Marcelo Ballvé

Head of Research at Sacra

We completed a high-level survey of competitors in the second-hand clothing (SHC) market to gauge basic trends and identify benchmark companies. For the scope of this request we focused on extracting headline figures and metrics, alongside macro competitive trends. Future research might drill in on certain themes and companies, andmore granular metrics.

A handful of companies are clearly setting the pace in what remains a fragmented market. Meanwhile as a whole, the industry is confronting accelerating trends that are likely to impact competitiveness and margins in the next three to five years.

These accelerating trends include:

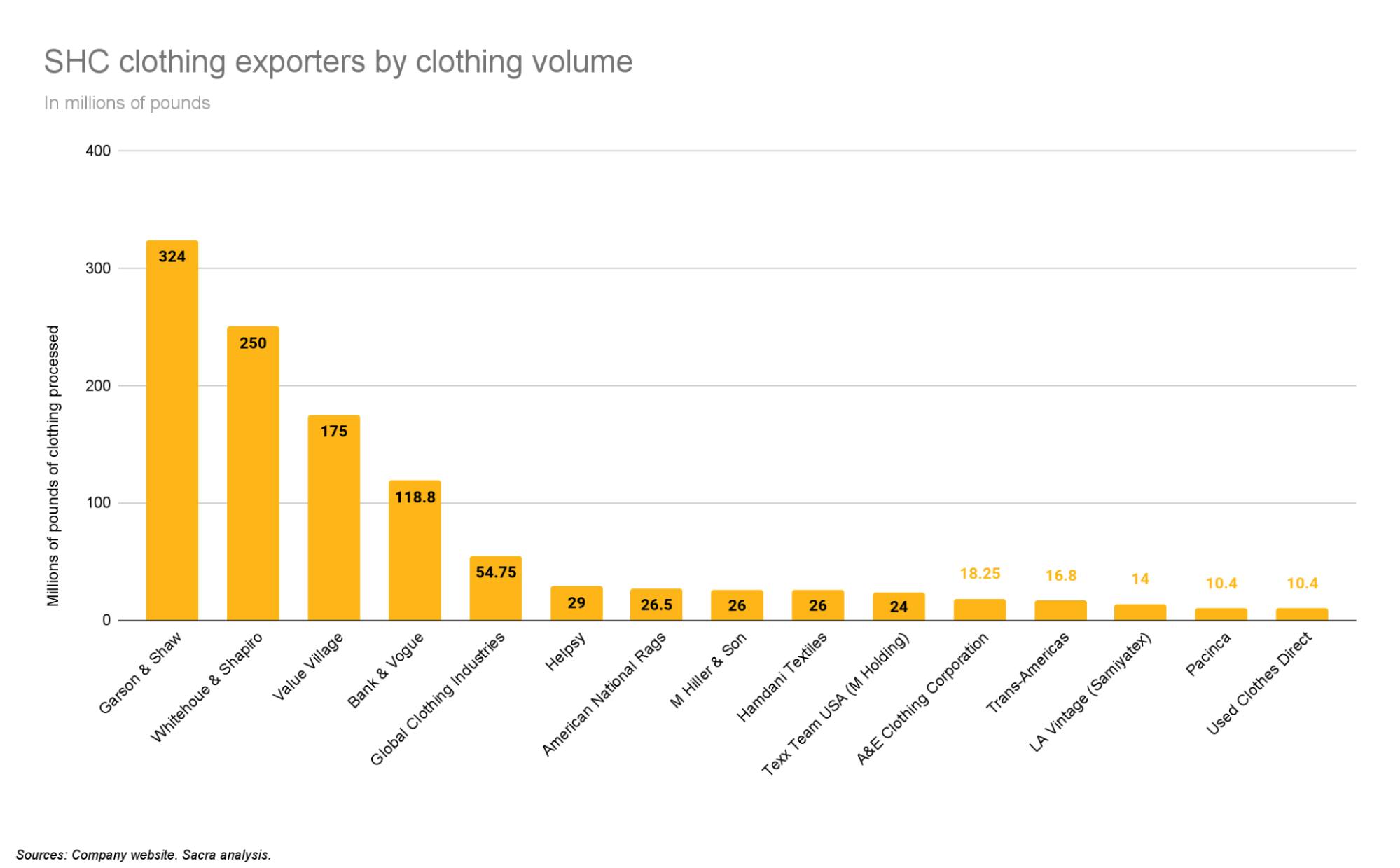

A possible categorization of this market is by the scale of SHC suppliers seen through the lens of clothing-processing volume. A clear distinction in this market can be drawn according to the cumulative weight of clothes processed annually by each supplier (see chart, below).

As seen in the chart above, the resulting market structure reveals a handful of suppliers that have meaningful scale. We define these “Scalers” as SHC operations that are processing 100 million or more pounds of used clothing per year.

Beyond these companies there are two subscale categories, those we call “Contenders,” which are processing 50 million or more pounds annually, and “Strivers,” which are processing between 10 million and 49 million pounds of clothing per year. Finally, there is a considerable long-tail of laggards, i.e. suppliers that process less than 10 million pounds of clothing.

There are suppliers that fall outside this classification because they operate solely as intermediaries. Their arbitrage is to buy large weights of used clothing and further take advantage of their cost-advantaged lightweight operations — i.e. lack of warehouses, equipment, and staff — to price their clothing at a modest mark-up. Thus, they achieve a niche in the market despite having to source from wholesalers themselves. Some are specialists — they curate according to suppliers, geographies, or grades — and lean into sourcing niches in order to achieve a desirable balance between quantity and quality.

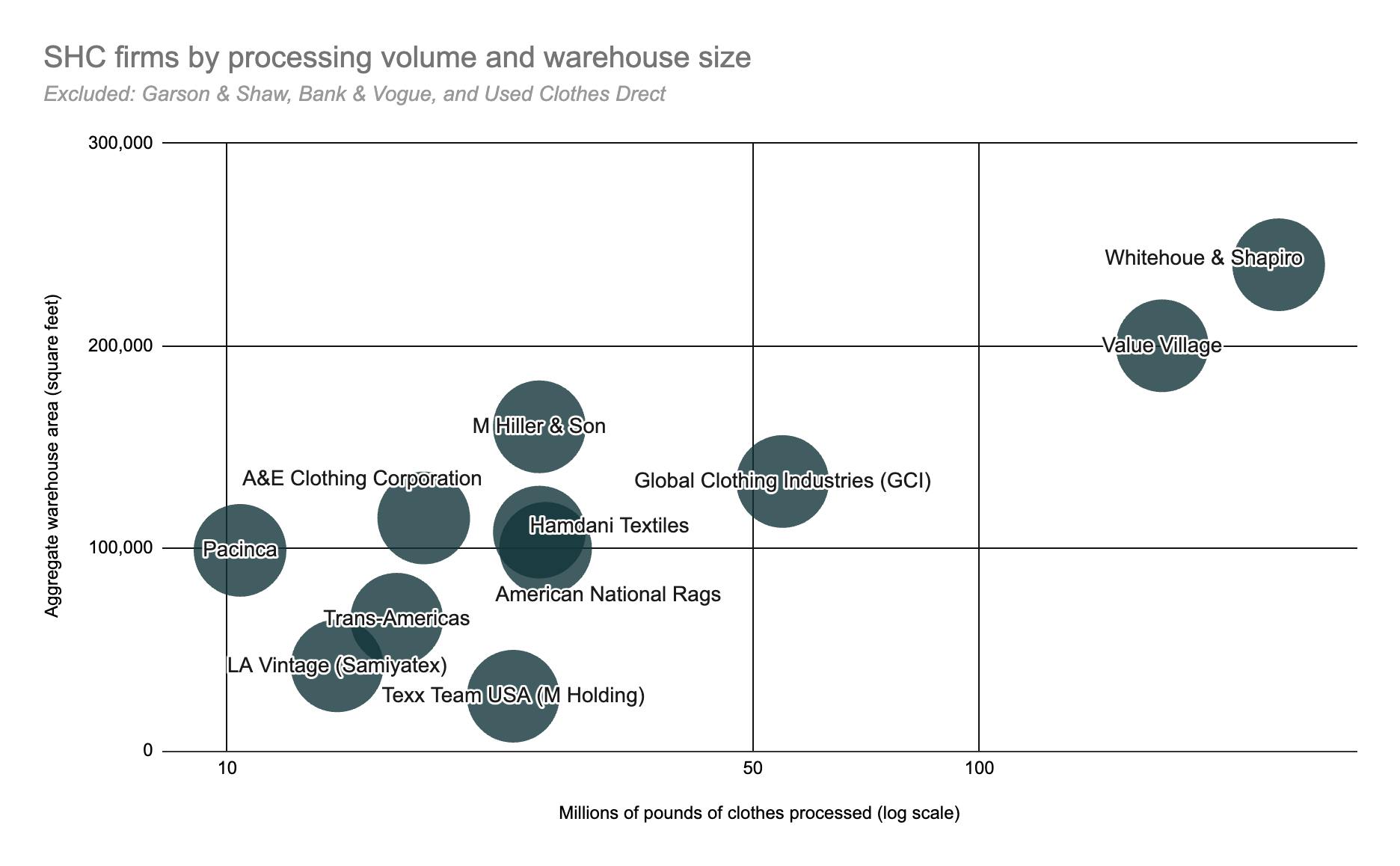

The above four classifications of SHC suppliers — Scalers, Contenders, Strivers, and Laggards — manifest other characteristics that are tied to their relative volumes of clothes processing.

One such metric is the number of employees; clothes sorting and grading operations require manual labor. That said, there is equipment that can automate or speed some of this work, including automated balers, conveyors, etc.

Another is the size — in terms of area — of the facilities that are able to house the sorting and storage operations. As can be seen in the chart above, total warehouse floor space correlates positively with the volume of clothing processed annually. Firms handling larger volumes have a larger real estate footprint.

This is somewhat obvious, as clothing is bulky and somewhat prone to deterioration. Processing it requires relatively large, roofed, and moisture- and temperature-controlled areas. Whitehouse & Schapiro in the Baltimore area, and Savers Value Village in Canada are two firms that have aggregate warehouse space of 200,000 square feet or more, according to company websites and media coverage.

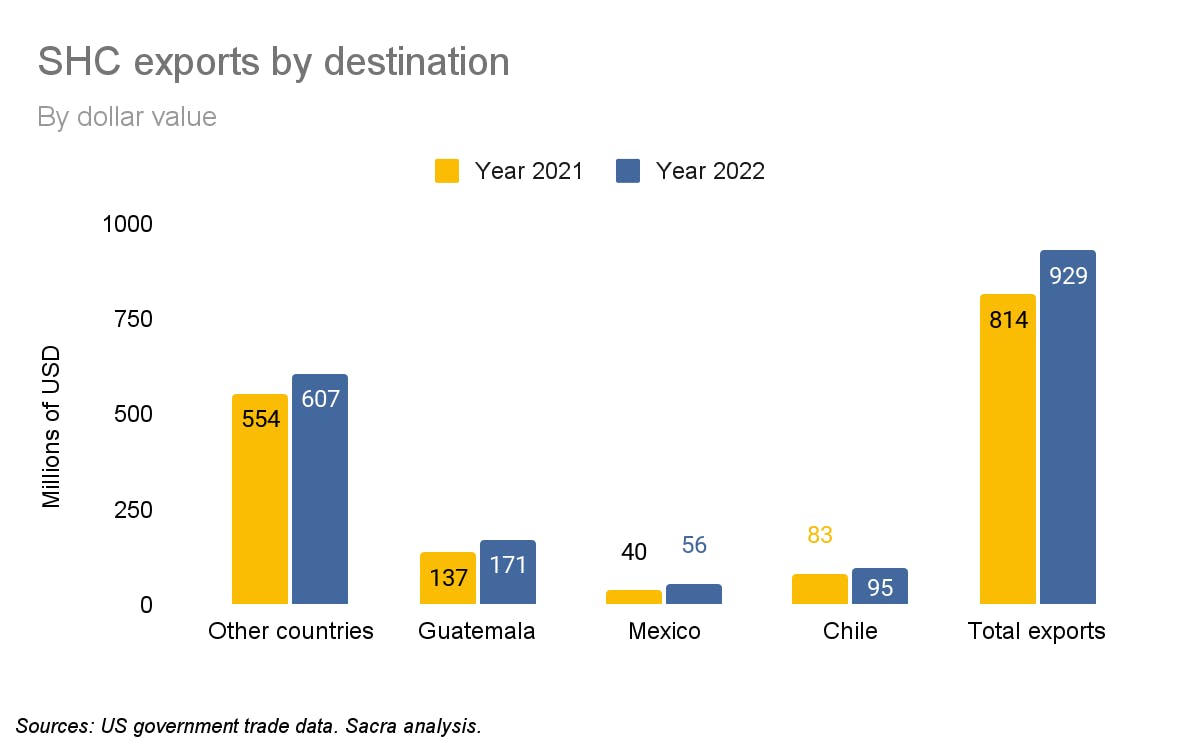

Between 2021 and 2022, US used clothing exports grew by 14%, to $929 million, on track to break the $1B mark in 2023, according to US government trade data. Exports to Mexico and Chile grew by 40% and 25%, respectively.

US exports grew more quickly from 2020 to 2021, when they expanded by some 35%, according to the OEC, but that may be a post-COVID bump.

The percentage increase in export growth is likely a more accurate representation of industry growth overall than broad-based numbers on the textile-recycling, secondhand clothing, and thrift industries. They are a more accurate reflection of the revenue pool tied to exporting SHC clothing in bulk, while other figures tend to include other revenue streams tied to manufacturing, retail, and textile reuse domestically.

Many of the firms that sort and process used clothing will have several streams of revenue.

The prices for export-worthy reusable clothing is at least 4x higher than that for degraded or dirty clothes used for rags or other upcycling. So, smart sourcing, alongside efficient and effective sorting, are meaningful in stewarding revenue quality.

A full treatment of these trends is beyond the scope of this memo, but example “mini cases” can make the points clear and crystallize the potential impacts of these trends.

Consolidation and efforts to leverage scale are beginning to push through this industry. Larger firms are acquiring smaller SHC exporters or effecting expansions in search of scale and better margins. Some examples:

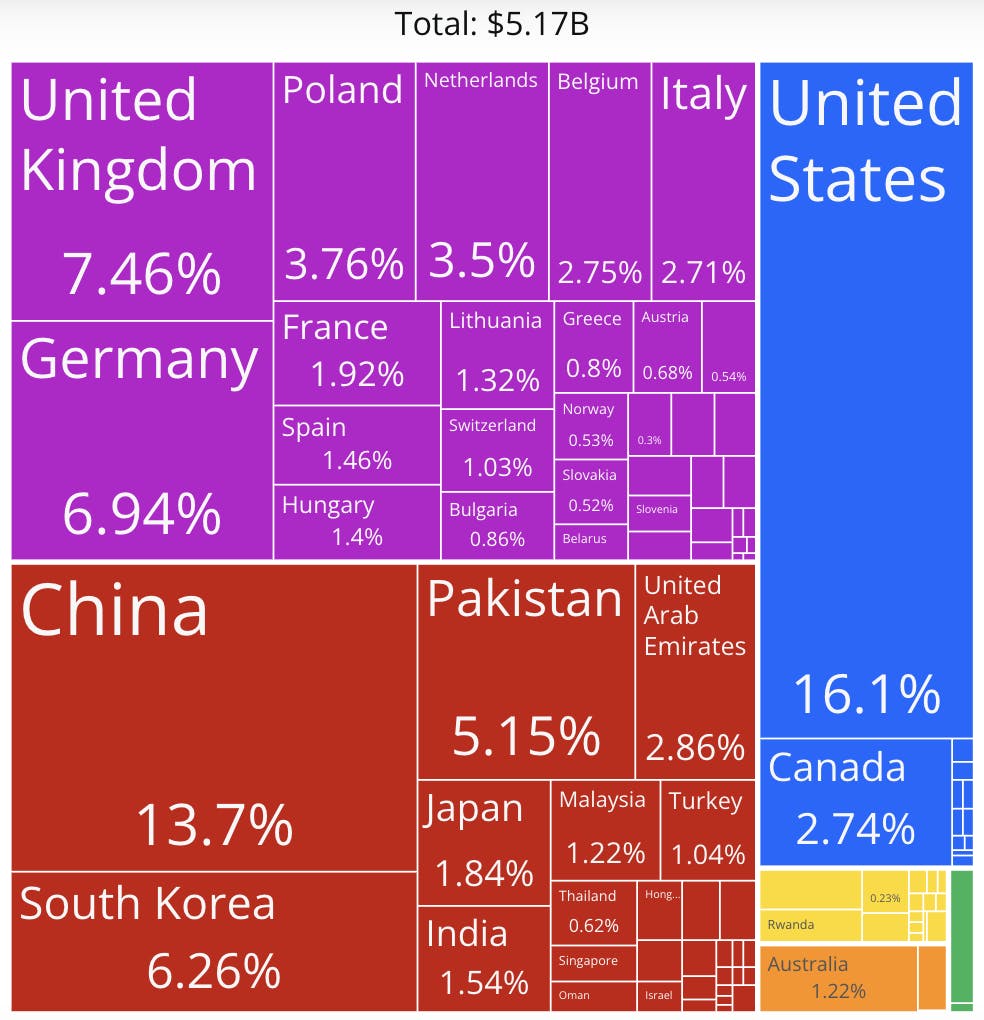

China is emerging as a major exporter of SHC, particularly to Africa. Chinese exports of SHC are growing more quickly than US exports, having seen 84% growth in export value in 2021, vs. 35% in the US in that year (as already mentioned). The value of Chinese SHC exports have grown in the triple digits in many African markets (164% in Angola between 2020 and 2021).

China was a close second place to the United States in volume of SHC exports in 2021.

China has a 13.7% share of global exports of $5.17 billion in that year (Source: OEC).

The volume handled by Hissen Global, and the increasing prevalence of western-style clothing of consumer quality in China, indicates that it will be able to price competitively in any markets where it competes head to head with US- or Canada-based suppliers.

New technologies promise to reduce the manpower needs of key stages in the processing and sorting of clothing.

Assembly-line style approaches are already the norm in the industry, as much depends on the accuracy of sorting.

Hamdani Textiles assembly lines for sorting used clothes.

Precision is important for yield. Reusable clothing must be processed into the more expensive for-export bales often classified by the type of clothing (e.g. women’s blouses, “tropical blends” of shorts and T-shirts). These must be set aside from textiles destined for waste, rags, or processing into new products.

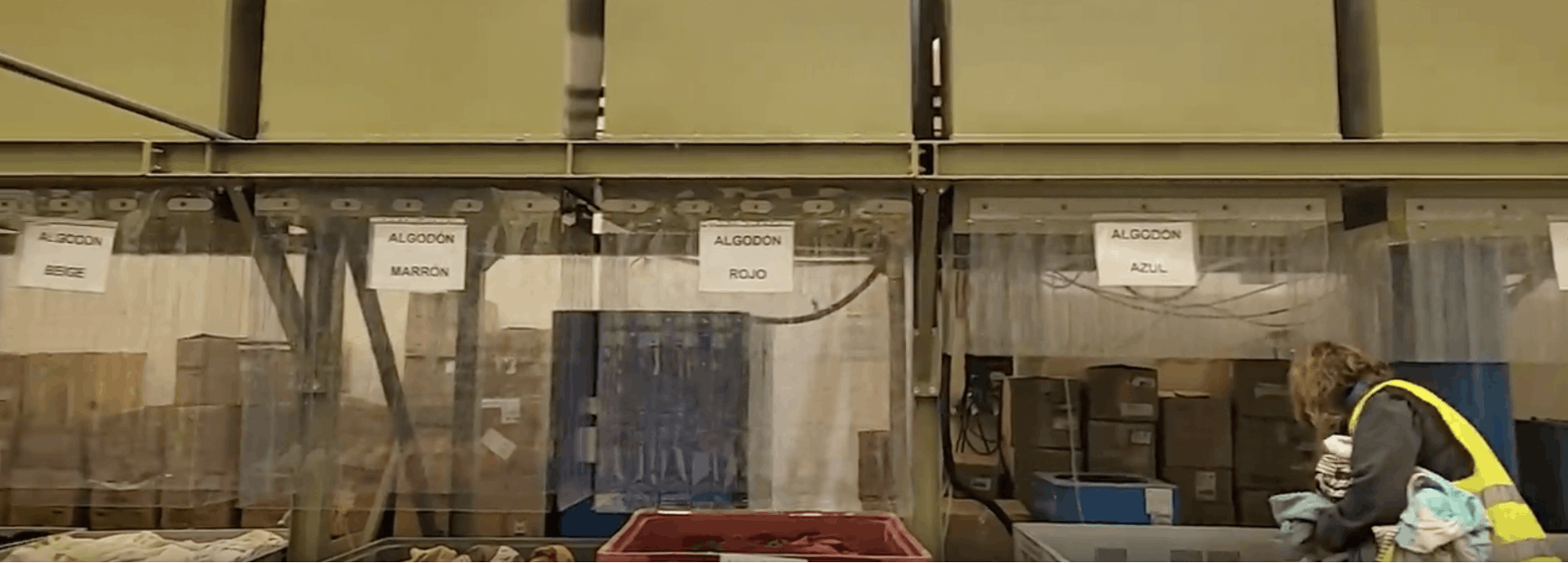

A worker at Coleo Recycling in Spain collects clothing pre-sorted by a Picvisa Ecosort Textil unit.

A promising technology in this regard is optical sorting, which is able to automate the processing of clothes by color, shape (garment type), and components (textile material) through a combination of deep learning, computer vision, and spectroscopy. In the latter, NIR or near-infrared technology, is used to detect the fiber content of clothing. This allows for pre-sorting of, say, white cotton T-shirts from garments using polyester and synthetic fibers, and/or garments of other colors and types. It is easy to imagine variations of this technology and applications relevant to for-export used clothing operations.

The example here is Megapaca, which is gaining leverage both by growing scale regionally (which increases their price-negotiating power), adopting technology, and by expanding up and down the value chain.