Rohit Kaul

Research at Sacra

Uphold, Abra and Celsius want to become the all-in-one platform for cryptocurrency banking like the Bank of America is for traditional banking.

The crypto market grew exponentially in 2021, with trading volume exceeding $14T, compared to $1.8T in 2020, indicating a large opportunity for any platform, even if it captures a small share.

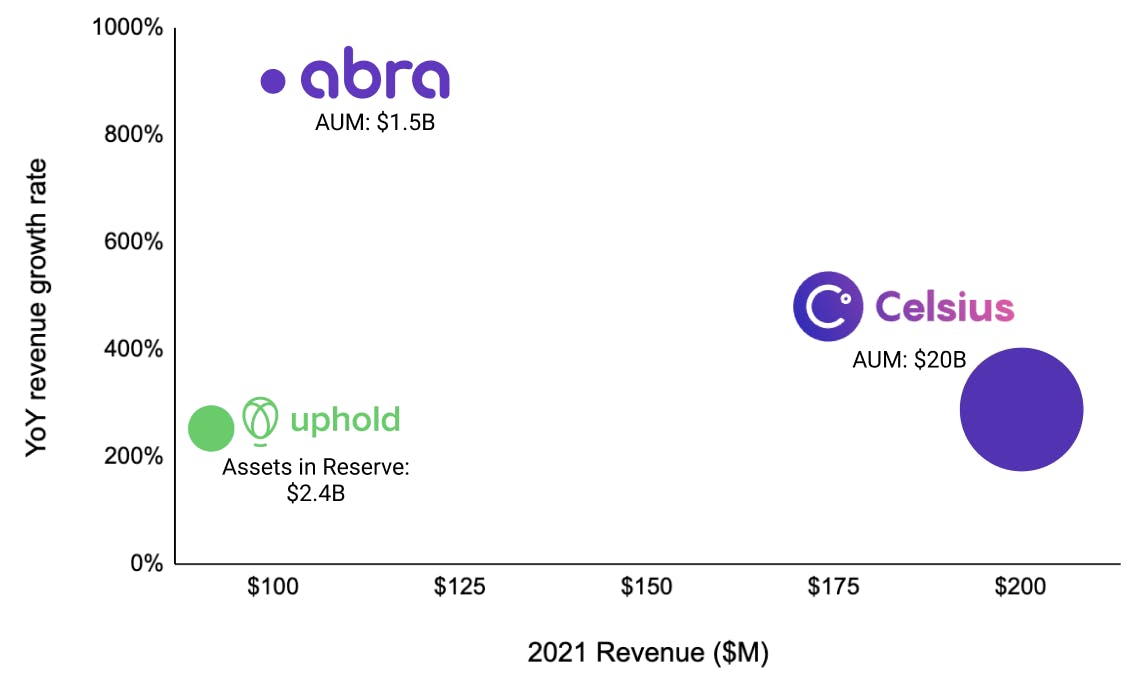

All three companies made more money in 2021 on the back of strong growth in the cryptocurrency market in 2021. Celsius is estimated to be the largest by revenue, followed by Abra and Uphold.

Celsius has also raised the most funds and is valued more than Abra.

Celsius has $20B in AUM, compared to Abra’s $1.5B AUM and Uphold’s $2.4B assets in reserve.

A crypto bank provides products on top of the deposits made by its users, like a traditional bank. They make it easy to deposit fiat or cryptocurrencies in the account and then earn money by facilitating transactions such as trading, lending, and borrowing. Key products are:

Deposit account: A wallet where users securely store their fiat and cryptocurrencies and connect their bank accounts, cards, or other crypto wallets to fund it. Most crypto banks charge no fee/low fee for funding/withdrawals from wallets.

Trading: Wallets are used for buying and selling cryptocurrencies using fiat. Another type of trading is swapping between fixed cryptocurrency pairs without cashing out to fiat. Crypto banks make money by charging a spread on these transactions.

Institutional lending: Crypto banks provide an interest account to users with much higher APY than traditional banking, up to 10-12%. They aggregate the cryptocurrencies in these accounts and lend to institutional borrowers. Lending is of two types:

Crypto banks take a cut from the interest earned from lending and pass on the rest to the users as APY.

Consumer lending: Users can borrow cryptocurrencies against their crypto deposits without a credit check. APRs range from 0% to 9%, increasing with an increase in the loan to collateral ratio.

Cards: Debit cards allow users to spend their crypto assets without transferring them to traditional bank accounts. Credit cards are similar and offered without a credit check, with the cryptocurrencies in the account determining the credit limit. Cards are additional revenue streams for crypto banks. They charge a spread for converting the crypto to fiat behind the scenes at POS transaction and by splitting the interchange.

Payments: Users can make domestic or cross-border P2P transfers in fiat/cryptocurrencies from their wallet to a bank account or another crypto wallet. Most crypto banks charge a low fee/no fee for these transfers.

Deposit accounts

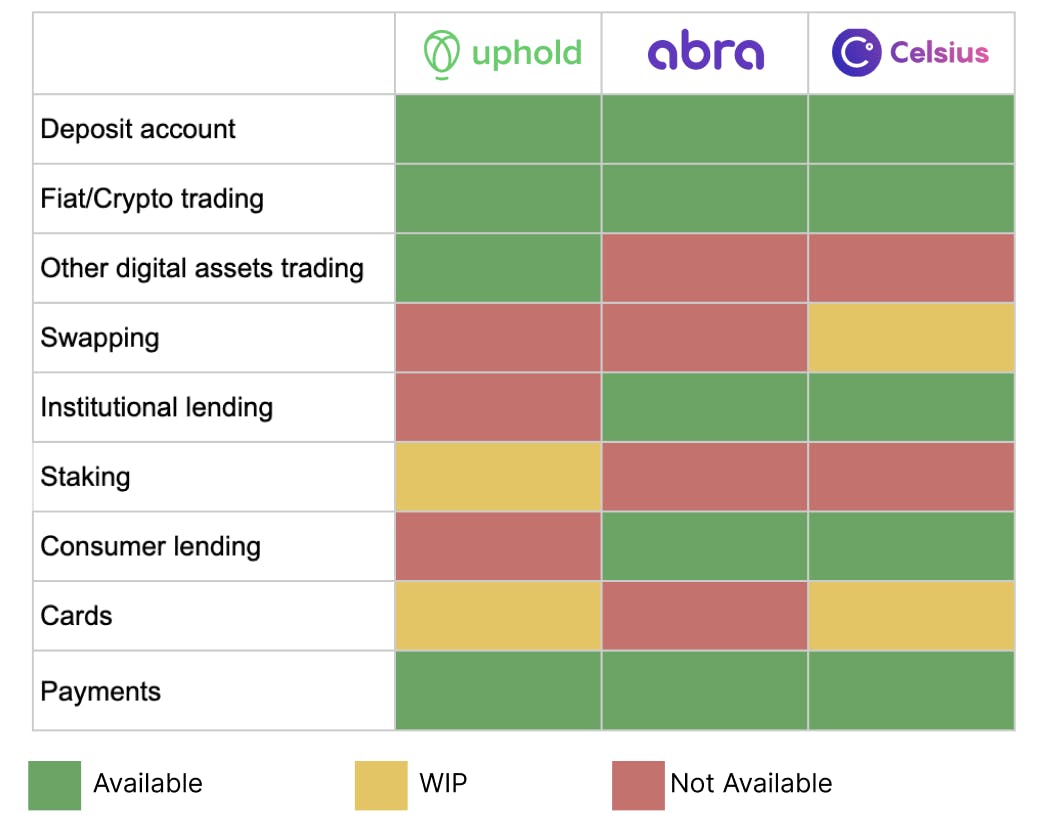

All three platforms offer wallets that users fund through bank accounts, other crypto wallets, or credit/debit cards at a low fee/no fee. Uphold positions itself as a secure wallet with 90% of crypto held in cold storage and maintaining 100% reserve against the assets on its platform. Abra and Celsius offer only basic security features such as 2FA.

Trading

All three platforms allow users to trade fiat/cryptocurrencies. Uphold has 115 cryptocurrencies, Abra 100+ and Celsius 40+. Typical spreads charged are:

On Uphold, users can buy and sell crypto, equities, precious metals, and fiat currencies in a single transaction, such as buying Gold using BTC or equities using ETH, without cashing out one asset and then buying a new one. Uphold has built APIs for blockchains such as Ethereum to talk to traditional bank platforms.

Abra and Celsius have coins, CPRX by Abra and CEL by Celsius, with CEL being much more popular with 155,000 wallets holding CEL, compared to just 337 for CPRX and CEL’s 24 hours trading volume at $4.6M, compared to CPRX’s $430,000.

Lending

Abra offers APY of 2-13% on 11 cryptocurrencies and Celsius offers APY of 0.25-14% on 40+ cryptocurrencies. Both offer higher APY if users take interest payments in CEL/CPRX.

Unlike Abra, Celsius offers new interest accounts in the US only to accredited investors. Non-accredited US citizens can use Celsius only for trading and borrowing. Investors outside the US can open new interest accounts. This change happened recently after Celsius came under investigation in several US states for potentially violating US securities law.

To offer high APY, Celsius undertakes many activities that hedge risk and make money in any situation. It actively mines Bitcoin with 67,000+ machines that can mine up to 420 bitcoins per week. It also actively trades cryptocurrency and invests in DeFi projects to earn higher yields than crypto lending. Abra claims not to use customer deposits for high-risk activities, including DeFi projects.

Both Abra and Celsius allow users to borrow TUSD, USDP and USDC stablecoins against BTC or ETH holdings without a credit check. Abra offers APR from 0% to 9.95%, and Celsius offers APR of 1% to 8.95%, decreasing with more collateral.

Uphold doesn’t provide institutional or consumer lending products and has staking on the waitlist.

Cards

Uphold has a debit card in the works, and Celsius announced the launch of a credit card.

Uphold is offering debit cards through Evolve Bank in the US that can be used at any Mastercard POS and ATM to spend crypto, fiat, gold, or equities held in the Uphold account. Uphold converts the asset to cash behind the scenes and charge users a fee. The card has 1% USD cashback and 2% crypto reward.

Celsius’s credit card has no credit score check, and the cryptocurrencies in the wallet determine the credit limits. Users can pay the card bill using fiat or stablecoins.

Payments

All three platforms allow users to make domestic or cross-border transfers in fiat/cryptocurrencies from their wallet to a bank account or crypto wallet at no fee/low fee.

A few tailwinds in the crypto ecosystem can drive the growth of these platforms.

However, some strong headwinds could put a brake on their growth.