Marcelo Ballvé

Head of Research at Sacra

See the link to our dataset at the bottom.

We completed a high-level survey of competitors in the webinar market to narrow the field to gauge basic trends and identify benchmark products and companies. In the final report, we will dig into differentiators and key features for the leading products and categories. Here, we outline:

A handful of companies are clearly setting the pace in the market, while as a whole products are pushing further on themes already identified in the main memo. Namely that is in-event engagement features, deeper analytics encompassing the webinar lifecycle, and data-enabled post-event content generation. The latter is increasingly being paired with gen AI capabilities.

The history of webinars is closely tied to the larger story of networking and the internet.

In 1996, XeroxPARC released a webinar software called PlaceWare — later named PlaceWare Auditorium — in 1996. This application allowed one or several users to give an online, audio presentation, with slides, to hundreds or even thousands of listeners worldwide. It included features that were to remain webinar mainstays, including surveys, private chat, and toggles to allow other participants to speak during the broadcast. PlaceWare Auditorium found early adopters in university and scientific settings.

Three years later, Cisco launched WebEx Meeting Center, with a focus on business users. In 2004, around the time of its acquisition by Citrix Systems, GoToMeeting introduced webinar video. In their first couple of decades, webinars remained a subset of an industry geared to networking and workplace communication. While there were a number of new entrants during the dot-com boom, the webinar space did not change radically until more recently.

Today, WebEx and GoTo continue to be names of note in the webinar space. But the market has expanded in new directions. This expansion includes several broad trends and entrants:

This is, roughly, where the market stands today.

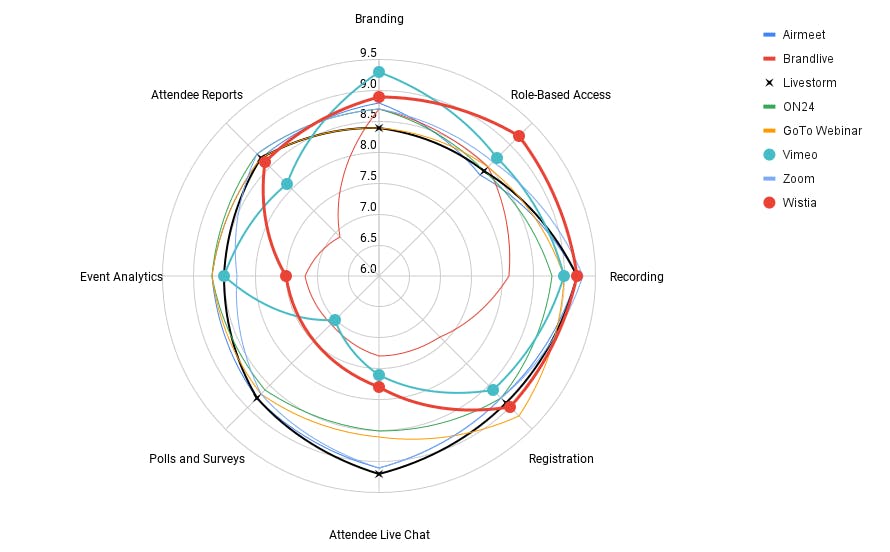

When looking at the competitive cohort through the lens of prominent online review sites, Wistia emerges as the best-rated all-around product. However, the picture changes when only nine webinar-specific metrics and ratings are considered.

The reviews underscore the importance of in-video engagement and event analytics for standing out.

Here are the rankings for the overall product.

Here are the same rankings shown when averaging scores given on G2 for the webinar product only.

While the rankings remain consistent for the other peers, Wistia drops in the webinar-specific metrics.

It is true that Surveys & Polls is one of the metrics. Wistia only launched the feature for webinars in December 2023, and so there was no score for this feature in the Wistia column. However, the webinar score we calculated is an average across the nine metrics and so does not unduly penalize Wistia for the feature gap.

Instead, the difference between Wistia and its higher-ranked competitors is in the ratings for in-video interactions, specifically chat, and webinar analytics (see chart, below). Again, Wistia improved Q&A and chat in an April 2023 release, and this is not fully captured in these reviews. But the market is clearly expressing the importance of these two dimensions in boosting product acceptance.

Finally, users rate the ability to brand videos on Wistia with a score that closely tracks the average for the competitive cohort, which means there may be room for improvement in this dimension.

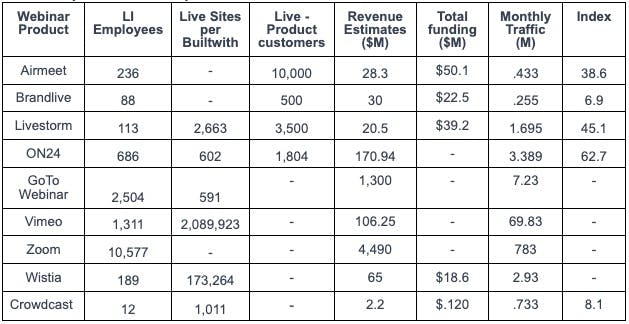

We collected a few data points in seeking to build an indicator of where each competitor stands in terms of commercial and financial traction. These included, where available, number of customers, number of employees on LinkedIn, funding and revenue, and number of live sites using the technology detected by Builtwith. The last proved extremely noisy, and was left out of the resulting indicator, but the numbers are included for reference.

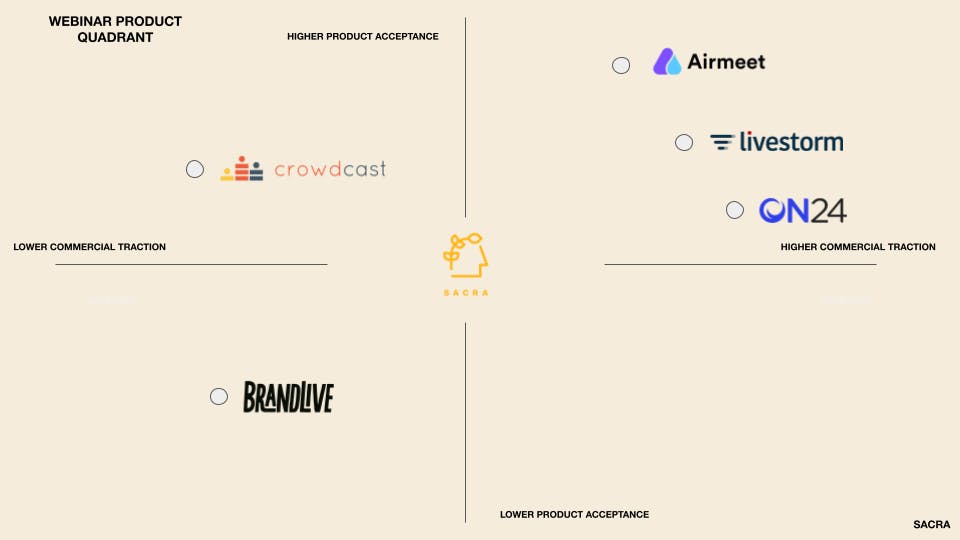

While imperfect, in tandem these data points offer a fair sketch of overall momentum. However, it makes no sense to compare companies that are stand-alone virtual-event software products to those that offer a portfolio of products, with webinars being just one among them. So the below analysis will focus only on Airmeet, Brandlive, Livestorm, ON24 and Crowdcast.

Combining webinar-specific reviews with commercial traction, we can begin to see how a few of the webinar-focused competitors stack up across a couple of dimensions.

*Crowdcast score is shown for the overall product across several sites, others are for webinar-specific product scores on G2 only

Other competitors Two companies that offer comprehensive virtual-event platforms also are worth watching. BigMarker, founded in 2011, and Goldcast are highly rated across review sites and boast significant logos as customers.

BigMarker has a good amount of market presence, with customers including Webflow and Figma. Goldcast, a Series A-stage company, is more of an up-and-comer but count investors well-known in the marketing and tech worlds, including Scott Belsky, Adobe’s chief product officer, Andrew Wilkinson of Tiny, and Lenny Rachitsky, former product leader of AirBnB who is well-known for his product-management newsletter.

Crowdcast, while making some noise in the market, is a 12-person Oakland, Calif-based seed-stage company. While worth keeping an eye on, it is not a market leader or contender as of yet.

Livestorm, Airmeet, and Zoom emerge as product leaders when looking specifically at products that have zeroed in tightly on enabling webinar experiences. Vimeo is of interest considering its parallel roots in video hosting.

In the case of Zoom, it’s notable that as a large company with a focus on video meetings they have gained a significant measure of product acceptance and positive customer sentiment around their webinar solution. Airmeet and Livestorm, companies specializing in live events that were founded in 2019 and 2016 respectively, also are generally reviewed higher than the rest of the competitive set.

Companies in the virtual-event bucket, including ON24 on which more data is available given it is publicly-traded, have sought to innovate in the area of event interactivity and post-event content generation. There are likely discrete lessons to be learned and feature ideas to be gleaned from this set of companies with ON24 as the core case study.

Video marketing software for businesses to create, host, and analyze on-brand video content

Virtual events software for hosting interactive conferences, webinars, and networking sessions

Browser-based software for hosting interactive webinars, virtual meetings, and online events

Video production software for creating branded, TV-style webinars and corporate events

Browser-based software for hosting webinars, virtual conferences, and hybrid events

Event software for B2B marketers to host, analyze, and repurpose virtual events