We are thrilled to announce this week’s exclusive with Winter Mead, Co-Founder @ Oper8r! His experience across venture capital and private equity (Hall Capital Partners, Sapphire Ventures), along with a number of years working for early-stage technology companies inspired his latest venture, Oper8r (Co-founded alongside Welly Sculley), which is focused on enabling the next generation of great founders in VC by empowering emerging micro-VC’s that fund them.

In addition to his day job, he’s also a teaching assistant at Stanford, facilitating discussions around entrepreneurship and venture capital alongside leaders like Eric Schmidt, Pete Wendell, Scott Kupor and Raymond Nasr. With experience as a founder, operator and investor, we discuss all things cap table related, including:

- His unique path into venture capital 📈

- The 3 biggest patterns he saw after seeing 4,000+ pitch decks 👀

- Oper8r’s playbook for helping great investors become fund managers 📕

- The emerging LP Ecosystem and opportunity ahead within VC 🌎

- Cap table advice ⼏

- The state of VC in 2030 🔮

TCT: Thanks for sitting down with us, Winter. Let’s jump in.

How did you start out with regards to your career?

After writing my grad-school thesis on technology trends in digital media, I moved to San Francisco to see if I was right! While working at a couple of startups, I saw the fundraising process firsthand, appreciated how critical capital was to realizing innovation, and became determined to learn how that side of the business worked.

How did you get into venture capital?

I give full credit to my friend (thank you, Amy!), who — knowing I was interested in VC — emailed me in 2010 about an open position at Hall Capital Partners, a $30B investment manager in San Francisco started by the brilliant Katie Hall. I joined the team led by Jessica Reed-Saouaf and Kirk Dizon, who were two of the pioneers of the micro-VC movement (Kirk also worked closely with Michael Kim to start Cendana Capital). So I was lucky to be in the room with some of the key people behind the micro-VC fund-of-funds movement. We underwrote many small and early VC funds, like Thrive Capital in 2011.

In 2014, I was fortunate to have the opportunity to join Nino Marakovic’s and Beezer Clarkson’s team at SAP, which at the time was building out their VC fund-of-funds program, now called Sapphire Partners.

You’re the Co-Founder of Oper8r, a community building the next generation of institutional VCs. What was the inspiration behind launching this? Can you share more about Oper8r’s mission and vision?

Between my time at Sapphire and Hall, I must have looked at over 4,000 pitch decks — many who were emerging VCs — and “grew up” with many of the emerging VCs that we invested in. A few patterns stuck out: 1) the market for emerging VC was growing at an accelerating rate; 2) many of these emerging VCs were outstanding investors, but lacked experience dealing with operations and investor relations — two ingredients critical to building a firm; and 3) many LPs were ignoring great talent because the VCs didn’t fit a traditional mold. These seemed like important problems to solve given that these VCs are the future of the industry.

You launched Oper8r Cohort I in June, a program focused on conveying what’s important to establish product/market fit with institutional LPs (which are in the business of selecting the best VCs). What are the goals of this first cohort, and how do you envision expanding this in the future?

We believe emerging VCs are critical to the future of the industry, and present a compelling opportunity to LPs. Our goal was to work with a small group of founding GPs with the investing potential and ambition necessary to build an institutional VC firm, and to offer Oper8r as their most valuable “LP” (note: we did not have our own fund) in helping with that journey. In other words, we borrowed from the YC playbook, but instead of focusing on helping great engineers become CEOs, we focused on helping great investors become fund managers.

We learned a lot from the experience — between screening 125 VCs to end up with the final 18, the 10-week program itself, and putting on alumni/ae events we’re organizing several times each month! Looking ahead, we see ourselves building resources for the broader emerging VC ecosystem (e.g. with data, benchmarking, and insights… and retweeting Samir’s sage advice!). We also see a clear need from the “emerging LP” ecosystem — the family offices, corporations, established VCs, etc. — that recognize the value of emerging VCs, but also lack resources necessary to implement the strategy. It’s clear that both parts are vital to helping the industry progress!

Oper8r is community driven. How has COVID affected your GTM (go-to-market) approach for community building and growing your audience?

We have always been a remotely run and virtual-first company, so COVID hasn’t affected our day-to-day operations. If anything, the new normal of virtual networking has let us engage with VCs and LPs in parts of the world that may have been “too distant” previously. Given the reality that innovation doesn’t happen in just Silicon Valley, we think virtual networking presents a great opportunity to accelerate connections as a result of merit and hustle, not zip code.

Switching gears a bit. What advice would you give to operators looking to get into venture capital in 2021?

If you’re an experienced team, check out Oper8r! If you’re looking to build a track record, consider programs like First Round’s Angel Track or LSVP’s scout program to start building a track record. And if you’re looking for a community to join, consider amazing platforms like Women in VC.

What’s the biggest kept secret in venture capital right now?

Many LPs — even household names! — still believe that VC returns are concentrated in the largest platforms, which has been thoroughly debunked. And many LPs who do recognize the value of emerging VC struggle to act on the thesis because they have fairly basic problems — with discovery, diligence, access, etc. — which can be paralyzing.

Sign Up Today!

To get these right in your inbox

You’re also a research and teaching assistant for Entrepreneurship and Venture Capital at Stanford University. When it comes to VC and entrepreneurship, what are the most interesting discussions you’re having about this with your students and colleagues?

The leaders of this class (Pete Wendell, Eric Schmidt, Scott Kupor, Raymond Nasr) are amazing. They offer case studies based on some of the best-performing VC-backed companies of all-time, and adjust the curriculum each year based on what’s topical. Hearing candid perspectives from successful founders, and the VCs that backed them is way more compelling than reading theory out of a textbook. Needless to say we borrowed from this model at Oper8r, where we set the topics, but brought in dozens of experts - largely institutional LPs - to share their firsthand experiences.

What are you passionate about outside of work?

I’m a proud volunteer at First Graduate, which guides underprivileged kids from grade school through college to enable more opportunities for these kids. I learned about the program from my wife, who was the first in her family to go to college, and owes this in large part to serendipity — relying on one teacher to be proactive to arrange college tours in a school that sent 30 of its graduating class of 500 to college. First Graduate helps manufacture this kind of serendipity by bringing together the people who need support the most, and people who care about providing it. I like organizations that support the underdog early and the people who genuinely embody this underdog mentality.

You seem busy but still able to stay organized and focused. What are your favorite productivity tools you use on a daily basis that help with this?

Calendly + Airtable! I schedule most meetings with people I’m meeting for the first time on Mondays, which usually means 15 back-to-back meetings. It’s a little overwhelming, but also like an exercise in pattern-recognition since most of these new meetings are with emerging VCs. I also try to maintain a zero-inbox policy. Partly to avoid a mountain of email. But primarily out of trying to be respectful by being responsive — few things are more frustrating than following up on an unanswered email for a 5th time, so I don’t want to add to the problem!

What’s your secret for getting on the cap table?

It depends on the cap table! In all cases, I would say it depends on relationship and partnership — how much mutual trust and complementary value is there? This is true for both companies (as a VC) and funds (as an LP). When it comes to allocation into a competitive emerging VC, trust is vital. Were you the LP who helped drive momentum for the first close, or were you the LP who showed up at the last close asking for special terms? It’s important to remember that VC is a people business. We believe strongly in being respectful and paying it forward by default.

What’s your biggest cap table “mistake”?

My biggest mistake was making a commitment to a small VC fund based on misinformation from several entrepreneurs and a large VC firm during an extensive reference process. In this case, the misinformation was so significant that it led to the small fund “blowing up” and all the LPs involved being very unhappy. The key learning was strong relationships are key for getting accurate information, especially in early-stage VC.

The year is 2030. What’s the state of Venture Capital?

A core thesis behind Oper8r is that emerging VCs and LPs today look a lot like seed-stage startups and angels 20 years ago, and that the market will undergo a similar type of evolution. 2030 is maybe too soon, but I expect we’ll start to see some of the same signs: more playbooks and programs on how to be a VC (many have spun up even in the past few months); a more formal market of LPs that specialize in emerging VCs, along with more sophistication, standardization, and (additive) complexity around valuations and terms; and — we hope! — a new wave of innovation as the result of underrepresented VCs entering the market and bringing capital to underrepresented founders and ideas. I’m excited for the future, and hope Oper8r will play a key role in enabling it!

Follow Winter on Twitter (@wintmead) for more insights into venture capital, fund of funds, startups and more!

Deal News 11/7-11/13

Secondary Markets

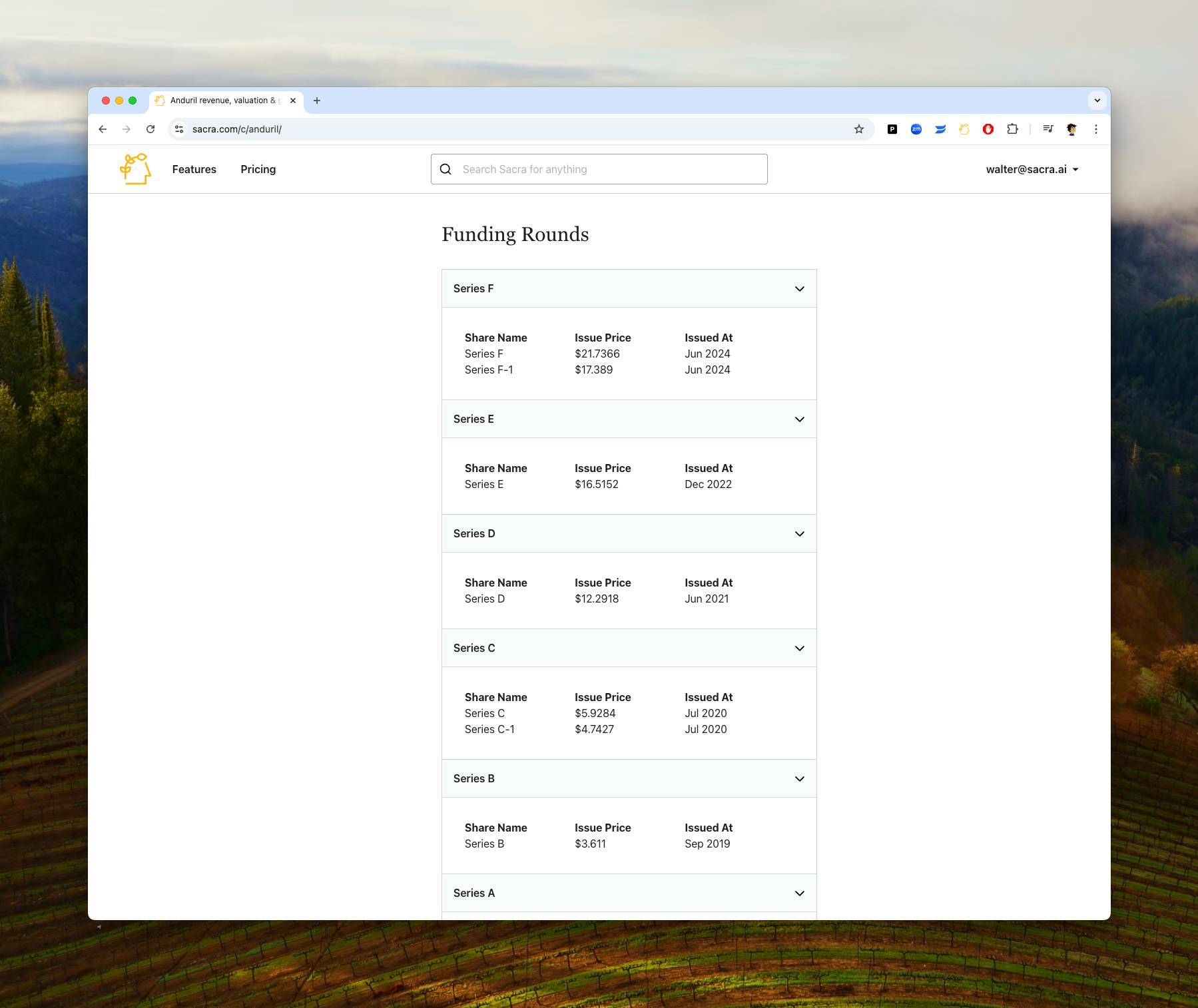

- SpaceX: led by Founders Fund, Google, Bank of America, Fidelity, Tiny Capital | SpaceX is an aviation and aerospace company that designs, manufactures, and launches advanced rockets and spacecraft. Press release.

Pre-Seed

- TrustClarity : $300,000 | TrustClarity is a B2B SaaS storefront platform.

- Respira Labs: $145,000 | Respira Labs is building an AI-powered sensor platform to track, predict and prevent chronic lung disease

- AmorSui : $120,000 | Sustainable PPE Management Solution.

Seed

- Kuda Bank: $10,000,000 | A no fee full service digital only bank with its own stand alone banking license, making banking affordable for all Africans on the planet

- Nana: $6,000,000 | Nana is building the Guild for the future of work. A distributed workforce of tradespeople, starting with the $4B Appliance Repair industry.

- VastBiome: $4,500,000 | VastBiome is a biotechnology company that mines microbiome drugs to treat cancer and autoimmune disease.

- Mozart Data: $4,000,000 | Mozart Data specializes in data stack, SaaS, data-visualization and engineering solutions for companies.

- Highwing: $4,000,000 | Highwing is an insurance technology company that develops an open-data platform for commercial insurance brokers and carriers.

- Union Protocol Foundation: $3,900,000 | Union Protocol Foundation is a technology platform that combines bundled protection and a liquid secondary market.

- SOTE: $3,600,000 | Sote is building the digital logistics infrastructure for Africa

- Reprise: $3,200,000 | No code platform to create demos of software

- CityMall: $3,000,000 | CityMall is a social e-commerce platform that sells lifestyle and curated products via peer-to-peer referrals on WhatsApp.

- OthersideAI: $2,600,000 | OthersideAI is a provider of an AI-driven software which turns summaries and shorthand notes into written emails.

- Direct. me: $2,600,000 | Direct. me is an online platform that helps influencers and businesses promote their online activity.

- Explo: $2,300,000 | Explo develops data management software for users to explore, manipulate, and visualize data without SQL.

- Nektar.ai: $2,150,000 | Nektar.ai is a B2B sales productivity startup that develops an AI-based virtual sales assistant to improve the productivity of sales teams.

- Turaco: $2,000,000 | Turaco develops simplified insurance and credit solutions through mobile technology to solve healthcare financing needs.

- Statiq: $1,800,000 | Statiq is an EV charging network that enables the customer to locate the nearest charging station, book a slot & make the payment digitally.

- Demoflow: $1,600,000 | Demoflow is a collaborative remote selling platform that streamlines prep, presentation, and documentation across a sales organization.

- Adaptilens: $1,600,000 | Adaptilens develop an accommodating intraocular lens.

- dClinic.co: $1,500,000 | dClinic.co is a dedicated Healthcare Blockchain company.

Series A

- Inipharm: $35,000,000 | Inipharm is a biopharmaceutical company.

- Isovalent: $29,000,000 | Isovalent builds open-source cloud-native networking software that solves networking, security, and observability for modern infrastructure

- Bond Vet: $17,000,000 | Bond Vet is a provider of veterinary services intended to provide urgent care for pets.

- Coherent: $14,000,000 | Coherent is a Hong Kong based insurtech company that provides digital solutions for leading global insurers.

- Tailscale: $12,000,000 | Tailscale is a developer of a corporate VPN alternative, aiming to make private networks easier to build and maintain.

- Kinetic: $11,250,000 | Kinetic develops wearable devices connected to cloud-based software in order to reduce workplace injuries for the industrial workforce.

- Bumped: $10,400,000 | Bumped allows users to receive shares of stock and securities from their favorite brands while they shop.

- GuideCX, Inc.: $10,000,000 | GuideCX's platform enables a customer facing view into an implementation/procurement/renewal process... keeping everyone on the same page.

- Maestro: $7,200,000 | Maestro is a software platform built to maximize value in private equity-backed companies.

Series B

- Hopin: $125,000,000 | Hopin is a live virtual events platform that enables attendees to connect, learn, and interact with people anywhere.

- LinkAja: $100,000,000 | LinkAja is an electronic-based service that makes your financial transactions more exciting.

- Cellwize: $32,000,000 | Cellwize enables mobile network operators to accelerate their 5G journey with a cloudified, AI-driven RAN automation platform.

- Livestorm: $30,000,000 | Livestorm is a browser-based video communication platform that easily connects teams to promote, host, and analyze online events.

- Fishtown Analytics: $29,500,000 | Fishtown Analytics is a developer of an open-source analytics engineering tool.

Series C

- Nuro: $500,000,000 | Nuro develops and operates a fleet of electric self-driving vehicles that are built to deliver assorted local goods.

- Carbon Health: $100,000,000 | Carbon Health is a tech-enabled healthcare company that delivers a virtual care experience.

- Eko: $65,000,000 | Eko develops FDA approved, AI-powered heart sound and EKG sensors for heart disease monitoring.

- Buoy Health: $37,500,000 | Buoy is an AI-driven digital assistant that helps patients self-diagnose and triage to the appropriate care.

- Truebill: $17,000,000 | Truebill is a platform that allows users to find, track, and manage their subscription services and recurring bills.

- So Good So You: $14,500,000 | So Good Brand is a Minnesota-based company and a producer of natural organic beverages and food products.

- FinPay: $5,000,000 | FinPay, LLC provides Patient Financial Management Solutions

Series D

- Better.com: $200,000,000 | Better.com is a comprehensive homeownership journey platform that utilizes technology to change the way people buy and own a home.

Series E

- Xpressbees: $110,000,000 | Xpressbees is an e-commerce logistics company that provides reliable logistics solutions to its partners.

- Menlo Security: $100,000,000 | Menlo Security is a cyber security company that protects organizations from malware.

- JumpCloud: $75,000,000 | JumpCloud enables IT to securely manage user identities and connect them to resources regardless of provider, protocol, vendor, or location.

Series F

- SentinelOne: $267,000,000 | SentinelOne delivers autonomous endpoint protection that prevents, detects, and responds to attacks across all major vectors.

Sources: Crunchbase, LinkedIn, Twitter