Hi everyone 👋

Sign Up Today!

To get these right in your inbox

Startup fintech services like Lithic and Sila are coming after incumbents like Jack Henry, Global Payments, FIS, and Fiserv, which combine for $40B in yearly revenue. But their approach, differentiated from end-to-end banking-as-a-service (BaaS) platforms like Bond, is to peel off specific functions like issuer processing and payments and build best-of-breed solutions.

The massive opportunity in unbundling this legacy fintech infrastructure that dates back to the 1960’s has fueled the growth of an entire ecosystem of modular, API-first fintech companies, with Lithic, Sila, Canopy (loan management), Wyre (crypto on-ramps), Dwolla (ACH/RTP), Peach (lending), and Highnote (card issuing) raising a cumulative $318M.

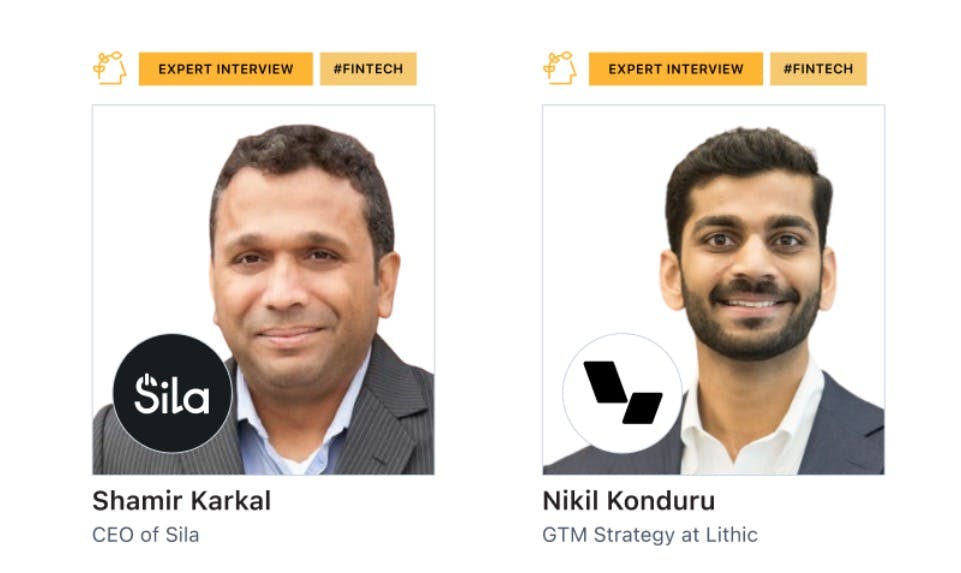

To better understand the economics and engineering of point solutions vs. all-in-one BaaS platforms, we talked to:

Some of our key learnings from talking to Shamir and Nikil:

[All-in-one customers] ended up scaling on them, and then rolled off them and either built their own in-house bespoke platforms... or went to a model where they were using five to six different processors. That's how all the large banks operate... They have their own code, with some Fiserv tech in there, some TSYS, and twenty others. —Shamir (link)

[No solution] is going to provide the best crypto on-ramp as well as the best identity and fraud decisioning as well as the best issuer-processing. That’s why we're building developer-first, composable, card issuing primitives so that startups can mix and match the best fintech infrastructure available in the market to build unique, differentiated products. —Nikil (link)

[We're] focused on building the most flexible card issuing tools that customers can leverage for any number of novel use cases. Just look at what Affirm, Klarna, Afterpay and the other BNPL players have managed to accomplish in such a short period... There’s a segment that’s powering billions of dollars in volume over the network rails, and it wasn’t even on anyone’s radar a decade ago. We’re going to see several more breakout segments like this in the next decade. —Nikil (link)

Check out the full interviews with Shamir and Nikil for more on the modern fintech services looking to rebuild the infrastructure of banking on the internet.

Thanks!

Jan

Banking-as-a-service: The $1T market to build the Twilio of embedded finance

If you missed it, check out our report on Banking-as-a-Service: The $1T Market to Build the Twilio of Embedded Finance.

While BaaS is still in its nascency, the promise of building a unified, Twilio-like API layer for banking has driven $150M in investment over the last 18 months. Our report on BaaS goes into detail on the industry's biggest players, unit economics, competitive dynamics, and more.

Q&A with Cypher on pre-IPO asset trading on Solana

Remember to join us in a few hours at 10am ET for a Q&A with Barrett W and James W, core contributors at Cypher.

Cypher (fka Off-Piste) is a platform that allows non-US investors to trade in private, pre-IPO names using synthetic assets built on the Solana blockchain.

As Cypher is launching first outside of the USA, this Q&A was scheduled to make it accessible for investors in non-US timezones.

Join us for this conversation as we dig into the potential of DeFi to not just provide investors with access to the upside of pre-IPO startups, but actually enable more accurate price discovery on those startups and give them a smoother on-ramp to the public markets.