Jan-Erik Asplund

Co-Founder at Sacra

Zapier's model for generating integrations fundamentally had to do with their strategy for dealing with the SaaS companies on the supply side. They incentivized SaaS vendors to integrate themselves with Zapier so they could get access to distribution.

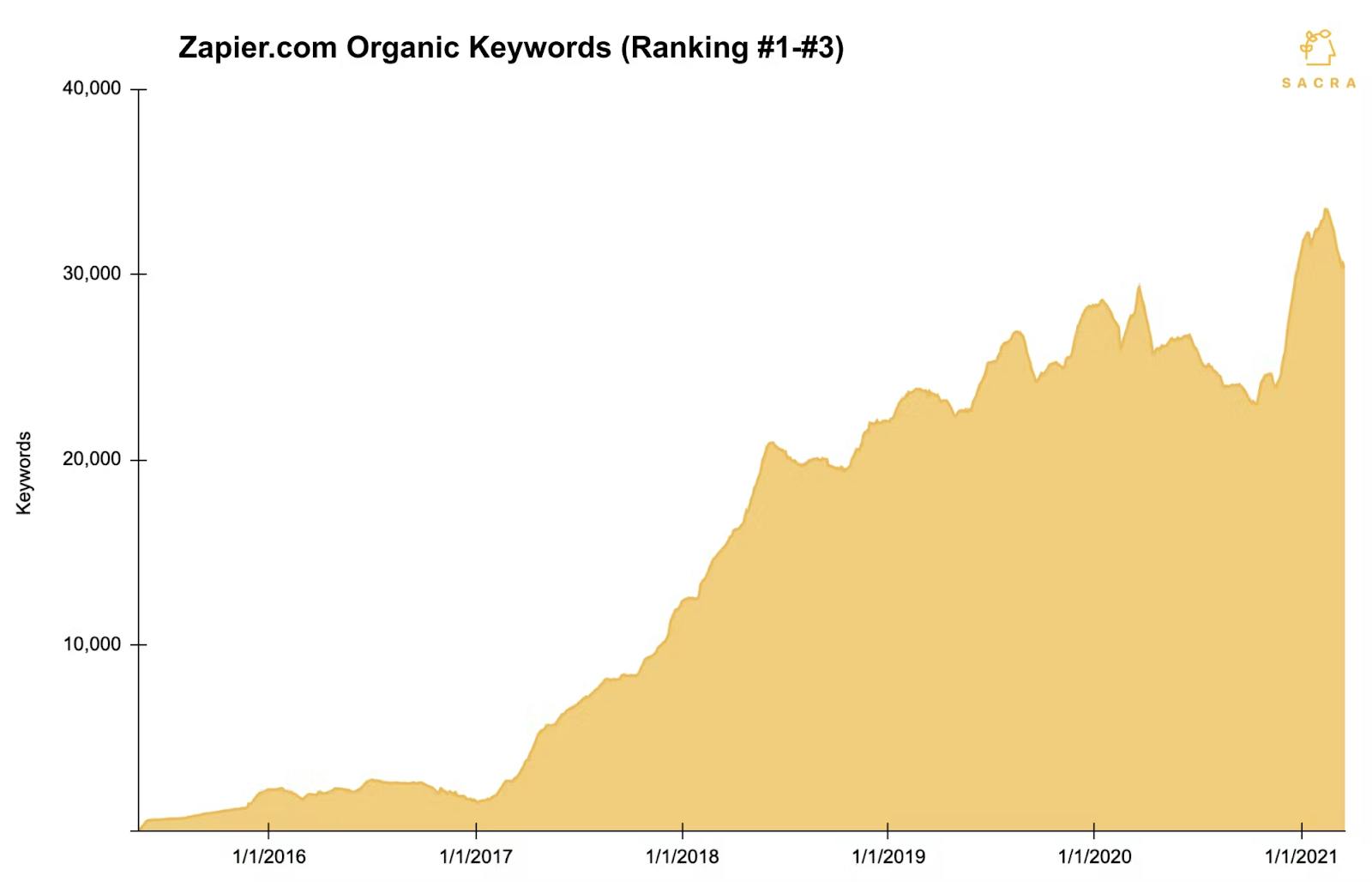

This was possible because of how Zapier grew—quickly and in a capital efficient way (raising only $1.4M to get to $140M+ ARR)—based on being first to the programmatic SEO strategy of ranking for two company names put together: e.g. “dropbox gmail integration”.

They came to own demand for integrations to the point where you could call them an aggregator: the same way that Google or Facebook or Netflix aggregated the suppliers of content (publishers), Zapier aggregated the suppliers of apps (SaaS companies).

This is why we refer to them as the “Neflix of productivity” in the report. Netflix aggregated movie and television content and then used the data they were able to gather as a result to create their own content with better unit economics and a competitive advantage over other content.

Similarly, Zapier took individual SaaS apps and modularized them, making them all accessible (and interchangeable) via their platform—and then set about collecting data on how people use those apps so they could offer their own apps (keeping users inside the Zapier ecosystem).

Where open source models have an opportunity is in finding another way to deal with the supply side: instead of incentivizing SaaS apps to integrate themselves into the platform, they can find low-cost ways to incentivize ecosystem developers/vendors to create and maintain these integrations.

The major upside of an open source approach is coverage—by leveraging an ecosystem of developers an open source approach to integrations can cover the long tail of all connectors between different SaaS apps.

The main downsides would be potentially lower quality or worse uptime, plus less functionality—3rd party developers rely on open APIs to build integrations, while SaaS companies themselves aren't limited, and can build more fully-featured integrations.

Given the lead that Zapier now have in their 5,000 integrations and their dominance of search results, it would be really difficult to compete with them head-on as an aggregator.

That said, there are a few strategies that exist for competing with Zapier in other ways.

Where Amazon commoditized its suppliers en route to building a massive fulfillment network, growing choice, and bringing costs as low as possible, Shopify took the alternative tack.

Shopify became a platform and “armed the rebels” by empowering suppliers (ecommerce merchants) to get their own customers, accept their own payments, and build their own businesses—they enabled all merchants to compete with Amazon.

That alternative approach has allowed both businesses to thrive and grow because they fundamentally serve different types of businesses, and the overall ecommerce world is huge enough to justify both approaches.

Zapier is like Amazon—its core customer is the end-user of their “zaps”, and SaaS companies are the supply that they are trying to commoditize. By aggregating SaaS apps on their platform, they make it easier and easier to build integrations and they accumulate internal network effects that help them build better products.

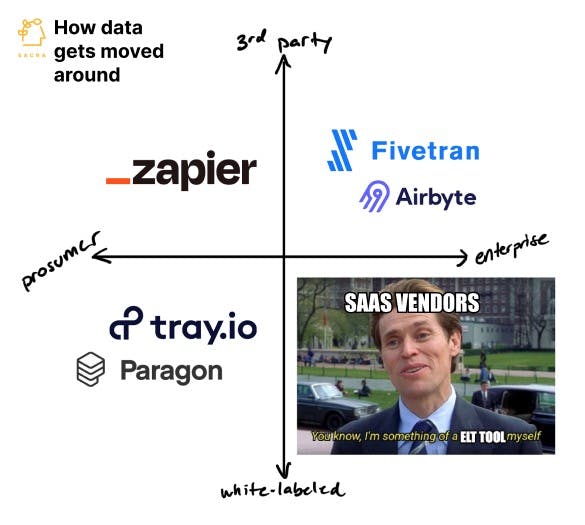

What we don’t have yet is a “Shopify” to Zapier’s Amazon, though a few players have emerged here, such as Paragon. Instead of commoditizing SaaS apps by offering integrations between them in their own marketplace, what platform approach companies can do is empower SaaS companies to offer their own native, white-labeled integrations.

Native, white-labeled integrations have the benefit of offering users a better customer experience since the SaaS company itself owns the integration—and can therefore build more fully-featured integrations more embedded into the flow of the application itself. Also, they offer SaaS companies insights—since they can see how people are using their integrations and what other apps they’re connecting with (data Zapier does not provide its partners today).

A platform like this could become the service that behind the scenes empowers everyone to compete with Zapier indirectly by providing every SaaS tool with the ability to provide integrations.

This approach bears some similarity to what open source projects like Frigg and Flogo are doing in competing with Zapier: instead of trying to compete on number of integrations, they're trying to help SaaS vendors build their own powerful native integrations.

The core advantage that open source companies might have in taking an "arming the rebels" approach to competing with Zapier would be their ability to get better traction with the engineering teams at SaaS vendors responsible for building out native integrations—for those engineers, using an open source "white labeled Zapier" means that instead of ceding this core functionality of their product to a product like Zapier or to another piece of proprietary software, they can fully customize their implementation, get access to a community of other developers building similar native integrations, and build in a cost-effective way.

Fivetran took a lead in the data warehouse integrators space by raising $728.1M to build roughly 200 connectors between Snowflake/Redshift and apps like Salesforce, HubSpot, and Facebook.

For teams that are looking for ways to connect their SaaS apps to their data warehouse without investing time in building and maintaining connectors themselves, Fivetran offers a set of clean, working integrations off the shelf.

Airbyte, despite launching 8 years later, has matched Fivetran on number of connectors by taking an open source approach and looking to own the long tail of data integrations.

With Airbyte, connectors are not built by Airbyte—they’re built and maintained by the data and analytics engineers who implement them at companies.

What they’re targeting is the fact that as the use of data warehouses to centralize data grows across organizations, the need for different integrations grows and a company like Fivetran can’t necessarily provide all the connectors that teams need.

By making their toolset and community available to data engineers who need to build novel connectors between SaaS apps and data warehouses, they can both ride and capitalize on the secular growth of the modern data stack, growing their connector catalog until it offers far better coverage of the long tail of connectors than Fivetran can offer.

Similarly, while Zapier has 5,000 integrations, their reliance on companies to build their own integrations for Zapier means they still cover only a fraction of all the SaaS apps that could have integrations out there.

An open source competitor that incentivized developers to build and contribute integrations to a shared marketplace of connectors could outdo Zapier by catering better to that long tail of connectors.

The downside of this approach (and Airbyte’s approach) is that in general, because you’re relying on integrations created by community contributors, the quality of those integrations will not be as high as it would be if those integrations were created by a dedicated company (ala Fivetran) or by the companies themselves. You have to be either using those integrations for non-mission-critical purposes or tolerate some issues if you’re going to rely on open source integrations.

A third approach for competing with Zapier that has emerged in the last few years with the proliferation of SaaS is the workflow-centric approach.

This effectively means building a Zapier-esque product but narrowing scope onto a specific vertical of integrations and then layering on additional features designed around the workflows of companies in that specific vertical.

One prominent example here is Alloy, which is building a “Zapier for ecommerce”. Alloy offers pre-built automations for ecommerce like “Send Slack notification when a customer places an order over $500 in Shopify”.

Alloy’s opportunity arose from the fact that Shopify, despite its platform approach, has room to improve on helping third-party developers build apps for merchants—and Zapier hasn’t built out the endpoint coverage to fill in the gaps.

Alloy offers some unique, no-code automation logic specific to ecommerce that Zapier doesn’t offer, like easy batching of actions, which makes it easy to e.g. perform an action over all orders in the queue.

Alloy also offers deeper access to the API endpoints of the integrations they cover: for example, with Shopify, Alloy covers almost all of the Shopify API’s possible endpoints while tools like Zapier and Integromat cover only a portion.

WhenThen has taken a similar approach as Alloy for the world of fintech while Troops did it for sales before being acquired by Salesforce.

For companies looking to compete with Zapier, there are lessons here.

Zapier is strong when it comes to personal productivity apps: integrations between e.g. products like Sheets, Airtable, and Google Calendar.

Zapier is less strong when it comes to ecommerce, which enabled Alloy to compete with them, and less strong on payments, which allowed WhenThen to get traction.

Web3 is another big area where Zapier hasn’t built out integrations, but where we're beginning to see both companies building "Zapier for web3" and web3 companies building integrations with Zapier (like Idexo).

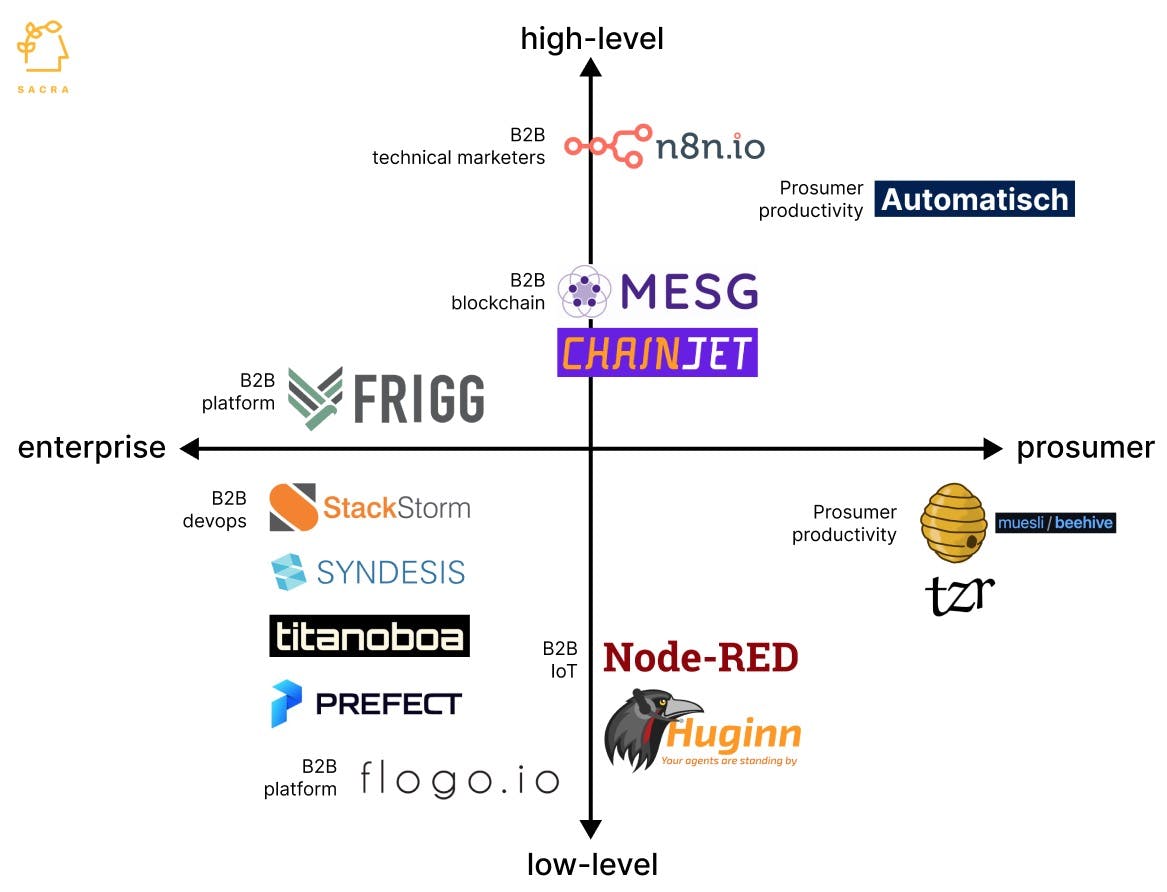

Much of the activity in the market for open source competitors to Zapier today is mainly concentrated across low-level/devops/IoT integrations that aren’t supported by Zapier.

Instead of targeting non-technical users in marketing and sales roles building workflows, these tools tend to target prosumers and devops teams that want to automate the execution of time-consuming or menial tasks: products like StackStorm, Syndesis, Titanoboa, and Prefect.

Apps like Mesg and Chainjet have looked to fill the need for a “Zapier for web3”, with the former more tailored for developers and the latter more tailored to non-technical builders.

Projects like Beehive, Automatisch and Kibitzr are closer to Zapier in building simple event/trigger automation systems that connect up common, everyday apps like Gmail, Slack, Twitter, and Discord. They’re designed for prosumers to use to hook up personal integrations, connect to select IoT devices, and query web services, and their connector marketplaces are populated by community contributors.

n8n is the biggest player in this space ($13.5M raised)—the Berlin-based automation company is backed by Sequoia, Tiny VC, and Felicis Ventures and launched in June 2019.

Instead of an impossible-to-debug Zapier that’s easy-to-use for non-technical folks or a product like Retool designed specifically to empower software engineers to write less code, n8n is in the middle: it has a visual user interface with a marketplace of ~220 off-the-shelf connectors that can be hooked up by anyone, with an open backend that a company’s developers can use to build more custom and complex integrations.

Automation tool for connecting and triggering actions across thousands of SaaS apps

Workflow automation tool for ecommerce brands and SaaS companies to build custom integrations