Marcelo Ballvé

Head of Research at Sacra

See the link to our dataset at the bottom.

Here are the preliminary results of the sizing:

These data points also confirmed some early hypotheses on target markets. For example:

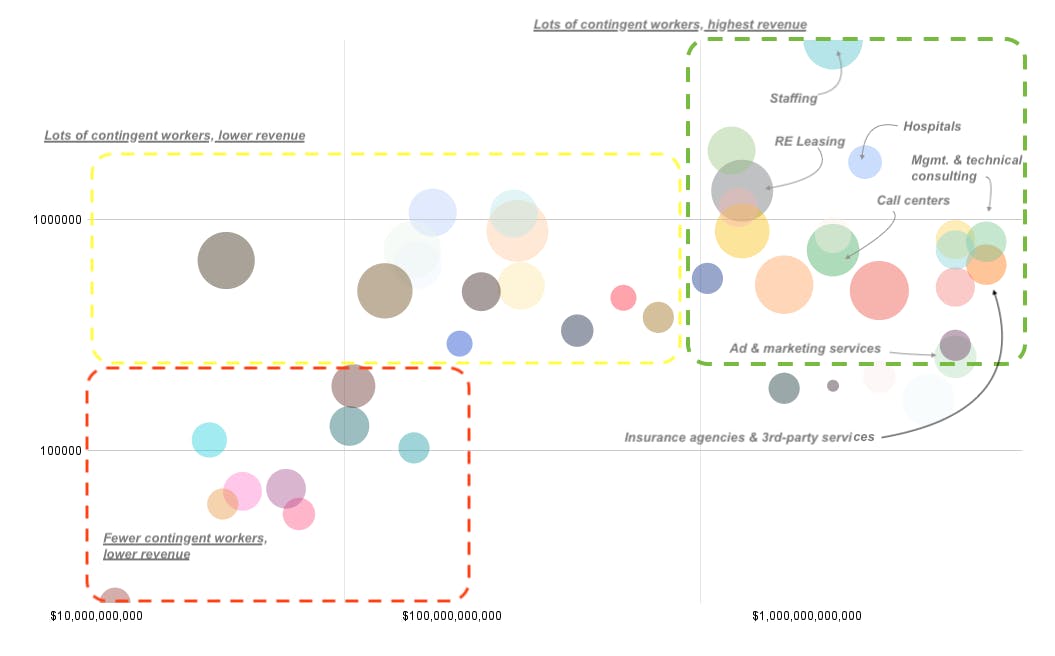

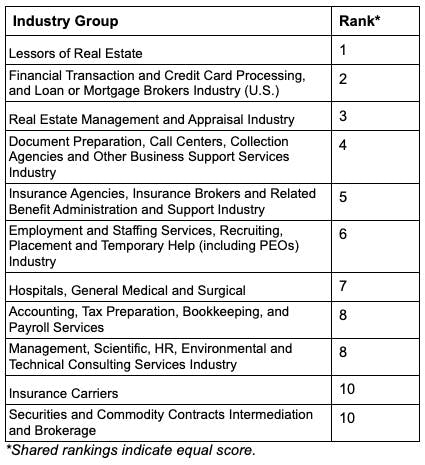

According to our ranking of market-attractiveness, Real Estate Leasing, Staffing and Employment Services, and the Financial Transaction and Credit Card-Processing categories were the three top-ranked target markets. The market-attractiveness index is a blended average of component indicators tied to the number and percentage of contingent workers in an industry, as well as the size of revenue and profit pools in the different industries.

Interestingly, Real Estate brokers fall out of the top 11, mainly due to lower revenue and profitability scores than other top categories. That said, this category still falls in the top half of categories for market attractiveness.

Academics have noted that BLS and Census data systematically undercounts the number of independent contractors and so skews data in key studies. The key reason, it turns out, is that individuals tend to self-identify as employees, even when their actual work situation tends to be mediated by a 1099 arrangement. This may be an important fact on which to educate investors or other financial stakeholders who try to arrive at estimates of the contractor workforce.

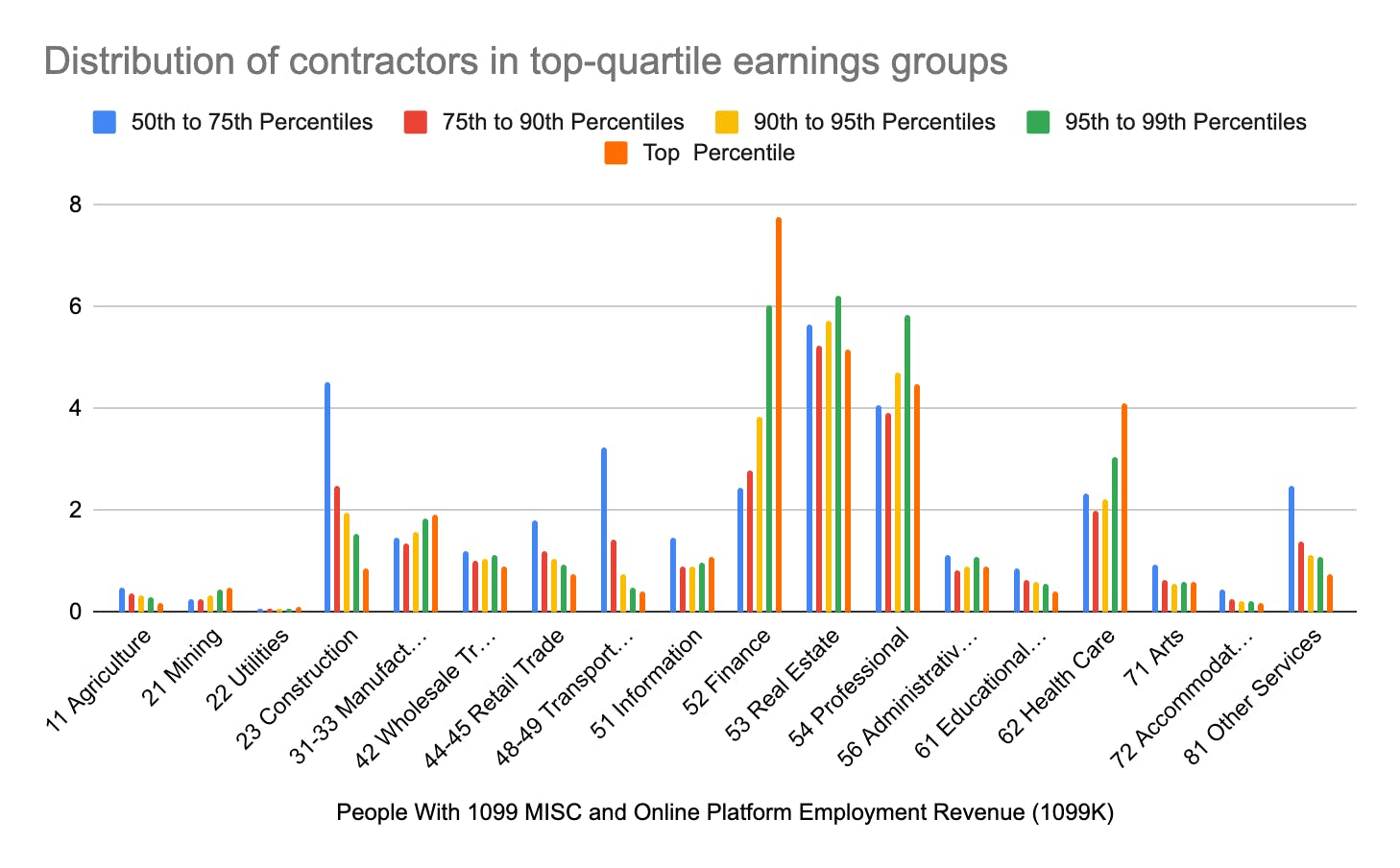

The most recent literature, from 2023, estimates that any official government data on independent contracting and 1099 work needs to be doubled to arrive at more accurate estimates on the prevalence of independent contracting overall and in specific verticals. A study by the Upjohn Center for Employment Research put the overall figure of independent contractors in the US workforce at 15 percent of the workforce, but this is based on lagged data, so we used 17 percent as the average across all industries.

We established NAICS sectors with a high preponderance of contingent work in interviews and using IRS and California tax data. Then, we zeroed in on 7 sectors to identify industries worth focusing on further.

Within these sectors we identified 44 NAICS Industry Group categories, with desirable characteristics.

Having done this, we collected industry group-level data from market-research databases to populate columns such as the total number of employees, revenue, and profitability. Data points such as sales-per-firm might also become interesting if we later look at the level of market concentration in each industry.

The key step and most laborious was to look for indicators and data points regarding the preponderance of 1099 work and contingent work in general in each industry. The idea was to ground the estimate of 1099s in real-world, empirical data wherever possible. For W2s, the estimate follows that of 1099s. The principle is that in high-1099 categories, a large proportion of employees are engaged in similar work across tax treatments. Several key studies helped in arriving at the multipliers.