Jan-Erik Asplund

Co-Founder at Sacra

Neo4j is the #1 most deployed graph database platform in the world doing about $100M per year. They’re arming enterprises with the ability to deploy the kinds of data models pioneered at companies like Facebook, LinkedIn, Airbnb, Dropbox and Google to handle huge amounts of linked, complex data.

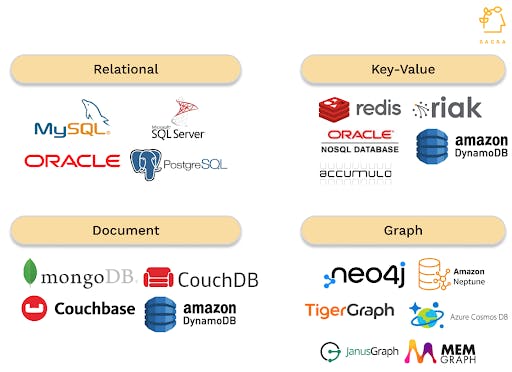

Since Neo4j was founded, Amazon (Amazon Neptune), Microsoft (Microsoft Azure Cosmos DB), Oracle (Oracle Big Data Spatial and Graph), IBM (IBM Graph) and SAP (HANA) have all launched their own competing graph databases.

What makes graph databases useful is that for any node in a dataset—like a user account, a past purchase, or a credit card number—they allow you to quickly and efficiently traverse and read from all the nodes that have some relationship with it. In a relational database, doing that requires writing a series of slow, memory-intensive joins.

This is why social networks like Facebook and LinkedIn were built on graph databases and why in recent years they have become popular for machine learning, recommendation algorithms, and fraud detection.

Neo4j is open source and drives most of its revenue from AuraDB, which is a fully managed service version of its product that is deployable via AWS or Google Cloud. AuraDB is a subscription-based service that charges based on the amount of storage used.

On top of AuraDB, they’re launching different vertical solutions and building an ecosystem of software and services (with the potential for premium pricing) to help teams solve specific problems with their graph databases, which today includes:

Neo4j’s growth to date reflects the extent to which enterprise businesses across different industries have started investing in personalization, analytics, and artificial intelligence. Neo4j has over 1,000 customers including Pfizer, PepsiCo, the WHO, CNN, BMW Group, Comcast, NASA, UBS, and Volvo Cars. More than 75% of the Fortune 100 is using Neo4j.

Today, Neo4j is overall only the 19th most deployed database platform in the world, behind relational platforms like Oracle (#1), document-based platforms like MongoDB (#5), and key-value platforms like Redis (#6). However, it’s not a winner-take-all market—there will be many winners according to use case.

While graph databases were designed for analyzing the connections inside high volumes of changing data, relational, key-value and document databases are still faster at writing information to databases and for use cases like storing time-series, logs, or large chunks of content.

The most likely outcome is that graph databases continue to exist alongside other databases that are better at other tasks. For example, you might run your ecommerce store’s product catalog on a document database like MongoDB, your cart on Redis, and your recommendation algorithm on Neo4j—with each one syncing up with the others.

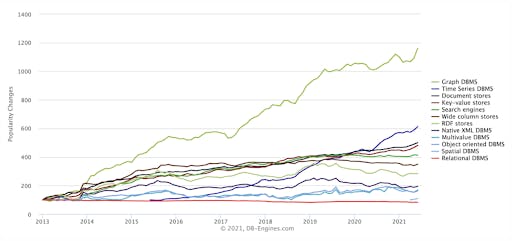

About 5 database companies have crossed $100M ARR—MongoDB, Redis, Couchbase, Datastax, and Neo4j. Graph databases, however, have been the fastest growing database category of the last decade, by a significant margin.

Neo4j’s key bet is on the continued growth of workloads involving complex relationships between nodes, and the tailwinds behind the biggest use cases for Neo4j today are significant:

Broader tailwinds include the continued expansion of the overall database and NoSQL markets: companies spent $50B on database software in 2021, a figure expected to double over the next three years.

The primary growth dynamic for Neo4j to continue to expand is customers of their managed AuraDB service growing the workloads they run through Neo4j and adding additional workloads over time, growing their spend and lock-in, both via the core product and the vertical solutions they sell on top.

Graph database for querying and analyzing complex relationships in connected data sets