 2020), Commure launched in 2020 as an integration-platform-as-a-service (iPaaS) for healthcare, with the vision of enabling developers to build apps to integrate with any electronic health record (EHR). Where SaaS integration products like Zapier and Tray.io benefitted from the proliferation of standardized web REST APIs, healthcare APIs are bespoke and complex, making this impossible—Commure quickly shifted to rolling up healthcare point solutions into their platform and making them interoperable, acquiring ListRunner for patient lists (2017), Merlin for healthcare worker hiring (2020), and Karuna Health for patient communication (2021).

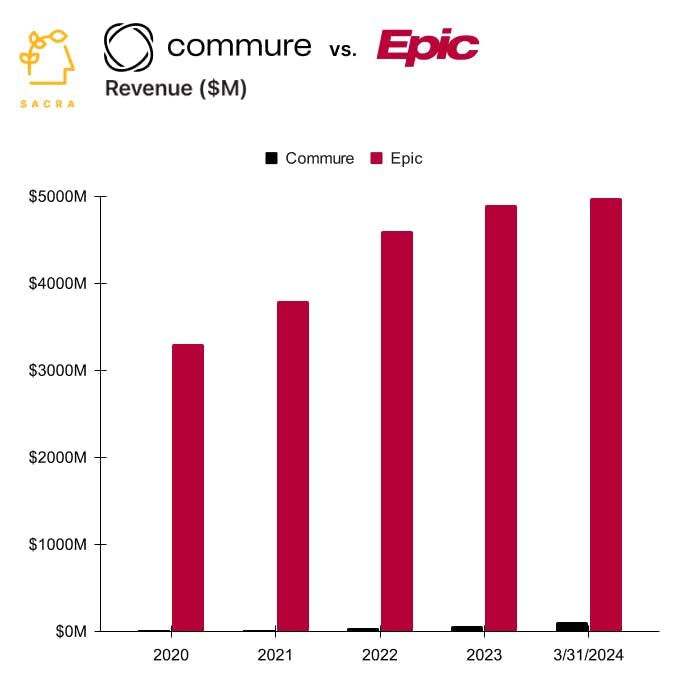

- After their merger with the revenue cycle management and patient monitoring startup Athelas (General Catalyst, Tribe Capital & Sequoia, $2.35B valuation), Sacra estimates that Commure hit $105M ARR in March 2024, growing 150% YoY, for a 57x forward revenue multiple on its $6B October 2023 valuation. Compare to the dominant EHR in Epic at $4.9B in revenue in 2023, up 7% from $4.6B in 2022 (the largest EHR with 38% market share), which provides a vast all-in-one for health systems from patient portals (MyChart), billing, and patient communications to telehealth, data warehouses, and mobile apps for clinicians.

- Through aggressive M&A like their July acquisition of AI scribe Augmedix (NASDAQ: AUGX), Commure’s product surface area and relationships with major healthcare systems like HCA Healthcare ($68B market cap, partnered with General Catalyst) positions it as an upstart digital health platform that could credibly compete with entrenched EHRs like Epic and Cerner as an all-in-one platform for hospitals. While most enterprise SaaS companies grow ACV by adding seats or expanding usage, health-tech companies like Athelas and Commure do it by cross-selling additional products into their relationships with hospitals, which buy software via long-term, fixed-fee contracts and have strong retention dynamics but limited opportunities for expansion.

For more, check out this other research from our platform:

- Commure (dataset)

- Epic (dataset)

- Virta Health (dataset)

- Freed AI (dataset)

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Brendan Keeler, Senior PM at Zus Health, on building infrastructure for digital health

- Ro and the telehealth capital cycle

- Noom (dataset)

- Hone Health (dataset)

- Kry (dataset)

- Lifen (dataset)

- Ro (dataset)

- Quartet Health