BillionToOne at $153M/yr

Jan-Erik Asplund

Jan-Erik Asplund

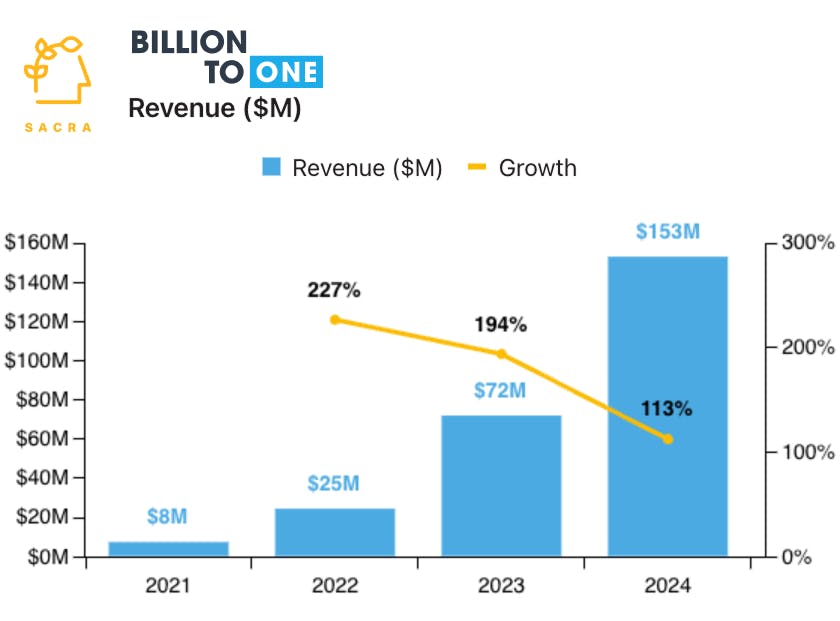

TL;DR: Offering genetic testing to expecting mothers with a non-invasive blood draw rather than invasive amniocentesis, Sacra estimates BillionToOne crossed $100M in revenue in 2024, generating $153M (up 113% YoY). Now, as they expand to cancer therapy selection and monitoring, they’re competing with Natera, Myriad Genetics, and Guardant Health. For more, check out our full report and dataset on BillionToOne.

Key points via Sacra AI:

- Developed during co-founder & CEO Oguzhan Atay’s quantitative cell biology PhD at Stanford, the core tech behind BillionToOne (founded 2016) counts DNA molecules in the blood using machine learning with 1,000x higher resolution to identify risk factors in single base-pair mutations—which the company productized into the UNITY Screen (2019), a test for conditions like cystic fibrosis, SMA and sickle cell disease with a single non-invasive blood draw rather than invasive amniocentesis. BillionToOne sells into OB/GYNs, hospitals, and fertility clinics—contracting to make the UNITY screen available to their patients—and bills insurance for $7,500 to $15K per test (~60% gross margin) with optional out-of-pocket add-ons like BabyPeek (discovering baby's eye color/hair color, $99).

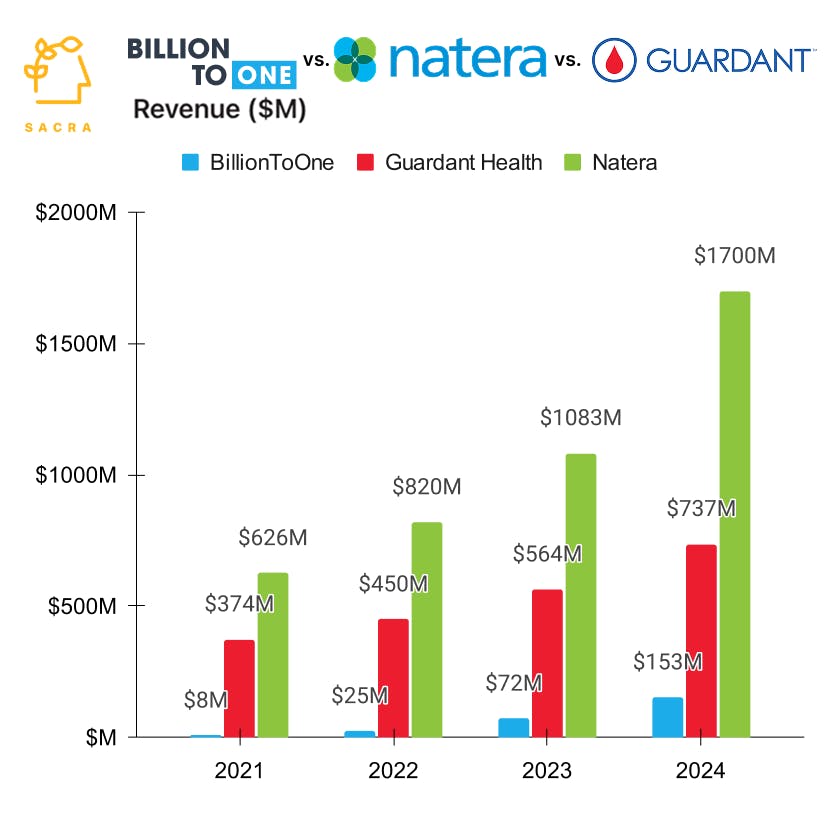

- Hitting 500,000 total prenatal tests processed in June, Sacra estimates BillionToOne generated $153M in revenue in 2024, up 113% YoY from $72M in 2023, with 60%+ gross margins, valued at $1B as of their $130M June 2024 Series D for a 6.5x revenue multiple on nearly $400M raised in total. Compare to leading prenatal and oncology screening company Natera (NASDAQ: NTRA) at $1.53B in trailing twelve months (TTM) revenue, growing 42% YoY, valued at $23.4B for a ~15x revenue multiple, and general lab testing company LabCorp (NYSE: LH) at $12.71B in revenue, growing 5% YoY, valued at $21B for a 1.7x revenue multiple.

- Becoming a multi-product diagnostics company, BillionToOne launched a liquid biopsy test for cancer (2022) that repurposes its molecular counting technology for monitoring tumors, expanding their upside from the $5B prenatal testing market to the ~$50B market for cancer therapy selection, therapy monitoring, and post-treatment surveillance. Where non-invasive prenatal testing has minimal FDA regulations and quick reimbursement paths, expanding into oncology comes with stricter validation and more oversight—hence the 220K square foot Austin testing facility for 1,000 new staff BillionToOne has in the works—and puts them in competition with genetic screening giants also using liquid biopsy technology like Natera, Myriad Genetics ($838M revenue in 2024, up 11% YoY), and Guardant Health ($737M revenue in 2024, up 31% YoY).

For more, check out this other research from our platform:

- BillionToOne (dataset)

- Benchling (dataset)

- Freed (dataset)

- Maven Clinic (dataset)

- Commure (dataset)

- Epic (dataset)

- Virta Health (dataset)

- Hone Health (dataset)

- Brendan Keeler, interoperability lead at HTD Health, on GTM for AI medical scribes

- Hone Health: the $55M/year D2C testosterone startup

- Sweden’s $215M/year telehealth giant

- Kathryn Cross, CEO of Anja Health, on the future of stem cell therapy