Today, we’re launching our analysis of data from more than $3B worth of tender offers. Tender offers are a critical liquidity tool for startup employees—in many cases, their only opportunity to sell shares at all—but the way they work today is broken:

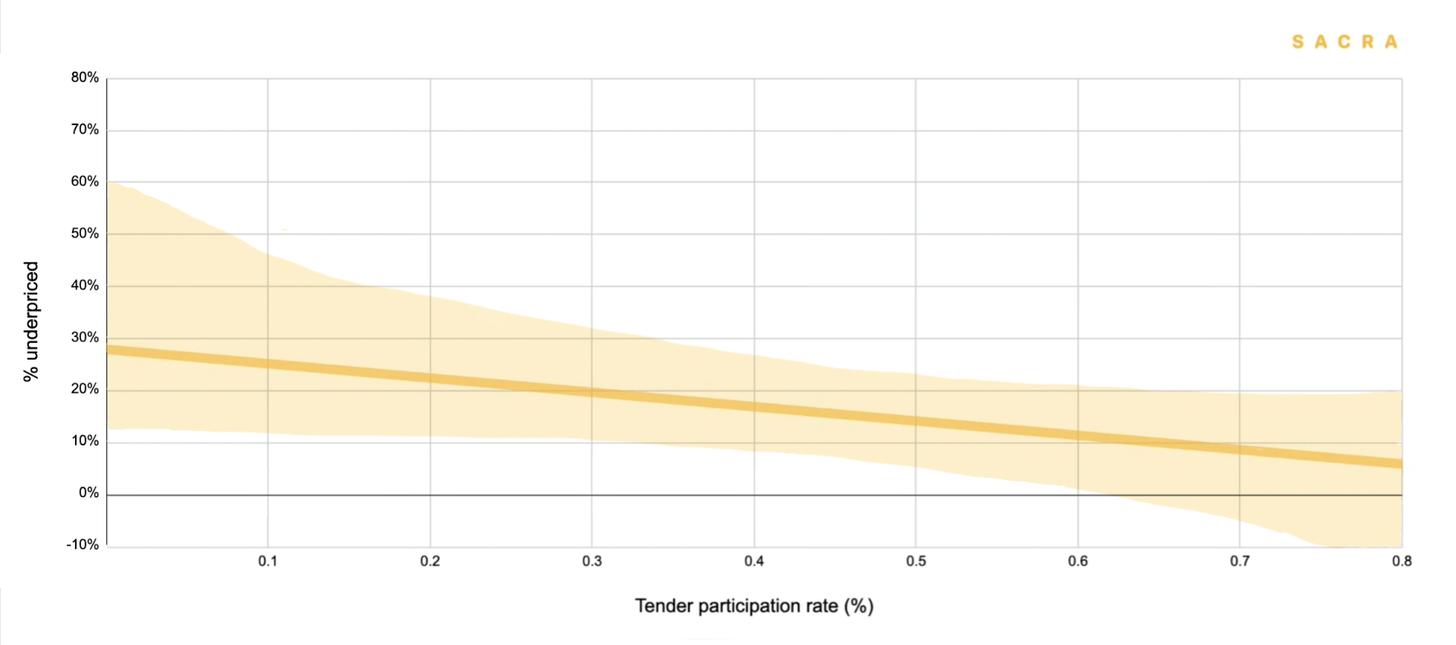

- Pricing pegged to the company’s last round: 83% of all transactions are priced at or under the price of the last round of funding

- Low participation: Only 37% of shareholders sell any of their shares into tender offers

- Employees are last to liquidity: 75% of all employee transactions take place once their company’s post-money valuation has exceeded $160M

Tender offers promise to help employees of private high-growth companies de-risk and diversify, but chronic underpricing means that selling into a tender frequently means leaving large sums of money on the table.

Check out the report to see our full analysis of the data and let us know what you think.

Thanks,

Jan