Hi everyone 👋

Sign Up Today!

To get these right in your inbox

TL;DR: We did a report on Rubrik, the enterprise data backup and security company doing $1B a year in revenue—check it out here.

Key points from our report on Rubrik:

- Rubrik found initial product-market fit with its “iCloud for enterprise data” solution for backup and recovery. Rubrik solved for the highly fragmented experience around data backups by vertically integrating a hardware-and-software solution compatible with multi-cloud.

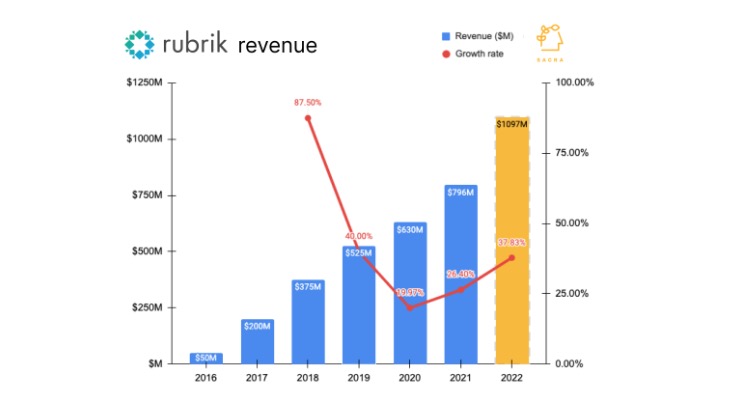

- We estimate Rubrik did about $796M in revenue in 2021, up 26% from 2020 ($630M). Compare to data backup companies like Cohesity, which did about $600M, and Commvault, which did about $769M.

- Subscription revenue will hit nearly $700M in 2022, up from $100M in 2019. Data backup companies across the industry are moving aggressively to get customers off traditional perpetual licenses and onto subscriptions to drive more predictable revenue.

- Data backup is a crowded, increasingly commodified market where vendors have to discount to win. Between Veeam, Commvault, Cohesity, Druva, OwnBackup, Acronis and others, both incumbents and startups have grown to compete with Rubrik.

- To escape that competitive dynamic, Rubrik has shifted focus hard to selling into cybersecurity and compliance use cases. They repurposed the immutable file system and timeline view of customer data key to their backups product into helping companies recover from ransomware and keep their organizations in compliance.

- We project Rubrik will collect about $1.1B in revenue in 2022, up 37% from 2021. The main driver of that growth is the accelerating growth of their SaaS products, including for ransomware and data governance.

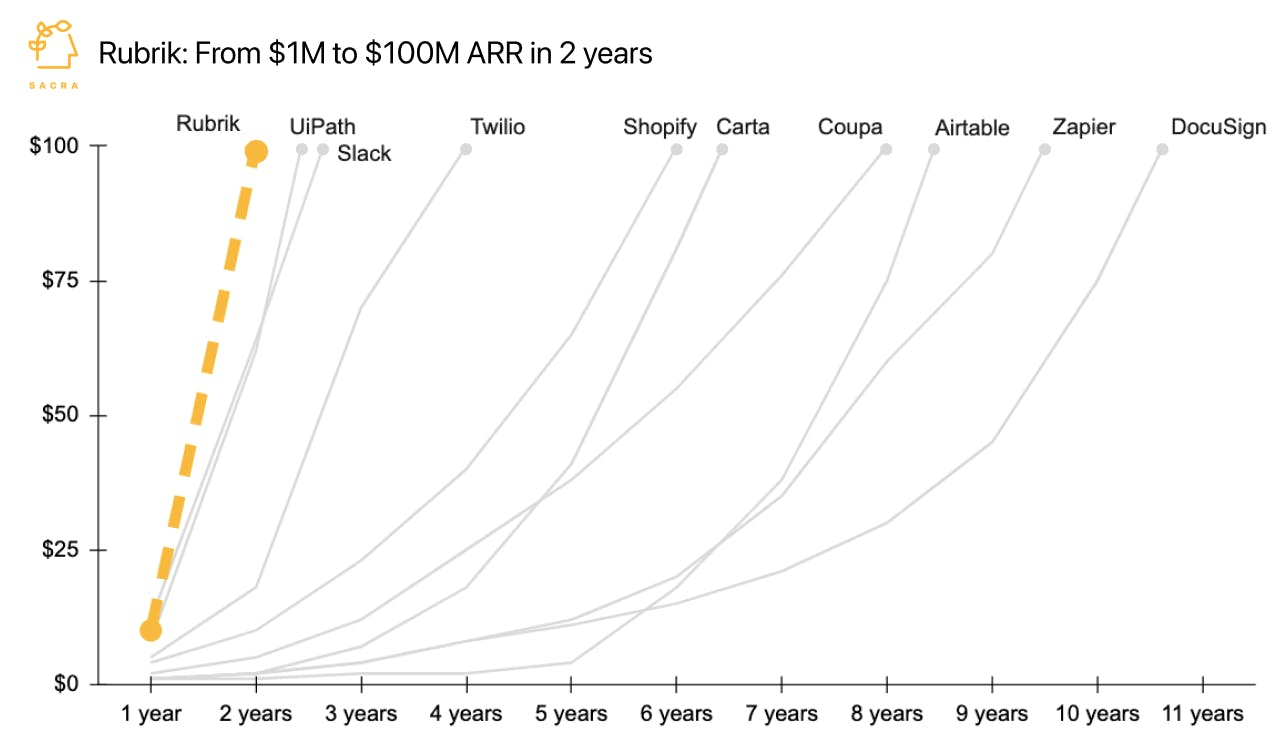

One of the fastest-growing enterprise startups ever, Rubrik is now a market leader in the world of data backups and recovery.

But igniting the next phase of growth and getting from $1B a year to $10B a year will mean successfully re-positioning the product and the entire company

For more on Rubrik, check out our full report here.

Jan & team

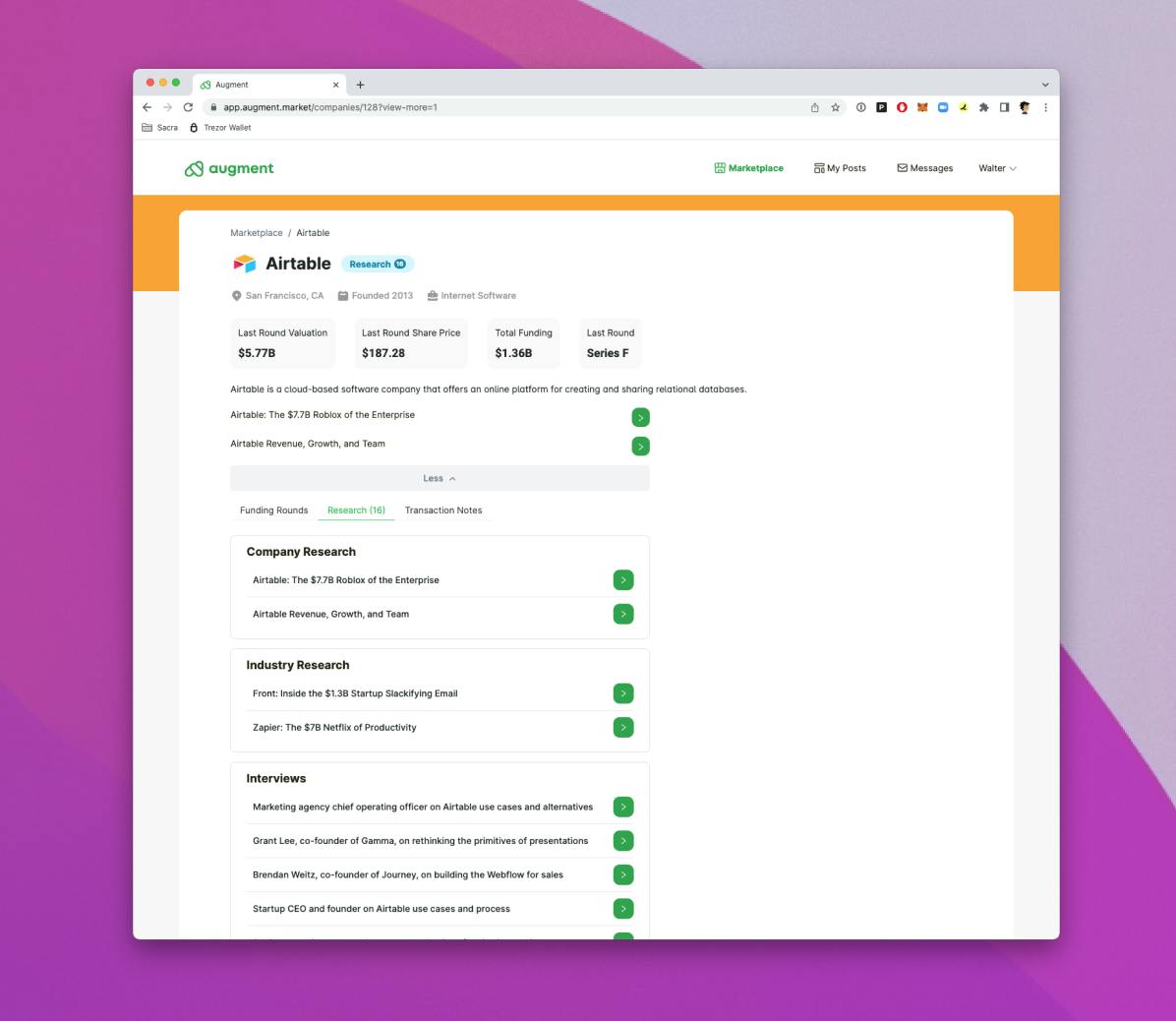

Product update: Sacra Documents API

We recently launched our Documents API to make it easy for you to embed Sacra interviews and company reports inside your app experience.

It's a great way to educate and engage users in your app about private companies.

If you’re an investing app, wealth management app or employee option exercise financing app, reply to this email to chat with us about it.

New interviews

Check out these new interviews on the platform. Reply to this email to offer questions you’d like us to ask upcoming interviewees, request specific interviewees and offer feedback.

- Christina Cacioppo, CEO of Vanta: $50M Series A from Sequoia to help SaaS companies move upmarket and sell into the enterprise

- Daniel Zarick, CEO of Arrows: $2.75M Seed from Gradient Ventures to build a CRM-compatible onboarding tool for product-led teams

- Balthazar de Lavergne and Mathias Pastor, Co-Founders of Semper: $4.5M Seed from FJ Labs to build an issuer-centric private markets exchange for Europe

New company profiles

Check out a few of our recent company profiles.

Preply: The "Upwork for language learning" that grew revenue from $9M in 2019 to $50M in 2021.

N26: The #2 neobank in Europe that collects about $233M in revenue per year on $90B in transaction volume.

Prove: An aggregator for identity information doing $109M selling data via API to banks, fintechs, marketplaces, and others.