$147M/year GarageBand for AI music production

Jan-Erik Asplund

Jan-Erik Asplund

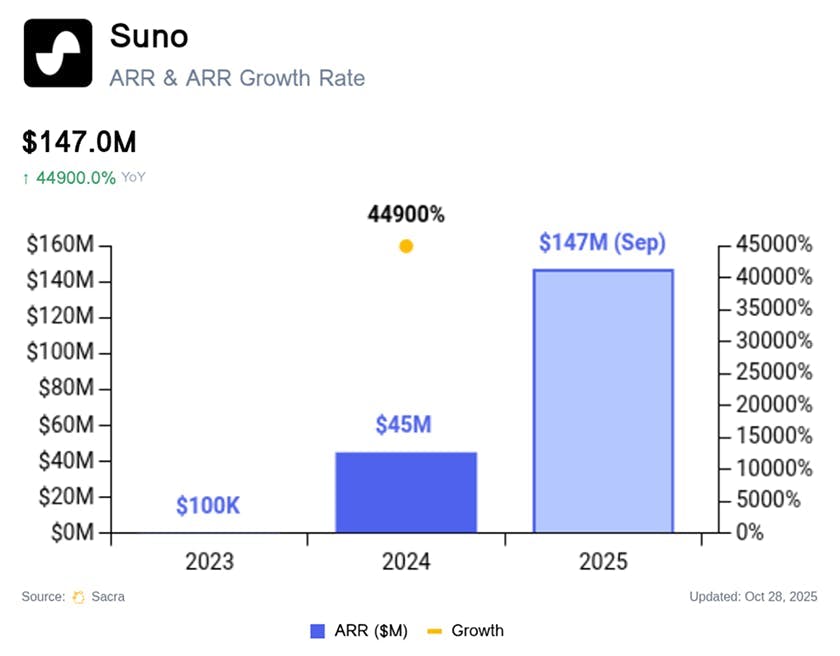

TL;DR: Once a hobbyist toy, AI music generator Suno is gaining traction with professional songwriters & producers as it layers on sample-accurate editing, stem separation and advanced editing, scaling to a Sacra-estimated $147M in annual recurring revenue (ARR) as of September 2025, up from $45M at the end of 2024. For more, check out our full report & dataset.

We last covered Suno at $45M ARR at the end of 2024, valued at $500M as the company was emerging as the clear category leader in text-to-song generation.

Key points from our 2025 update via Sacra AI:

- Suno stands alone as the only major text-to-song player that allows users to own their creations and use them commercially (on the $8/mo Pro and $24/mo Premier plans), with Udio settling its Universal Music Group lawsuit by ending user ownership as of Wednesday, ElevenLabs (launched AI music in August 2025) training exclusively on licensed catalogs from music rights partners and OpenAI reportedly building music generation but yet to launch.

- Combining commercial rights with post-generation music editing workflows via its launch of an advanced editing interface (June 2025) and acquisition of Pro Tools-like web-based digital audio workstation (DAW) company WavTool (June 2025), Suno has crossed over from its hobbyist consumer / prosumer customer base into 1) YouTubers and content creators sourcing royalty-free music, 2) professional producers generating ideas & arrangements, as well as 3) an emerging set of creators who generate & mass-upload AI tracks to Spotify to earn streaming royalties, with ~30,000 AI-generated songs now being uploaded everyday.

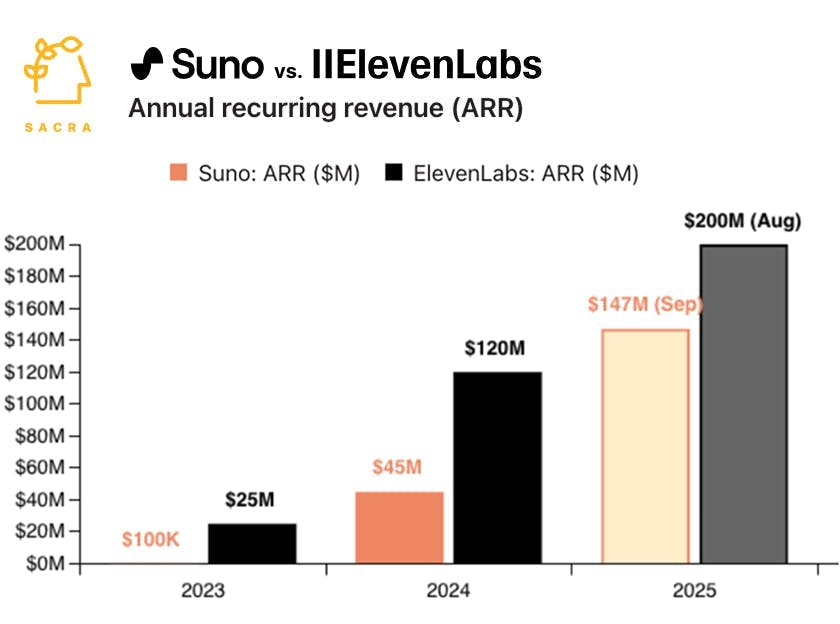

- Now in talks to raise $100M at a $2B valuation or ~14x forward revenue, quadrupling its previous valuation of $500M set in its May 2024 Series B (Lightspeed & Matrix Partners), Sacra estimates Suno hit ~$147M annual recurring revenue (ARR) in September 2025, growing 3.25x+ from $45M at the end of 2024—compared to ElevenLabs at $200M ARR as of August 2025, growing 1.6x+ from $120M at the end of 2024, valued at $6.6B or ~33x forward revenue as of their $100M September tender offer.

For more, check out this other research from our platform:

- Suno (dataset)

- ElevenLabs (dataset)

- AI talking heads growing 1024%

- Chris Savage, CEO of Wistia, on the economics of AI avatars

- Hassaan Raza, CEO of Tavus, on building the AI avatar developer platform

- AI writing goes enterprise

- Together AI: the $44M/year Vercel of generative AI

- Jenni AI: the $5M/year Chegg of generative AI

- Mux: the AWS of video

- How AI is transforming B2B SaaS

- David Park, CEO and co-founder of Jenni AI, on prosumer generative AI apps post-ChatGPT

- Adam Brown, co-founder of Mux, on the future of video infrastructure

- HeyGen (dataset)

- Synthesia

- Tavus