Applied Intuition at $415M/year

Jan-Erik Asplund

Jan-Erik Asplund

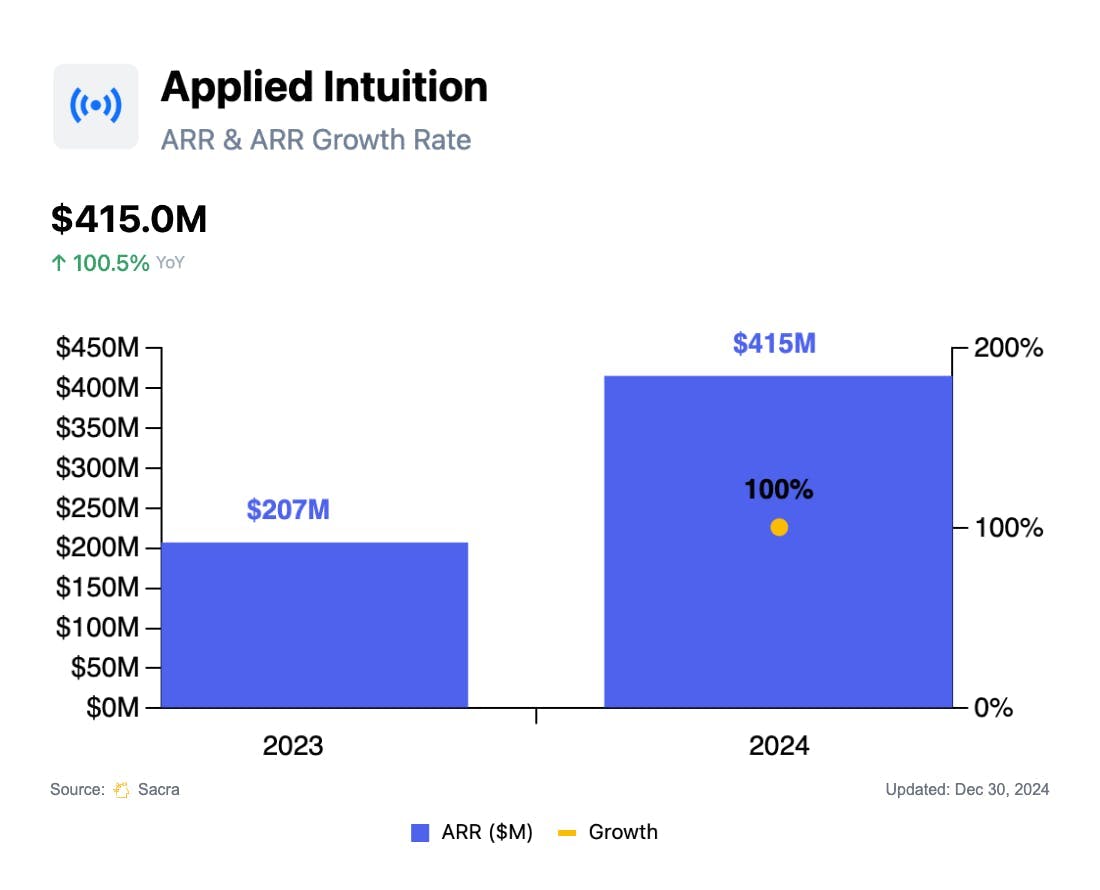

TL;DR: With the $800B autonomous vehicle market expanding beyond passenger cars into trucks, defense, construction, mining, and aerial/maritime robots, Applied Intuition's vendor-agnostic simulation platform is positioned as the horizontal Android of autonomous driving vs. Tesla’s walled garden. Sacra estimates Applied Intuition reached $415M annual recurring revenue in 2024, up 100% from $207M in 2023. For more, check out our full report and dataset on Applied Intuition.

Key points via Sacra AI:

- Founded in 2017, Applied Intuition built a safety-certified simulation platform that lets autonomy engineers test self-driving systems in millions of virtual scenarios—by uploading real-world driving data, turning it into customizable test cases, and instantly rerunning those cases to see how the software responds to edge conditions like jaywalkers at night or sudden braking in the rain. OEMs buy 3–5 year seat-plus-compute subscriptions with deals averaging ~$740K to access Applied Intuition’s all-in-one dashboard that replaces stitched-together MATLAB, game engines, and internal tools, compressing validation timelines from months to hours.

- Expanding into defense after winning a $249M purchase agreement with DoD to support autonomous and acquiring defense AI company EpiSci, Sacra estimates Applied Intuition hit $415M ARR in 2024, up 100% YoY from $207M in 2023, valued at $15B as of their June Series F (BlackRock & Kleiner Perkins) for a ~36x forward revenue multiple. Compare with incumbents Ansys at $2.54B in 2024 revenue, up 12% from $2.27B in 2023, acquired by Synopsys for $35B or ~14x revenue; Tesla (NASDAQ: TSLA) at $97.7B in 2024 revenue, up 1% from $96.8B in 2023, trading at a market cap of ~$1T or ~10x revenue; and Anduril at $1B in 2024 revenue, up 138% from $420M in 2023, last valued at $14B or ~14x revenue.

- With few pure-play simulation competitors and Tesla’s vertically integrated Mac-style walled garden as its lone peer at scale, Applied Intuition is positioning itself as the horizontal “Android” for autonomous driving, a vendor-agnostic software layer OEMs can license instead of spending billions to build their own. This neutrality opens a TAM that’s 10x larger than passenger autonomous driving—long-haul trucking companies going after 24/7 driverless operations, defense programs building swarms of drones, construction & mining companies that need off-road autonomy, and aerial drones and air taxis getting virtual flight hours—all dependent on generating a high volume of synthetic edge cases for training.

For more, check out this other research from our platform:

- Orest Pilskalns, CEO of Skyfish, on building autonomous drone infrastructure

- Scale at $760M ARR

- Scale: the $290M/year Mechanical Turk of machine learning

- Saildrone (dataset)

- Saronic (dataset)

- America First vs. American Dynamism

- Anduril (dataset)

- Anduril at $1B/yr

- SpaceX (dataset)

- Anduril, SpaceX, and the American dynamism GTM playbook

- The biggest mistake defense startups make

- Ross Fubini, Managing Partner at XYZ Capital, on the defense tech opportunity

- Shield AI (dataset)

- Scott Sanders, chief growth officer at RRAI, on the defense tech startup playbook