Rohit Kaul

Research at Sacra

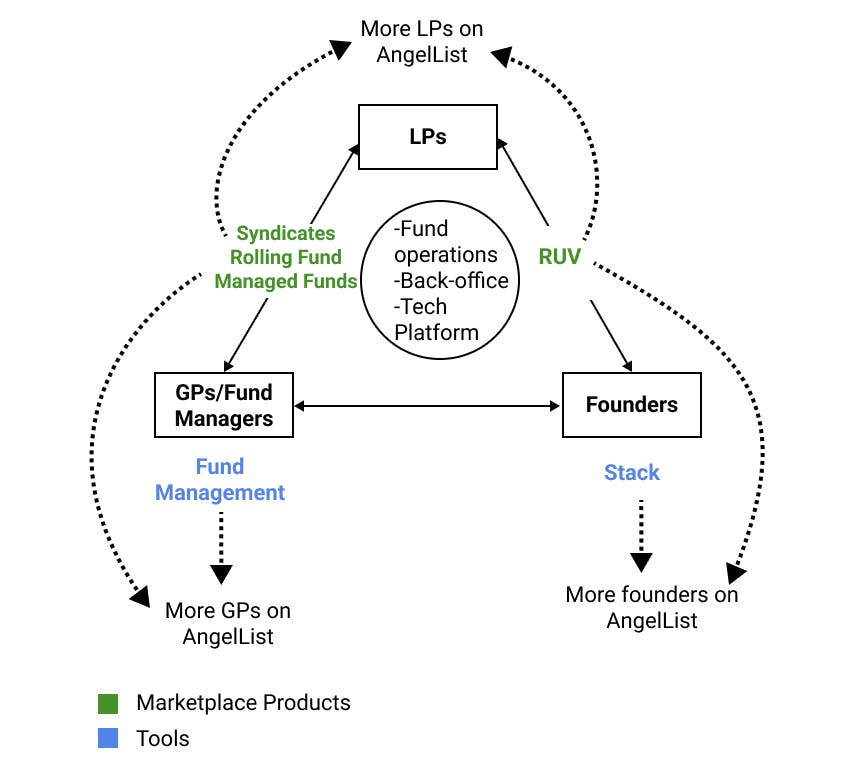

AngelList Venture was spun out of AngelList Holdings in 2020. It is a multi-sided marketplace for LPs, GPs, and founders that reduces entry barriers in fundraising and investment. AngelList monetizes through a venture fund fee structure by charging management fees and carry for most of its GP/LP products while making the products for founders free/near-free.

AngelList Venture recently raised $100M at a $4B pre-money valuation from Tiger Global and Accomplice, bringing their total raised since inception to $224M.

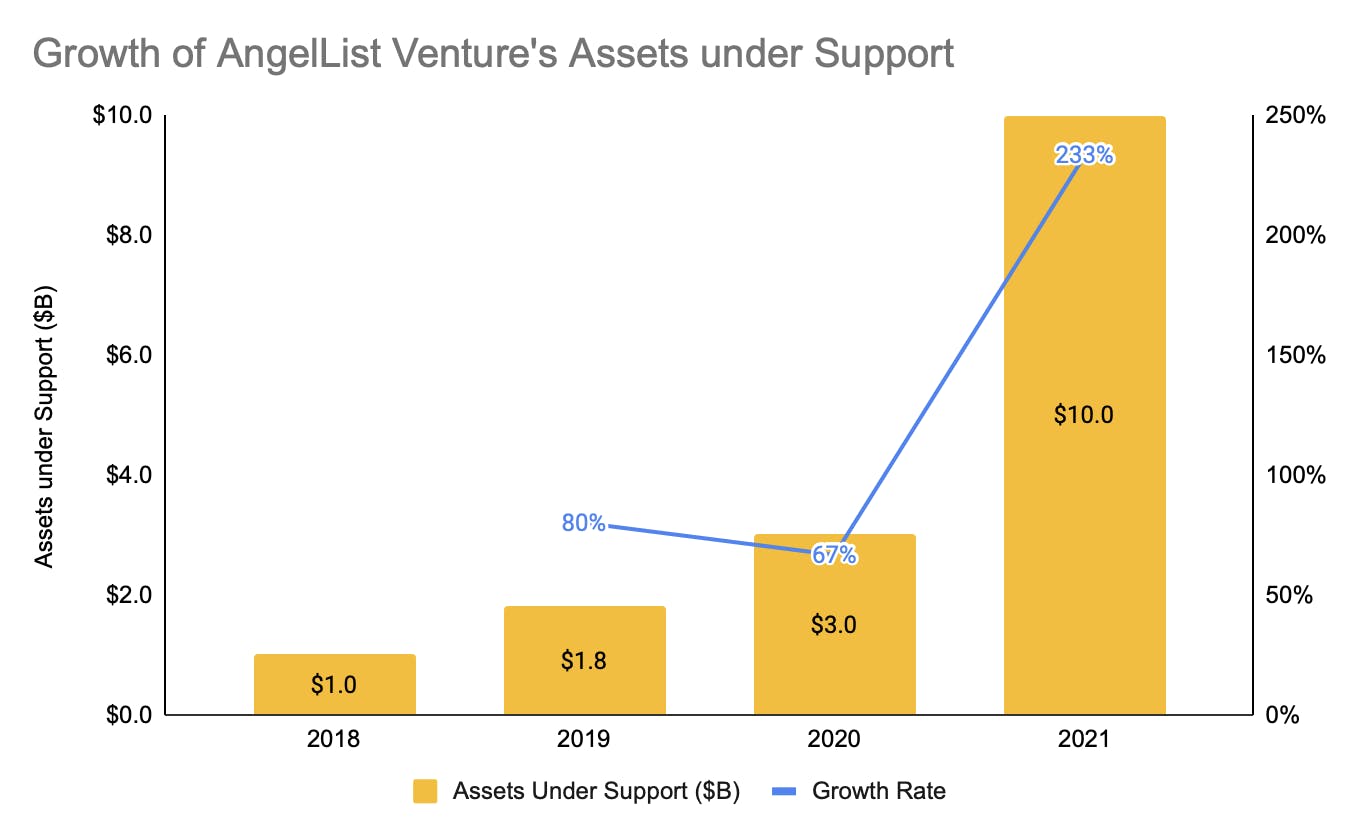

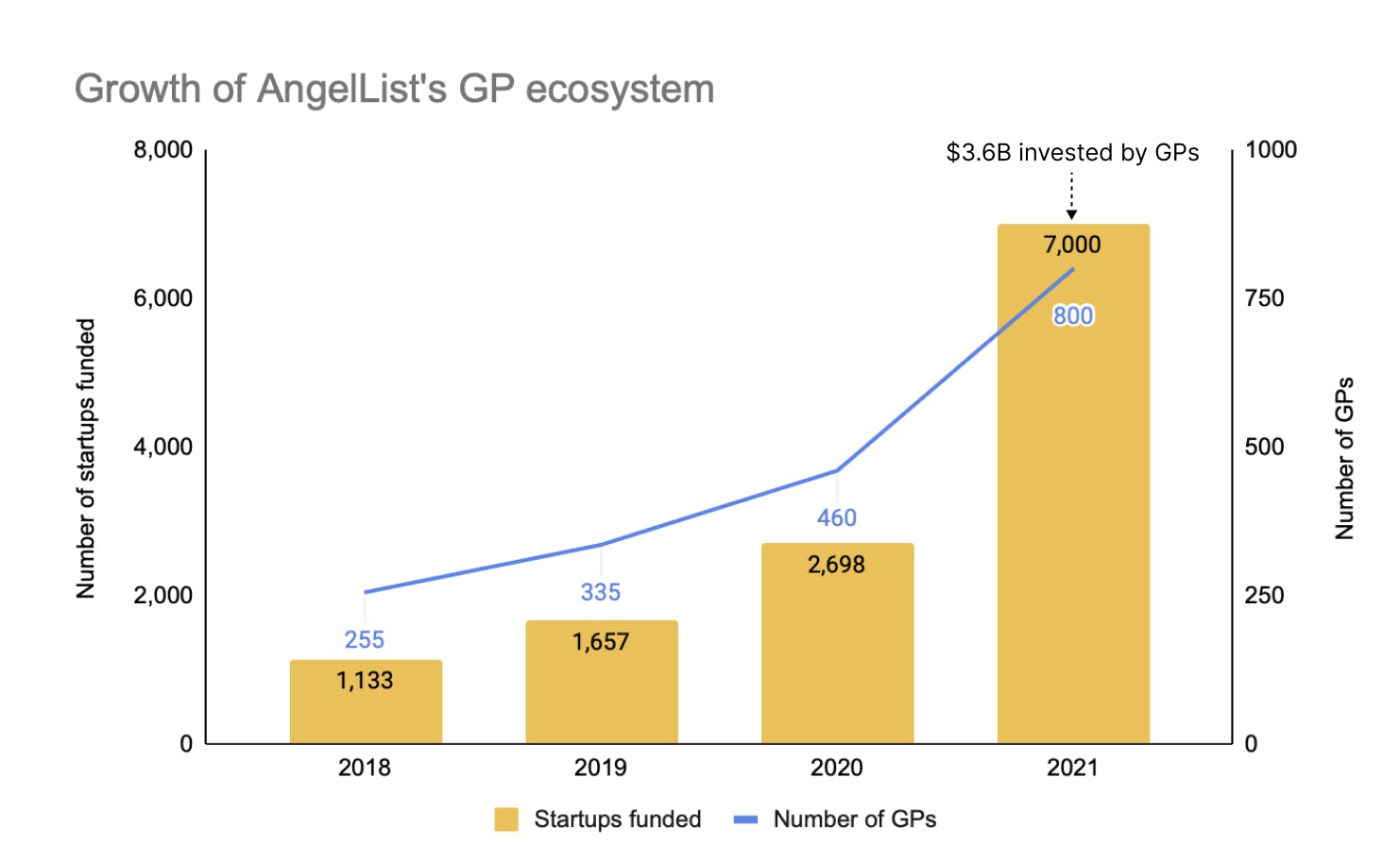

AngelList Venture’s assets under support (AUS) has increased by 10X since 2018 at a CAGR of 115.4%, while the number of GPs on AngelList has increased from 255 (2018) to 800 (2021). This growth is driven by the productization of investing and fund raising by AngelList Venture and the tailwinds of rising private company valuations in 2021.

GPs invested $3.6B into 7000 startups in 2021 using AngelList’s platform, with ~$1B from AngelList LPs (LPs who discover deals through AngelList listings).

In 2020, AngelList had 380 active funds with $3 billion in assets under support. US-wide there were ~3,680 active funds, managing $548 billion, giving AngelList a share of 10% in active funds and 0.54% in assets under support.

Its revenue streams are:

AngelList Venture is a tech-enabled multi-sided marketplace for GPs, LPs, and founders that democratizes investing/fundraising. Its products abstract away the complexities of transactions such as fundraising & investment and unlock access to the venture capital ecosystem beyond the traditional institutional investors and large venture capital funds.

It has two types of products with two different goals:

AngelList Venture lists GP funds on its platform, making it easy for individual investors/LPs to invest through AngelList, rather than through traditional VC funds or writing checks directly. AngelList LPs invested $1B+ in deals in 2021, making it an attractive source of investment for GPs beyond just the tools.

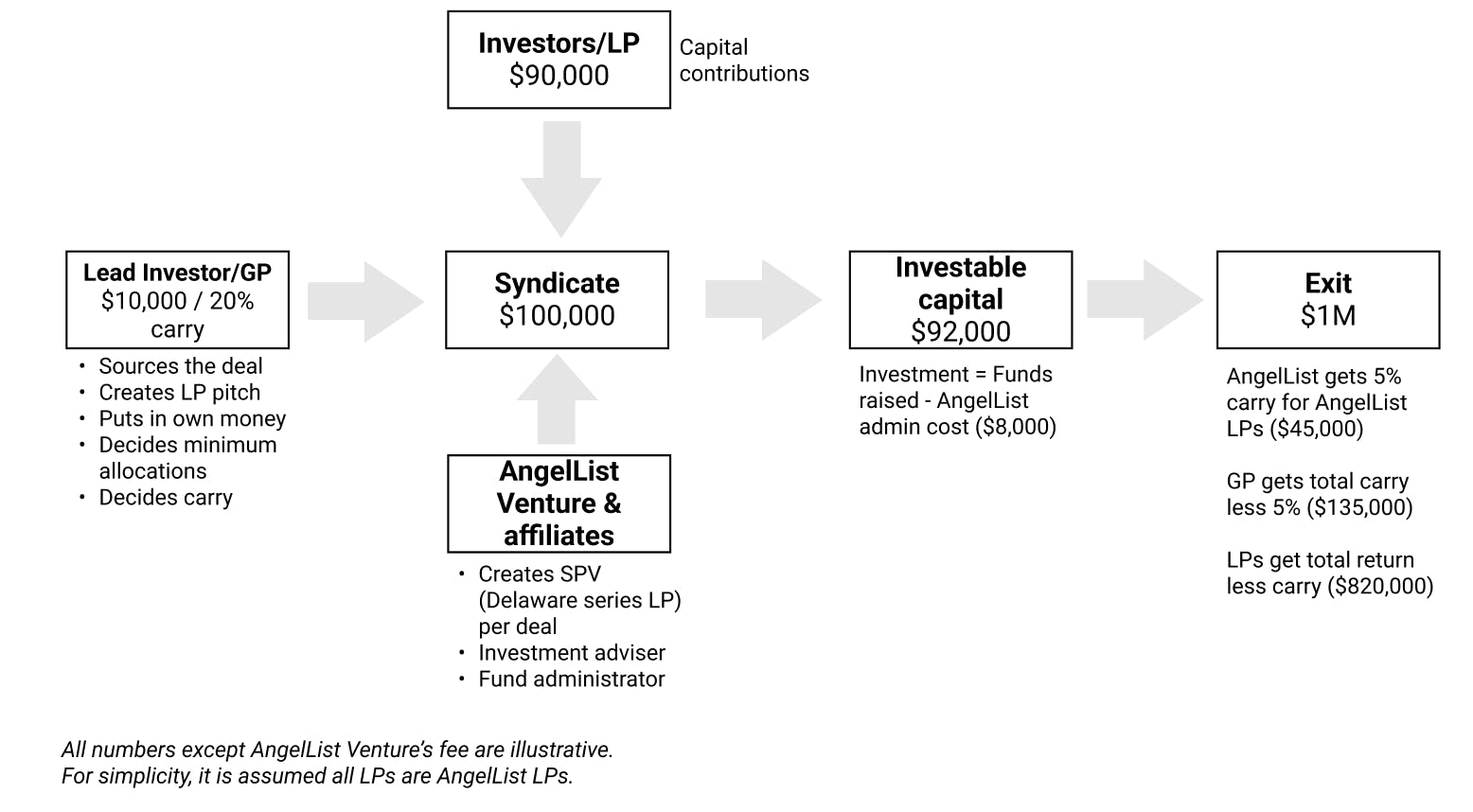

Syndicates (Launched in 2013): Syndicates was AngelList Venture’s first LP <> GP product. $1.2B+ has been invested in Syndicates by LPs thus far and ~61% of it has come from AngelList LPs.

Syndicates are SPVs that allow an individual LP to invest alongside an experienced lead investor (GP) on a deal. A GP creates a Syndicate on AngelList’s platform that makes it discoverable to AngelList LPs.

How the fund flow for AngelList Syndicates works

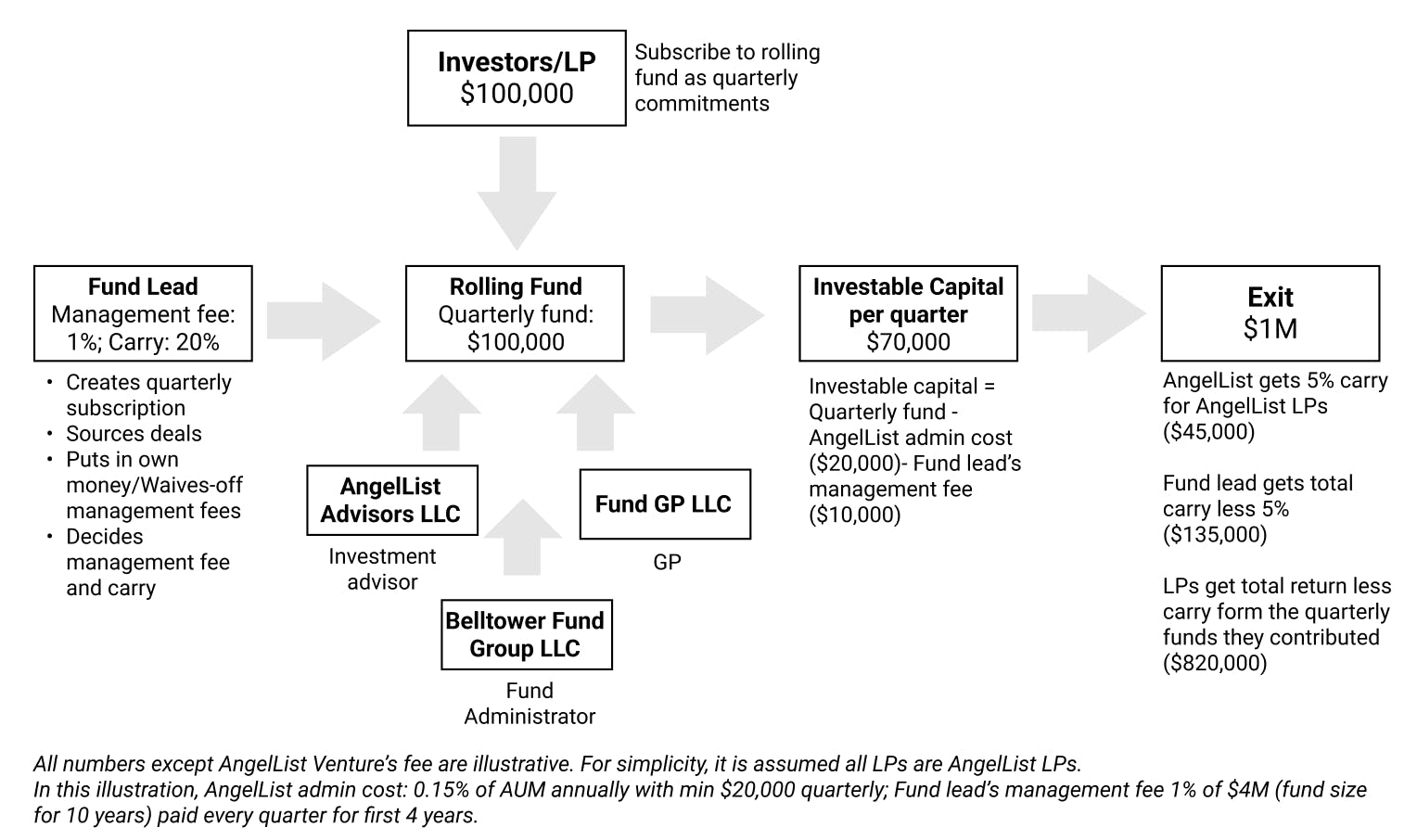

Rolling Funds (2020): Rolling Funds allow LPs to access the deal-flow of GPs as a quarterly subscription rather than a one-time commitment. GPs can accept capital anytime during a quarter and deploy it immediately in the same/next quarter. Each quarterly fund is a new SPV structured as a Delaware series Limited Partnership, set up under a Master Delaware Limited Partnership.

How the fund flow for AngelList Rolling Funds works

Rolling Funds have seen early traction with investors/operators with strong social media reputations acting as GPs. In the first eight months post-launch, 70+ rolling funds were launched. AngelList is also an LP in several rolling funds and makes money like a traditional LP. AngelList uses Belltower Fund Group as the rolling funds’ administrator to avoid conflict of interest.

“Previously the best way to start a VC fund was to build an investing track record. That takes many years. Rolling funds allow people to turn reputations into investing capital. The interesting development is that these reputations don't have to be investing-related. If you have a great network and you're well-known as an amazing founder or PM or ML expert, you can probably roll that into a rolling fund.” —Leo Polovets, Susa Ventures

Managed Funds (2015): AngelList offers funds where LPs can directly invest, managed by experienced investors from the AngelList ecosystem. These include:

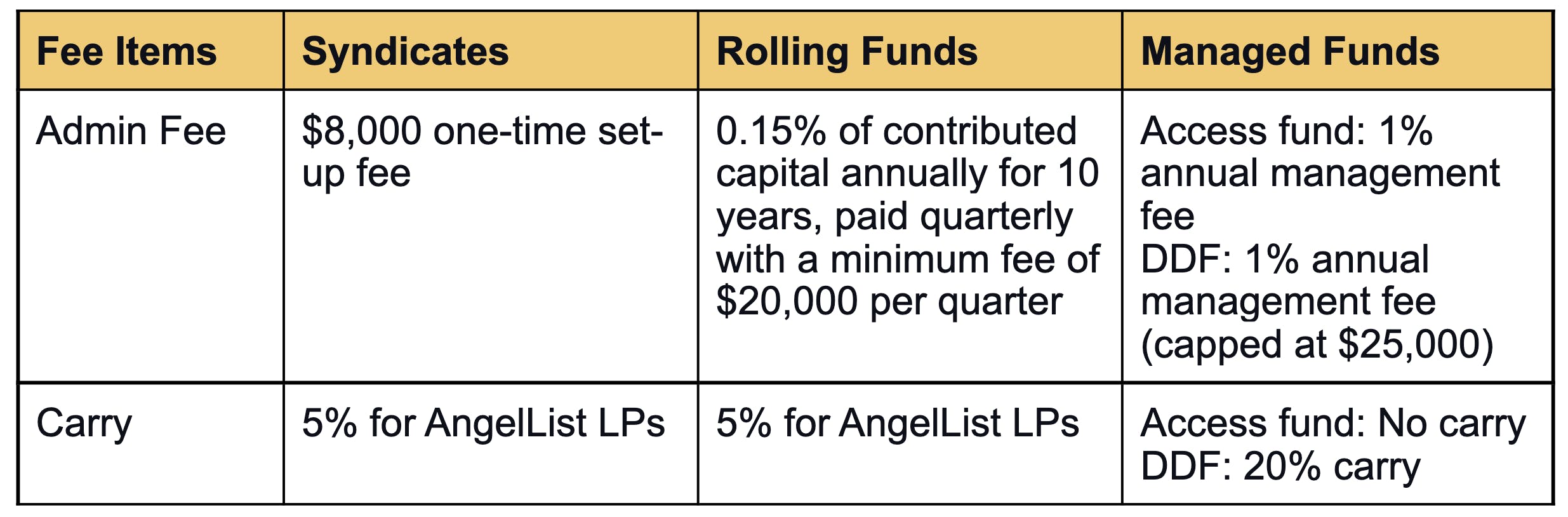

Fee structure:

For the rolling funds, GPs typically charge LPs a management fee that is 1-2% of the total fund size. This fee is calculated for 10 years fund duration and is paid to GPs over the first 4 years. The management fee is escrowed out of the investable capital every quarter. AngelList doesn’t get this money and it is paid directly to the GPs.

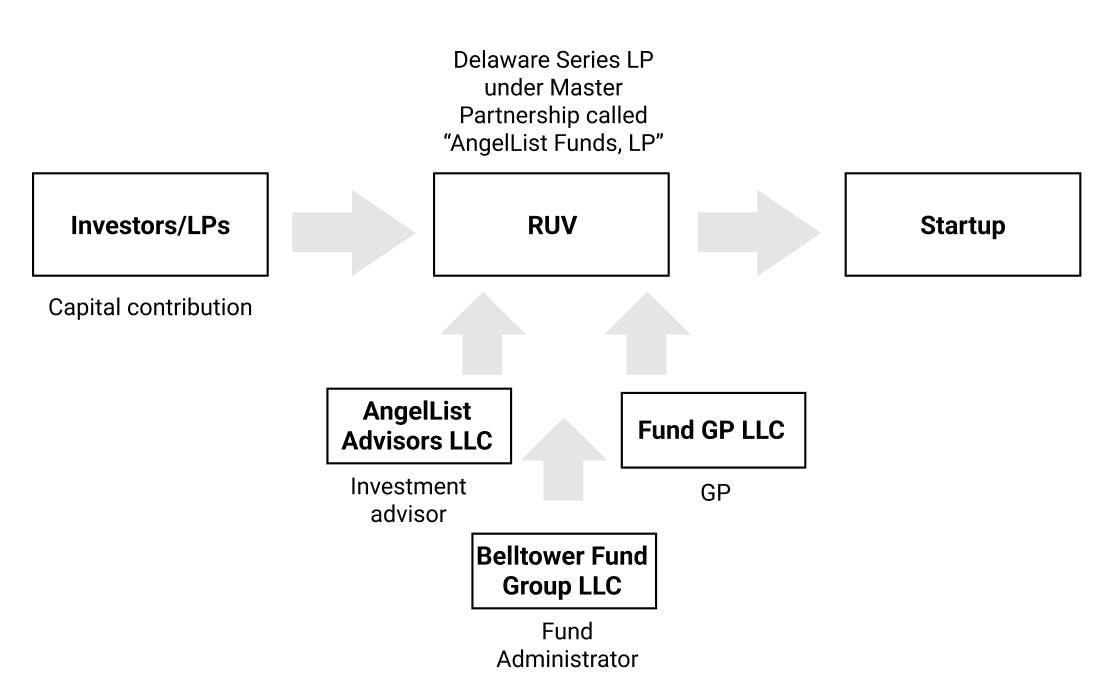

Roll Up Vehicles (2021): RUVs allow founders to consolidate allocations from up to 249 investors as a single line item on their cap table, simplifying the cap table. The fund collection and signatures process is abstracted to a single URL that founders send to investors. The deal is not published on AngelList and is accessible only to invited investors.

RUV is structured as Delaware series Limited Partnership (SPV) under the Delaware master Partnership of AngelList Funds, LP. The SPV is on the startup’s cap table and has voting rights. It can proxy back the voting rights to founders. AngelList offers it free to Delaware-based startups and charges $2500 to non-Delaware-based startups/startups requiring customizations.

Early traction for RUVs is from second-time founders who’ve gone through a messy cap table and prefer a more straightforward solution. RUVs also provide founders the ability to raise funds from potential customers. For instance, healthcare companies that sell to healthcare providers can raise RUV from them, getting their customers more deeply involved in the company’s success.

AngelList Venture has historically focused on LPs and only recently introduced products like RUVs for founders. RUV is a loss leader product launched to attract founders who bring new potential LPs to AngelList (it’s unclear if AngelList’s LP growth has stalled). Founders can themselves become LPs in the future. RUVs also allow AngelList to collect useful information about private companies that could be valuable at scale.

Structure of an RUV

Stack (2021): Stack is an all-in-one tool that provides entity formation, cap table management, banking, hiring, and fundraising tools in a single package. Stack is free to use for founders with just a $500 incorporation cost.

Fund management (2017): The fund management product allows GPs to quickly set up and run venture capital vehicles. The software makes it friction-less to receive capital from LPs, make investments, track positions, and manage fund administration.

AngelList Venture charges 1% of a fund's size (capped at $25,000 annually) and 5% carry on AngelList LPs. AngelList provides deep services to GPs such as KYC/AML of LPs, SPV set-up and documentation, tax and fund administration, accounting, and investor communications. 380+ funds use the fund management product with an AUM of $2.5B+ (2020).

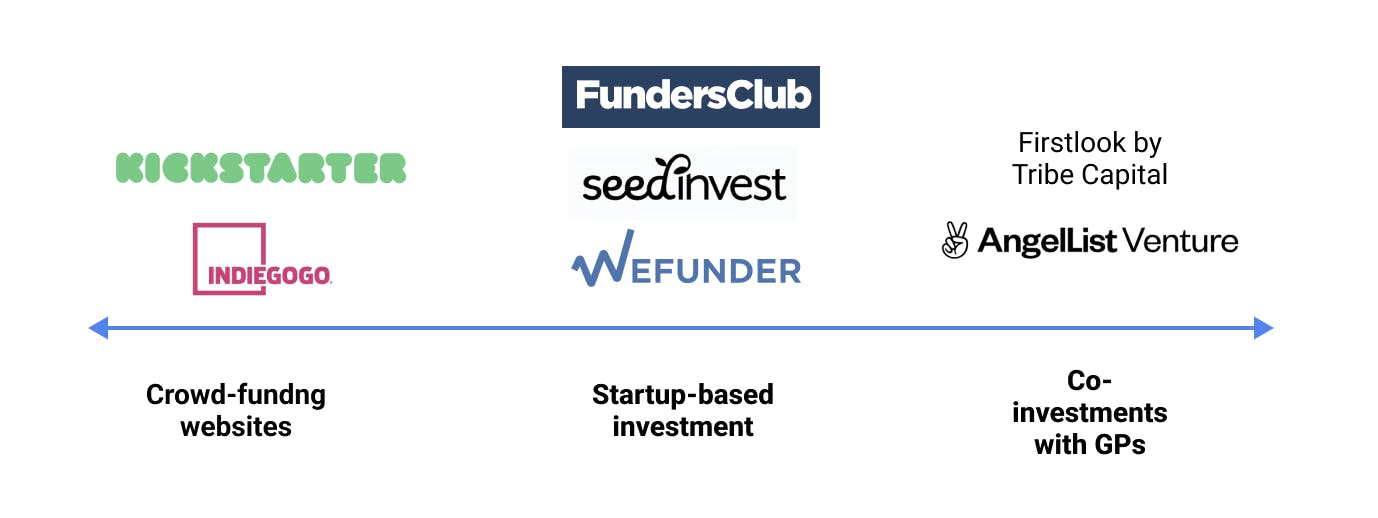

Given AngelList’s roots, most of the LPs are angel investors. These angel investors have a wide range of investment options such as crowdfunding portals (Kickstarter and Indiegogo), other angel investment portals (Wefunder, SeedInvest, and FundersClub), or directly investing in start-ups.

There are ~300,000 active angel investors in the US, and in 2021, ~38,000 LPs invested through AngelList Venture. Thus, ~87% of angel investors use non-AngelList investment opportunities. The average LP check size through AngelList is ~$94,000, more than than the US average angel investment size of ~$76,000 (2020).

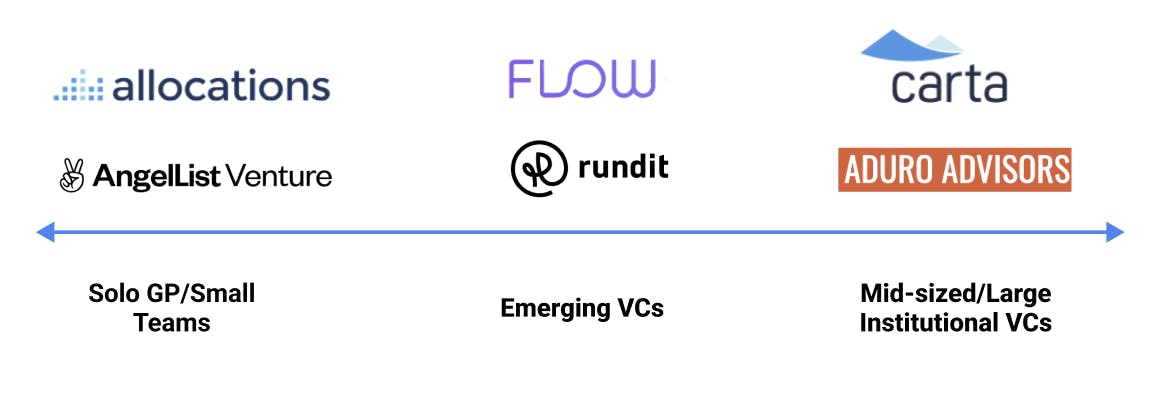

There are ~800 GPs and 380+ funds on AngelList Venture, indicating that most GPs are solo/small teams. Other companies that provide SPV formation and cloud-based end-to-end fund management include allocations.com (1000+ funds, $500M invested), Flow (8000+ LPs, $4.5B+ AUM) and Carta (500+ funds, $20B+ AUM).

AngelList’s latest founder tool, Stack, competes with different existing tools for wallet share such as Stripe Atlas (incorporation), Mercury (banking), Carta/Pulley (cap table), and Fairmint (fundraising).

Solo GPs have been on the rise recently. Solo GPs earlier used to write small checks and did not have control over a deal. However, this is changing fast. For instance, in the $100M Series A funding of Playco (a gaming company) in September 2020, Josh Buckley (CEO, ProductHunt; solo VC) led the round with Sequoia, set the price, and took the board seat.

Solo GPs are also raising large funds—for example, Harry Stebbings ($140M), Josh Buckley ($500M), and Lachy Groom ($250M).

This rise of solo GPs is driven by the ability of individuals to command massive distribution advantage through Twitter/Substack, maturity of VC as an asset class allowing LPs to dabble in newer vehicles, and the emergence of fund management infrastructure.

AngelList Venture is already heavily indexed on the solo GP ecosystem and has tools & marketplace to bring more value to them. The opportunity for AngelList Venture is to move up the stack and tap into larger solo GP funds.

An untapped opportunity in the startup ecosystem is to unlock the cap table as leverage for founders to attract talent and provide liquidity to employees/investors. Companies such as CartaX and Pulley already provide cap table management products.

AngelList is coming from behind in this space, but it has a unique ability to spin up SPVs and wrap them into different products rapidly. AngelList leveraged this ability to recently introduce Recurring Transfers that allow startups to offer liquidity to their employees regularly, rather than waiting for a liquidity event.

AngelList creates an SPV at regular intervals that acquire shares from employees. The LPs acquire an interest in this SPV. AngelList manages the entire process, and founders don’t have to worry about the cap table complexities and management overhead of executing multiple agreements between buyers and sellers.

Marketplace and back-office software for startup investors and venture fund managers