Today, we launch our report on Zapier: The $7B Netflix of Productivity.

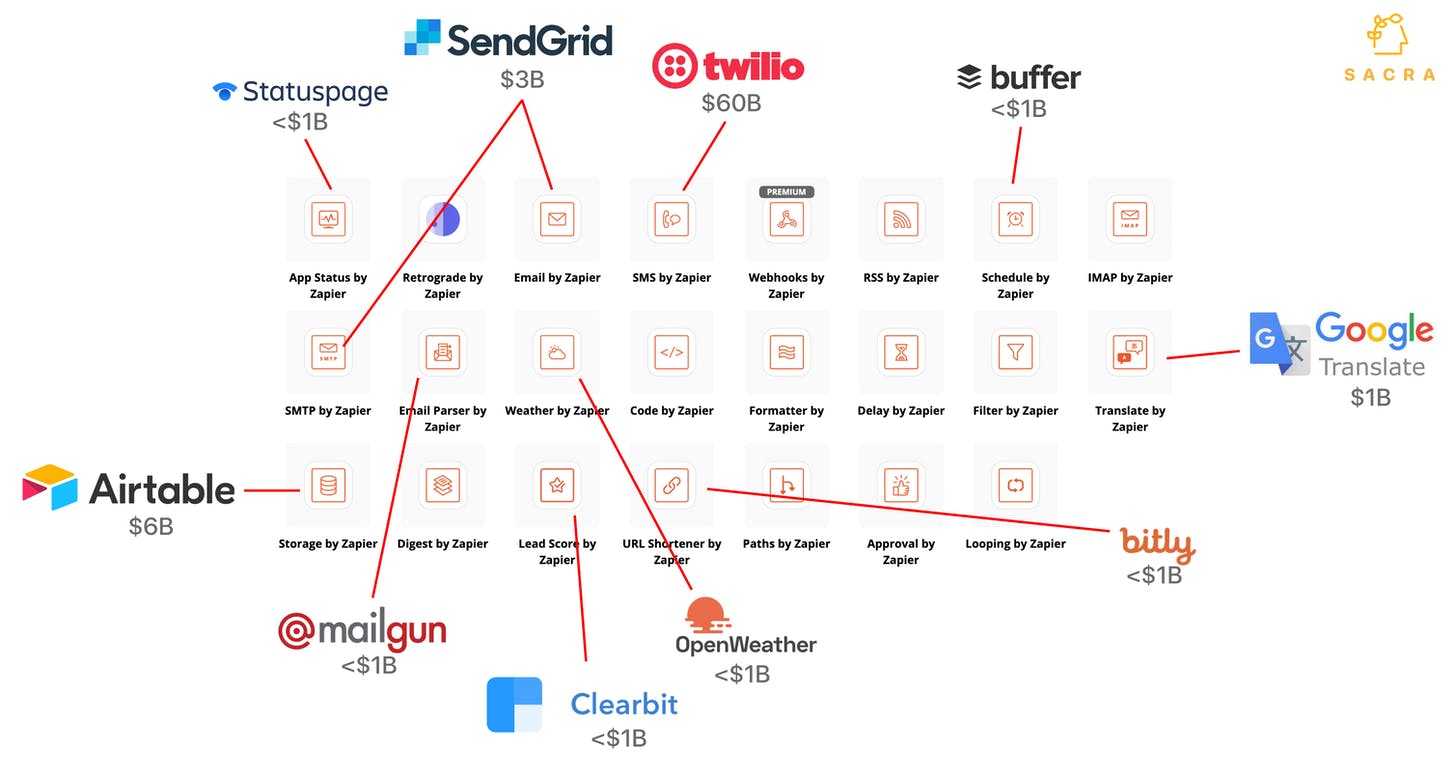

Zapier is a $140M ARR integrations platform that helps millions of startups, solopreneurs, and SMBs pipe data in and out of SaaS products that don't have a tnative integration. It was recently valued at $5B in a secondary sale involving Sequoia and Steadfast Financial. Our model suggests that was a bargain, given Zapier's 50% CAGR over the last three years, the huge and growing no-code market, and the unique opportunity Zapier has to do for the productivity space what Netflix did for streaming content.

Some key points from our analysis of the data:

- Despite only raising $1.4M, Zapier hit $100M ARR in just under 10 years. Their tiny amount of capital raised gives them a 100x ratio of ARR/funding that puts them in elite territory alongside other largely-bootstrapped companies like Atlassian (128x) and Cloudinary (80x).

- By programmatically generating SEO-optimized landing pages for each new tool and integration on the platform, Zapier built a growth engine that has scaled to 6M+ pageviews per month, more than sites like Deadspin, Teen Vogue, Gothamist, Seventeen, Saveur or Cook's Illustrated.

- In our base case, Zapier remains the logic layer of no-code and continues to grow at 37% CAGR to $800M+ in ARR by 2026. In our bear case, growth slows to 20% as competition from other no-code platforms and native integrations heats up. In our bull case, Zapier builds the no-code super aggregator and is able to grow at 50% CAGR for the next five years, growing into a nearly $30B valuation.

Check out the report for our full analysis, and respond to this email to let us know what you think!

- Jan