$24M/year FanDuel for prediction markets

Jan-Erik Asplund

Jan-Erik Asplund

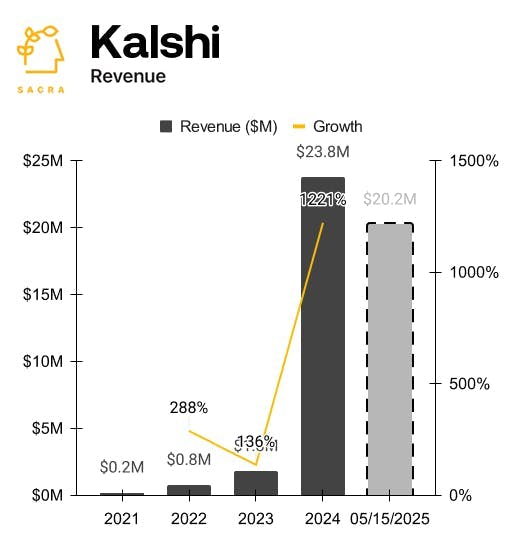

TL;DR: Kalshi became a cultural phenomenon during the 2024 U.S. presidential election as millions bet on Donald Trump to defeat Kamala Harris, driving a record $1.2B in monthly trading volume. Post-election, Kalshi has shifted to sports—now 75% of trading—as a 50-state legal alternative to FanDuel and DraftKings, with Sacra estimating Kalshi generated $24M in 2024 revenue, up 1,221% year-over-year. For more, check out our full report and dataset on Kalshi.

Trading exploded on prediction markets like Kalshi ($36M raised from Sequoia) and Polymarket ($165M raised, Founders Fund) during the 2024 U.S. election season, with millions betting on the outcome of the presidential race and seeing the balance tilting heavily towards Trump before the media called the race using polling.

We took a closer look at Kalshi to understand how prediction markets are dealing with the post-election hangover.

Key points via Sacra AI:

- After spending 2 years securing the first-ever CFTC license for an event contract exchange, Kalshi launched in 2021 to allow users to trade binary call options on the outcomes of future events, like COVID vaccination rates, Fed rate hikes, and the Oscars. By operating as a regulated exchange, Kalshi is available to users in all 50 states—retail users pay a variable fee that nets Kalshi an effective ~1% take rate on volume, with market makers like Susquehanna trading for free and earning rebates of ~0.25% on filled orders for keeping markets liquid.

- The approval of Kalshi’s election markets in October 2024 sparked a massive spike in trading (Kalshi did $1.97B for the year, up 980% year-over-year) and revenue as millions of users placed bets on the presidency and on Senate and House races, with Sacra estimating that Kalshi grew to $24M in revenue for 2024, up 1,221% year-over-year. Compare to Polymarket which did $9B in 2024 trading volume across 314K active traders, up from $73M in 2023—growing faster than Kalshi as a borderless, crypto-native prediction market but with the downside of no regulatory approval in the U.S. and higher user onboarding friction.

- Fast time-to-resolution in sports betting—where users wager on the outcome of that night’s game and can recycle their capital within 24 hours—has driven Kalshi’s expansion into sports, now 75% of total volume (~$513M in March, ~$453M in April, down from the $1.2B election month peak but 20x above the pre-election baseline), putting it on pace for the year to double its $2B in 2024 volume.Versus sportsbooks like DraftKings and FanDuel, which rely on state-by-state gaming approvals (still banned in 11 states) and profit from a 4–5% house edge on every bet, Kalshi's classification as a federally regulated derivatives exchange supersedes state laws—allowing it to offer legal sports bets in all 50 states at just a 1% fee per trade.

For more, check out this other research from our platform:

- Trevor John, co-founder of Underdog Fantasy, on the business model of fantasy sports

- Arjun Sethi, co-CEO of Kraken, on building the Nasdaq of crypto

- Whatnot at $359M/yr

- David Ripley, COO of Kraken, on the future of cryptocurrency exchanges

- Duncan Cock Foster, co-founder of Nifty Gateway, on NFTs as luxury goods

- Stan vs Whop

- Underdog Fantasy

- eToro vs Robinhood