Clio at $300M/year

Jan-Erik Asplund

Jan-Erik Asplund

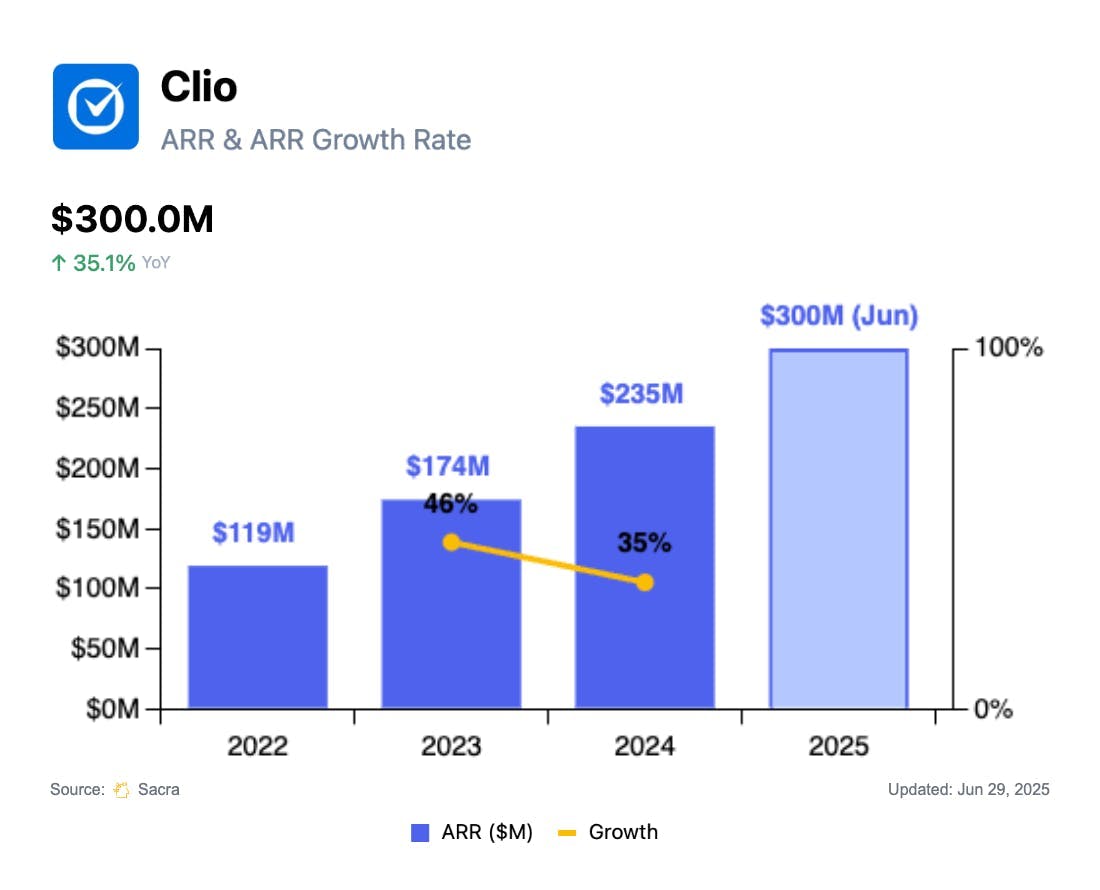

TL;DR: After building a practice management SaaS for solo lawyers & SMBs and layering on marketing, payments, & accounting, Clio is seizing the AI moment to cross over from back office to front office with its AI copilot for law firms. Sacra estimates that Clio hit $300M in annual recurring revenue (ARR) as of June 2025, up from $235M at the end of 2024. For more, check out our full report and dataset on Clio.

Key points via Sacra AI:

- Circa 2008, law offices paid $10,000+ upfront for one-time licenses to use on-prem practice management software like Amicus or ProLaw—plus ongoing investment in services & training—inspiring Clio (2008) to bundle time tracking and client & matter management into a subscription, browser-based SaaS. While skepticism around storing client files in the cloud slowed Clio’s early adoption, 20+ bar associations gave cloud storage the greenlight in the early 2010’s—as tools like Google Docs (launched 2006) and Dropbox (founded 2007) took off, Clio found product-market fit with efficiency-seeking solo & small law firms that lacked full-time IT staff, monetizing through subscriptions starting at $39/user/month (Starter) up to $129/user/month (Complete).

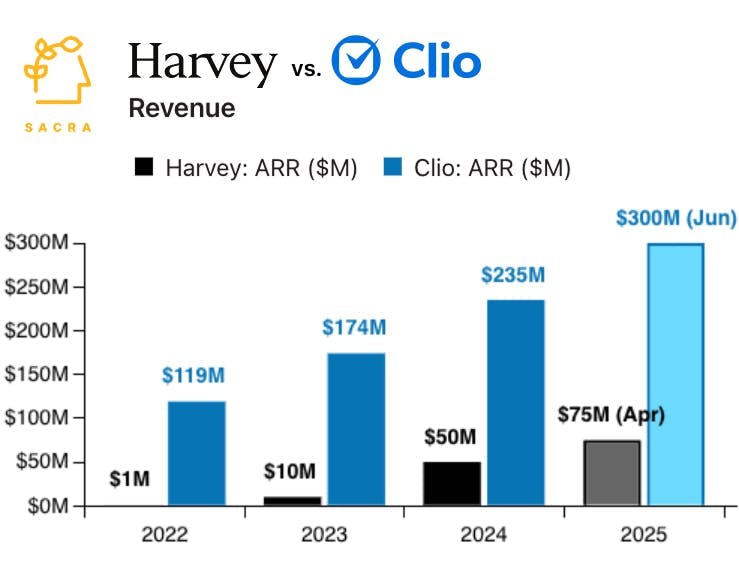

- Since the launch of Clio Payments (2021), payments now drive the majority of net new revenue growth, with Clio reaching a Sacra-estimated $300M in annual recurring revenue (ARR) in June 2025, up from $235M at the end of 2024 (up 35% YoY from 2023), valued at $3B as of their July 2024 Series F for an estimated ~15x forward revenue multiple at the time. Compare to Thomson Reuters (NYSE: TRI) at $7.3B revenue in 2024 growing 7% YoY valued at $95B for a 13x multiple, LexisNexis (NYSE: RELX) at $12B revenue in 2024 growing 6% YoY valued at $99B for a 8x multiple, and legal AI research & drafting platform Harvey at $75M ARR, up 50% this year from $50M in December 2024, valued at $5B as of their June Series C for a 67x multiple.

- With its June 2025 acquisition of legal research platform vLex—and its 1B+ cases, statutes, and treatises from 200+ jurisdictions—Clio can combine its library of precedent with the lead-to-ledger data, document storage & workflows it already owns, giving solo & small law firms a Harvey-style AI assistant that can retrieve information, draft filings, and perform research. While Clio has mostly sold into SMBs—where firms run leaner, handle a higher volume of clients, and adopt SaaS (and now AI) more out of necessity—its 2025 acquisition of Sharedo gives it the enterprise-grade foundation to begin moving upmarket and selling into Am Law firms.

For more, check out this other research from our platform:

- Clio (dataset)

- Harvey at $75M ARR

- Ironclad at $150M ARR

- Harvey (dataset)

- Ironclad (dataset)

- Wade Foster, co-founder & CEO of Zapier, on AI agent orchestration

- Danny Wheller, VP of Business & Strategy at Hebbia, on vertical vs horizontal enterprise AI

- Hebbia (dataset)

- Glean (dataset)

- Writer (dataset)

- Zapier (dataset)

- Airtable (dataset)

- Anthropic (dataset)

- OpenAI (dataset)

- Mike Knoop, co-founder of Zapier, on Zapier's LLM-powered future

- Will Bryk, CEO of Exa, on building search for AI agents