Jan-Erik Asplund

Co-Founder at Sacra

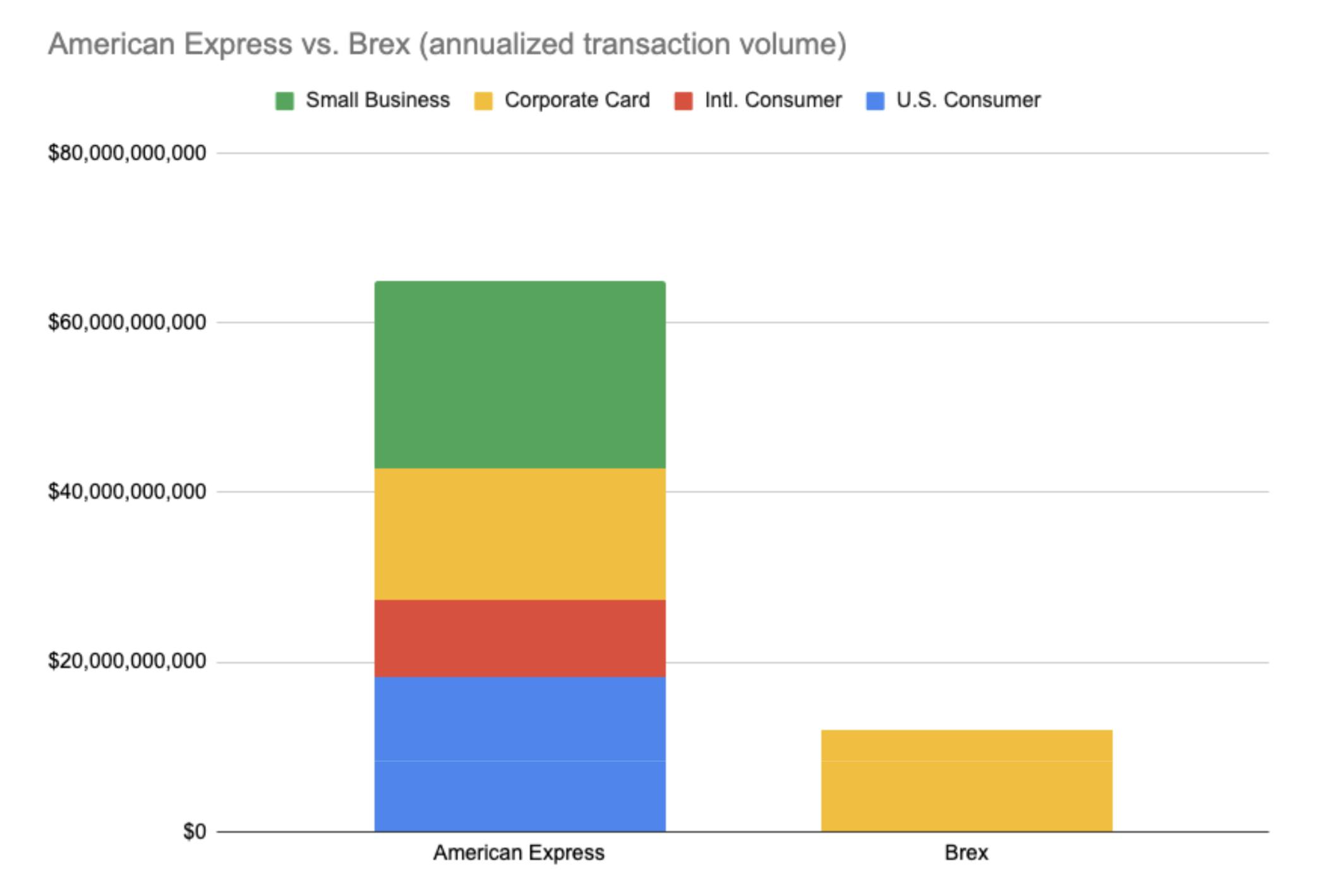

Brex hit about $12B in annualized transaction volume at the beginning of 2022. Meanwhile, American Express, in its last earnings conference call, reported receiving $16.2B of transaction volume from SMB customers during Q2’21, for about $65B annualized.

Here’s how American Express’s overall volume mix broke down—SMB was and is typically their biggest customer segment:

American Express also makes money from lending—during the quarter, they lent out $77.8B in total, and about $16.3B to small businesses. That’s $65.2B annualized. Their loan balance, unlike their card mix, skews heavily consumer:

Overall, American Express made $10.2B in total revenues in Q2’21. Here’s how the overall revenue mix broke down:

Software suite for global companies to manage cards, expenses, and business accounts