Jareau Wadé

Founder at Batch Processing

Are there benefits for the end user, the merchants themselves who are on the platform? Is it beneficial to them to be on a platform that pays through Finix versus something else?

There are four models roughly for how payments are delivered.

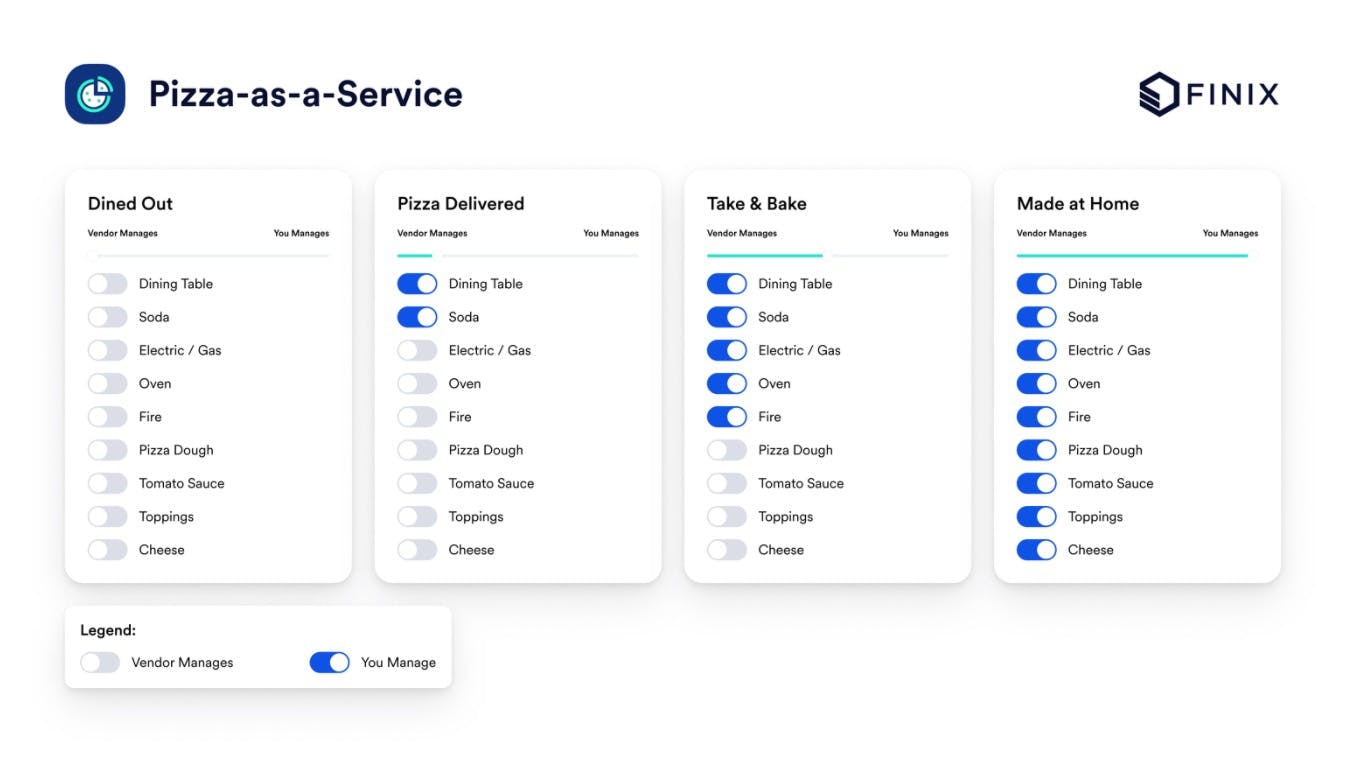

We'll go over the pizza first and then we can talk about the payments. Basically, the legend at the bottom is: what do you do versus what does the vendor at the pizza shop do?

First is, you're hungry, you want to eat pizza, you decide you're going to dine out. You're essentially asking the restaurant -- the vendor in this case -- to do everything for you. You're showing up, but they're baking it, it's their ingredients, and they provide the table and the drinks. You outsourced it.

Then there's the delivery model, which is a hybrid in a way. You're still not baking, and it's not your electricity or gas that you're paying for the oven and not your ingredients. But you're eating at your own house.

Then the take-and-bake model -- the DiGiorno model. This is where you meet in the middle: another hybrid model where you are using your oven this time. You're a bit more invested in the infrastructure, but you're still not preparing the pizza from scratch. It's prebuilt for you and you bake it.

The last one is full from-scratch: you're tossing dough, making pasta sauce. Yes, you bought some things from the store, but really you're creating the entire product yourself.

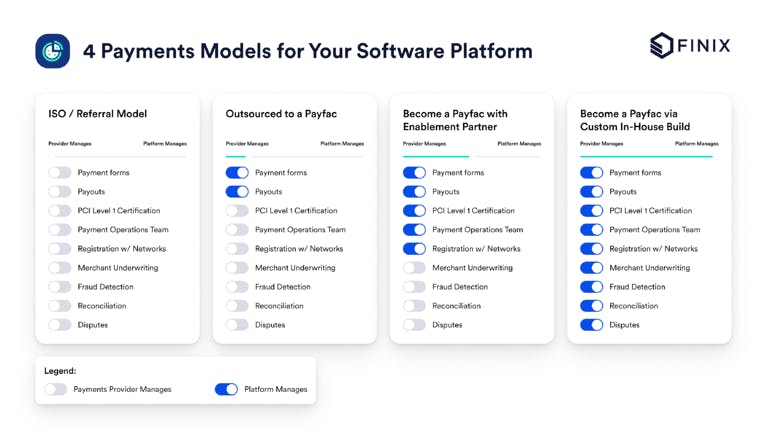

If you go to the payments model, this maps very cleanly to the four popular models right now for delivery of payments, at least in the US. They are: the ISO model, outsourcing to a PayFac, becoming a PayFac yourself and using a infrastructure provider and, again, full custom in-house build. The most dramatic product experience that you're going to see as an end user is going from model one to model two or model three.

Model one is the referral or ISO model. ISO stands for “independent sales organization,” where the software company has a gateway integration with the payments provider, but it ends there. If the merchant wants to go sign up for the payments, they have to do that elsewhere. If they want to inquire about settlement, funds delivery or a dispute or chargeback, they have to go to the payments processor. Not the software vendor, who might be the primary relationship and the reason that they have that payments provider.

I’ll use one of our customers, Clubessential, as an example of what you get when you go from, let's say, model one to model three. They're a Cincinnati-based fitness and wellness club management platform. They're narrowly focused and this is vertical. The experience before is that a club would have to sign up for their software and then also sign up for a payments provider. When that club had a question about why a transaction was declined or why there was a dispute, they would go to Clubessential first. Then there was an operational burden on Clubessential to go and seek that information from the payments processor themselves. Often they couldn't get that information, because the direct relationship was between the merchant and the payments provider underneath the surface. By going to model three -- where Clubessential has become a payment facilitator using Finix’s software -- they can answer those questions themselves because they essentially are a mini processor. The software and the payments are delivered from one entity and in one experience, which increases the happy path scenario, where the merchant can get their questions answered and there's less operational burden on Clubessential in this case.

But it doesn't stop there. We've seen other clients that I won't name, but they were able to build custom funds flows because they were able to receive an approval from an underlying bank sponsor that wasn't something offered off the shelf under model number two. The specific example I'm thinking about is: we have a client who wanted to pay back loans from credit card proceeds. You can imagine the benefit if you were the small business who's receiving a loan. You don't have to have this funds flow issue, where you're waiting to get a line of credit opened and you get your funds delivered into your bank account, only to turn around and pay them back to the same entity that's delivering the funds from your credit card processing. You can just automatically have it go back to pay back your loan and keep your credit line open or higher than it was otherwise.

That type of invisibility and effortless experience is exactly what you enable by merging software and payments. On the left side of this distribution, there are a lot more disjointed and separate experiences. It's a bit of a spectrum, but that's really what you unlock by combining these things. It's not just transactional, it's not just the economics. There are great benefits, like we saw when Lightspeed used Finix with Worldpay to launch Lightspeed Payments in 2019. You can see in their public filings that they expected to double their take rate per transaction, and that turned out to be true and then even a bit more.

Then the last thing that this does is it reduces churn. If you're getting your payments and your software from one provider and it's a great experience, because of all these things we just talked about -- or maybe even the software company can subsidize and offer cheaper rates because they're making money from payments, not just software, or vice versa -- that relationship will exist longer into the future, which pushes up your lifetime value.

Finix is a payment facilitator for platforms and SaaS businesses.