Jan-Erik Asplund

Co-Founder at Sacra

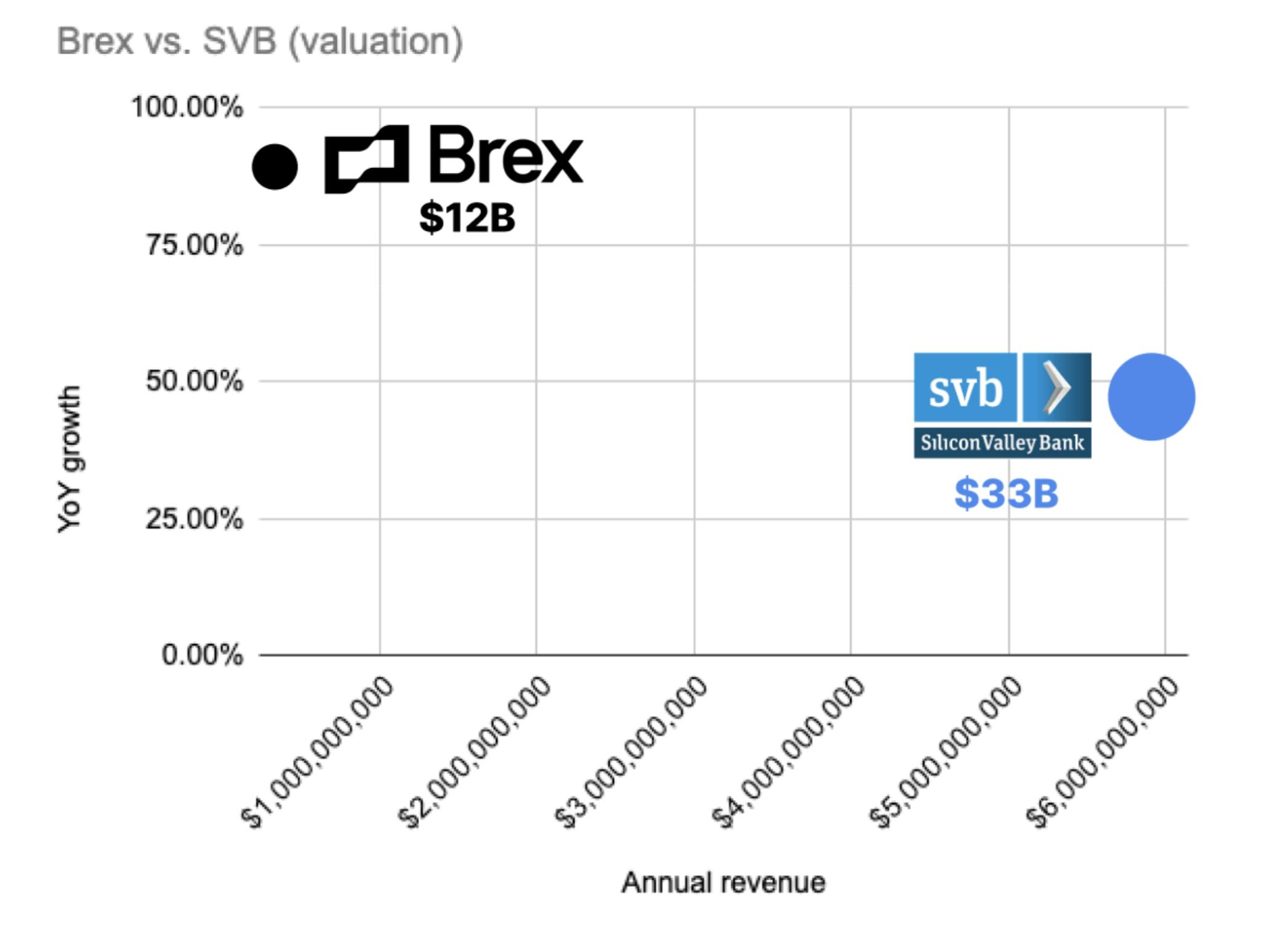

At $320M in annualized revenue, Brex’s $12.3B valuation breaks down to a 37.5x revenue multiple, on 90% year-over-year growth.

Silicon Valley Bank, which has a market cap of $33B, brought in a total of $5.9B in revenue in 2021 for a multiple of 5.6x, on revenue growth of 47% from the year before.

Here’s how SVB’s revenue mix broke down:

Both company’s 2021 growth figures benefit from being put in the context of businesses bouncing back from COVID in 2021. Notably, SVB grew its total client funds 71% in 2021, from $192B to $329B—the biggest ever expansion of their balance sheet.

SVB Q4 2021 highlights: https://s26.q4cdn.com/898615280/files/doc_presentations/2022/01/01/Q4_2021_IR_Presentation_vFINAL.pdf

SVB FY’21 annual report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0000719739/a4d73acb-d9f8-4272-a4f7-885ca051dde6.pdf