We’re thrilled to announce this week’s exclusive with Cindy Bi, General Partner at CapitalX! Coined a “Super Angel”, Cindy launched Rolling Fund - CapitalX in August of 2020, and has raised over $4m from LP’s across the globe thus far. Since 2011, she’s seeded more than 100 startups including 3 unicorns (@zapier @cruise @rippling) to date. With a unique blend of consultant/founder/operator/investor experience, we dive in and discuss all things cap table related, including:

- How GIS sparked her passion for software 🖲

- CapitalX’s unique blend of LP’s and Q4 initiatives 🌏

- Her favorite productivity tools ⏭

- Secrets for getting on the cap table ⺇

- The state of Rolling Funds in 2030 🔮

How did you start out with regards to your career?

I was quite fortunate to receive a full scholarship at Georgia Tech to study Civil Engineering. But I quickly fell in love with spatial data analysis and GIS (Geographic Information System) at a summer internship job so I quit the PhD program and started working there full time. The company sponsored me for an H1B Work Visa and Green Card. Once I had my immigration status figured out (I was actually fired from my 1st job), I got a 50% raise doing software consulting at Accenture. In the meantime, I also founded a hardware company selling hunting cameras online. I was mainly responsible for partnership, strategy, sales and marketing and also quickly built a wholesale network to expand online sales through retail. Later I sold my equity to my business partner who’s still running and growing it in Atlanta.

How did you get into angel investing? What was your first angel check?

After a decade of doing 2 jobs at the same time, I took a sabbatical to spend more time with family in China. Later I decided to come to Silicon Valley and joined a remote-only “file API” company based in Australia with hundreds of software developers across the globe. The company was very profitable so I convinced my employer to allocate some capital and let me invest in startups on the side to take advantage of my geographical proximity to the high-quality startups coming out of Y Combinator.

My first angel check was in 2011 for an “email API” startup, MailGun, which was quickly acquired by RackSpace. It’s worth mentioning that one of the founders was also an immigrant and I later invested in the same founding team’s 2nd startup, Gravitational, which is backed by Kleiner Perkins and is growing very fast.

You launched CapitalX in August through a rolling fund on AngelList. Through this model, you’ve been able to attract LPs from around the world. Can you tell us more about the mix of investors that have committed capital? We know it’s only been a few months, but how would you compare these LP’s to LPs in traditional funds?

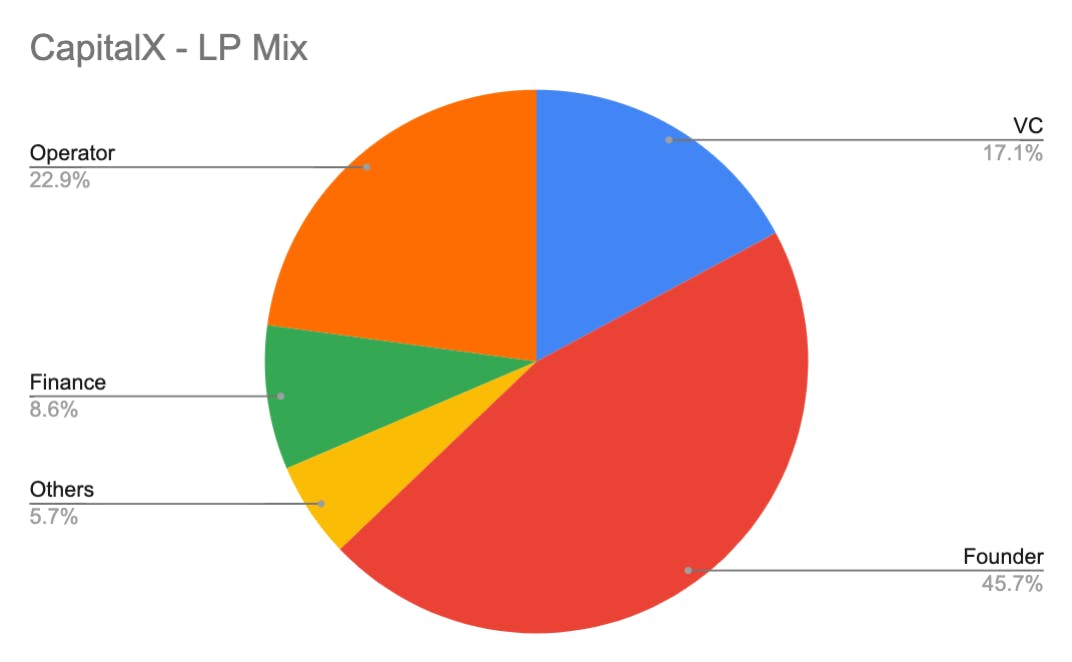

I have global LPs from more than 10 countries although most of them are from California and New York. As illustrated from the chart below, 46% of CapitalX LPs are founders, 23% are operators, 17% are investors at other VC funds, and 9% in finance with 5% others (doctor, professor, attorney, and family offices). So it’s quite fascinating to have almost 70% LPs as founders or operators at tech companies to build a very robust ecosystem.

I’ve never raised outside funding before but I’m well aware that traditional funds usually go through a lengthy fundraising process that lasts 9-12 months before GPs can deploy capital. In comparison, within two months since I launched CapitalX, the fund has already made 9 new investments with 2 more pending.

I encourage potential LPs to invest in CapitalX with a super efficient process that resembles self-serve B2B sales: check out CapitalX.vc, review my PitchDeck for my fund thesis and track record, email me with their bio and questions, then directly invest via AngelList Fund Page. This is also similar to how I invest with “high conviction and fast commit” after doing thorough public data research.

What will CapitalX be focused on in Q4 2020?

I’ll write fewer but bigger checks ($250k instead of $100k) so each portfolio startup’s 10x markup may bring a more meaningful return to the quarterly fund. By having fewer startups in the portfolio, I may also reserve more time working with the founders (when needed) to earn pro rata rights and invest more in follow-on rounds via SPVs or future funds.

Since shifting to a remote first environment, what’s been your strongest source for deal flow? Has anything changed, or still status quo?

Nothing much has changed for me because I’ve already worked remotely for more than 10 years and made many previous investments without meeting the founders in person with a “Online First, Offline Optional” process.

Once I decided to transition away from my operator role to invest full time late last year, I started investing more outside of the YC network with my personal capital because I have more time looking into the startups that reached out to me directly or were referred to me by founders in my past portfolio or coinvestors. I now get additional deal flow from my LPs who are also active investors.

You’ve given examples of how you’ve won over founders to get into startup deals. On the flip, what memorable stories can you share of founders winning you over because they wanted you on their cap table?

David@Retool was persistent to add me to his cap table at seed round and I’m so glad he did although I paid a higher price only a few weeks later! And Oleg@People.ai copied me on a few of his monthly investor updates before getting the investment — this is actually not an uncommon practice for founders to send (a redacted version of) their investor updates to potential investors that they really want to work with. I’ve also been persistent to close a few notable LPs because I highly respect their background.

2020 has been the year of rolling funds and SPACs. What new fundraising or venture capital trend will we see in 2021?

I’m excited to see emerging GPs outperform, especially those who respect founders’ time by having engaging and insightful discussions and making high-conviction fast-commit investments. As venture capital becomes more like a commodity, investors that don’t do enough research before meetings and only try to follow other funds to fill a round will eventually be left further out.

What are your favorite productivity tools you use on a daily basis?

I use Wordpress a lot to make private notes and this works well for “Solo Capitalist” with categorizing and search functions better than email. For virtual team collaborations, I highly recommend Taskade and FocusMate that I also invested in.

You’ve invested in multiple unicorns that came out of Y Combinator (Zapier, Cruise, Rippling). Given the volume of companies that go through YC, what criteria do you use to decide on who to invest in? Do you assess the Winter & Summer batches the same, or different?

I didn’t notice any seasonal changes between Winter & Summer batches but YC has enrolled more international founders over the years so certain cohorts may have more startups from India, SEA, Europe or Africa for example.

I’ve openly shared my playbook identifying top early-stage startups and you may check my fireside chat video clips: (public) data driven, early momentum for signal, cohort vs competitor analysis, embrace intuition, online first, underestimated talent, early enough to build for the future, fast commits.

What are you passionate about outside of work?

I used to go to the gym a lot before Covid and especially enjoyed meditation in the steam room after a hard workout. Now I live next to Lake Tahoe so I do paddle boarding a few times a week while listening to my favorite podcasts, before the weather gets too cold!

What’s your secret for getting on the cap table?

High conviction, fast commit, and a bit earlier than bigger funds if possible. Founders are resourceful self-starters so I let them do their own thing. But I especially like founders who are disciplined to send monthly investor updates so I can provide insights or make intros when I see fit.

Sign Up Today!

To get these right in your inbox

What’s your biggest cap table “mistake”?

In 2012, I missed 2 unicorns (Intercom and Gusto) due to lack of experience and talked about it on my Youtube here. Early this year, I should have pursued RoamResearch more passionately for their previous round after I reached out to Conor via Twitter DM in January. It’s due to my lack of focus at the time as a passive angel investor during the transition out of my last fund.

What advice would you give someone who is looking to write their first angel check in 2020?

Invest with high conviction in top talent who has high integrity and unweaving resilience to apply their expertise to build the next big thing.

The year is 2030. What’s the state of Rolling Funds?

A few Rolling Funders have invested in multiple unicorns and decacorns, grown their AUM to tens of millions a year, and delivered real alpha returns to global LPs — that’s a future I’d love to help to build!

Thank you for your time and thoughts, Cindy! We look forward to the continued success of the various companies you’re involved with!

Follow Cindy on Twitter (@CindyBiSV) for more insights into venture capital, startups, and more!

Deal News 10/3-10/9

Seed

- Abridge raises $5,000,000, led by Union Square Ventures, UPMC | Abridge brings context and understanding to every medical conversation so people can stay on top of their health.

- Mandolin raises $5,000,000, | Mandolin is a digital platform designed to help artists, venues, and fans connect through live music.

- Dispo raises $4,000,000, led by Seven Seven Six | Dispo operates as a social network.

- Tone raises $4,000,000, led by Bling Capital | Tone helps your e-commerce store capture more revenue with AI-enhanced, human text message conversations.

- Strike Graph raises $3,900,000, led by Madrona Venture Group | A compliance SAAS solution simplifying cybersecurity certifications. These certifications dramatically improve revenue for B2B companies.

- Shipa raises $3,750,000, led by Engineering Capital, Jump Capital | Shipa is an Application Management Framework for Cloud-Native Applications.

- Scratchpad raises $3,600,000, led by Accel | Scratchpad is the fastest experience to update Salesforce, take sales notes, and work your daily todos.

- DigitalBrain raises $3,250,000, | Digital Brain helps you get through your support tickets twice as fast.

- Zira raises $3,100,000, led by Abstract Ventures, General Catalyst | Zira designs and develops employee management solutions that leverage technology to empower companies.

- HDT Bio raises $3,000,000, led by Zoic Capital | transforming inventive immunotherapies for oncology and infectious disease.

- Cyvatar.ai Inc. raises $3,000,000, led by Bill Wood | Cyvatar is a technology-enabled cybersecurity as a service provider.

- Bespoken Spirits raises $2,600,000, | Bespoken Spirits has developed technology to precisely tailor spirits for aroma, color, and taste in just days.

- Walnut raises $2,500,000, led by NFX | Walnut offers a failure-free, codeless, and 100% customizable platform.

- Doppler raises $2,300,000, led by Sequoia Capital | Doppler develops an application management platform used to help developers manage their API keys across all their projects.

- VIVA Finance raises $2,300,000, led by Acumen | Online Lending Platform

- JobGet raises $2,100,000, led by Pillar VC | JobGet is the fastest job platform for anyone looking for a job in the retail and hospitality industry.

- Earthly Technologies raises $2,050,000, led by 468 Capital | Build automation for the post-container era.

Series A

- Federation Bio raises $50,000,000, led by Horizons Ventures | Federation Bio is a microbial therapeutics company targeting diseases in which the human microbiome can play a curative role.

- Hyperice raises $47,800,000, led by Main Street Advisors, SC. Holdings | HyperIce makes innovative vibrating foam rollers and ice compression wraps for training, faster muscle recovery, and rehabilitation.

- Cerebral raises $35,000,000, led by Oak HC/FT | Cerebral is a mental health telemedicine company that offers comprehensive online care and medication management for anxiety and depression.

- Observe raises $35,000,000, led by Sutter Hill Ventures | Observe provides performance management tools based on a versatile observability platform.

- Point Pickup raises $30,000,000, led by BBH Capital Partners | Point Pickup Technologies is a mobile APP delivery platform solving on-demand, pre-scheduled, and recurring same-day delivery needs.

- mmhmm raises $21,000,000, led by Sequoia Capital | mmhmm is a virtual camera application used to create virtual rooms, backdrops, and presentations during video conferencing calls.

- Grid AI raises $18,600,000, led by Index Ventures | Grid AI enables training state-of-the-art AI models on hundreds of cloud GPUs and TPUs from their laptops. Focus on ML, not infrastructure.

- MANTA raises $13,000,000, led by Bessemer Venture Partners | MANTA is the central hub of all data flows, allowing information users to understand where, how, and what about their information assets.

- NOCD raises $12,000,000 | NOCD helps people with OCD get better and then stay better.

- Remotion raises $10,400,000, led by Greylock | Remotion is a video calling platform designed for remote teams to collaborate through live video chats.

- Abridge raises $10,000,000, led by Union Square Ventures, UPMC | Abridge brings context and understanding to every medical conversation so people can stay on top of their health.

- BloomCredit raises $10,000,000, led by Allegis NL Capital | Bloom Credit is a fintech platform that works to improve the financial eligibility of people declines for lending products.

- NormShield raises $7,500,000, led by Moore Strategic Ventures | NormShield provides comprehensive Security-as-a-Service solutions focused on cyber threat intelligence, vulnerability management.

- BSPK raises $7,000,000, led by Northern Light Venture Capital | BSPK is a digital platform that allows luxury brands to connect with their clients.

- Andie raises $6,500,000 | Andie is a designer and manufacturer of one-piece women’s swimsuits and sells them to consumers through its e-commerce platform.

Series B

- Avail Medsystems raises $100,000,000, led by D1 Capital Partners | Avail Medsystems is a medical technology company that develops telemedicine software for the procedure room.

- A2 Biotherapeutics raises $71,500,000 | A2 Biotherapeutics develops novel medicines for serious illness.

- Datavant raises $40,000,000, led by Transformation Capital | Datavant is a San Francisco-based company dedicated to organizing the world's health data.

- Shogun raises $35,000,000, led by Accel | Shogun is an E-commerce platform that helps brands create unique buying experiences and optimize their online stores.

- Skilljar raises $33,000,000, led by Insight Partners | Skilljar is a customer training platform for enterprises to accelerate product adoption and improve customer retention.

- AccessFintech raises $20,000,000, led by Dawn Capital | AccessFintech is a UK-based fintech firm that offers risk management service for banks and buy-side firms and tracks the trade lifecycle.

Series C

- Unqork raises $207,000,000, led by BlackRock | Unqork is a no-code enterprise application platform that helps companies build, deploy, and manage complex applications.

- Cooler Screens raises $80,000,000, led by Verizon Ventures | Cooler Screens is a developer of interactive digital displays to replace glass doors in store aisles.

Series D

- Neocis raises $72,000,000, led by DFJ Growth | Neocis develops robotic technologies for applications in the healthcare industry.

- GrubMarket raises $60,000,000, | GrubMarket supplies local fresh food online with affordable prices and convenient delivery.

- Onapsis raises $55,000,000, led by Caisse de Depot et Placement du Quebec, NightDragon Security | Onapsis provides cybersecurity and compliance solutions for cloud and on-premise ERP and business-critical applications.

- TigerConnect raises $45,000,000, led by HealthQuest Capital | TigerConnect is a healthcare collaboration platform that streamlines clinical workflows and systems.

Series E

- Tipalti raises $150,000,000, led by Durable Capital Partners | Tipalti is a global payables automation platform that provides a cloud solution to scale and automate global payables operations.

- Dialpad raises $100,000,000, led by OMERS Growth Equity | Dialpad is a cloud-based business phone system that turns conversations into opportunities and helps teams make smart calls.

Series F

- Chargebee raises $55,000,000, led by Insight Partners | Chargebee offers subscription and recurring billing system for subscription-based SaaS and eCommerce businesses.

Sources: Crunchbase, LinkedIn, Twitter