Today, we're excited to launch our report on WeWork: Behind Their Overpriced $9B SPAC.

Read it, and drop a reply to this email to let us know what you think.

Last December, we published a report on WeWork. Our core thesis was that WeWork had a perfect mixture for turnaround with over-pessimistic news headlines, structural shifts, asset disposal and stakeholders’ alignment between SoftBank, landlords and new management.

New disclosures from the company as it prepares to go public in Q3 2021 have confirmed some parts of our thesis, but the business remains highly risky:

- WeWork has saved $1.7B from cost-cutting and rent renegotiation, their enterprise mix has increased to 50%, and All-Access has improved asset turnover and occupancy

- With only $660M in cash on hand by Q2 2021, WeWork runs the risk of not covering its interest expense and capex

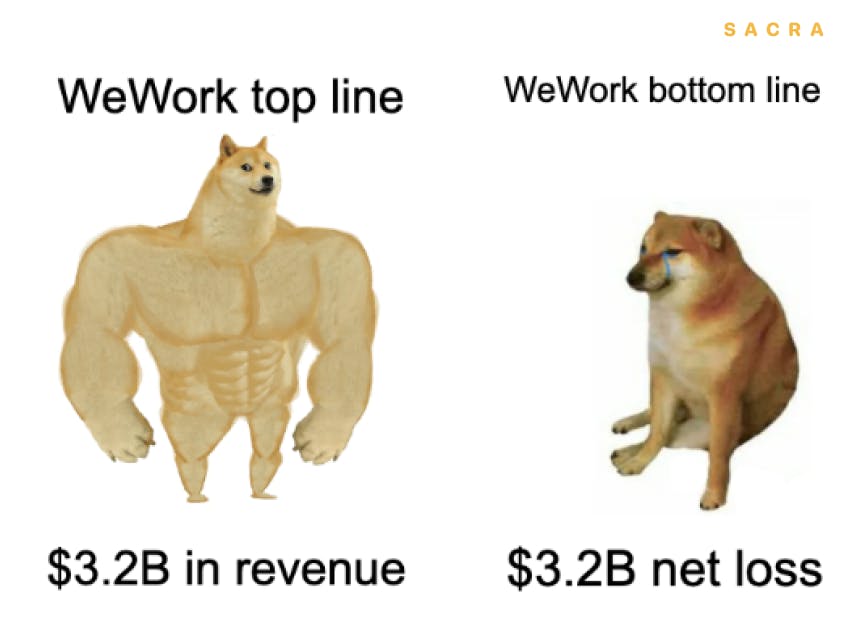

- WeWork is going public again—after less than 2 years—because it recorded a net loss of $3.2B in 2020 and needs cash to meet its outflows

Check out the report for our full analysis.

Thanks,

Nan