Apollo at $100M ARR

Jan-Erik Asplund

Jan-Erik Asplund

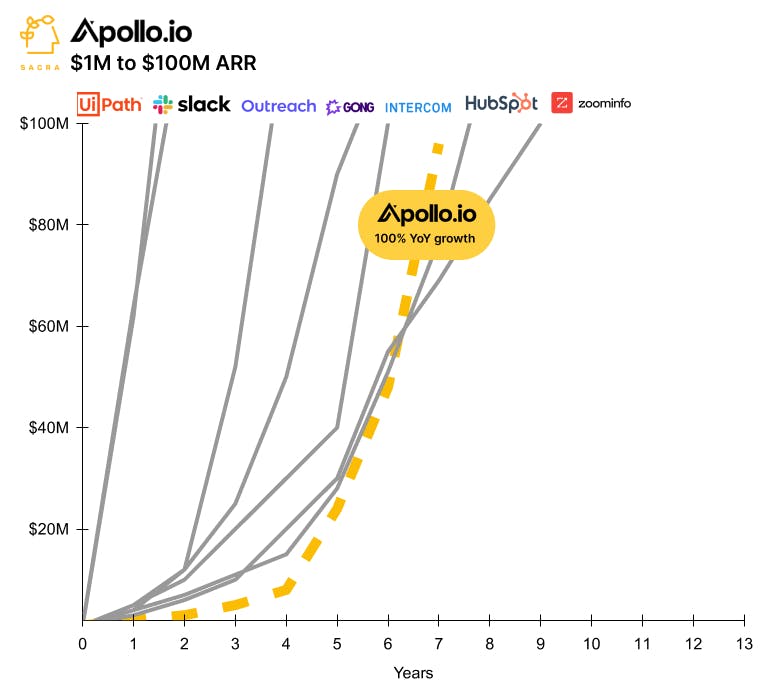

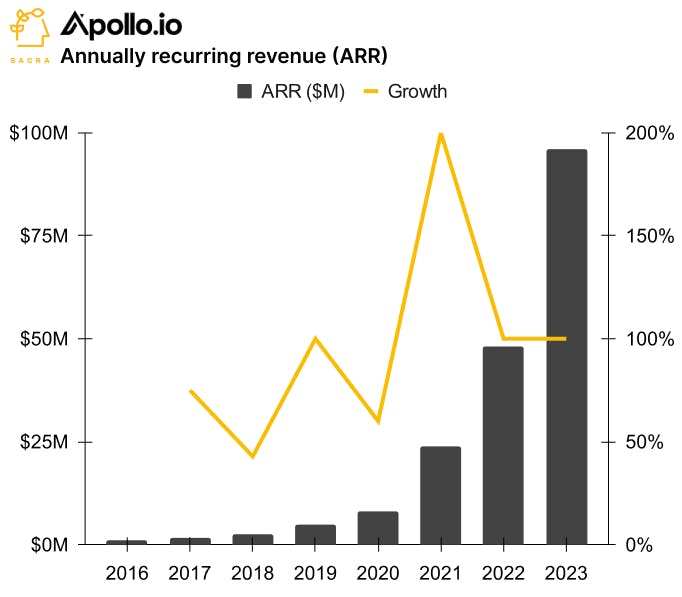

TL;DR: Sacra estimates that Apollo.io has crossed $100M annual recurring revenue (ARR) growing 100% year-over-year by offering a self-serve vertically integrated data and sales GTM platform. As they go all-in-one, they're butting up against ZoomInfo (NASDAQ: ZI) with the upside potential to threaten HubSpot (NYSE: HUBS). Check out our Apollo.io report and dataset for more.

Key points from our research:

- As of the late 2000s, sales teams would buy lead lists from data brokers like Dun & Bradstreet (NYSE: DNB) and ZoomInfo (NASDAQ: ZI), then import them into a CRM like Salesforce (NYSE: CRM) to send emails and make cold calls. Around 2010, ZoomInfo started differentiating from the pure data brokers by layering on software tools for email validation, list segmentation, and database cleaning that they sold into mid-size and enterprise companies.

- Apollo.io (launched in 2015) found initial product-market fit vertically integrating sales data with workflow tools, letting sales teams generate lists of leads and start emailing immediately, hitting $1M ARR by 2016. Going bottom-up and self-serve contra ZoomInfo’s top-down, enterprise approach, Apollo.io added $50-$100/month SMB-focused plans to target the large market of SMBs that wanted ZoomInfo without a $9K annual contract—after which growth hit an inflection point, accelerating from 50-100% YoY to 100-200% YoY and hitting $40M ARR by 2022.

- Sacra estimates that Apollo.io hit $96M in annual recurring revenue (ARR) in 2023, up 100% from $48M in 2022 for a 16.6x forward revenue multiple on their $1.6B valuation (August 2023). Compare to ZoomInfo at $1.26B in annualized revenue at the end of Q3’23, up 9% year-over-year for a 4x forward multiple on their $5B market cap and Outreach at $250M ARR in 2023, up 11% from $225M ARR in 2022 for a 17.6x forward revenue multiple on their $4.4B valuation (June 2021).

- Apollo.io is going after ZoomInfo's “batteries included” go-to-market (GTM) platform from a product-led growth angle, with smaller scale but much higher revenue velocity. LinkedIn is building its own GTM platform from the angle of direct engagement through their social network with Sales Navigator, which they launched in 2014 and has grown to $1B+ of revenue.

- As a go-to-market platform that brings sales, biz dev, marketing and exec teams into one place, Apollo.io presents an insurgent threat to HubSpot’s (NYSE: HUBS) all-in-one vision, which acquired data API startup Clearbit for $150M in November 2023 to compete. As LLMs take pure data tools to zero and every tool looks to integrate data and workflow, the growing feature overlap between products like Apollo.io, Gong ($285M ARR) and Outreach ($250M ARR) will drive consolidation as teams look to reduce redundant spend in 2024, reversing the trend of proliferation that we saw in sales tech from 2013 (~400 sales SaaS) to 2023 (1,000+ sales SaaS).

For more, check out this research from our platform: