We’re thrilled to announce this week’s exclusive with Walter Chen, co-founder of Sacra! Walter, a 3x founder, started his career as a lawyer and software engineer before going on to found companies including iDoneThis (acquired 2015), Animalz, and now Sacra, a digital platform to provide research reports on private markets. Walter is also an investor at Golden Wok, whose investments include Farmstead, Podia and Tribe Capital, to name a few. With deep operating and investing experience, we discuss all things cap table related, including:

- The $225 billion dollar opportunity: how Sacra is planning on bringing more transparency to the private markets and how they will help facilitate secondary liquidity 🤝

- Startup Investors: cap table opportunities via secondaries 📈

- Startup Employees: how you can liquidate before an exit 🤑

- Cap table advice ⺇

- The State of Private Liquidity in 2030 🔮

TCT: Thanks for sitting down with us, Walter. Let’s jump in.

How did you start out with regards to your career?

I taught myself how to code from a young age, played a lot of video games, started building websites, etc — typical nerd stuff. The dot com boom happened while I was in high school, and the movie Startup.com stuck out in my memory as something that might be fun to do someday.

In college, I read Paul Graham's essays while studying computer science. I took a left turn when I went to law school and practiced law a couple years during the financial crisis circa 2008-2010. But I got sick of my job around that time and quit my job to start a company with a friend. That became my first company, a team productivity tool called iDoneThis.

You founded iDoneThis, which was acquired in 2015. What was going through your head at this time? What were your biggest takeaways from this acquisition?

After we sold the company, I thought it would die. We sold the company in part because we were contending with relatively high revenue churn, which meant that we constantly felt like we were running just to stay in place.

A few years after we sold, I happened to meet the new owner of iDoneThis, who bought the company from our buyer. I was surprised — iDoneThis had only shrunk by half and still generated meaningful 6-figure ARR.

That experience showed me the resilience of recurring revenue and a strong inbound acquisition engine. With Animalz, that gave me the confidence to promote internal leadership to CEO and COO to run and grow the business instead of just selling it.

Alongside Jan-Erik Asplund, you founded Sacra, a digital platform to provide research reports on private markets earlier this year. What was the inspiration behind this? What is the core thesis behind Sacra?

The core idea behind Sacra is that by bringing more transparency to the private markets, we can help facilitate secondary liquidity. That brings liquidity to employees and early investors, which they'll invest back into the ecosystem of entrepreneurship.

Before Sacra, Jan and I worked together at Animalz, a content marketing agency where we worked with B2B SaaS companies and VC firms. We did a ton of long-form research (and we still do at Animalz) on the private markets and we found that (1) there's a scarcity of private markets research because of how companies control the dissemination of info and keep it close to the vest and (2) there's a huge demand for this type of research.

We saw Sacra as an opportunity to direct this type of research towards an end that would make your typical startup employee's life better in a meaningful way and that would facilitate investment back into the startup ecosystem, which we believe is a massive force for value creation and good in the world.

Sacra published “The Privately-Traded Company: The $225 Billion Market for Pre-IPO Liquidity” in September of 2020, highlighting the state of market liquidity. What are the biggest opportunities ahead for private market liquidity as an issuer?

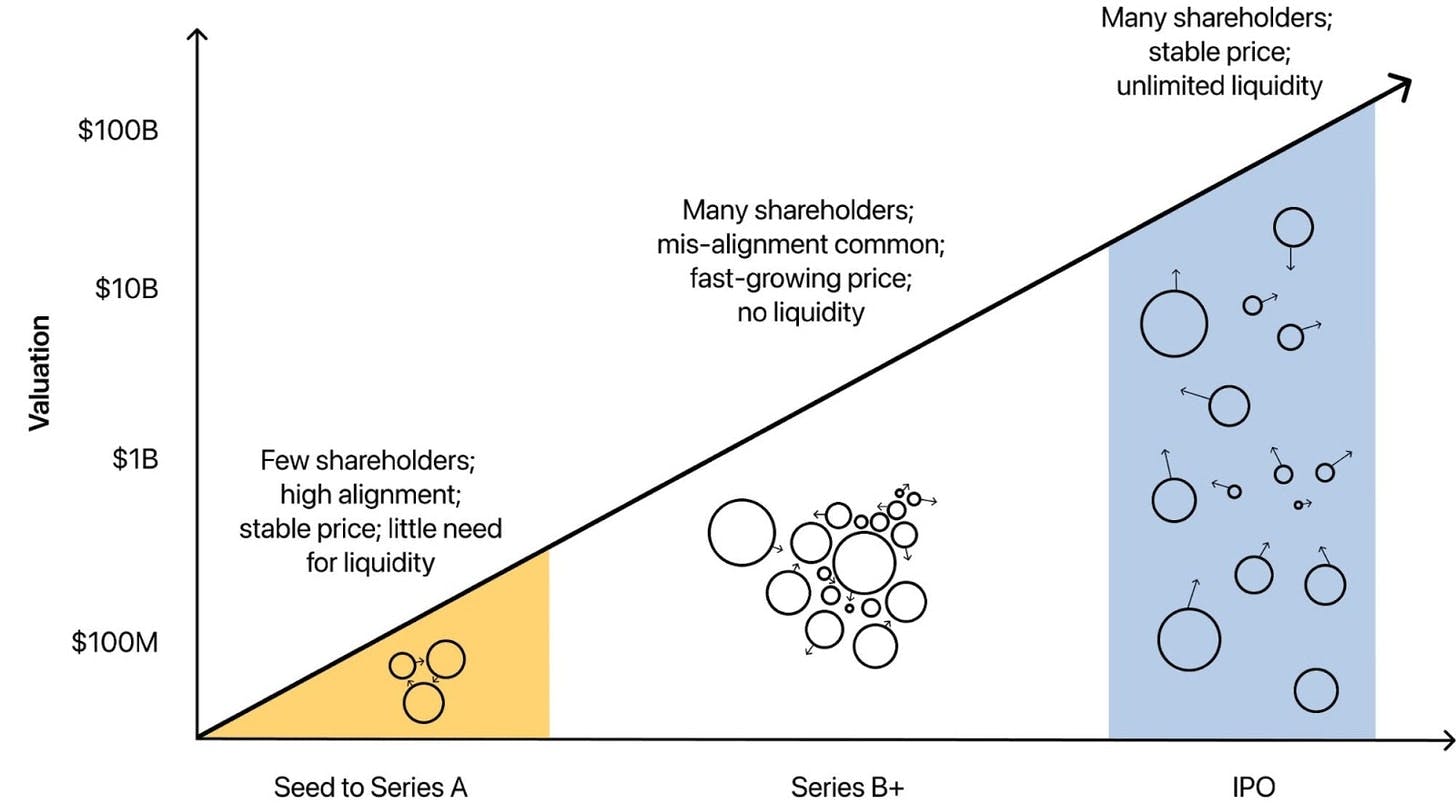

For issuers, liquidity has been binary in the past and that's forced companies and founders into an either / or situation. With more liquidity in the private markets, companies can choose how liquid they want their stock to trade, depending on what the company needs and the type of business that they want to build. Liquidity helps drive alignment on the cap table, which is fundamentally friendly to long-term holders like founders.

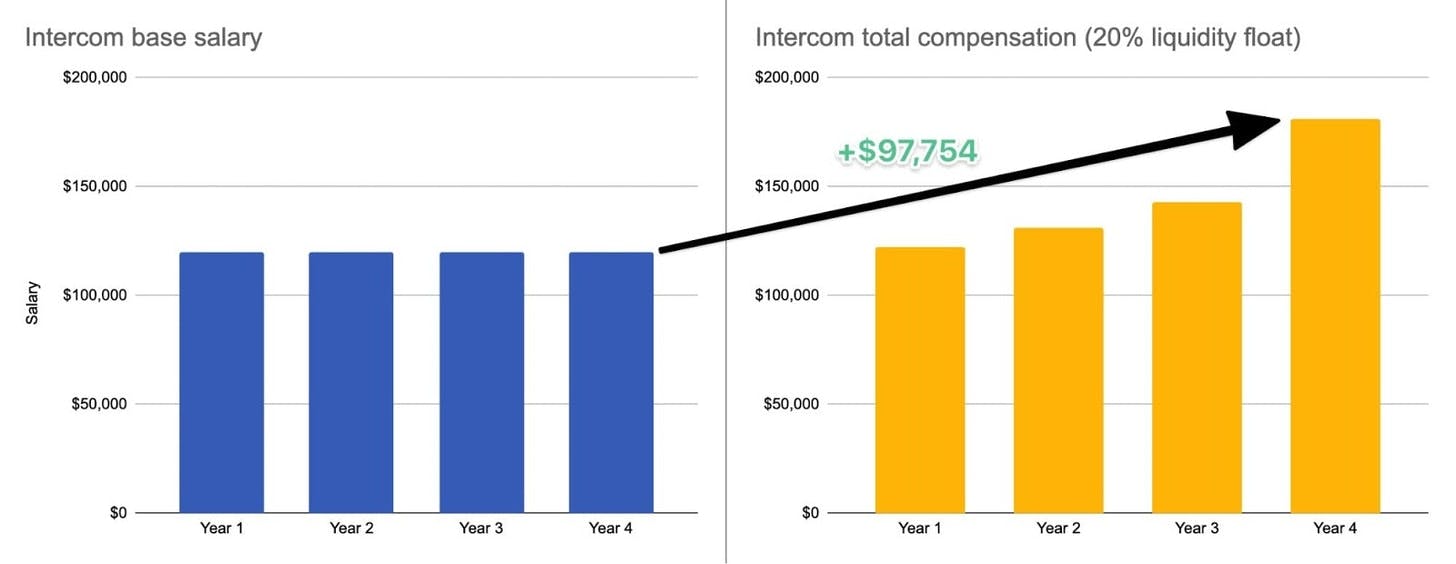

Also, offering liquidity is the flip side of offering employees equity but it's one that companies have neglected. That's why employees so undervalue equity and often don't exercise options—because they can't sell it anyway. By telling employees that they offer not only equity but also regularly recurring liquidity, companies allow their employees to put a price tag on their equity, which then allows for like-for-like comparisons with equity incentive plans at Google or Facebook.

You don't need a sky-high valuation to give employees meaningful bonuses through secondary sales: with Intercom's $1.2 billion valuation, yearly secondary sales with a 20% float could allow a Series B hire to earn an extra $100,000 over their first four years.

Check out our full report here, and email me at walter@sacra.com for a discount.

What types of opportunities will there be for startup employees looking to sell a portion (or all) of their shares?

In addition to platforms like Forge and EquityZen, and upcoming platforms like CartaX, we're seeing the rise of employee compensation platforms like Trove and Vested. These products will provide employees with a portal into understanding their all-in comp and that'll be an entry point into connecting with employees about liquidity and the sale of their equity.

As private markets liquidity grows, we'll also see the explosion of products like SecFi, which will, e.g., provide employees loans with their company equity as collateral, giving them the liquidity to buy a house without having to sell their shares.

One thing that gets forgotten in these conversations is that for employees, it isn't only a binary sell vs. hold question. Price matters. Many start-up employees have reached out to us asking for research coverage of their companies as a way to facilitate more accurate pricing in the secondary markets.

On the flip, what are the opportunities ahead for investors looking to make their first investment in the private markets?

We think late-stage, pre-IPO companies are a great place for investors to make their first private markets investment because many of those companies are household names, products that investors have used and are familiar with, and have mature financials that public markets investors understand.

Whereas one characteristic of private markets investing is that companies control the cap table, so that connections are required to get the opportunity to invest, platforms like Forge and EquityZen make it easy to invest in pre-IPO companies without having a prior relationship. Syndicates through AngelList are similar, though those opportunities seem to tend towards the earlier stages.

With Sacra, one area where we believe we can contribute to the Forges and EquityZens is that we can provide research for the names that they deal in on the platform, conveying trust to outside investors who are accustomed to public equities research-style monitoring and oversight of liquidity. It's that monitoring that can facilitate much more liquidity and increase the transaction volumes for everyone in the secondary space.

Sign Up Today!

To get these right in your inbox

Sacra is still in beta. Is there a launch date set? What’s the best way to stay up to date?

Sign up for our email list to stay in the loop 😁

In addition to your day job, you’re also an investor at Golden Wok, which has invested in companies such as Farmstead, Podia, and Tribe Capital, to name a few. Can you tell us about your investment strategy and decision-making framework?

I like to allocate capital towards the change I want to see in the world. To me, that means supporting founders and ideas that I connect with.

- When it comes to founders, I like to invest through my network because I believe that it strengthens my relationships and attracts like minded people to the network.

- Like every founder, I'm deeply familiar with the tools that we pay for and that helps me formulate ideas for products that I'll never have the time to actually execute on. When I meet a founder that is working in that problem space and has thought it through more deeply, I get excited and want to invest.

By allocating only ~5% of my net worth to angel investing, I can sleep well at night knowing that even if all my investments fail, I'll still be okay. The big thing that stands out for me is that after investing in 17 companies over 4 years, I'm not sure if I'm any good or if I'm terrible at it.

I named my 'fund' Golden Wok, after the Chinese restaurant that my aunt ran for 30 years — and it's my aunt's story that embodies what I'm trying to do with my startup investing.

In 1977, my aunt Julie and uncle David came to the United States from Taiwan empty-handed, starting from zero. They followed my dad to State College, Pennsylvania, where my dad had just joined the math faculty at Penn State.

Because of the early 1980s recession, my aunt and uncle couldn't find jobs. My aunt had worked in restaurants and she felt that running a restaurant was something that they could do. They told my dad about their idea to open a Chinese restaurant in State College and he got a huge smile across his face. He wanted to eat better Chinese food in town.

My dad co-signed for a loan and they used the startup capital to open Golden Wok at the corner of College Avenue and Atherton Street. They brought in a chef from New York City and opened on July 1, 1983. Within a few weeks, word of mouth spread and they had lines around the block. A few years later, they bought the building.

In 1997, when I was 14, I bought the domain goldenwok.com for my aunt and launched the first version of her website.

The idea is that the new Golden Wok is a spiritual successor to the restaurant and an homage to its origin story. My dad helped my aunt get started with access to capital and his belief, and it's through her hard work that she built an institution and generational wealth for her family. It's that experience of being the earliest supporter that motivates the investing that I'm doing.

What are you passionate about outside of work?

My dog Tulip is my passion. If you've been on a Zoom call with me, then you've heard her barking in the background. She's a very persistent and determined terrier and I learn a lot from her about entrepreneurship by watching how she goes after squirrels.

As an investor, what’s your secret for getting on the cap table?

When founders have specifically carved out room for me on the cap table in competitive deals, it's been because we've built a relationship over time as friends who have mutually supported each other.

That said, I think a major perk of not being a professional investor and only investing my own money is that I don't really need to worry about competing to get onto cap tables.

In general, I try to take an interest in people and building long term relationships. When I feel regret, it's when I tried to use someone for some short term gain, focusing more on the thing that I wanted than the people involved.

On the flip, what’s your biggest cap table “mistake”?

We indiscriminately took checks from willing investors on iDoneThis and one of them tried to veto the acquisition because he wasn't happy with it. Even though he was a small check, he made himself a nuisance. I will say on a positive note that the experience helped me think through the type of investor that I wanted — and didn't want — to be.

What I overlooked with iDoneThis is that while seed investors don't typically get any form of real control, who you surround yourself with will exert a ton of influence on you and make a difference day to day on how it feels to go to work. Over the intervening years, I've learned a ton from Chris Savage, co-founder/CEO of Wistia, about how important cap table alignment is for taking a long-term view on building a business.

The year is 2030. What’s the state of private market liquidity?

The longer arc that's part of the financialization of startups generally is towards more financial tools and options and that gives founders, investors, and employees the freedom of choice.

I think that's hugely powerful and I'm excited for Sacra to play a small part in that.

Thank you for your time and thoughts, Walter! We look forward to the continued success of you and the various organizations you’re involved with!

Deal News 10/17-10/23

Pre-Seed

- Synthetaic: $1,000,000 led by Lupa Systems| Synthetic is a Delafield, Wisconsin-based company that grows large and high-quality datasets sufficient for machine learning.

- Teleportal Inc: $210,000 led by Acequia Capital (Acecap), Betaworks Ventures, Logan Lorenz| Teleportal is a spatial computing company building developer and creator tools.

- Via.Delivery: $75,000 | Via.Delivery is a platform to make offline retail pick points for eCommerce.

Seed

- Fabric: $9,500,000 led by Redpoint| Fabric is a headless commerce platform helping direct-to-consumer and B2B brands utilize an e-commerce platform designed for their needs.

- VECTARY: $7,300,000 led by EQT Ventures| The most accessible 3D and Augmented Reality design platform. No downloads, all in the browser.

- Cuddlynest, Inc: $6,000,000 | World's premier booking platform offering all accommodations for all types of traveler, anywhere in the world, for the best price.

- Welcome Homes: $5,350,000 led by Global Founders Capital| Welcome Homes operates as an online residential real estate platform.

- Frost Giant Studios: $4,700,000 | Frost Giant Studios is a production studio focused on real-time strategy (RTS) games for competitive gaming on PCs.

- Render: $4,500,000 led by General Catalyst| Render is the easiest cloud for developers and startups to host all their apps and sites.

- Secureframe: $4,500,000 led by Base10 Partners, Gradient Ventures| Secureframe is a provider of SOC 2 and ISO 27001 compliance automation software for compliant security.

- Vowel: $4,300,000 | Vowel is operating in stealth mode.

- DataChat: $4,000,000 led by WRVI Capital| DataChat is a new Conversational Intelligence platform.

- Polymarket: $4,000,000 led by Polychain| Bet on your beliefs.

Series A

- Be Biopharma: $52,000,000 led by Atlas Venture, RA Capital Management| Be Biopharma is developing B cells as medicines.

- Output: $45,000,000 led by Summit Partners| Output develops innovative software and gear for musicians, composers, producers, and sound designers.

- VENN: $26,000,000 led by BITKRAFT Ventures, Nexstar Broadcasting Group| VENN is a 24/7 post-cable network aimed at gaming, esports, and entertainment audiences.

- FinLocker: $19,800,000 led by Cultivation Capital| FinLocker provides a personal financial assistant tool that enables loans and financial transactions.

- Lili: $15,000,000 led by Group 11| Lili empowers freelancers with financial services and tools to balance work and life in one account.

- eVisit: $14,000,000 led by TVC Capital| Evisit is a telemedicine patient engagement platform for SMB healthcare practices.

- Unit21 : $13,000,000 led by A.Capital Ventures| Unit21 is a platform that provides no-code tools and services for risk and compliance teams.

- Loyal: $12,500,000 led by Concord Health Partners| AI-driven digital patient experience platform.

- Intellimize: $12,000,000 led by Addition| Intellimize helps marketers drive conversions and revenue growth by personalizing websites to deliver the right experience to each visitor.

- ThinkIQ: $11,600,000 led by Ecosystem Integrity Fund| ThinkIQ team blends a strong mix of technical, domain, business, and operational professionals.

- Pulley: $10,000,000 led by Stripe| Pulley offers a cap table management platform designed to help startup founders, employees, and investors monitor their equity information.

Series B

- Retool: $50,000,000 led by Sequoia Capital| Retool provides a tool creation software that helps construct custom business tools without any programming knowledge.

- Anyscale: $40,000,000 led by New Enterprise Associates| Anyscale provides an application development platform for developers to build distributed applications.

- AiFi: $14,500,000 led by Qualcomm Ventures| AiFi is an information technology company specializing in developing store automation systems.

- Diality: $12,500,000 | Diality is a medical device company creating a patient-centric, portable, simple, and smart dialysis machine

- Possible Finance: $11,000,000 led by Union Square Ventures| Possible Finance provides financial tools needed to manage day-to-day lives.

- Telesense: $10,200,000 led by Finistere Ventures | TeleSense is an AgTech company providing environmental monitoring and control solutions for the food and grain industry.

Series C

- Tekion: $150,000,000 led by Advent International| Tekion is a cloud-built platform with advanced machine learning and AI capabilities for a personalized and seamless consumer experience.

- Newfront Insurance: $100,000,000 led by Founders Fund, Meritech Capital Partners| Modern platform to transact insurance.

- 4iQ: $30,000,000 led by Benhamou Global Ventures, ForgePoint Capital| 4iQ is a Cyber Intelligence company that protects digital identities and investigating threats, adversaries, and fraud.

Series D

- Sirnaomics: $105,000,000 led by River Head Capital, Rotating Boulder Fund, Walvax Biotechnology| Sirnaomics is a biopharmaceutical company developing therapeutics for critical human diseases RNA interference (RNAi) technology.

- Handshake: $80,000,000 led by GGV Capital| Handshake is a college career network that helps students and recent graduates find their next opportunity.

- ROKT: $80,000,000 led by TDM Growth Partners| Rokt builds an e-commerce marketing technology that gives customers a more personalized and relevant experience while buying online.

Series E

- Arctic Wolf Networks: $200,000,000 led by Viking Global Investors| Arctic Wolf provides a managed detection and response security service that works as an extension designed for IT network security.

- BrightFarms: $100,000,000 led by Cox Enterprises| BrightFarms is an indoor farming company specializing in providing locally grown packaged salads.

Sources: Crunchbase, LinkedIn, Twitter