Rohit Kaul

Research at Sacra

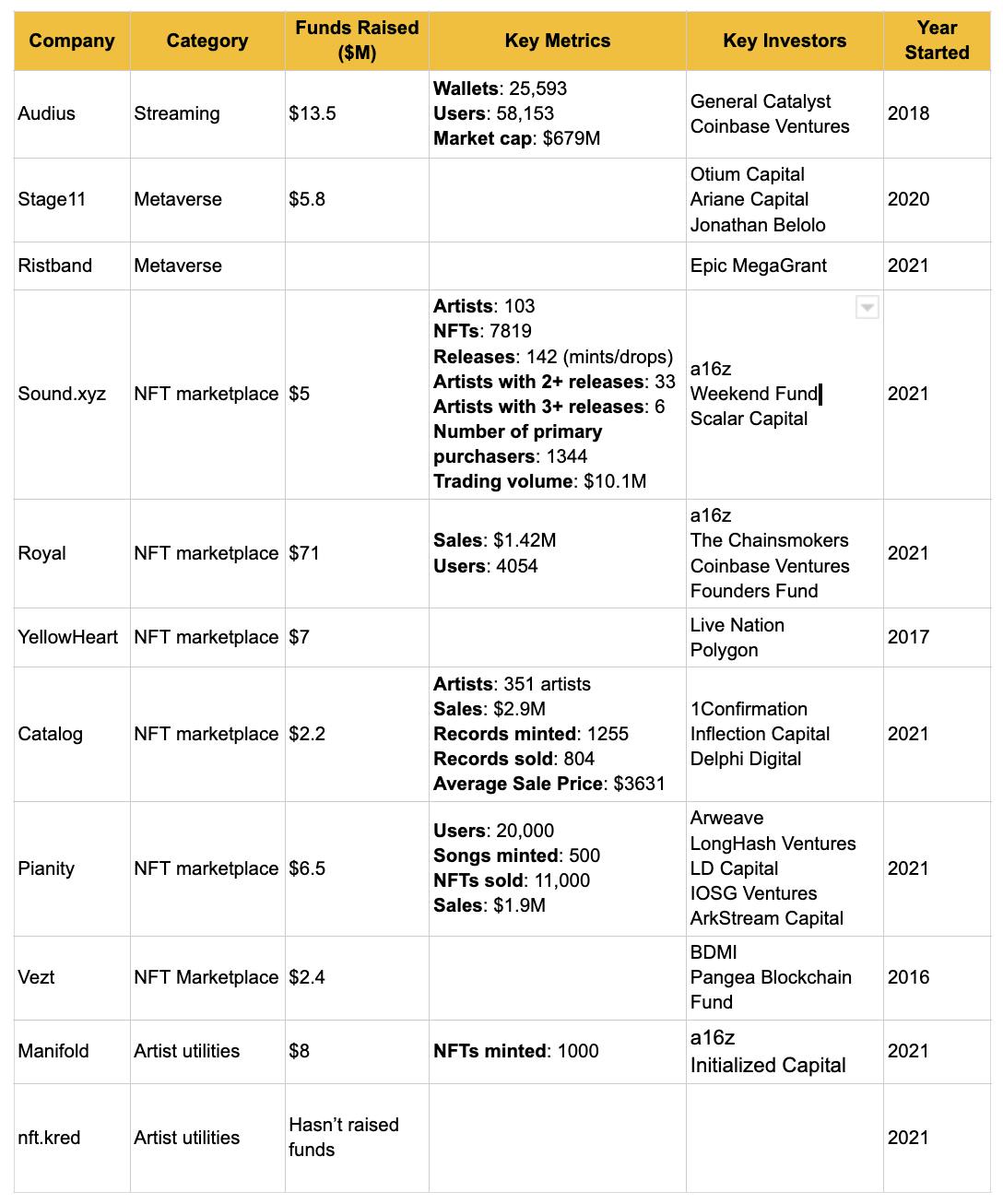

The NFT market grew exponentially in 2021, with trading volume growing to $25B from $100M in 2020. But the Web 3.0 audio market is at a very early stage, with $83M of primary sales of music NFTs in 2021. This opportunity fueled the rise of startups that extend the NFT and blockchain-based products to digital audio content and musicians. These Web 3.0 audio startups can be categorized into 4 buckets:

These marketplaces are unbundling OpenSea by providing musician-specific tools and features apart from buying/selling of NFTs. They offer one or more of these three features - Buying/selling digital audio, fan engagement, and owning music rights.

Artists sell digital audio as NFTs directly to buyers, taking out the intermediaries such as music labels, publishers, and streaming services. Apart from audio tracks, artists also bundle perks for buyers such as concert tickets, exclusive album art, community access, and digital/physical merchandise.

This is a competitive space already, with many VC-backed startups. Two key companies here are Catalog and Pianity. General-purpose NFT marketplaces such as OpenSea and Nifty Gateway also have music NFT collections.

These marketplaces go beyond buying/selling audio and use NFT/blockchain to provide artists new ways to engage with fans and monetize the engagement rather than the music tracks.

Using these platforms, artists can sell fractional copyrights to their digital music. The buyers get money from the future royalties of the songs based on their ownership rights, and artists get upfront payment to fund their projects.

Streaming platforms allow artists to upload music that listeners can stream, like SoundCloud and Spotify. However, they take out the intermediaries such as publishers, streaming services, and music labels by enabling listeners to directly pay the artists.

It’s an emerging space in the Web 3.0 audio ecosystem where companies are leveraging mixed reality, NFTs, and motion sensing to create immersive live music experiences inside metaverse that include lifelike performances, artists, and fans engagement, and artists selling concert-based merchandise.

Web 3.0 and NFTs can be difficult for artists who are not tech-savvy. These startups offer no-code tools to help artists navigate through the complexities of Web 3.0.

There are a few strong tailwinds that are driving the case for music NFTs.

Artist payment structure

Streaming platforms such as Spotify and Apple Music generate 84% of the music industry revenue of $26B. But many artists on these platforms find it difficult to make money. On Spotify, out of 472,000 active artists (10+ tracks and 1000+ monthly listeners), only 7800 (1.6%) make more than $100,000 annually. One of the key issues is the share of different entities such as publishers, music labels, and streaming platforms. NFT-based marketplaces have the promise of improving artists’ monetization by removing the intermediaries and letting the users pay the artists directly.

Sustained VC investments in crypto

There’s been an exponential increase in crypto-focused funds in the last 12 months. For instance, a16z raised $2.2B for its crypto fund and is raising another $4.5B for the next round, Katie Haun (formerly a16z) raised a $1.5B crypto fund, and Coinbase launched a $2.5B VC fund. In 2021, VCs invested $25.2B in blockchain startups. This works well for the emerging Web 3.0 audio startups.

Popular artists are experimenting with Web 3.0

Many popular artists are releasing NFTs of their music, drawing more users to NFT platforms. Kings of Leon, 3LAU, Mike Shinoda (Linkin Park), Snoop Dogg, and Grimes are some of the big names that have experimented with NFT/blockchain-based releases of their songs.

There are a few headwinds that can impact the Web 3.0 music industry.

Regulatory issues

NFTs have an uncertain regulatory environment that can impact mass adoption. The US SEC recently started an investigation to check if NFTs are utilized to raise money like traditional securities. While SEC doesn’t regulate NFTs like securities, it has hinted that it could be a possibility. Furthermore, it is possible that some or all marketplaces trading these NFTs will be considered security exchanges. Such developments can add a significant compliance burden on NFT platforms and hit the brakes on their growth.

Artist’s reputation risk

Even though many artists are experimenting with Web 3.0 and have done well-executed NFT projects, there are also projects that have gone poorly. Artists may have chosen the wrong partners or over-promised and under-delivered on a project. There is still a lot of uncertainty in the artist community about the right playbook to execute NFT projects so that they don’t come across as inauthentic or ripping off their fans.

Ownership and rights issues

There are many unanswered questions about the licensing and ownership of music NFTs. For instance, when an audio piece owned as an NFT is used for a TV commercial, how is the royalty distributed? Similarly, when a fan buys an NFT, how does the ownership or licensing rights of the music piece change in the analog world? Some of these issues have an impact on how much money NFT holders can make and a lack of clarity can hurt wider adoption.