We have an exciting announcement: The Cap Table is now a part of Sacra!

Having previously been anonymous, TCT was started in 2018 by Conor Gleeson, and was relaunched in 2020 with the addition of our co-founder Shamus Noonan. We’ve had a ton of fun building this newsletter, and we’re thrilled for what we’re going to be able to do as a part of Sacra to further our shared mission of bringing more transparency, and more equity owners into the private markets.

Expect the following from TCT in the months to come:

- Weekly free content & exclusives designed to Help You Get on The Cap Table

- Even more in-depth analysis, resources, and news

- Additional media like podcasts & video, and a community for TCT subscribers

Below is a copy of an internal blog post that Conor wrote about how TCT began, and ultimately how it became a part of Sacra.

The below is from an internal blog written by TCT co-founder, Conor Gleeson, on his last day at Carta, originally published 12/1/2020.

How Working at Carta Turned me into an Entrepreneur

To my friends at Carta,

Today was my last day at Carta. It was an incredible two and a half years, and I feel humbled and grateful for my time with the company. I heard a saying once that you should never turn a successful entrepreneur into an employee, and I think that’s true, but I also think there are companies that can turn successful employees into entrepreneurs. Carta is one of those companies.

On that note, I’m excited to announce my next role as a founding team member at Sacra, the sell-side research company for the private markets.

Sacra’s wedge product is research reports on late-stage private companies like those offering liquidity on platforms like CartaX, with the goal to build a software and media ecosystem around that and become the ‘Bloomberg for Private Markets’.

Sacra is the sell-side research company for private markets.

The story of how this opportunity came to me is tied closely with my time at Carta and The Cap Table.

Back in February, Carta CEO Henry Ward, wrote a call to action for founders to begin building companies for a future of liquid private markets. If you buy the thesis that there will be more liquidity in late-stage private markets, and you should, there will necessarily be a sell-side function. Henry asked for someone to go build a company around this idea.

I started obsessing about it.

Early on in my career, I worked at BlackRock, where I became a power user of tools like the Bloomberg Terminal, Morningstar Suite, and Aladdin. Information in public markets is asymmetrical between institutional and retail investors — you don’t see on Robinhood what traders on a sales desk see on their proprietary platforms. The asymmetry of information in private markets is even worse.

Flashback to 2018: I started a pseudonymous Twitter handle and lightweight newsletter, The Cap Table (TCT). It was a passion project, originally meant to develop new leads for me as an account executive on Carta’s sales team via scraping funding news. I hacked it all together via IFTTT and other no-code/light-code tools and used it to hunt new logos for Carta.

I noticed that I’d developed a Twitter following without much effort, so after thinking about Henry’s call to action, I decided to relaunch the newsletter. In April 2020, I met a co-founder who had similar passions to me.

Freshly minted as a sales leader at Carta in January 2020, I had joined the Revenue Collective, a private group for sales and marketing leaders. My RC mentor, and the San Francisco Chapter lead, Joshua Amrani, and I hosted an event at Carta’s office and started speaking pretty regularly. A few weeks later, he called me and said there was someone I needed to meet: Shamus.

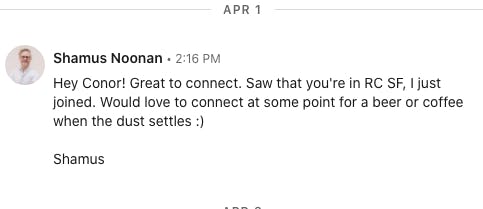

Shamus didn’t wait for an intro!

Shamus Noonan is a Sales Manager at Crunchbase and the co-founder of The Cap Table Newsletter. We met over Zoom at the beginning of the COVID-19 shutdown in San Francisco. After one intro call, Shamus shared that he was trying to start a newsletter, and I shared my ideas about TCT. Shamus sent me a deck the next night about what it might look like to work together, and we immediately got on the same page about building something.

Shamus came on to join TCT as co-founder. He brought expertise on the startup landscape, being at Crunchbase, and a crisp and concise voice on the editorial side. Both of us were obsessed with startups and venture capital, and aspiring private investors. We didn’t have a lot of direction in the beginning, but after a few weeks of trying different things, we found our format by way of a vision I had on a sunny Saturday morning in San Francisco.

It happened in Golden Gate Park. I was walking my dog, and all of a sudden had a striking realization: a newsletter could have the same network effects as Carta if it targeted the same personas. By interviewing VCs, founders, employees, board members, lawyers, and angel investors in startups, I could drill up and down the ownership stack. I could create content that seems niche but is relatable and scalable across many personas, which could all lead into a sell-side research ecosystem for private markets. I called Shamus and rushed home to get pen to paper to begin sketching it out.

Shortly after, I reached out to Arjun Sethi from Tribe Capital. I’d met him after he helped me out on several deals for Carta as an AE. He and his partner, Alex Chee, were eager and willing to help. Eventually, afterwards, I revealed who I was, and what my plans were for the newsletter: to fold it into a sell-side research platform.

Lots of VCs say they are founder-friendly. Arjun and Alex at Tribe “walk the talk”

I put together decks, a manifesto, and pitch materials, and eventually took it to Alessandro Chesser, my mentor at Carta. Alessandro encouraged me to take it to Wes Bayer, James “Cuddy” McGillicuddy, and Davis Thacker on Carta’s Strategy team, and eventually Henry.

Everyone listened and was incredibly helpful and thoughtful. At first, I was scared; I’m pitching the idea of leaving to my coworkers, even my CEO, I am going to get fired, was a constant thought. But this is one of the many things that makes Carta a magical place to work. Entrepreneurship isn’t discouraged. Rather, it is our responsibility as ‘Cartans’ to take what we’ve learned here and set the world on fire.

Before I got too far along, the team let me know that Carta had placed a bet on another sell-side research company, but not who, so I decided to pivot to another idea: stock option exercise lending. I pitched around 50 VCs and angels, including Tribe, Sequoia, Floodgate, GFC, Box Group, Correlation Ventures, Inspired Capital, and tons of angels in my network. Eventually, I decided to kill that project, too, because it seemed that Carta might actually be the best company to solve that problem, albeit sometime in the future.

Feeling a little defeated, Shamus and I continued on with TCT as a standalone project. Each week got a bit better, we started to see some traction, and eventually started to see some ARR growth. We spent every early morning, night, and weekend for nine months trying to figure out how to make this thing grow. I created an OKR framework for the business, and began tracking our goals on a weekly basis, and surprisingly, exceeding them. We started popping up on different publications and websites, and Twitter started buzzing about us. And each week, the network effects got stronger and stronger.

Our exclusive w/ @polina_marinova of The Profile is live! https://t.co/imsPVm9Cj7

— THE CAP TABLE (@thecaptable) May 29, 2020

Sign Up Today!

To get these right in your inbox

Internally at Carta, I started spending more time paying attention to product, got more involved in the Hackathons, and had frank and encouraging discussions with my manager, John Longyear, that my next career step would likely be something entrepreneurial. I took part in the Stanford/NYT writing course Carta offered, listened to all of Henry’s podcasts on business-building, and began building up the skills I needed to be a founding member at a venture scale startup.

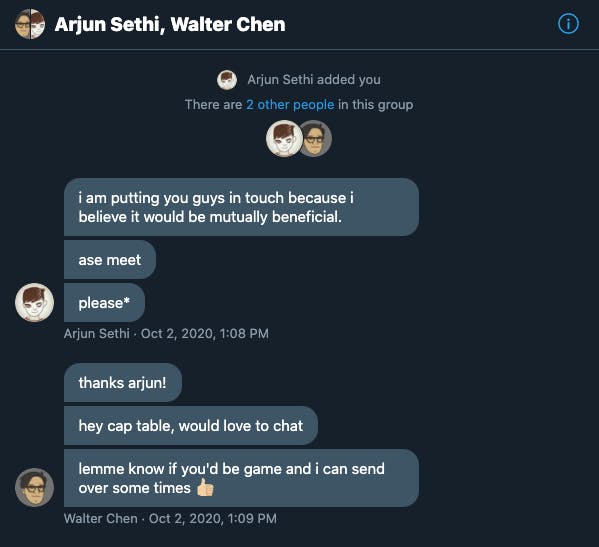

Then, back in early October, I got another cold DM on Twitter, this time from Arjun, connecting me to Walter Chen, the CEO and co-founder of Sacra. We met over Zoom and immediately hit it off, chatting about all of the picks and shovels that would be built around the late-stage liquidity landscape, secular trends, and some of the pitfalls of private markets in general. Shamus and I interviewed Walter and were blown away by the thoughtful responses. Eventually, I shared my sell-side decks and materials and joined their private Discord group to meet their investors and early team members.

After several weeks of conversations, Walter asked me what I thought about Sacra acquiring TCT, and me and Shamus joining full-time.

Shamus decided to stay on as an advisor given his own career and personal goals and help with the editorial side of the content & overall GTM strategy. My situation was different, and I had a burning desire to take an entrepreneurial swing. We decided that I would join the founding team and that TCT would become a part of Sacra. Never would I have thought that 6 months of hustling on a side project would lead to Shamus and my’s first exit as founders and a dream job for me.

I thought a lot about this decision. I left close to half of my Carta equity on the table. I left a team that I truly enjoyed working with and believe will take Carta to $50bn and beyond in the next few years. I’m doing something incredibly risky with little backstop But ultimately, I believe in Sacra’s team, the market, and the opportunity, so I’m taking a swing at it.

In hedge funds, people speak with reverence about “Tiger Cubs”, in VC they talk about “Baby Kleiners”… new entities that are validated by the place from which they were spun out. In the near future, people will talk about “The Carta Mafia”, and I’m incredibly proud to be a part of it. Again, Carta is a place for people to learn how to be entrepreneurs.

To my friends at Carta, I am always a text, call, or email away. Thank you again to everyone who helped me in my time there. I’m incredibly grateful and proud to be a lifelong Cartan.

From the entire TCT and Sacra teams, thank you to our readers for your continued support. We’re excited that this new partnership will allow us to continue to further transparency in private markets, and bring more people onto The Cap Table.

If you’re a free subscriber who loves our weekly Friday exclusives and free content, don’t worry! We’ll still deliver them to you your inbox every Friday at 10AM PST / 2PM EST.

- Conor & Shamus