Hi everyone 👋

Sign Up Today!

To get these right in your inbox

In the words of Warren Buffet, “You don’t know who’s been swimming naked long in the private markets until the Nasdaq tide comes in.”

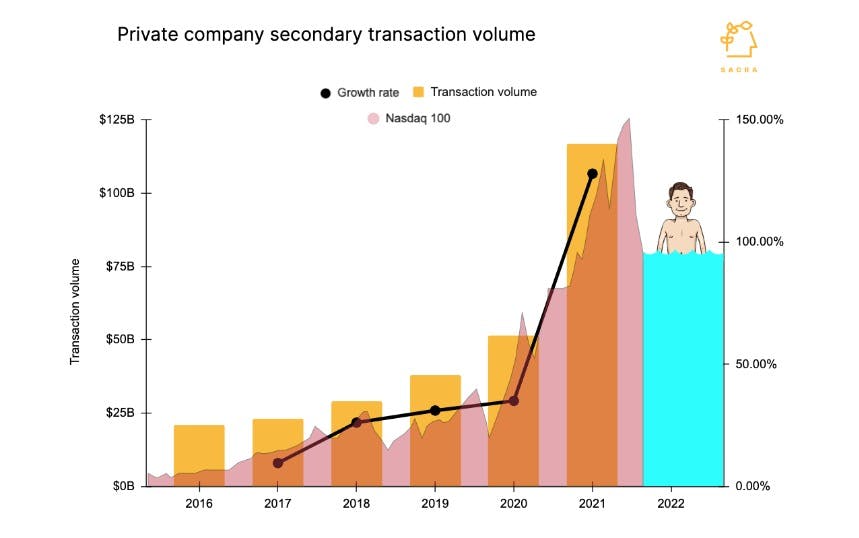

Investors have clamored into long exposure in privates as secondary market transaction volumes ballooned to $115B+ in 2021 with $23B flowing through Carta, Forge, Nasdaq Private Market, and Figure.

That’s why large public funds and institutional investors, your Fidelitys, T. Rowe Prices and Ontario Teachers’ Pension Plans, sell call options and buy puts—to protect themselves from this kind of volatility. This type of risk management is sorely lacking in the private markets.

To understand how that might be changing, we talked with Javier Avalos, co-founder and CEO of Caplight, which is building equity derivatives for the private markets:

Hedge funds, very large multi-stage VCs, large public investors… pensions, endowments, insurance companies, and even the large banks, via either their direct investing groups or their private banking clients. All of these groups, clearly, are institutional in nature. They're professional investors. They have this infrastructure available to them in other asset classes, and it doesn't make sense that they don't have the same tools available to them in private markets… if we're not doing that, it means that the hedge fund is less likely to go through the friction of putting one of these trades on. (link)

If you think about what secondaries consist of, it's the brokered activity of “try to match a buyer and a seller.” But a secondary is also a tender. It's a company supporting their employees or their early shareholders getting liquidity through a company-sponsored tender offer -- that's secondary trading by definition. I think what you're starting to see is the emergence of all of these different use cases becoming productized and competition over who's going to own which vertical. Forge is competitive with Carta on their company-facing side of the business, as is Nasdaq Private Market, as is Figure. We're going to continue to see groups emerge, tackling different verticals. (link)

[S]ynthetics, which is where we spend our time, is a further evolution to this marketplace because it removes a lot of the friction that exists with the actual execution and settlement… In the liquid names, [price discovery] is a very short part of the actual execution of the trade. What is a lot longer is how that trade actually gets closed… The reason the private markets remains so uncertain -- I've heard several people refer to it as unreliable at times -- is once you've done all that work in the private markets, you've agreed to a price, you've done all the price discovery, you've got your block set up and ready to go, now you're stuck waiting for the actual shares to physically transfer from one group to the other. (link)

Q&A with David Peterson, partner at Angular Ventures

On Tuesday (2/22) at 9am PT/12pm ET, join us for a conversation with David Peterson, partner at Angular Ventures, to talk about going from startup operator to investor.

David joined Airtable as an early employee in 2017, building the company’s first growth team and leading partnerships. We interviewed David about his time at Airtable leading growth, particularly on Airtable’s PLG sales motion.

In 2021, he left Airtable to join Angular Ventures, a small, upstart venture fund based in London.

The $225 billion market for pre-IPO liquidity

In case you missed it, check out our 70,000+ word primer on the private secondary markets with 7+ hours of interviews with current and former executives at Carta, Forge, and Nasdaq Private Market.

Our report breaks down:

- how one of the top secondary-focused merchant banks gets on the most competitive cap tables at 15-30% discounts

- Tribe Capital’s secondary strategy for securing 5-10x returns on each fund

- Forge’s former COO Hari Raghavan on why late-stage investors over-index on information (and how they should evaluate companies instead)

- Spotify’s secondary market strategy that let them save $90 million on their initial public offering

- how CFOs can use controlled liquidity to increase employee compensation by 200%, make acquisitions, and raise capital on better terms