We’re thrilled to announce this week’s exclusive with Hari Raghavan, founding team member at AbstractOps! During his time as COO at Forge (formerly Equidate), he was a part of the team that scaled the business 100x over three years before moving on to launch AbstractOps, an automated back office for early stage CEOs. An active angel investor since 2015, Hari’s notable investments include Notion, Rippling and Slack, to name a few. With deep operating experience and domain knowledge of private market liquidity, we sat down to talk all things cap table related, including:

- 100x’ing: 4 ways to grow a company, at scale 📈

- Angel investing: advice for writing your first checks and how to define an investing thesis 🧐

- The “CEO dashboard”: how AbstractOps is helping remove friction around corporate information and creating a Corporate OS and Data Platform 🖲

- Cap table advice ⼏

- The state of Secondary Markets & Liquidity in 2030 🔮

TCT: How did you start out with regards to your career?

I started my career in management consulting, at BCG. I’ve always had a bit of FOMO, so I worked on a bunch of industries (industrial goods, financial services, etc.) and functions (growth strategy, M&A, org design, etc.)... it was a great foundation to understand how businesses work across the spectrum.

I always knew I wanted to end up in the tech ecosystem though. It’s where the most interesting things were happening. So, at some point, where the pain of middle management and politics overtook the benefit of the excellent learning curve, I quit and moved out to the Bay Area.

You were employee #1 at Forge, the private market liquidity platform, helping them 100x during your time there as an employee and then COO from 2015 to 2018. What were the top (scalable) initiatives you implemented that helped Forge grow so quickly in such a short time? If you were to do it over again, what would you do differently (if anything)?

It was all a team effort, so I’ll talk about what “we” did rather than what “I” did.

- Innovate on as few things as possible. In the beginning, we had an unusual transaction structure, in a nascent industry, with a new team to the space. There are only so many things you can challenge the status quo on, at once. So when the transaction structure became more standard, and we became more expert in the space, and as the space itself matured... each deal became way easier.

- Metrics started accelerating when we focused on higher ROI / higher leverage business. We happened to hire a head of BD who had a lot of institutional experience, and our experiments in this space went really well. And institutional deals are much higher leverage in a services business. Why work on a $200K deal with $20K in revenue, when you could work on a $5M deal with $250K in revenue (and it was only perhaps 2-3x as much work?). You don’t have to say yes to every customer, or every deal.

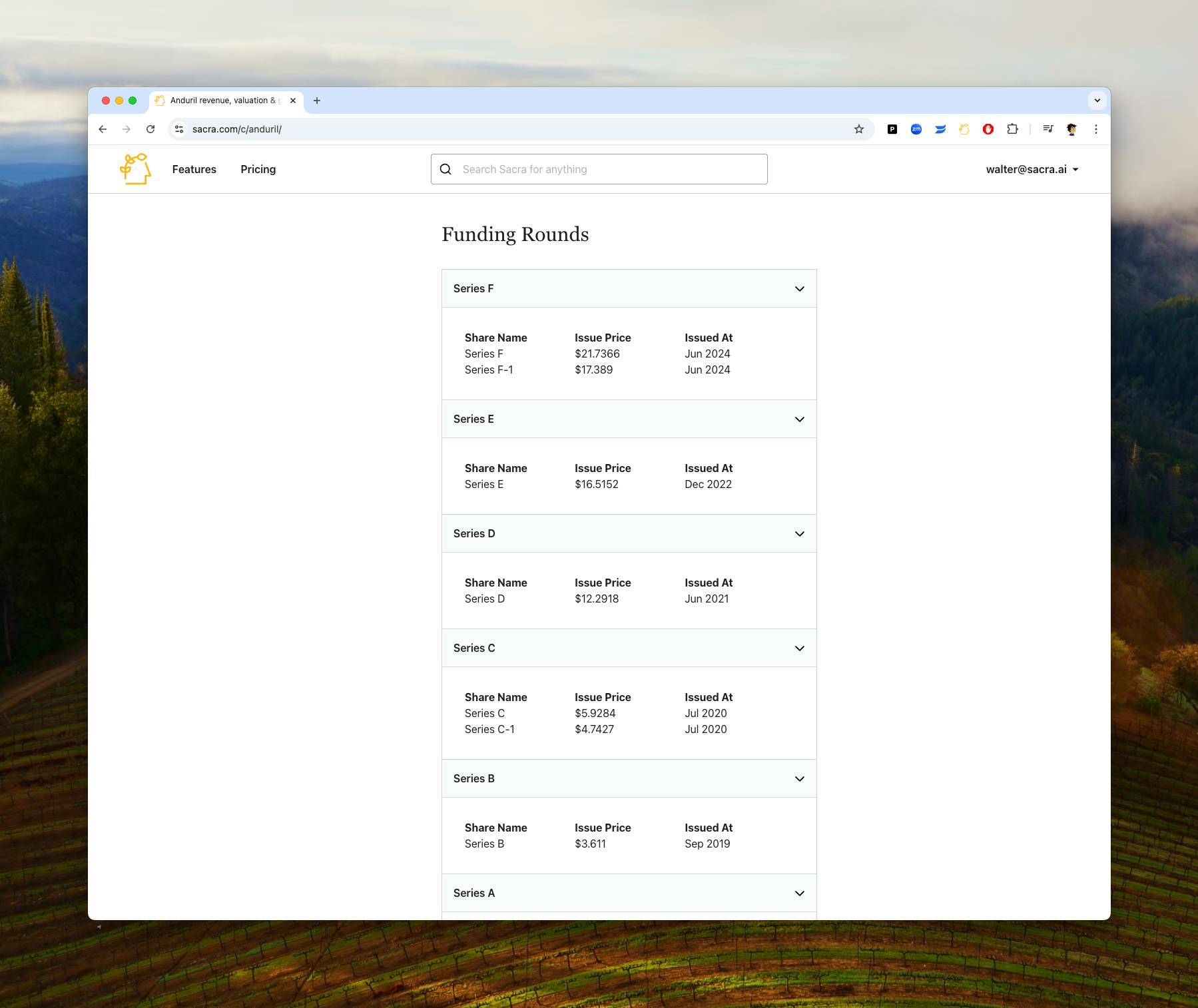

- We got a lot of buzz by enabling transparency in private market valuations, which established us as topic matter experts. We rebuilt hundreds of companies’ cap tables through forensic analysis, which means that shareholders could suddenly see what their shares were worth, and journalists were calling us to analyze data related to funding announcements.

This know-how is still useful today:

YC's investment in Airbnb is likely the single best angel investment in history. $20K for 6%, which is ~$2,200,000,000 at today's close.

— Hari Raghavan (@haridigresses) December 11, 2020

That is 110,000x MoM, a ~275% IRR compounded over ~11.5 years.

(I know YC <> other "angel" investments but the point holds.)

I mean, I guess I can be interesting at times, but Airbnb is way more interesting.

- We focused product efforts on operational bottlenecks. A lot of deals in the first year or two fell through because it took us too long to send a HelloSign out for signature, or make sure wire information was confirmed on time. By removing friction in the process with software, we had much higher throughput and fewer unforced errors.

You’re an active angel investor and advisor with 40+ investments across early stage (Notion, Rippling, Mercury) and late stage secondary (Slack, Spotify, Robinhood) investments. What was your first investment? How did you go about getting the money to make this investment?

My first investment was in the seed round for crystalknows.com, via an AngelList syndicate. It was out of my (paltry) savings. You don’t have to have a lot saved to write a couple of $3-5K checks a year… I’m glad this approach is starting to become known.

That said, I do hope people dip their toes rather than jumping in the deep end (e.g., I only made one <=$5K investment per year in 2015, 2016, and 2017, because I simply didn’t have much liquidity). But, I happened to see a lot of deals since I had colleagues who were active angels… so I started building a mental model around what “clicked” for me vs. didn’t, and being (accidentally) patient this way allowed me more time and experience to get better without putting much money at risk.

In short — the method I accidentally stumbled on that helped me get better was to see a lot of deals in the first few years but only do a very very small percentage.

One great way to do this is to see if any of your friends are in “investment clubs” (there are lots of Slack channels and such dedicated to this), or follow a bunch of AngelList syndicates. (Note: do respect confidentiality and good faith when you do all this.)

How would you describe your angel investing thesis? What would you recommend to first time angel investors for a better entry: angel deals in early stage or later-stage via SPVs?

When considering the market or product: I only ever invest in things that are “operating systems for X”. I think too many people are conditioned to build features, not products (especially when investors keep asking “what’s your wedge”)… so when the [X] is a large market, and even in the MVP you can see how the team is already thinking / building it as an OS, that’s the a-ha moment for me.

When thinking about the founding team: I love depth, in many forms:

- Passion / Earnestness - how deeply does the team care about working on this?

- The Mind Maze - how deeply has the team thought about the problem?

- Stickiness / Moat - how deeply can the product embed itself in the ecosystem/customer?

Lots of investors are obsessed with whether the team is technical, but this ignores the fact that sometimes the best solutions don’t involve deep tech. It might be a business model innovation (Uber), or a more delightful user interface or experience (Mercury), or better focus on fewer features (Notion), a better distribution channel (Hippo), or new incentive alignment (Lemonade). Of course, some generational companies do require true technical innovation (Stripe, SpaceX, etc.) but there’s lots of other ways to create billions or even hundreds of billions in value.

In other words, rather than arbitrary checkboxes, the real thing that matters to me is founder-market fit. Is it an ML platform? Of course the founders need to have technical chops. Is it a financial services data play? I’d way rather the founding team include a Goldman Trader than a Facebook engineer.

What was your first 100x/10x and how did you get into that deal?

Notion was my first 100x. It was an AngelList syndicate. As these things usually go, it was total luck… I was an early adopter of the product and I’d been desperately looking for something like it for internal knowledge management at Forge. When I saw it pop up on AngelList around that time, it was an easy decision.

You’re part of the founding team at AbstractOps, an automated back office for early stage CEO’s. What are the biggest challenges CEOs face around managing back their back office and administration for equities?

“Operations” can be loosely defined as repetitive actions that follow human heuristics… IFTTT rules. The problem is, those rules in HR / finance / legal feel arcane, intimidating, and confusing. Some things (payroll, incorporation, etc.) have been thoroughly solved. Others, despite having multiple large companies in the space (taxes / bookkeeping, equity issuances, etc.) are still convoluted and hard to follow.

But all that aside, the part that’s actually getting worse is that there’s no system of record or automated rules for corporate information. It’s a running joke that a company’s cap table management system is only up to date when they’re in diligence for the next round.

The biggest reason is friction. The information is in dozens of places and you end up having massive G&A teams acting as human APIs. There are sales dashboards, DevOps dashboards, financial dashboards, etc… but, there’s no CEO dashboard. There is sales automation, marketing automation, automated testing, automated deployment… but almost no automation in the “corporate stack.”

That’s what we’re building. If Salesforce is your Customer OS and Segment is your Customer Data Platform… we’re your Corporate OS and Data Platform.

Sign Up Today!

To get these right in your inbox

Speaking of automation, how do you stay organized with your angel investments (managing notes and SAFEs pipeline, etc)? What does your personal tech stack look like?

Ha, I really hope someone solves this! My money is on AngelList, they’ve gone farther than anyone else.

In the meantime, I have a fairly complex Airtable base where I track each company; map it to each investment transaction; reconcile it with each bank account transaction; and I update the marks to market every 3-6 months. I have rules and views that spit out the MoM, IRR, and capital accounts each year.

You’re also a fellow at On Deck, an accelerator that helps entrepreneurs launch their next big idea within a community of investors and operators. How does On Deck help prepare operators looking to make the leap and start their own company?

On Deck is a special company. They’re run by some really thoughtful people that care deeply about entrepreneurship (in the broadest sense) and community. As part of the “Founder Fellowship” (the first one back in 2019 — I was OG OD!) there was a ton of opportunity to mingle with others going through the same thing; get feedback on your projects; help each other out; participate in fireside chats; etc.

But that’s all very tactical. Really, what it’s about is being part of a community of really high caliber people, all of whom have a giving spirit and a ton of entrepreneurial energy. If you put that together in a melting pot you get some pretty great results.

You’re an operator and investor. How do you balance doing both at once? What’s your secret for staying balanced?

I’m a bit lucky… potential investments are also potential customers of AbstractOps. I get to kill two birds with one stone.

Even so, I’ve gotten much more disciplined with spending time on investing over the last year, to focus on AbstractOps. I think you kind of have to invest on evenings and weekends, if you want to do justice to the startup you’re running.

What’s your secret for getting on the cap table?

First, have 1-2 things where you’re an industry expert (i.e., I can say I know employee equity compensation, or back-office best practices, better than almost anyone), so you can be their go to person. It’s the easiest way to add value.

Second, be transparent with your passion for what they’re doing, and make sure the companies know you won’t let details get in the way… I’m never the one setting the terms so why would I act as a blocker? Saying “whatever the terms are, shoot over the SAFE, I’ll sign and wire immediately” goes a long way.

What’s your biggest cap table “mistake”?

I’d rather not name the company, but it was probably investing in a company despite the following exchange:

Me: “Do you have a lead?”

CEO: “If Jeff Bezos were starting a company, would you ask if his round had a lead?”

Even if the company ended up doing really well, I wish I hadn’t invested. Confidence is strongly correlated with success, and arrogance with failure.

[Note: I never ask who the lead is, because I want to invest on my own conviction, not based on herd mentality… that said, ensuring that the company will have runway is an important test for those of us who don’t lead rounds or set terms.]

What are you passionate about outside of work?

I used to collect hobbies: fantasy novels (Brandon Sanderson FTW); poker; biking; (making) craft cocktails; men’s formal attire (my suits aren’t getting much love in the Bay Area though).

What’s the state of the secondary markets and private market liquidity in 2030?

Companies self-select into three stages:

- “Startup” phase (the first 5-6 years, what we currently think of as Seed through Series C companies, perhaps 200-500 people and a $500M-1B mkt cap).

- “Growth” phase (in between)

- “Public” phase (IPO/Direct Listing and beyond)

During the startup phase, companies enable and support early exercise. There isn’t an expectation of liquidity (except perhaps for extraordinary life events).

During the growth phase, companies switch to RSUs and enable a repeatable, predictable, quarterly liquidity cycle. Current and former employees, and early investors, can participate and sell up to [X]% of their vested stock each cycle, and there is a single price / closing set at the end of each quarter based on bids and asks collected from participants throughout the quarter. Company financials / board decks are made available to a) insiders, both buyers and sellers, and b) pre-vetted external buyers. This also gives companies a continuous pulse on the markets to inform primary fundraises.

Going public is made way easier by the above. Because of the intermittent secondary market activity, IPOs are priced more effectively, and DLs are made way easier (a robust secondary market is critical to setting the “reference price” for a direct listing).

The fact that liquidity isn’t a more important right in private companies is a travesty. It’s taking a while, but a number of companies are starting to move in this direction, and platforms are starting to automate and unlock it, too. It’s going to be an interesting decade for private markets.

Follow Hari on Twitter (@haridigresses) for more insights into the private markets, startup equity, and angel investing!

Deal News 1/16 - 1/22

Seed

- Perenna: $10,000,000. Perenna is building a mortgage lender with a customer-first mindset.

- Bear Flag Robotics: $7,900,000 led by True Ventures. Bear Flag Robotics is developing autonomous technology for farm tractors that enables growers to increase productivity and improve safety.

- Swapp: $7,000,000 led by Entree Capital, Point72 Ventures. Swapp aims to disrupt the current planning methodologies by providing an AI-driven end-to-end planning service.

- Avesha: $6,000,000 led by Taiwania Capital. Avesha is a technology platform that enables application workloads to disaggregate across cloud, multi-cloud, and edge locations.

- XP Health: $5,000,000 led by Valor Capital Group. XP Health is an artificial intelligence-powered vision benefits platform for employees.

- Savage Game Studios: $4,400,000 led by Makers Fund. Savage Game Studios is a dynamite team with expertise across all operational functions from art to tech and gameplay.

- Saddle Finance: $4,300,000 led by Electric Capital, Framework Ventures, Polychain. Saddle Finance is an automated market maker (AMM) optimized for pegged value crypto assets.

- HiPeople: $3,000,000 led by Moonfire Ventures. HiPeople creates in-depth talent insights to make hiring easy for everyone.

- LatticeFlow: $2,800,000 led by btov Partners, Global Founders Capital. LatticeFlow is empowering organizations to build and deploy robust AI they can understand and trust.

- Archlet: $2,800,000 led by Senovo. Archlet is a B2B SaaS application empowering company buyers to make faster and more informed decisions in strategic sourcing.

- Skyqraft: $2,200,000 led by Subvenio Invest. Skyqraft provides autonomous aerial infrastructure inspection.

- Softr: $2,200,000 led by Atlantic Labs. Softr is the easiest no-code platform to create powerful websites & web-apps from Airtable, in 10 minutes.

- CreditEnable: $2,000,000 led by JPIN, Venture Catalysts. CreditEnable provides data analytics, deep learning, AI and technology to build solutions to financial challenges.

- Backtracks: $1,600,000 led by Moonshots Capital. Backtracks helps podcasts, audio content creators, and brands know and grow their audiences.

- Eli: $1,500,000. Eli enables women to take control of their health across their lives, by providing them with their daily hormone profile.

Series A

- Brigit: $35,000,000 led by Lightspeed Venture Partners. A financial health app helping every American build a brighter financial future.

- Plexium: $35,000,000 led by Lux Capital, Pivotal bioVenture Partners. Plexium is a drug development startup that leverages techniques from various physical-science and computational disciplines.

- StackPulse: $20,000,000 led by GGV Capital. StackPulse helps SREs and developers make their software services more reliable through automation and orchestration.

- Trovata: $20,000,000 led by Wells Fargo Strategic Capital, Inc.. Trovata is a data-driven enterprise fintech platform that specializes in cash flow analysis, automation, and data science.

- Leocare: $18,100,000 led by Daphni, Felix Capital, Ventech. Leocare Assurance is an insurer that offers multi-equipment contracts.

- Omnipresent: $15,800,000. Omnipresent makes it easy to employ, pay and support your international team.

- Rewind: $15,000,000 led by Inovia Capital. Get peace of mind with Rewind. Rewind protects businesses by backing up their SaaS data.

- Ace Vision Group: $13,300,000 led by Picerne Group. Ace Vision Group develop laser-based therapeutic technologies to heal age-related eye dysfunction and restore the eye's natural performance.

- Valtix: $12,500,000 led by Cisco Investments, Northgate Capital, The Syndicate Group. Valtix protects customer applications in the public cloud with its multi-cloud network security platform delivered as a service.

- Curtsy: $11,000,000 led by Index Ventures. Curtsy is an app that lets women buy and sell clothing, shoes, and accessories on their phone.

- proSapient: $10,000,000 led by Smedvig Capital. proSapient is a research platform that gathers networks of insights from executives and SMEs via global consultations and surveys.

Series B

- Getir: $128,000,000 led by Base Partners, Crankstart Foundation. Getir is an Istanbul-based startup providing rapid on-demand deliveries.

- Verve Therapeutics: $94,000,000 led by Casdin Capital, Wellington Management. Verve is focused on discovering and developing therapies that safely edit the genomes of adults to confer protection against coronary.

- Multiverse: $44,000,000 led by General Catalyst. Multiverse is a tech startup that matches talent who have not graduated from college with apprenticeship opportunities.

- Jumpcode Genomics: $21,000,000 led by Arboretum Ventures, Baird Capital. JUMPCODE's CRISPR-mediated rRNA depletion kits remove nucleic acids from sequencing workflows to improve sensitivity and performance.

- Ironhack: $20,000,000 led by Lumos Capital Group. Ironhack is an international tech and design school that believes the best way to learn how to do something, is by actually doing it.

- Wintermute Trading: $20,000,000 led by Lightspeed Venture Partners. Crypto market maker focused on high-frequency algorithmic trading and market making services.

- OpenDrives: $20,000,000 led by IAG Capital Partners. Open Drives builds network attached, shared storage solution for high resolution image and video workflows.

Series C

- Vera Therapeutics: $80,000,000 led by Abingworth. Vera Therapeutics is a biotechnology company developing innovative biologic therapeutics with transformative clinical potential.

- Higher Ground Education: $40,000,000 led by Venn Growth Partners. Higher Ground Education aims to bring the Montessori education methodology to the mainstream through modernization.

Series D

- Personio: $125,000,000 led by Index Ventures, Meritech Capital Partners. Personio is developing an HR management and recruiting platform for SMEs and startups.

- Volta Charging: $125,000,000 led by Energize Ventures. Volta Charging designs, installs, and maintains a network of electric vehicle charging stations.

- Aledade: $100,000,000 led by Meritech Capital Partners. Aledade is a primary care physician platform that provides everything doctors need to create and run an accountable care organization.

- SOCi: $80,000,000 led by JMI Equity. SOCi is the leading all-in-one marketing platform built for multi-location marketers

- Quali: $54,000,000 led by Greenfield Partners, Jerusalem Venture Partners (JVP). Quali provides cloud platform solutions that increase productivity, cut costs, and optimize infrastructure utilization.

Series E

- TripActions: $155,000,000 led by Addition, Andreessen Horowitz, Elad Gil. TripActions provides a platform to help companies streamline elements of business travel like: payments, rentals, and bookings.

- K Health: $132,000,000 led by GGV Capital, Valor Equity Partners. K Health is a data-driven digital primary care system that uses AI to deliver personalized primary care.

Series H

- Deliveroo: $180,000,000 led by Durable Capital Partners, Fidelity Management and Research Company. Deliveroo owns and operates an online food delivery platform in the United Kingdom.

Sources: Crunchbase, Twitter, LinkedIn