- Valuation Model

- Expert Interviews

- Founders, funding

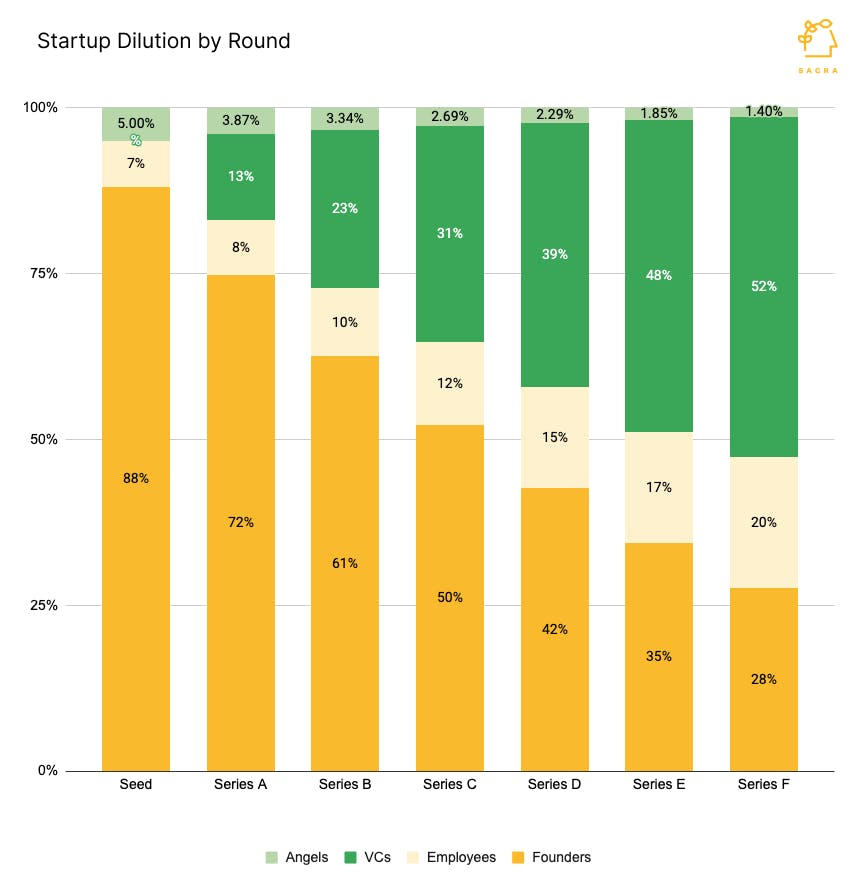

What is the distribution of startup ownership across funding rounds?

Jan-Erik Asplund

Co-Founder at Sacra

When a new startup is formed, founders start out owning 100%. They give some away to their earliest employees, raise a seed round, and might start an employee option pool—a reserved batch of shares for future employees.

Once startups start raising priced rounds from VCs, it was typical as of a few years ago for companies to expect to dilute about 20% with each round—today, we’re seeing investors comfortable with smaller, 10-15% stakes.

The result is more equity kept in the hands of founders. Above is a representative example of what the overall distribution of startup ownership might look like for a company that goes from seed to Series F. Founders are diluted down to about 28% ownership by the Series F stage, while larger investors (VCs) own 52%. Seed investors who don't reinvest in the company still see their stakes significantly diluted, from about 5% at inception to around 1% at Series F.

All of this can vary greatly from company to company depending on how much is raised and on what terms. Here are some examples of where founder equity (collectively) has been at IPO across various software companies:

- Atlassian: 75%

- Tableau: 49%

- LinkedIn: 21%

- Splunk: 12%

- Yelp: 11%

- Pandora: 2%

Overall, founders own a rough average of 15% of their companies at IPO. Employees own between 20% and 30%, and investors own between 55% and 65%.